Stock trading can be a rewarding and profitable activity, but staying profitable can be challenging. Just like any other profession, stock trading also requires practice and dedication to learn to become a successful trader. Fortunately, plenty of tools and learning resources are available online that can help new traders along their trading journey.

This blog will focus on helping new traders enter the stock market by highlighting the best online stock trading platforms, simulators, and strategies. It will cover how beginners can use stock market simulators to practice risk-free, explore swing trading and algorithmic strategies, and review essential tools like technical analysis for decision-making. Additionally, the blog will discuss trading psychology and offer insights into choosing the right broker and platform for specific needs like day trading and options trading.

Best Stock Trading and Options Trading Platforms for Beginners

With such a wide range of trading platforms available on the market, it can be quite overwhelming for beginners to choose the right one. We have reviewed several popular platforms and shortlisted the best stock trading platforms suitable for beginners. Many of these offer free trials and the barrier to entry is very low. You should have no problems giving these platforms a test run.

1. eToro

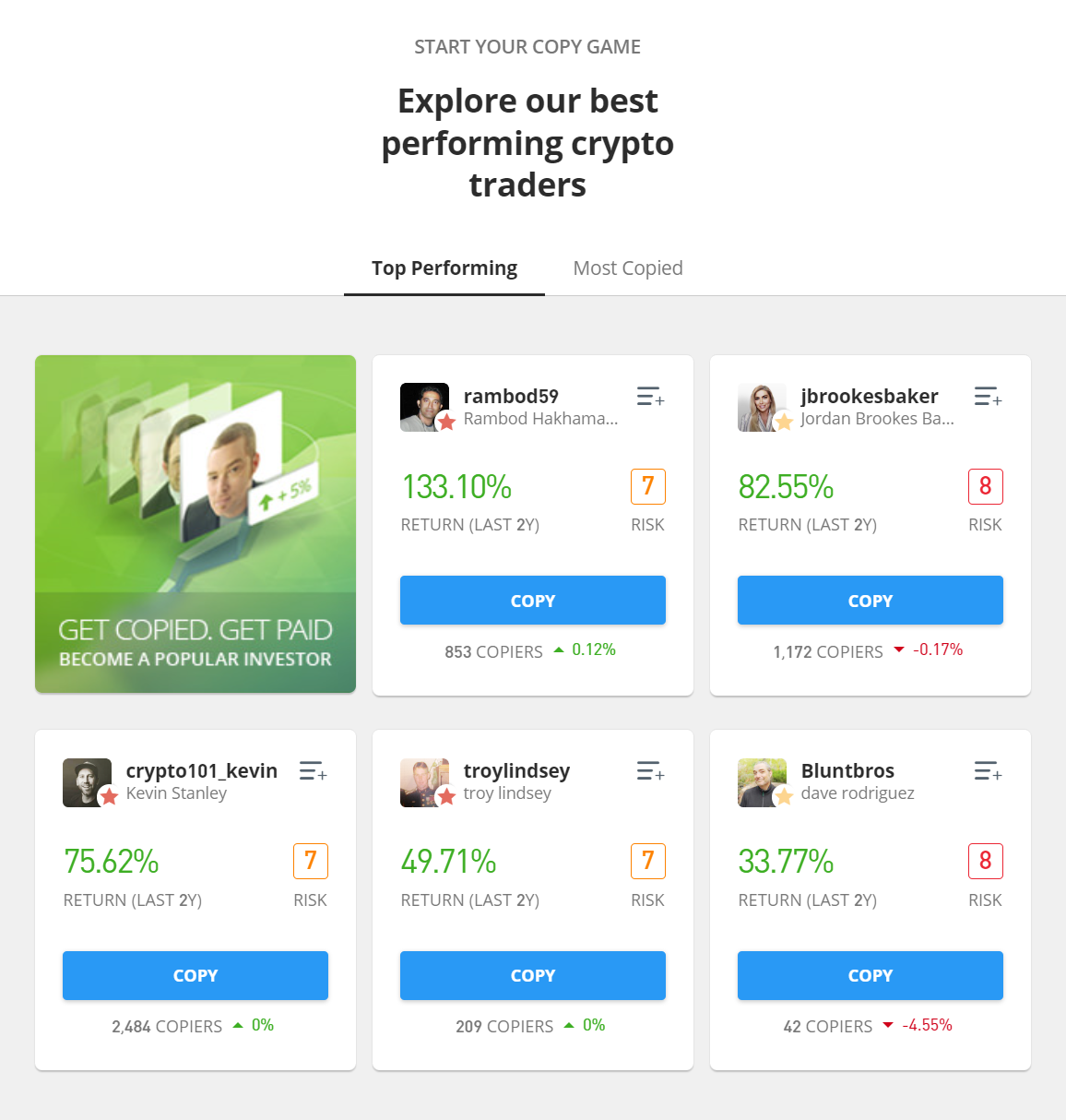

eToro’s trading platform is user-friendly and easy to navigate, which is something beginners will find useful. The platform also offers a demo account that allows traders to get familiar with the platform and practice trading in a virtual environment before risking real money in actual trading. The platform’s social trading feature enables new traders to copy trades of seasoned traders and learn from their trading strategies. The platform also has plenty of educational resources like articles, webinars, video tutorials, some of which are specifically targeted to new and inexperienced traders to turn them into better traders.

2. Webull

Webull is a popular trading platform that allows users to trade stocks, options, futures, ETFs, among others. There are no minimum deposit requirements, and the platform also allows traders to practice and hone their skills by providing them with a paper trading account. The platform is available as a mobile application, web-based application, as well as a desktop application and has easy-to-use interfaces. The platform also has an extensive, well-organized library of educational and training material, such as videos and articles, on beginner to advanced topics. Be sure to check out our full review of Webull.

3. Charles Schwab

