In this article, I am going to cover some basic trading techniques you can use with the Bollinger Bandwidth indicator. Before we dive into the strategies, let’s first discuss the indicator.

Bollinger Bandwidth Overview

The Bollinger Bandwidth was first introduced by John Bollinger in the book, Bollinger on Bollinger Bands.

The indicator measures the percentage difference between the upper and lower Bollinger Bands. Most chart engines plot the indicator as an oscillator beneath the price chart.

For a quick refresher, Bollinger Bands encapsulate price and are two standard deviations from the 20-period simple moving average (SMA).

How to Calculate the Bollinger Bandwidth

First, subtract the values of the lower band from the upper band. The difference is then divided by the value of the middle band which is the 20-period SMA.

The result is a normalized bandwidth value.

Bollinger Bandwidth Chart Example

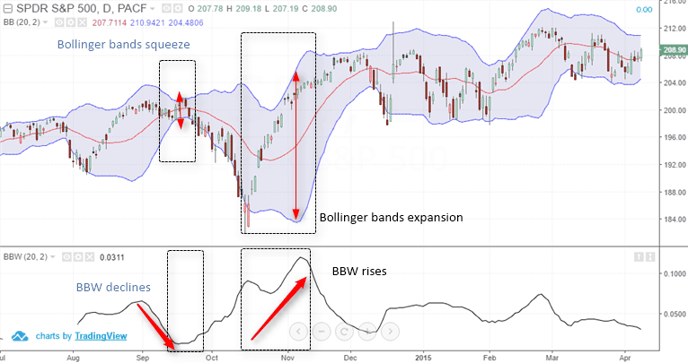

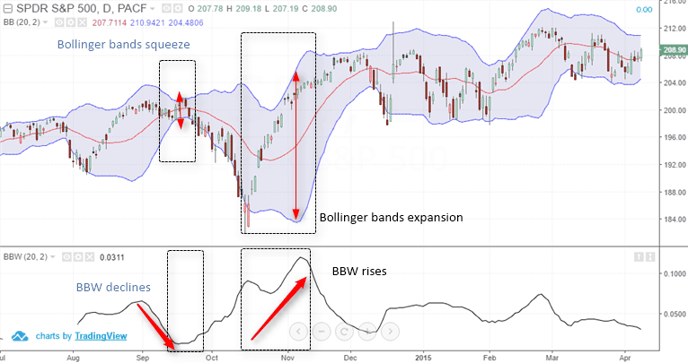

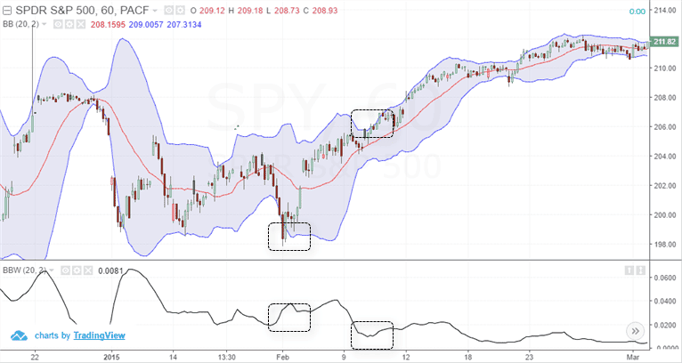

Bollinger bandwidth indicator with Bollinger bands on SPY ETF Chart

In the above chart, when the distance between the two outer Bollinger bands contract, the Bandwidth indicator falls and when the upper and the lower Bollinger Bands expands, the Bandwidth indicator rises.

The Bollinger bandwidth provides a visual of price consolidation (low bandwidth values) and periods of volatility (high bandwidth values).

As a trader, you can zoom out on your chart to get a sense of the volatility within context to prior moves.

Interpreting Bollinger Bandwidth Indicator Signals

When the upper and lower bands are far apart, it indicates the current trend is nearing an end.

Conversely, when the upper and lower Bollinger bands tighten, an impulsive move is likely right around the corner.

