Sharpening Your Trading Decisions with a Simulator

Trading simulators offer a safe space to hone your skills before risking real capital. Think of them like a flight simulator. Before pilots or astronauts ever take off, they spend a lot of time studying the dynamics of flight -- while they're on the ground. This requires a lot of testing, understanding risks and potential mistakes, and becoming comfortable in the cockpit.

Trading simulators offer similar benefits for serious market analysis training. A simulator allows you to leverage historical data, real-time market conditions, and analysis tools to enhance your decision-making skills to interpret market trends effectively. Those who use this tool wisely are leaps and bounds above new traders who simply decide to jump into trading with real money.

Can you imagine jumping into the cockpit of an airplane with no prior training? While your life and others might not be at stake, your livelihood is. Is that something you want to risk?

With that thought in mind, let's explore the benefits of using a simulator for market analysis training. We'll touch on three main points:

1. Historical Data Analysis

2. Real-time Market Conditions

3. Analysis Tools

Understanding each of these contributes to your ability to trade well over time.

Learning from the Past: Historical Data Analysis

As the saying goes, those who don't study history are prone to repeat its mistakes. This is just as true for the stock market as any other system in life. Human nature never changes. It is the same today as it was a thousand years ago.

To understand how the market works, you must understand the cycles it undergoes, the power of human nature's influence on boom and bust cycles, and build your intuition for the best times to buy or sell based on historical market precedents. Current markets are never a mirror image of previous markets, but by studying and trading through older cycles, you'll recognize older patterns in real time.

How can a market simulator like TradingSim help with this? We're glad you asked.

Simulate Past Scenarios:

Trading simulators should allow you to trade with historical data. With this data, you can replay significant market events -- think crashes, bull runs, bear markets, squeezes, etc. -- and see how different strategies performed during those times. You'll be able to pick up on technical analysis data that worked during those periods and apply them to current market conditions.

