Trading Psychology

There is a lot of focus on trading strategies, indicators, and technical analysis when trading. Learn about the psychology of trading.

.png?width=594&height=198&name=TRADING%20PSYCHOLOGY%20(1).png)

Trading Psychology

There is a lot of focus on trading strategies, indicators, and technical analysis as you begin your trading career. And this is certainly needed. However, as your career progresses, you’ll likely find that analysis and strategy eventually take care of themselves as you find your niche in the market. Trading psychology, on the other hand, may require a considerable amount of work for most traders.

At Tradingsim, this goes to the core of what we do. Our mission is to provide a safe learning environment for you to not only learn how the market works technically but also to build your confidence. Over time, as you trade in a simulated environment and test your outcomes, this will boost your trading psychology performance as well.

Many traders do not realize that much of trading psychology is a byproduct of practice. Some will argue that simulated trading isn’t as realistic and therefore can’t prepare you for the emotional side of trading. This is only true if you have not learned to trust in a tested strategy.

For that reason, we can think of no better place to begin your trading mindset journey than in a simulator. However, there are many nuances to trading psychology that you’ll need to address along the way. Let’s take a look at some of the most important ones.

Stock Market Emotions

The stock market is full of emotions. You can probably guess the most common stock market emotions, like fear and greed. But, did you know that the stock market can elicit many emotions?

After all, that’s all the stock market really is: human emotions on display. The sooner you realize this, the better trader you will likely become. It is the market that tests and preys upon your emotions. You should learn to master them sooner than later.

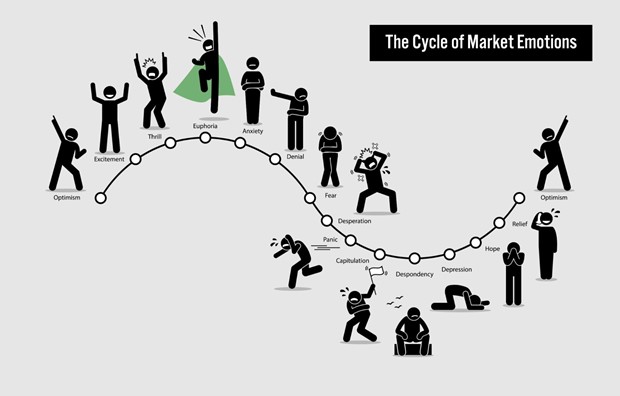

Stock Market Emotional Cycle

It’s true, stock market emotions run the gamut from fear, despair, hope, anxiety, and even euphoria. It is so common to experience these emotions that you can actually expect them to occur in a predictable cycle. We call it the stock market emotional cycle.

Think of it this way: we all start out with optimism – optimism that we are going to make lots of money in the market. Over time we may have trades go in our favor and make lots of money. However, if we aren’t in tune with the normal price cycle of the market, we can ride our profits all the way back down, leading us to despair.

Here is an example of a stock market emotions chart that shows the cycle from hope to despair and back again.

The goal, of course, is to become a trader who learns to manage his emotions and make wise decisions. Instead of hope and fear and greed, become a process-oriented trader who can trust his judgment on the market.

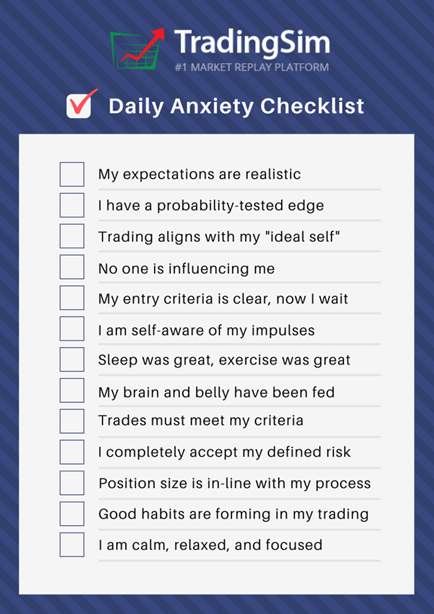

Stock Market Anxiety

Anxiety is a pretty normal emotion for a lot of people these days. With all the fear of covid and war and famine hitting the newsfeed, it’s no wonder we’re all a bunch of anxious people. Unfortunately, the stock market can create a lot of anxious people as well.

Stock market anxiety usually stems from a lack of knowledge and understanding. The less you know about something, the riskier it becomes. And for most new traders, this lack of knowledge can lead to anxiety in trading.

“Indeed, it’s often because of our need to make money and our overconfidence that we pursue shortcuts in our learning processes as traders and take too much risk. That leads to volatility of P/L and losses, which in turn trigger our nervousness, tension, stress, fear, and worry.”

