Technological improvements have grown by leaps and bounds and changed the way the financial markets are interlinked and traded today. Gone are the days of using a pen and paper to conduct technical analysis or calling your broker to place an order.

The advent of computers has brought trading to the homes changing the way the average mom and pop invests or trades. Every step of trading, from the way the orders are placed to the way the orders are conveyed to the broker and to the exchange and the way they are filled is determined by technology.

Algorithmic trading has been one of the most talked about disruptive technologies in recent years. Still, it isn’t something new to the trading world and has existed since decades. Known by different names such as automated/algorithmic trading systems (ATS) or black box trading, it is the process of using computer programs that are designed to follow a specific set of instructions to buy or sell based on a set of rules. Think of algorithmic trading as a robot trading the financial markets when specific requirements are met.

What is Algorithmic Trading?

Algorithmic trading as the name suggests is a piece of code that automatically trades the markets. Think of Algorithmic trading as a set of logical rules a program has to follow.

For example, you could build a trading program and code it to trade the market open based on some criteria, or you could build an automated trading system that buys on a bullish moving average crossover and so on.

Automated trading comes out of a mechanical trading system. It is easier to code a mechanical trading system than a discretionary trading system because the rules are specific and finite and most importantly does not contain any subjective thinking on its part.

Some of the different types of algorithmic trading systems are:

- Momentum: Momentum based ATS look for strongly trending stocks. ATS based on this method can look into entering the strong trend, holding for a few hours or days before exiting for a profit

- Mean Reversion: This type of ATS looks at price reversing to its mean price. It is somewhat opposite to how the momentum based strategy works

- Valuation: Some advanced ATS can look to valuation of stocks and identify stocks trading at a discount and initiates positions. Common examples could be the Dogs of the Dow

- Seasonality: In this type, automated trading systems look at a seasonal behavior of an instrument and initiate trades accordingly. For example sell in May, or buying natural gas futures into the winter months

- Sentiment: The sentiment based ATS looks at crowd or trader psychology. Example of sentiment based ATS is buy the rumor, sell the news

Introduction to High Frequency Trading

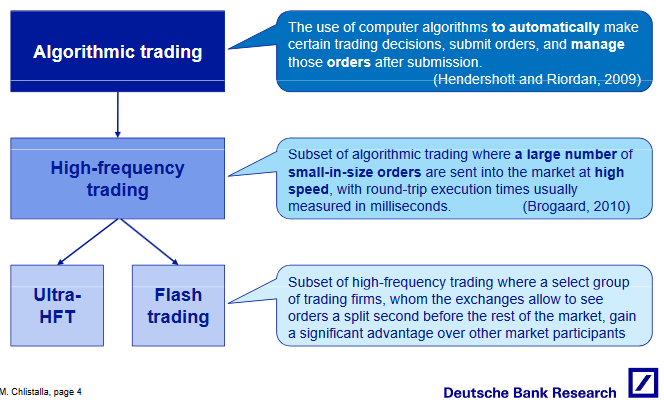

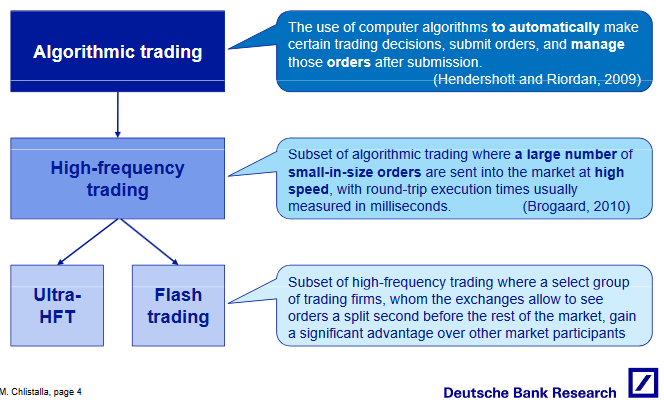

People tend to confuse High Frequency Trading with Algorithmic Trading. However, these two are completely different. In fact High Frequency Trading or HFT is a subset of Algorithmic trading and HFT can be further categorized into different subsets.

Algorithmic Trading and HFT (Source – DBResearch)

The subject of High Frequency Trading is one that is often debated and can evoke strong emotions among traders, perhaps due to a personal issue such as being stopped out, irrational market behavior and so on.