Charles Schwab offers commission-free trading in stocks and ETFs. After acquiring TD Ameritrade, Charles Schwab has integrated TD Ameritrade’s popular Thinkorswim trading platform into its offering. The platform also provides traders with paper trading functionality, allowing them to test their strategies and gain confidence before trading in the real market. Charles Schwab also has a learning section on its website dedicated to educational content like podcasts, Schwab coaching, technical analysis, fundamental analysis, etc.

How to Use Stock Market Simulators for Learning

Stock market simulators can be a great tool for beginners as well as experienced traders to improve their trading performance. We've written a specific guide on the best simulators in the market. Here is how you can get the most out of trading simulators:

Choosing the right stock market simulator that has all the features that you will need while training for the real market is key. Fortunately, many popular trading simulators available on the market have got most of the features required for trading adequately. However, one of them stands out against the rest, which we'll discuss. The most popular simulators for you to consider are TradingSim, Webull Paper Trading, and MarketWatch Virtual Stock Exchange. These will allow you to learn and and test different trading strategies.

The first step is to create an account on the simulator and choose the amount of virtual money you want to start trading with. Get yourself familiar with the simulator’s user interface and navigate to different sections available to you on the platform.

Once you feel comfortable with the simulator’s interface and can easily enter and exit trades using different order types, you should start testing out some trading strategies. Start with the most basic ones, such as buying and holding individual stocks for a few days or weeks, create a diversified portfolio by picking stocks from different sectors, and utilize your capital using dollar-cost averaging strategy.

If you want to do swing trading or intraday trading, you should practice using different technical indicators and tools available on the simulator. Try to draw trendlines, plot moving averages, and understand how you can use specific technical indicators to get trading signals and devise a trading strategy using them. You can also use historical price charts to backtest these strategies.

Practice risk management techniques by putting stop-loss orders, limit orders, and right position size. Review each of your trades or periodically analyze your portfolio performance to determine areas for improvement and learn from your mistakes. While it is best to focus on one trading instrument or asset type, you can always experiment with options, ETFs, futures, commodities, etc. to see which one you understand better. Finally, many trading simulators have plenty of educational content available for traders, which you can take advantage of to improve your trading.