Dr. Brett Steenbarger, Ph.D.

There are certain factors that cause stock market anxiety. In the list below, consider if any of these things apply to you. It might help you learn to control your emotions in the stock market if you can eliminate some of these issues.

- Are you trading because you need to make income?

- Are you risking all of your money plus margin on a single trade?

- Do you have any idea what the outcome is of your strategy?

- Is the stock you are trading very volatile?

- Do you like to share your winning trades and not your losing trades?

- Are you placing undue pressure on yourself to become rich quickly?

If you answered yes to any of these questions, you may be stressing yourself out. Day trading anxiety can come from many different angles. We don’t recommend going full-time with trading until you have proven you can replace your income as a consistent trader. For most, this will take years. Likewise, learning to be disciplined with your position size, strategy, and ego, may take time.

To help mitigate stock market anxiety, we’ve created this checklist for you. Feel free to use it.

How to Master Trading Psychology

According to veteran trader, Roman Bogomazov, trading mastery takes many, many years. In our SimCast episode with him, he outlines four core components to trading mastery, and the last involves trading psychology mastery. Here are the core four:- Knowledge

- Skill

- Process

- Mindset

Notice that Mindset is the last on the list here. It takes many years to master trading psychology. And part of that process is having the knowledge base, skills, and experience of many market cycles.

This is part of the process. Years of trading experience in front of the screens builds implicit learning. The more you recognize patterns and shifts in market sentiment and behavior, the more you’ll be ready for those similar opportunities in the future.

That being said, let’s look at some of the key components of mastering trading psychology.

Trading Discipline

Trading Discipline is a matter of intentionality, according to the most prolific trading psychologist of all time Dr. Brett Steenbarger. Dr. Steenbarger believes that it is a byproduct of having energy through personal discipline as well.

For example, if you do not sleep well or feed your frontal cortex through proper exercise and diet, you may lack energy and focus. You may also need breaks throughout the day. Eventually, all the little things in your life will add up. Lack discipline in the small things, and you will also lack discipline in trading.

“If you lack energy, you will lack focus; if you lack focus, you lack intentionality; if you lack intentionality, you’ll lack the ability to follow trading plans”

Dr. Brett Steenbarger

Perhaps you need to be a bit more diversified in some areas of your life, like being a father or a husband. Take the things you value in life seriously and with intentionality, then apply this to your trading career.

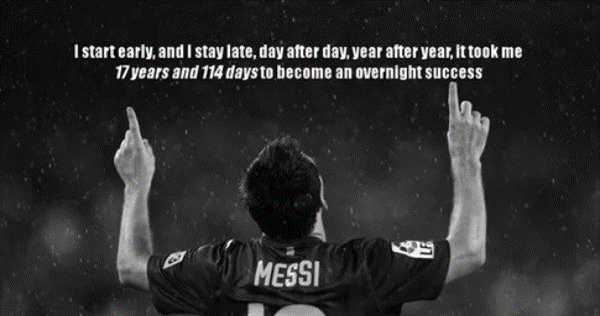

Trading Performance

The first step of any performance is practice. Practice, practice, practice. Trading is a performance profession. It is really no different than a sports profession, acting, or even doctor or lawyer for that matter. It all depends on how well you practice your craft when the lights are off and the seats are empty.

Don’t take it from us, even Dr. Steenbarger, who has worked with hundreds of professional traders over the years, has this to say about trading performance:

“Think about every performance field: athletics, acting, music. In none of those do we start out by following people online, doing some reading, and then trying to make a living from our performance. Rather, we recognize that it takes years of practice and mentoring to become a professional athlete, movie star, or recording artist.”

Dr. Brett Steenbarger, Ph.D.

So, keep in mind that if you don’t enjoy the trading process, or the process of learning, it is unlikely that you will excel in your trading performance. The traders who go on to become successful actually enjoy the process of learning, studying, practicing, and being a part of the market.

In other words, like discipline, achieving high trading performance is a product of being intentional with your efforts. However, there can be a lot of underlying “limiting beliefs” and bad habits that you need to fix. We talk about this in our SimCast episode with Créde Sheehy-Kelly.

Bad Trading Habits

Believe it or not, most of our bad trading habits may actually stem from mental or physical habits. You can take two individuals who are new to trading, give them the exact same education, strategies, etc., and they will likely end up with different outcomes.

The reason for this lies deep within each trader's mindset and the baggage they bring to the market.

Bad trading habits can form simply because of the way we were raised. Were you raised in a home that encouraged resiliency and positive self-talk? Or, were you raised to believe that some things in life are too difficult to be achieved? Do you struggle with self-sabotage when things don’t go your way?

