Step into the collaborative world of social trading with our thorough breakdown of premier Social Trader Tools for 2023. Leverage collective wisdom through copy trading, community insights, and shared financial analysis to elevate your trading trajectory.

Social trading is a modern phenomenon that has grown as social media applications have become staples in everyday life. In recent years, particularly during the COVID-19 pandemic, social traders became an unforeseen force that powerfully affected markets. WallStreetBets, Twitter (now known as X), and other social trading channels brought new traders together, educating and imposing trade ideas on the masses for better or worse.

In this post, we’ll cover the ins and outs of the social trading movement, its successes and failures, and the best social trader tools of 2023.

The History and Evolution of Social Trading

Technically, social trading has its roots in word-of-mouth advertising. We’ve all heard stories of how trade ideas and news get tossed around the kitchen table. There’s an old cliche in the markets that if your mother starts giving you stock tips, it might be time for the market to top.

But the truth is that word spreads quickly when a strong bull market is lifting everyone’s bank accounts. That being said, much of what we call social trading began during the dot com bubble around 2000. During that time, email communication had become the norm, AOL was a big name in the internet world, and Skype and AOL Messenger were growing as popular forms of free communication across the web.

Add the revolutionary approach of E-trade and their focus on giving individual investors access to markets, daytime CNBC, and a strong bull market, and then suddenly you had an army of baby boomers gambling in stocks. It’s no wonder stocks went parabolic during that time.

Fast forward 20 years later and you have the maturity of trading houses and brokerages that allow you to place trades directly from your phone, watch, or any other connected device. On top of that, social media platforms have become mainstays. In fact, many brokerages now have built-in social trading platform tools to share ideas, charts, predictions, and analyses.

Benefits of Social Trading

Social trading is by no means a perfect approach to trading markets. In fact, it can be quite dangerous. Herd mentality is a real thing, and can lead some unassuming traders over the edge of the fiscal cliff. Along those lines, it is always wise to take precautions when trading no matter what the crowd believes or how many followers a social trading guru might have. That being said, here are a handful of benefits that social trading may offer:

- Camaraderie: Trading is by nature a very lonely profession. Though social traders may add up to the millions, they’re usually comprised of a million stay-at-home traders with no social interaction. Social trading provides an outlet for communication and interaction in an otherwise lonely world.

- Learning Opportunities: Often the best learning comes through mentorship. While it can be difficult to find a quality mentor in the markets, social traders often share their trading lessons freely. This can be a boon for budding traders who may have yet to suffer losses through trading. Learn from your peers and save yourself the headaches.

- Reduced Time Commitment: This is a double-edged sword because nothing really substitutes for time and experience in the markets. However, reliance on social trading can often shorten your learning curve and the time you spend in the market. Just know that even the herd can be wrong sometimes. Make sure you have a risk management strategy in place, and don’t be a bag holder!

Social Trading Platforms

There is an ever-increasing number of social trading platforms emerging in the world of forex, crypto, commodities, and other assets. From full-blown copy trading platforms to simple social sharing tools, new social traders are sure to find a social community and trading platform to their liking. Here is an overview of three of the more popular social trading platforms available in 2023:

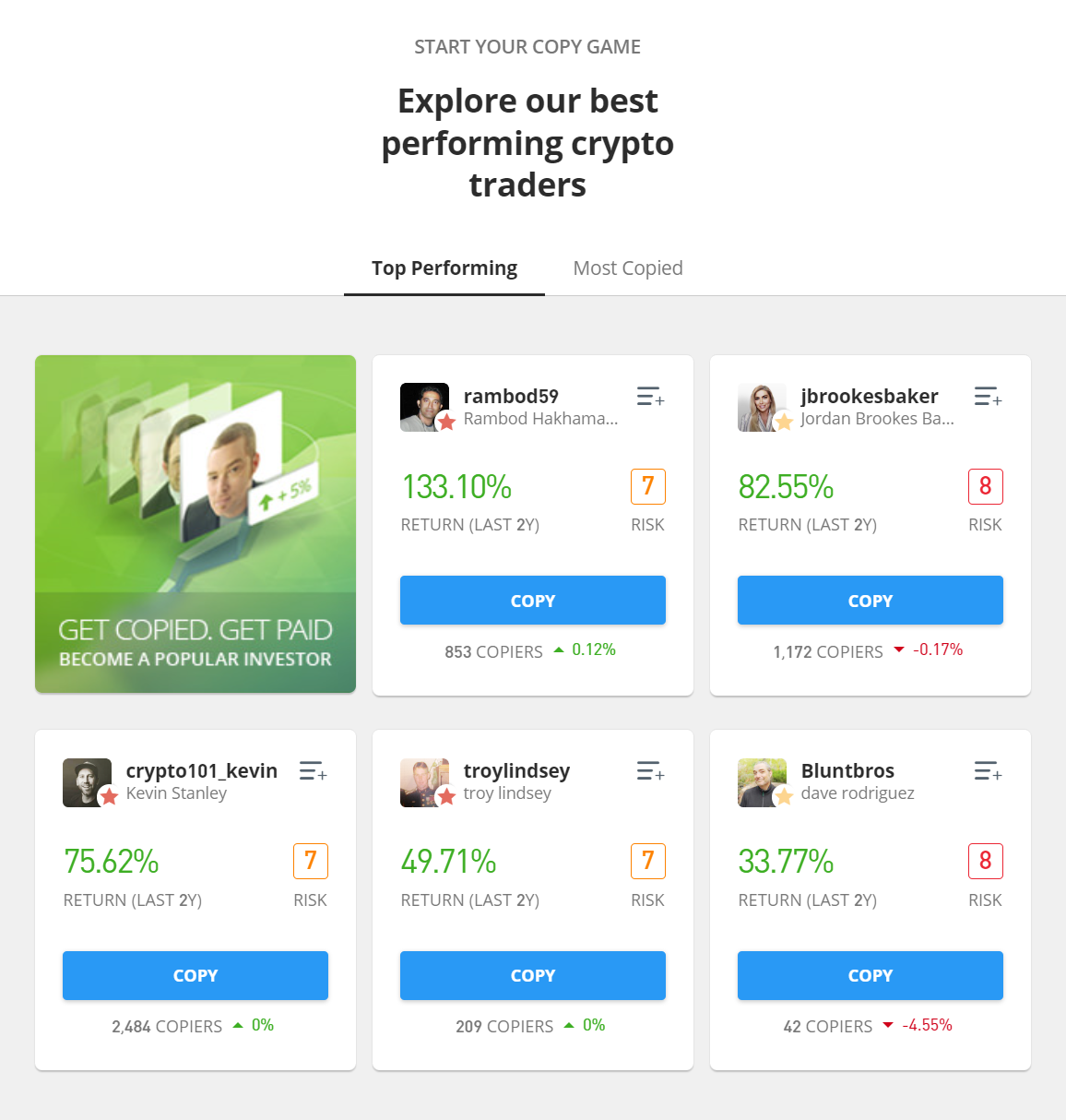

- eToro: eToro is a web- and app-based trading platform centered around the concept of social trading. While not inherently the most comprehensive trading platform for sophisticated day traders, it provides novice traders with social tools to find ideas and even copy top-performing traders on their platform. eToro has this to say about their product:

“One of our key differentiators is the fact that we created a community of traders, in contrast to the often solitary feeling of trading online. eToro is a bustling online social network, where you can discuss ideas, share trading decisions, and talk strategies on the social News Feed.”

- Tradingview: Tradingview is far and away the largest charting platform in the world. From the onset, the company placed a focus on user-generated programming and social sharing. As such, you can find an entire library of user-based content, trading ideas, and communities.