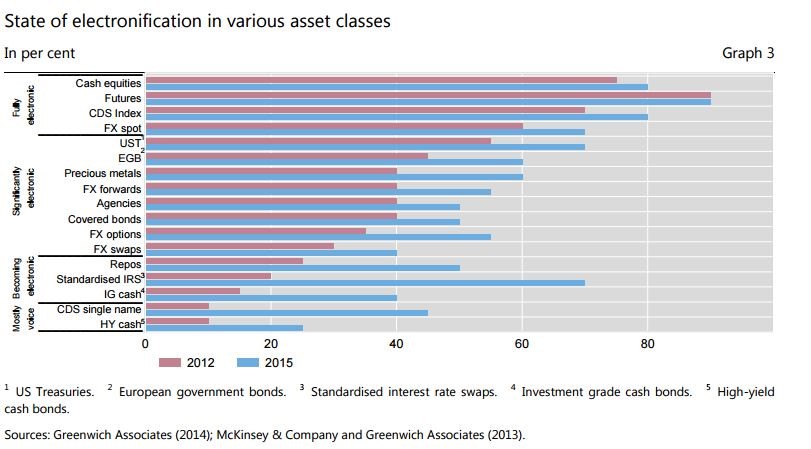

According to some recent estimates, as early as April 2016, HFT is said to account for roughly over 70% of trading volume in US equities alone and about 50% in the European equity markets. In the futures markets, HFT accounts for nearly 80% of foreign exchange futures volume and nearly two-thirds of interest rate and Treasury futures volume.

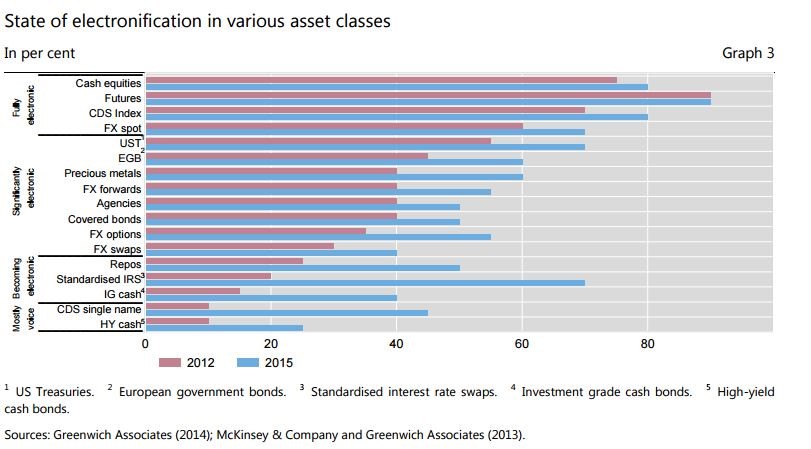

Percentage of HFT trading across various assets

HFT trading in percentage terms across various asset classes (Source: Want to be a trader in 2020? Look at these charts)

What is HFT?

High Frequency Trading works on the concept of speed and information.

- Speed or latency determines how fast orders can be executed

- Information determines how fast any new information that is released can be interpreted by the HFT machines