A lot of your bad trading habits could be bad mindset habits. Let’s look at some of these.

- Honesty and transparency

- Proper expectations

- Enjoyment

- Flexibility and poise

- Making good decisions

- Laziness

- Positivity

- Risk/Loss Aversion

- Self-love

- Focus and vision

- Teachability

- Resilience

If you read through these and find that you struggle with certain areas, it may be that your deeply entrenched mental habits are fueling your bad trading habits. Perhaps you should seek out ways to become more self-aware of your own psychological habits?

The Importance of Trading Psychology

We’ve touched on a lot of different issues regarding trading psychology so far. This is by no means an exhaustive list of problems you may encounter. Nonetheless, we want to point out just how important trading psychology is to your success in the markets.

Whether you’re struggling with physical habits, mental habits, or any other psychological issue, the sooner you work on those and iron them out, the better off your trading will become. All the best trade plans in the world can’t make you enough money if you aren’t disciplined enough to follow through.

As part of that, it’s important to know that we are humans, emotional beings. Trading is not about becoming a robot. Rather, it is about becoming self-aware. Now, let’s look at how we can manage our trading emotions through specific struggles we may face in the market.

Trading Mindset

There are a few things that can really affect your trading mindset that are worth discussing. How you manage risk, and how you deal with losses are two key components to the trading mindset. Yes, they are part of an overall good process, but if you don’t have a good grasp of these, you may struggle.

Stock Trading Risk Management

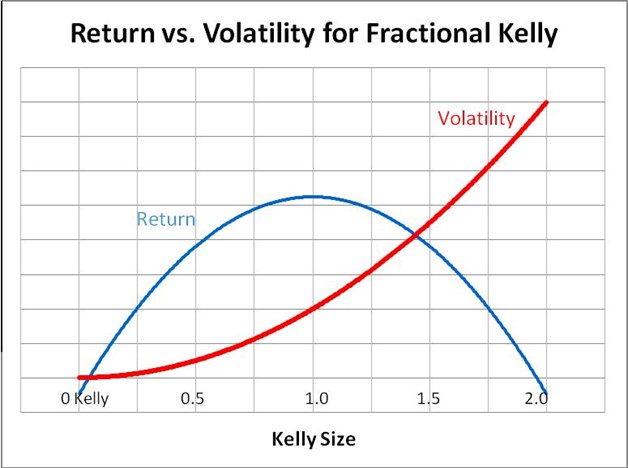

Your process for risk management will set the tone for your trading mindset in each trade. It is the first thing that you should think about when putting on a trade. Period. This is the name of the game: how long can you survive in the market. Without proper risk management, you won’t.

Stock trading is not a gamble. It shouldn’t be all or nothing like Vegas. Instead, it is a game of probabilities. As part of that game, you must understand that risk management is key to your success. Knowing when and where to stop out of your trades, along with how much of your account you will risk, is of utmost importance.

As a rule of thumb, we don’t recommend risking more than 2% of your account on any single trade at a maximum. Realistically, you should keep this to about 0.5% to 1% of your account. Not every trade deserves maximum risk.

However, until you truly learn to accept the risk, you will interpret the noise of the market as a potential threat and will find some way of rationalizing to yourself that you must exit the trade too soon.

However, until you truly learn to accept the risk, you will interpret the noise of the market as a potential threat and will find some way of rationalizing to yourself that you must exit the trade too soon.

To help with your trading risk management strategies, we recommend you watch our SimCast episode with Kris Verma where we discuss the Kelly Criteria. It will help you learn how to set your risk and position size for every trade.

Dealing with Trading Losses

The ability to reset is paramount in the world of trading. Call it resilience, bouncing back, or whatever you like. Those who don’t take losses personally and have mastered a way to bounce back quickly, are setting themselves up for success.

The secret to this is really no secret, however hard it is to learn as a new trader. That is, the market is a game of probabilities. You’re going to lose. And how well you lose will determine how much you win.

Take Kristjan Kullamägi for example. Kristjan is worth almost $100 million dollars. Yet, he started trading with only a few thousand dollars and blew up countless times.

Most telling about Kristjan, however, is his win rate, which is somewhere around 25%. Yes, you read that correctly. A man who has amassed $100 million dollars in about a decade only wins 25% of the time.

Think about that the next time you beat yourself up for a losing trade.

Trading Mindset Quotes

One of the best ways to boost your attitude about your trading mindset is to read good trading mindset quotes. Whether it is Mark Douglas, Brett Steenbarger, Jesse Livermore, or any other trader, quotes have a way of encouraging us in the heat of the battle.

That being said, here are a handful of our favorite quotes on trading mindset:

“Big expectations lead to big frustrations.”