Swing Trading Strategies for Beginners

Swing trading involves keeping a trade open for several days to even several months. Due to the longer-term nature of the trade, swing traders usually look for long-term trends rather than short-term movements. Here are some swing strategies beginner investors can try:

1. Trend Following Strategy

Trend following can be an easier strategy for beginners due to its simplicity. It involves identifying the long-term trend, which experienced traders can spot fairly easily even without the use of indicators. Beginners, however, can use daily charts and use 50-day and 200-day moving averages to accurately spot the uptrend. If the current price is above the 50- and 200-day moving averages, it is considered an uptrend and vice versa.

The entry point for a long trade is when the price pulls back in an uptrend, while the entry point for a short trade is when the price pulls up in a downtrend. Stop loss can be put just below the recent swing low for a long trade, while for a short trade, it can be set just above the recent swing high in a downtrend.

The exit or take-profit point for long trade can be set at the previous high in an uptrend, while for short trade, it can be set at the previous low.

2. Breakout Strategy

The breakout strategy is another simple strategy that beginners can execute easily. Traders need to first determine support and resistance levels before searching for breakouts from these levels. A long trading opportunity arises if breakout occurs at the resistance level. Conversely, a short trading opportunity arises if breakout occurs at the support level.

Stop loss is put just below the breakout point for long trades and above the breakout point for short trades. Average True Range (ATR) value can also be used to calculate the points below or above the breakout candle or support and resistance levels to give the trade enough room to not stop you out of the trade.

Fibonacci retracements or extension levels can be used to determine take profit points. A dynamic stop loss can also be used to capture maximum profit even above the retracement levels.

Technical Analysis Tools for Stock Traders

Whether day trading or swing trading, you can use different types of technical analysis tools and indicators available in the simulator to dial in your strategies. The tools use different data inputs like price, volume, period, etc. to help traders analyze the price action and predict the market’s future direction. Some popular technical analysis indicators include moving averages, moving average convergence divergence (MACD), stochastic oscillators, fibonacci retracements, relative strength index (RSI), and Bollinger Bands, among others.

Algorithmic Trading Explained for New Investors

Algorithmic trading refers to computerized or automated trading by programming a trading strategy into a machine or device. The machine uses the programmed trading strategy, also called an algorithm, to automatically monitor the market and enter and exit trades based on the programmed algorithm. Trading software like MetaTrader 5 and various other programs can be used for algorithmic trading.

Algorithmic trading helps traders with high-frequency trading, allowing traders to enter and exit large numbers of trades at lightning speed. Since trades are executed by the system automatically with little to no human supervision, traders can significantly improve their trading performance. Algorithmic trading is based purely on data, allowing traders to keep their emotions out of their trading.

For more information on Algo trading, check out our guide here.

Choosing Online Brokers for Day Trading

If you are a day trader or want to start day trading, here are some key features to consider while choosing an online broker:

1. Commissions & Fees

Day trading involves buying and selling of securities multiple times during a trading day to benefit from small moves in the market. If the commissions and fees charged by the broker are too high, they can add up and make it difficult for traders to remain profitable. So you could benefit from a broker that preferably charges zero commissions and low fees. Today, it is quite common for stock brokers to allow commission-free trading.

2. Trading Platform

A capable and efficient trading platform is essential for successfully executing trading strategies. A trading platform is where traders spend most of their time and is like a playground for them. It should allow traders to place different order types and set dynamic stop loss and take-profit points. Additionally, it should have, at a minimum, the most popular technical analysis tools and have different types of charts to enable traders' price action analysis. Nowadays, most brokers offer web, mobile, and desktop versions of their trading platforms, which can be handy and provide traders with a great deal of flexibility in choosing a device for trading.