![]()

A chart of the world’s most popular investing websites

While Tradingview has yet to offer its own brokerage services, it plays host to several brokerages through API, including Gemini, WeBull, Tradestation, and many others. This allows you to trade directly through their charting platform connected to your broker of choice.

- WeBull: With the advent of “no fee trading” brought on by popular trading apps like Robinhood, WeBull showed up on the scene around 2018 as a tech-savvy alternative to the very basic Robinhood app. Since then, it has grown to become one of the more popular no-fee trading platforms for active traders and investors alike.

As part of that growth, it has embraced the social trading phenomenon by creating community profiles, chats, and social feeds for its users. WeBull traders can share ideas, join and follow communities, and keep abreast of social sentiment on any number of ticker symbols. You can even share your trades to the WeBull feed or outside apps like X (formerly Twitter).

Copy Trading: A Potential Game Changer

Copy trading is the ability to mirror top-performing portfolios published by individual investors for participating brokerages. Brokers like eToro, NAGA, and AvaTrade, among a growing list of others, allow you to mirror the trades of their published investors. Most of these platforms provide a ranking of these investors and then give you the option to place the exact trades that they make.

How It Works

The process is very simple to the end user, however, the software behind the scenes may be quite complicated. To become a copied trader you must be approved by your brokerage, assuming they offer copy trading. This allows other social traders to not only follow you but also copy you.

Many platforms like eToro offer incentives to top-performing traders if they allow other users to copy their trades. With their published ranking system, you can see who the top-performing traders and portfolio managers are at any given time. You then choose who you’d like to copy, and voila!

It’s like a modern-day portfolio manager but without the fees. You simply set the amount of money with which you wish to copy trades, then the platform automatically calculates the proportions in the portfolio as trades are placed. In fact, you can copy multiple traders simultaneously, and execution times on trades typically execute instantaneously.

Advantages of Copy Trading

Copy trading allows inexperienced traders access to more experienced traders. It also puts the control of managing your portfolio into your own hands.

Most individual investors are looking for the best return on their money, but don’t really know how to manage their own stocks. Unlike entrusting your portfolio with a typical brokerage house like Raymond James, which would charge a fee and may not publish the results of their portfolio managers’ returns, you can decide who you want to manage your money based on published results.

It’s kind of like a fantasy league for investing. Not satisfied with your results? Fire the trader you’re copying and hire a different one. With no fees.

Disadvantages of Copy Trading

Like all trading, there is no risk-free money management. Even traders with a good track record can fail. Just look at the leader on eToro. He had a bad year in 2022, losing over 60%.

To manage your risk, it would be best to only allocate a certain amount of your portfolio to each trader you’re copying. You might also consider how consistently they’ve been on the leaderboard, and for how long.

In addition to risk management, copy trading will not teach you how to trade unless you “re-engineer” the trades that your system is placing for you. It’s always best to understand risk management and technical market analysis before putting any real money to work.

Social Trader Tools: The Essentials

You need some necessary tools to begin social trading and do it effectively. Aside from some sort of smart device like a phone, tablet, or computer, here are a handful of things you’ll need access to to become an effective social trader.

- News and sentiment analysis: Discover the news and sentiment regarding the assets you are looking to trade. This can be done through a news service, usually offered for free through your brokerage or apps like X (Twitter).

Often, new products, social sentiment, or breaking news will affect the assets in your portfolio. It’s a good idea to stay up-to-date on what’s affecting them.

- Risk management tools: Possibly the most important tool you’ll need. Often, newer traders forego the need to manage risk because all they see are dollar signs. Greed has a sneaky way of stealing your money when you put the blinders on.

That being said, use proper risk management tools like stop-losses to keep your account from blowing up.

- Social trading signals: It’s where you get your ideas and trades. Ultimately, if you’re going to follow the crowd, you need to know how to decide to buy or sell. These signals can come from the trading community you’re involved in, your own criteria, or by simply copy trading and waiting for the trade to execute.

Social trading tools are an important part of the decision-making process for placing trades. If sentiment shifts, for example, you want to know about this and take the trade in the direction of the prevailing sentiment.