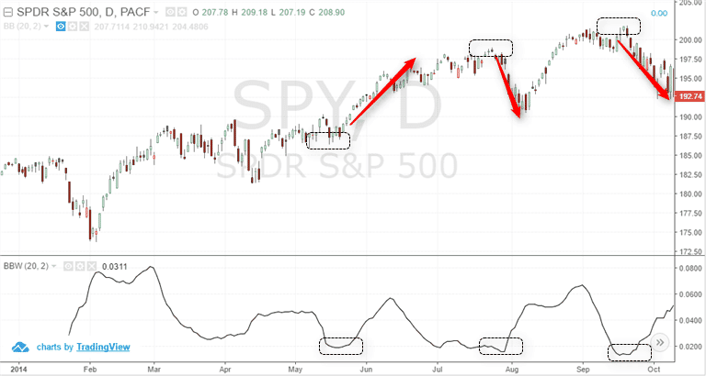

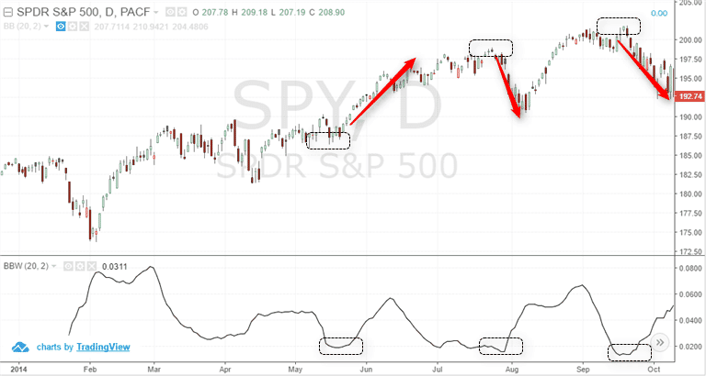

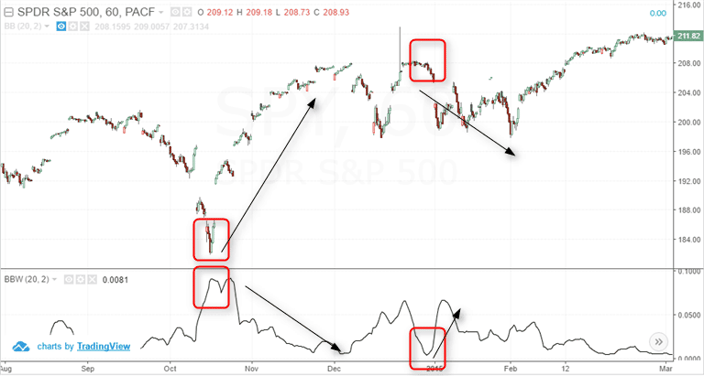

Bollinger bandwidth and market volatility

The above chart shows how lows on the Bollinger bandwidth signal a potential strong move in the markets. In the first instance, the low period of consolidation was marked by a strong breakout in prices.

In the second scenario, the low bandwidth reading called the short-term top and subsequent price selloff.

Lastly, the third example shows triggered a rally.

Bollinger Bandwidth Does Not Forecast Market Direction

As you can see, the low points do not predict which way the market is going to break. You will need to use other analysis techniques to identify your edge.

3 Bollinger Bandwidth Trading Strategies

The most common way to trade with the Bollinger bandwidth indicator is breakouts. As previously discussed, low periods of volatility precede high periods of volatility.