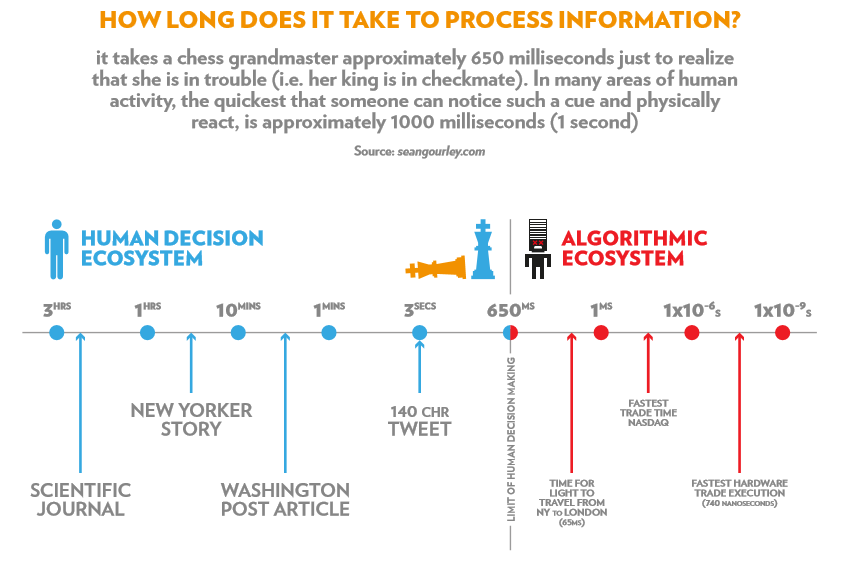

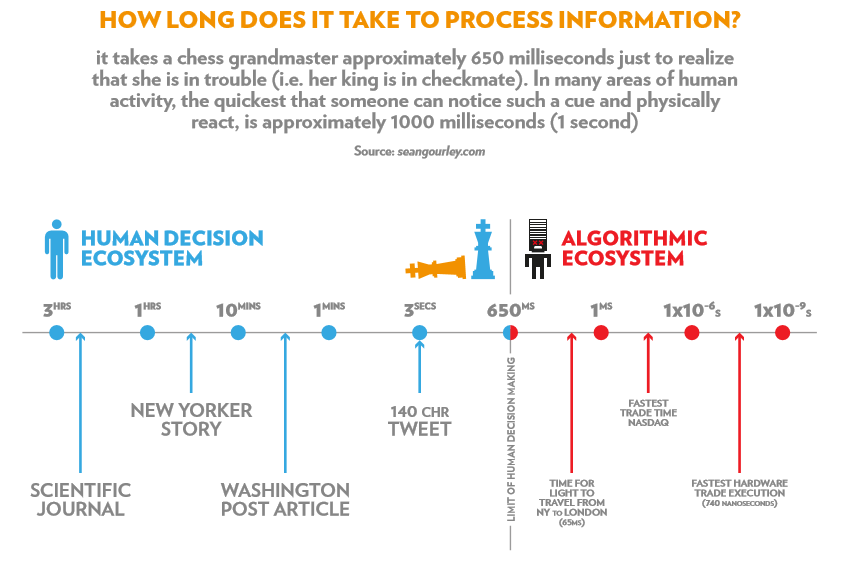

To get an idea on how fast HFT’s work, imagine this. It takes 300 to 400 milliseconds to blink an eye. A millisecond is one-thousandth of a second (1000 milliseconds = 1 second).

For HFT’s, it takes 1 microsecond to complete an order. (1 microsecond = 0.001 millisecond). On average, an HFT can trace 7000 times within a 300 – 400 millisecond time frame.

HFT’s take the subject of automated trading to a whole new level as the machines with high computing power can now read market news as well.

Human information processing compared to HFT (Source – seangourley.com)

Some of the most common aspects that are used in support of High Frequency trading are Liquidity, volume, tighter spreads.

Liquidity is the most essential part for any trading system or exchange. Algorithmic trading enhances the effectiveness of the overall markets. Due to the sheer volume of HFT based trades, the overall costs are reduced on account of narrow spreads and based on the depth, the price of the assets are less affected by other trades (non-algo trades). Liquidity is also important as it helps to absorb market shocks better than compared to an illiquid market, which adds to the robustness of the financial systems. Last but not the least, liquidity is essential to price discovery which is an important aspect for the markets.

Due to the number of trades an HFT program will make, exchanges particularly like HFT firms. More trades from HFT’s translate to more volume, which in turn increases more commissions for the exchange. In March 2016, NYSE was fined $5 million after a whistleblower discovered that the exchange showed preferential treatment to a HFT firm.

In some cases, HFT’s are also said to be directly responsible for lower spreads in the markets.

Interestingly, each of these advantages of High Frequency Trading can be easily debunked!

Surviving in the world of algorithmic and HFT trading

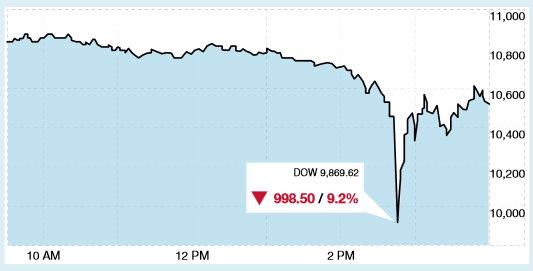

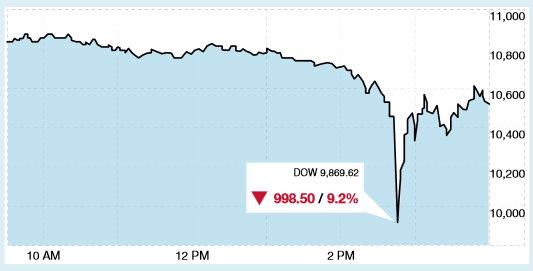

It is estimated that the popularity of HFT and algorithmic trading will continue to rise in several major global markets as the need for independent and proprietary trading firms and quantitative trading strategies increase. Despite facing immense pressure especially after being responsible for the May 6, 2010 flash crash that sent the Dow Jones falling by 1000 points only to recover back in about 15-minutes, HFT’s aren’t going anywhere.