Similarly, capital preservation should be your #1 priority. Setting boundaries on how much you can lose on any given trade will keep you in the game for the long run, allowing you to take advantage of the big moves.

The Power of Trading Communities

While trading communities have been around since the inception of “boiler rooms” in the 90s and early 2000s, they’ve evolved in recent years. In 2020, the combination of the pandemic, helicopter money, and an army of work-from-home employees bolstered the power of trading communities across the web.

Once thought only for gamers, applications like Discord, Twitch, and chat rooms have become the norm for traders as well. Many of these channels were started during the pandemic by self-described market gurus, fly-by-night market wizards, or just friends getting together to share ideas.

Benefits of participating in a trading community

One of the biggest benefits of participating in a trading community like a Discord room or chat room is the amount of shared knowledge you receive. Newer social traders lack a lot of the experience that professional traders have. To shorten that learning curve, a trading community often provides on-the-job wisdom.

Emotional support is another benefit of participating in a trading community. As we’ve stated before, trading is often a lonely endeavor, rife with the emotional ups and downs of winning and losing. Connecting with a community of traders can help when you know others are suffering or succeeding alongside you.

Successful Traders from Trading Communities

Chris Camillo: known for his ⅓ role on Dumb Money, Chris has amassed quite a bit of wealth through what he calls social arbitrage. Through carefully analyzing social trends for publicly traded companies, he places longer-term market bets on these companies, with wild success.

Chris has been mentioned in the book Unknown Market Wizards, is a published author, and has a Discord channel devoted to followers of his social arb model.

Insert twitter feed: https://twitter.com/chriscamillo?lang=en

Nate Michaud: Nate is an OG in the day trading world. He is the purveyor of InvestorsUndeground.com, a social trading community and chat room. From the very beginning, Nate hired a day trading developer named Max to help innovate tools in his room.

Today, you can find a thriving community of day traders who enjoy a suite of tools like “most mentioned ticker symbols,” scanners, Twitter mentions, and more. This allows members to keep a pulse on social sentiment for stocks and more technical and fundamental details like secondary offerings, halts, and more.

Embed: https://twitter.com/investorslive

What are Social Investment Networks?

Social investment networks is a phrase that is still being defined. Although it is used as a term to describe companies and investors who seek investments in socially responsible projects, it can also be used interchangeably with social trading communities. Most of these communities are rooted in discovering and exploiting social trends.

Collaborative Trading Technologies

One way to be a part of a social investment network is to join one of the many growing social investment brokers. Each of these applications uses advanced collaborative trading technologies to empower non-professional investors to copy trades.

While the number of collaborative trading technologies continues to grow, here is a short list of some of the more popular social investment networks:

- Covesting

- NAGA Autocopy

- eToro’s CopyPortfolio

- eToro’s CopyFunds

Social Financial Analysis

One of the more prominent social financial analysts in recent history is Chris Camillo. Chris’s social arbitrage model has proven to be a game changer in the industry. In fact, his returns over ten years beginning in 2006 resulted in a 95% annualized return and have netted him over $40 million according to some estimates.

Chris created his own social financial analysis technology called TickerTags, which he later sold to a division of Jeffries Financial Group. TickerTags was a “social listening” tool that gathered data on social sentiment across platforms like Twitter. Compiling the data, he was able to witness the formation of trends and apply this to his trading decisions.

Summing Up the Social Trader Tools of 2023

Social trading has taken huge leaps as technology has grown in the past few decades. Couple this with the work-from-home movement that was strengthened during the pandemic, and now we have many thriving social trading communities across the web.

It’s important to remember that even social trading carries its risks. Taking advantage of the many social trading tools and strategies should be done with caution and a healthy dose of risk management.

It is yet to be seen what the future of social trading holds beyond 2023. Could we see AI play a bigger role in portfolio management? What social trends will impact investing in the years to come?

Day Trading

Day Trading