#1 – Bollinger Bandwidth and the Broad Market

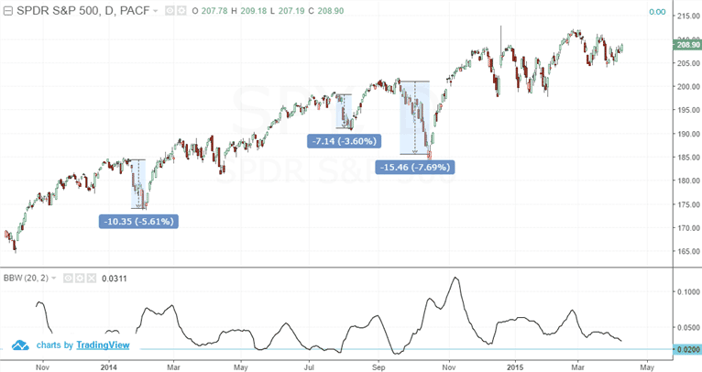

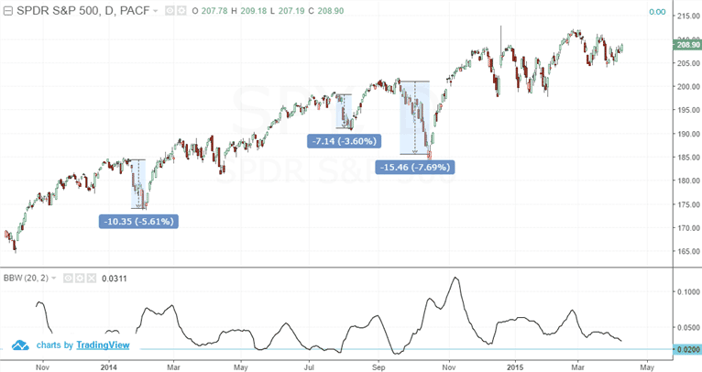

According to John Bollinger, the fall in the Bollinger Bandwidth indicator below 2% or 0.02 has led to big moves in the S&P500 index.

Bollinger bandwidth indicator and the 2% threshold

In all the three instances price fell 5.6%, 3.6% and 7.6% from the short term market tops when the indicator dipped below 2%.

To profit on this setup, you can buy futures contracts or an ETF that mirrors the broad market. To determine your potential profit potential, review prior rallies to determine the mean.

#2 – Double Bottom Trade Signals

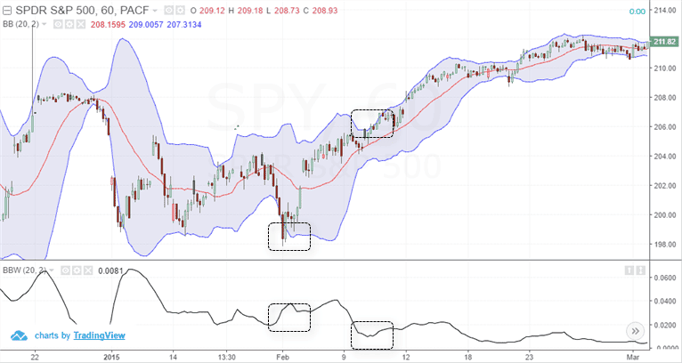

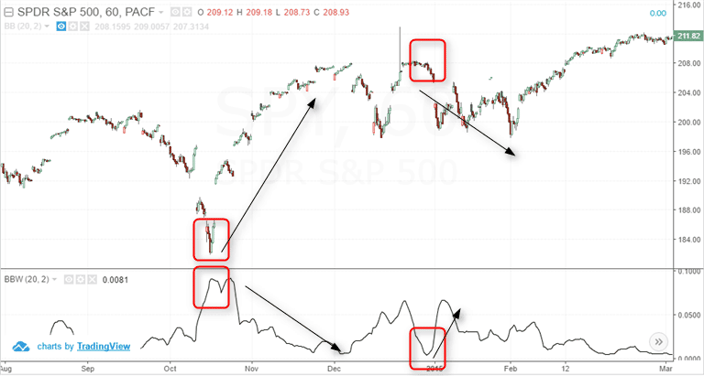

In the following chart, we have the SPDR S&P500 SPY ETF intraday chart. Here we can see that while prices posted a low it was marked by a low in the Bollinger bandwidth.

Bollinger bandwidth and price trends

This low was also a test of a prior low with the candle completely outside of the Bollinger band.

So, you have multiple signals confirming the index is oversold. While we only cover double bottoms, you can apply the Bollinger bandwidth indicator to validate other chart patterns.

#3 – Major Trend Reversals

In the below chart of the SPDR 500 the market put in a major low in the first red box. In this setup, you want to wait for volume and price to go parabolic to the downside.

If you notice the volatility easing the initial push could be enough for the security to climb the wall of worry. You can jump onboard the trend with a close stop below the most recent low.

You will want to apply trendlines or another indicator to follow price higher. When you are buying securities with such high volatility on a countertrend move, you have to hold on to your position a little longer, so the risk-reward works out on the trade.

Bollinger bandwidth indicator at extremes

Next up, the market formed a top with another extreme reading of the Bollinger bandwidth indicator.

Here you can go short with a stop above the most recent high. You can trail the position using trendlines or price action.

How Can Tradingsim Help?

If you are thinking about trading with the Bollinger bandwidth indicator, you can do so within Tradingsim. You can practice placing trades and identify which strategy works best with your trading style.

To learn additional Bollinger bandwidth strategies, learn from the master himself – John Bollinger on his website.

Good Luck!

Day Trading Indicators

Day Trading Indicators