3. Real-time Quotes

The broker should provide its clients with real-time price data feed as a delay or lag of milliseconds can result in either an order getting partially filled or not filled at all. Even worse, you could get filled at a different price, depending on the chosen order type. The speed and reliability of real-time quotes becomes even more significant for traders who want to carry out algorithmic trading, high-frequency trading and scalping because their success depends on the smallest of price movements as they enter and exit trades within minutes, if not seconds.

4. Research

Many brokers have a team of analysts who regularly conduct research and analysis on specific stocks, sectors, and the economy in general. The team, then, presents their analysis and research in the form of research reports, giving their recommendations, predictions, or target price about a particular stock, sector, or the overall market index. Some brokers offer research reports to all their clients irrespective of their account type, while some offer it as a separate service at additional cost. Nonetheless, it is generally better to choose a broker that provides its clients with free or paid research over the one that doesn’t provide it. That said, many brokers will also provide condensed information for you to make your own decisions and to do your own research.

Trading Psychology: How to Manage Risk and Emotions

Trading psychology and sound risk management strategy are hallmarks of a successful trader. Beginner traders often struggle with risk management. Emotions get the better of them, which often results in them taking huge losses on a single trade. Here are some best practices you can adopt to manage risk and emotions in a better way.

Some common emotions that traders face during trading are fear, greed, loss aversion, and overconfidence. For example, fear compels traders to close their trades prematurely out of panic without realizing the trade’s full profit potential. Similarly, loss aversion arises due to cognitive bias as traders often lack the courage to exit a losing trade and book a small loss. Instead, most traders keep the losing trade open in hope that the market will turn around and the trade would turn positive, which most often result in heavy losses. By identifying and being aware of these common emotions, one can better manage and avoid falling victim to these.

A trading strategy should always have risk management principles incorporated into it in order to keep your emotions from clouding your thinking. You should have rigid rules for setting up entry and exit points, calculating the position size, while implementing the best risk mitigation techniques. When you input your stop-loss and take-profit points when placing your trade, you will be able to trade emotionlessly as the trade will exit automatically after hitting the stop-loss or take-profit point.

Never risk more than 1% of your total capital on a single trade, which will help preserve your account for a longer term and prevent your account from blowing up in just a few trades. Only take those trades that have a risk reward ratio of greater than 1:2, which will keep you in profit even if your losing trades outnumber the winning trades.

How to Trade Stocks Online Step-by-Step

- The stock broker is your gateway to the stock trading world, so the first step you should take to start trading stocks is to choose a stockbroker. You’ll have to open an account with the broker by filling out an online form. You might also have to provide your broker with your identification documents, such as proof of residence, driving license, or your ID card.

- Once your account is approved, you’ll get your login credentials to the trading platform. You’ll have to deposit some money into your trading account using many of the popular payment methods, such as Paypal, Stripe, etc. Once the amount you deposit is reflected in your trading account, you are all set to start trading stocks.

- To choose which stocks to trade, you’ll have to conduct your research. For long-term investment, investors usually use fundamental analysis, which means analyzing a company’s financial statements and studying its business models in relation to its peers and business environment. The analysis helps investors to determine the stock’s real value, allowing them to make investing decisions.

- On the other hand, traders most often use technical analysis to predict future movement of a stock price. They use a combination of different technical indicators and tools to analyze price charts and determine entry and exit points to make profit.

Parting Thoughts on Mastering Stock Trading for Beginners

In today’s digital world, everyone can start trading with just a few taps on their smartphones. Opening a brokerage account is quite easy and there are plenty of educational resources for beginners to get started with their trading journey. Stock trading simulators, like the one offered here at Tradingsim, can help beginners a great deal in honing their trading skills. Even professional traders routinely use trading simulators to test and refine their trading strategies. The key to success in the trading world is to continue practicing and refining your trading skills and strategies according to changing market conditions.

Want to try our simulator for free for seven days? Following the link below:

Futures

Futures