Brett Steenbarger, Ph.D.

“It takes conscious and deliberate focus to understand how your mind and emotions are impacting your trading and to cultivate the mindset that will support you in achieving your trading goals. It’s not something that just happens on its own.”

Créde Sheehy-Kelly

“As long as a stock is acting right, and the market is right, do not be in a hurry to take profits”

Jesse Livermore

“The game taught me the game. And it didn’t spare me the rod while teaching.”

Jesse Livermore

“Successful traders spend as much time studying themselves and their trading as studying markets. In the patterns of your best and worst trades is the information that can make you the best trader you can be.”

Brett Steenbarger, Ph.D.

The Best Trading Psychologists

Trading psychology, in a lot of ways, is like performance psychology. If you can coach performance, you can probably make an impact on trading performance. There are many who offer advice and practical wisdom, but there are few who actually study the science of trading psychology.

Let’s look at a few people who have made a huge impact on the trading industry, and name a few books to help along the way.

Dr. Brett Steenbarger, Ph.D.

Dr. Steenbarger is far and away the most influential trading psychologist in the world. His research and writings are prolific. He has worked with many of the most famous traders in the world and regularly works with proprietary traders and other professionals who make millions in trading profits.

Dr. Steenbarger’s works are endless. He has almost 5000 articles on his site, traderfeed.blogspot.com. Not only that, but he has written many books, given interviews, and regularly posts YouTube videos.

Our favorite book by Dr. Steenbarger is The Daily Trading Coach: 101 Lessons for Becoming Your Own Trading Psychologist. In this amazing work, he has compiled short 3-4 page lessons on almost every topic that applies to trading and the struggles that traders face. He leaves no stone left unturned when it comes to trading psychology. In fact, it’s almost like you have a 1-on-1 session with Dr. Brett every time you pick up the book after a day of trading.

No matter where you are on your trading journey, you can’t go wrong with any of the material from Dr. Steenbarger.

The Best Trading Podcasts

Nowadays, one of the best ways to fuel your mind and feed your brain is through podcasts. There are so many interesting interviews available that you can really learn a lifetime of trading psychology vicariously through trading podcasts.

Day trading podcasts are a way to introduce you to the real traders in the community. Whether you trade forex, futures, or stocks, the podcasts we mention below can offer you a genuine look at different traders and trading styles.

We think they are so beneficial that we started our own podcast called the SimCast. We’ve had some really great conversations with some amazing traders. In your spare time, you should check out any of these top 8 podcasts for day trading.

- The SimCast

- Confessions of a Market Maker

- BtheStory

- SMB Capital

- Chat with Traders

- TradingNut

- Better System Trader

- The High Performance Podcast

Listening to a day trading podcast can be beneficial for those who are commuting to work and are seriously committed to learning how to improve their day trading.

However, there are also many video podcasts now and most of them are free. This allows you to get insights into technical analysis like never before.

Trading Psychology Books

Little do we realize that more often than not, when we think we know something, we actually understand very little.

This is where education can help. Oftentimes, awareness is the beginning of our enlightenment and path toward freedom. In trading, this can come through the help of trading psychology books, courses, or free online content.

The great thing about pretty much any line of work is that usually someone has gone before us and made the mistakes. Not only have they made the mistakes, but many have documented their mistakes. And in this day and age, we have information at the tips of our fingers. So, why not take advantage of that?

Here is a list of some of the best trading psychology books that we recommend:

- The Psychology of Trading – Brett Steenbarger

- The Daily Trading Coach – Brett Steenbarger

- Trading in the Zone – Mark Douglas

- Flow: The Psychology of Optimal Experience – Mihaly Csikszentmihalyi

- Market Wizards – Jack Schwager

- Reminiscences of a Stock Operator – Edwin Lefevre

- The Art of Thinking Clearly – Rolf Dobelli

- Sway: The Irresistible Pull of Irrational Behavior – Ori and Rom Brafman

- Market Mind Games – Denise Shull

- Trading Psychology 2.0 - Brett Steenbarger

- High Performance Trading – Steve Ward

- The Disciplined Trader – Mark Douglas

- Atomic Habits – James Clear

That should be plenty of reading to get you started! With so many great resources, you are sure to find something that impacts your trading performance and trading mindset. The best trading psychology books will be a well that keeps on giving. With every re-read, you’ll glean more and more.

Trading Psychology Summary

We hope you’ll make use of the many resources we provide here on our site and our blog. As we mentioned at the beginning: there is no better way to start working on your trading mindset than in a simulator. Practice your trading habits with no risk, then build on those habits through intentional education, mindset training, and activity.

Here’s to good fills!

Love these and want more?

Stay in the know

Make the most out of every trade!