Dow Jones – May 6th Flash Crash

New regulations are expected to bring more transparency and also reduce the volatility in the markets. Experts believe that HFT is but a natural step in the evolution of the financial markets. Currently many research papers are being presented on areas such as risk and compliance management, technology adaptation, code optimization and so on.

The point here is being that HFT’s and automated trading is here to stay. But what does this mean for the average retail trader who still prefers to trade from the comfort of their home, analyzing the charts and placing their orders manually (electronically of course)?

First of all, there is no foolproof method that will guarantee you protection against sudden spikes in the markets caused by HFT and algorithmic trading but you can follow some methods to ensure that your losses are minimized.

Take fewer trades: This does not mean that you should trade less, but rather when you trade, focus on the best possible set ups based on a strategy that you follow. By ensuring that you trade only the best possible trade set ups, you not only limit the losses on the trade, but you also become selective in your trading. Fewer trades would mean lower transaction costs over a period of time and it helps to ensure that you make consistent profits over time. Remember, good traders manage risk.

Avoid overnight trading: Lower liquidity periods in the futures markets occur between the close of the US and the mid-Asian trading session. This period of low liquidity means that an HFT or an algo is able to easily push prices around simply by using large volumes of trades. Your best chances of minimizing your losses is to trade when there is high liquidity such as the overall of the European and US trading hours. This ensures that even if a trade moves adversely against your position, the high liquidity will ensure that your stop loss is filled at the price and not at the next best available price.

Skip ranging markets: Most HFT’s are at their best in sideways markets. By utilizing big volumes and choppy price action, HFT’s can make significant amount of money. For the retail trader, a sideways market will only leave you confused and will eat away at your trading capital due to the trades being constantly stopped out. On the other hand, when you focus on a strong trending market, it can help you to ride the trend.

Be well capitalized: One of the most common reasons retail trades fail is because they are undercapitalized or do not use good position management. Besides the performance bond or initial margin that is required, leave enough maintenance margin and some additional capital to ensure that your trade has enough breathing space.

Trading with HFT’s and Algos – Final Thoughts

Mike Bellafiore is a well known name in the trading industry and he is the co-founder of SMB Trading, a prop trading firm. He is also the author of many successful trading books such as The Playbook and One Good Trade.

In his books, Mike outlines some ways how you can survive in a world with HFT’s and algos. Some of the points he highlights are:

You will get stopped out of more positions. Therefore use better stops. Stop hunting is a common phenomenon and HFT’s largely contribute to this. Mike suggests that traders should also utilize other tools such as understanding the orders by looking at the Level-II orders. Of course, there is still the risk of spoofing, but when combining good risk management, stops and order book you can at the very least be better prepared.

Past trading setups will no longer work. Mike says that as HFT’s continue to grow and learn how to play the markets; the retail trader should not get complacent with their trading strategy. By adapting to the market behavior and constantly observing the markets you will be able to fine tune your trading strategies while at the same time not allowing yourself room to get complacent which is when things start to come apart.

Institutional buy/sell orders. It is common knowledge that when a big player wants to buy or unload shares, they do so by utilizing passive algos that dump stocks without raising suspicion. Looking at the trends in the institutional buying and selling behavior will help you stay on the right side of the markets. Examples include waiting for a pullback to go long, or to look for strong market behavior during the intraday hours.

Beware the false buy/sell signals. False signals or false breakouts are a common phenomenon and it is suggested that the retail trader should be aware of these risks, especially when they trade breakouts.

To conclude, while HFT’s and algos might have disrupted the market and in a way changed the playing field, the retail trader is required to be more observant and needs to be quick in adapting their methods of trading the markets. It might seem like a challenge for retail traders, but at the end of the day unless you continue to learn something new and change with the times, you will risk getting stopped out!

Investing

Investing