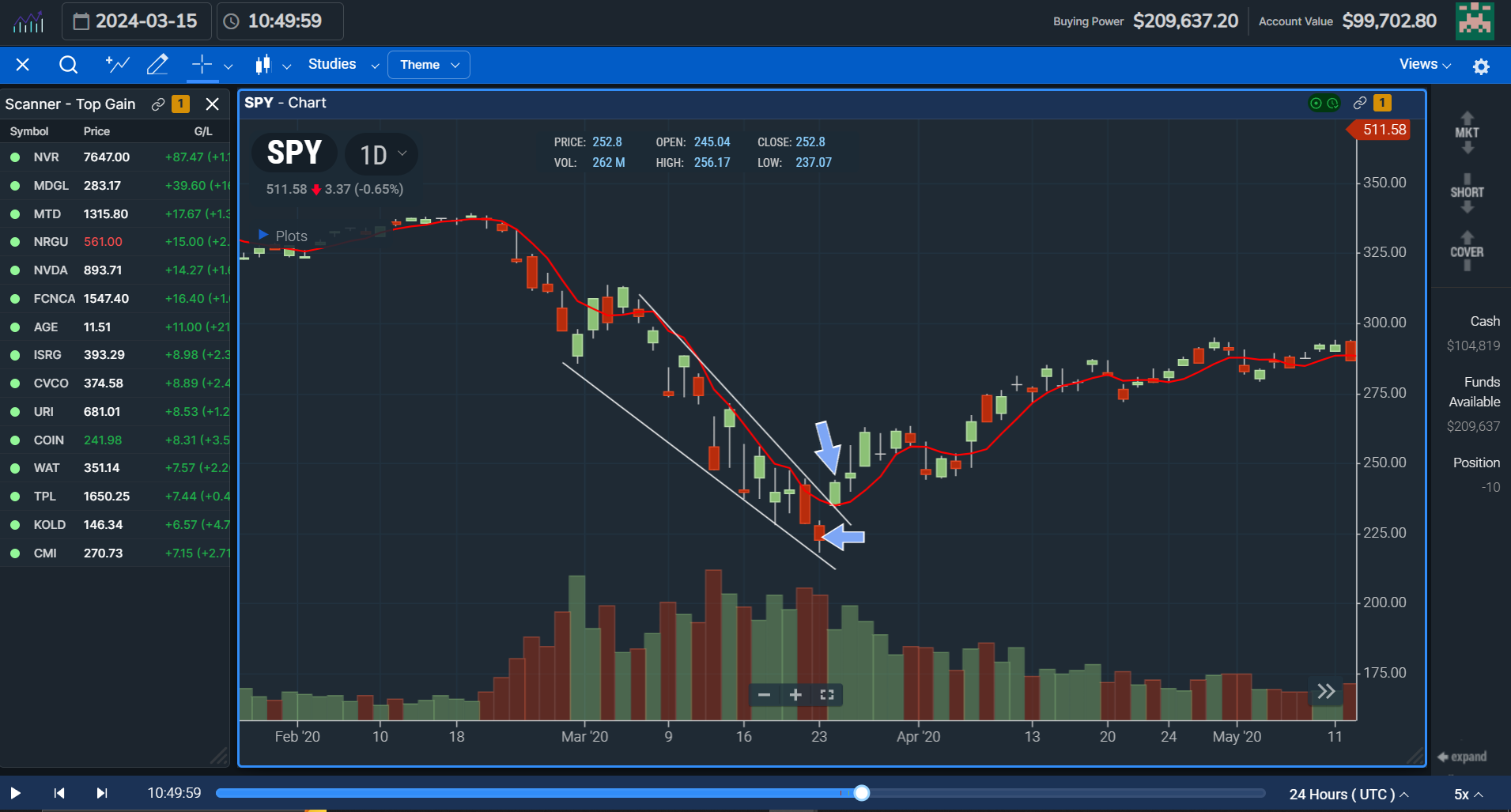

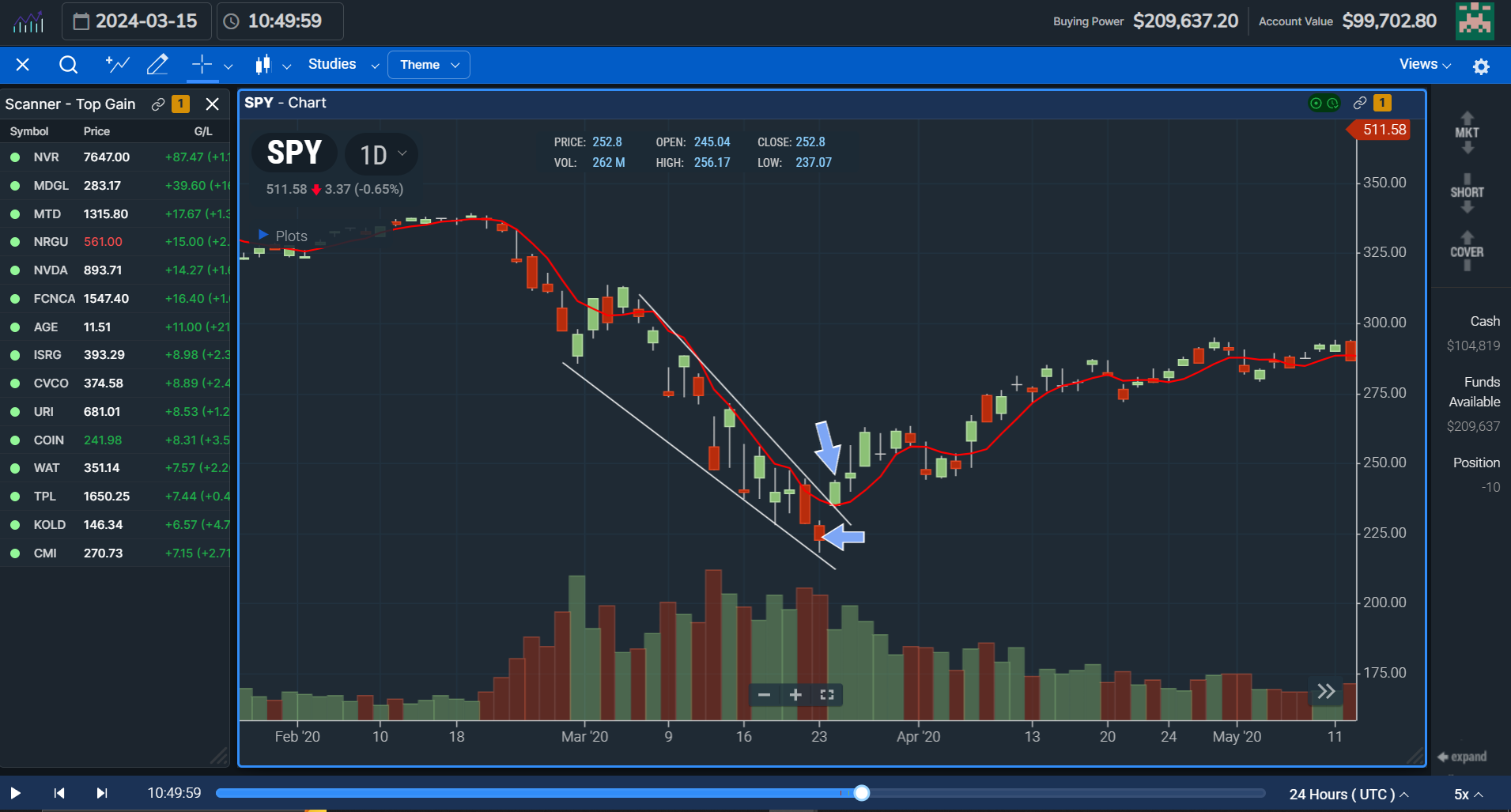

Here's an example. Let's jump in the simulator and take a look at what happened during the Covid crash of 2020 and see what we can glean from a simple observation:

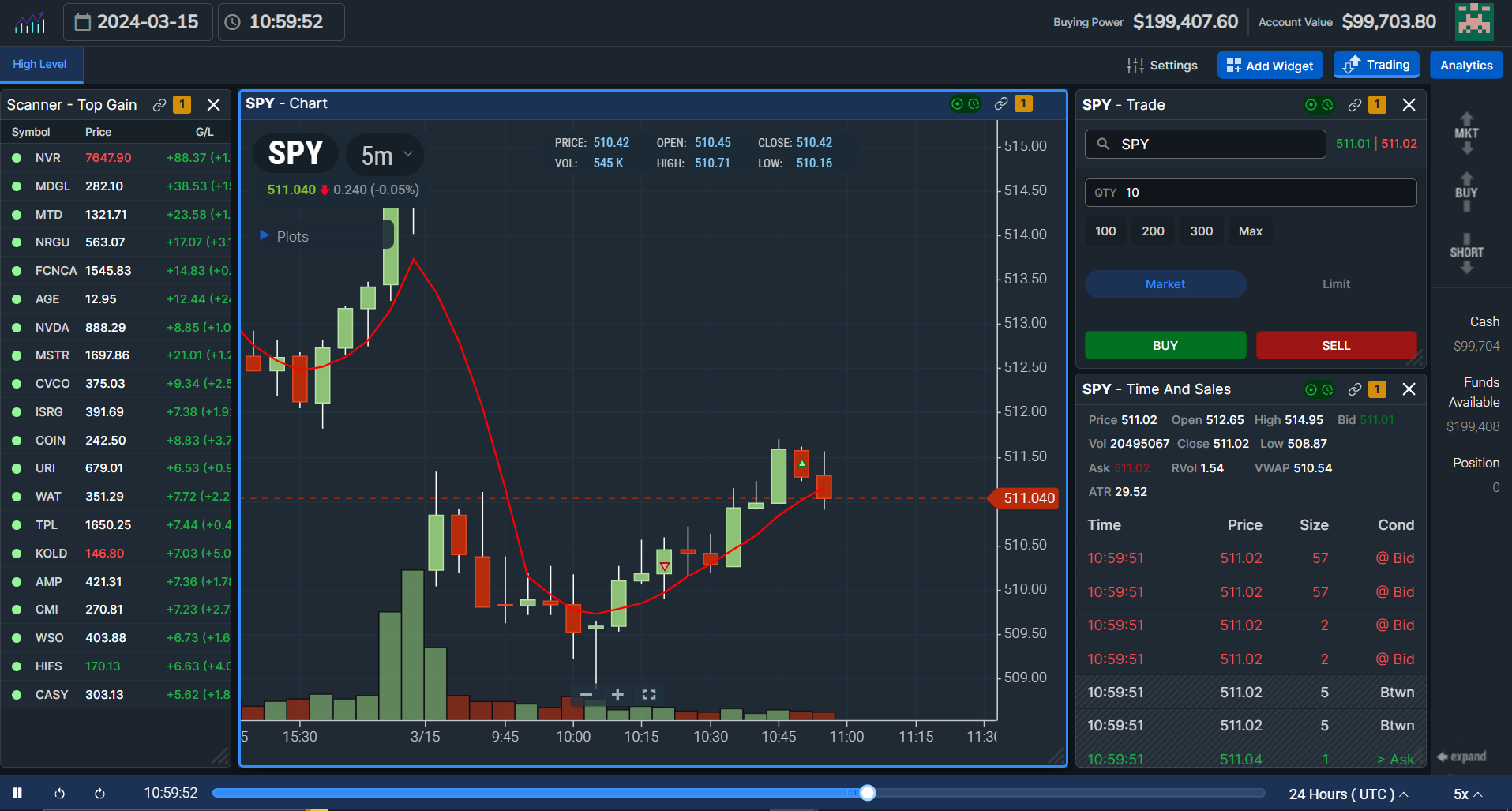

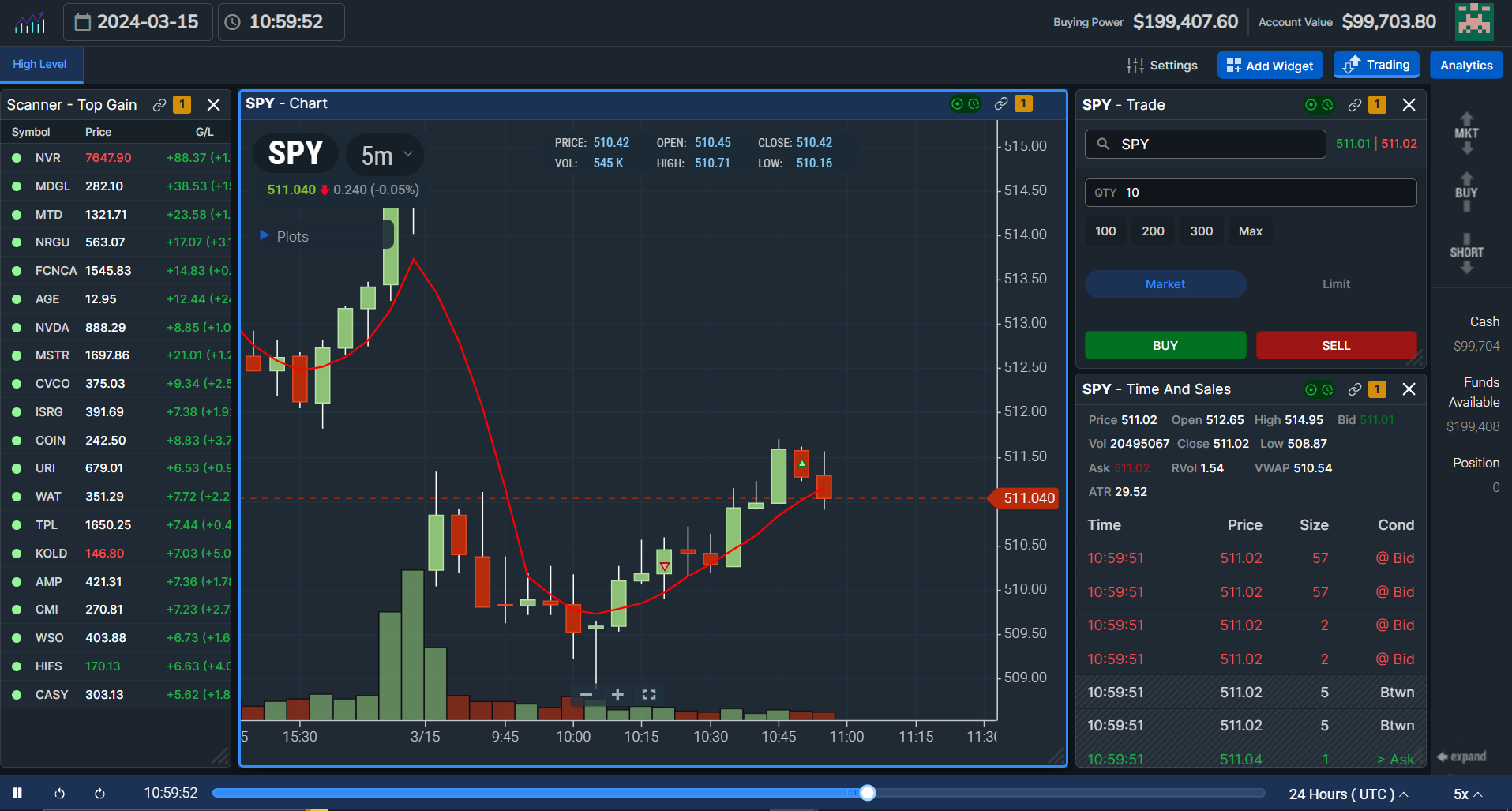

Let's assume you haven't got much trading experience. If not, we threw a couple of market analysis tools on this chart of the SPY, an ETF that follows the S&P500 index. The tools we randomly chose were trendlines, a 5-day simple moving average (the red line), and a few arrows to denote important bars on the chart.

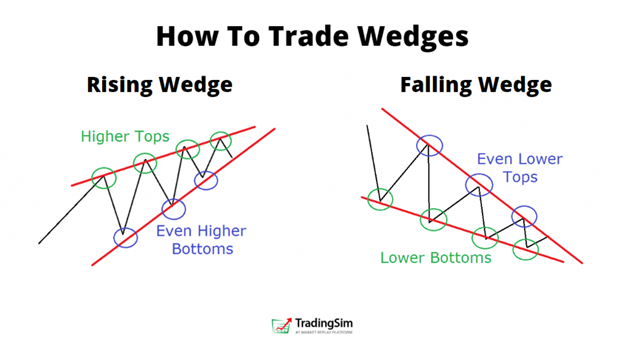

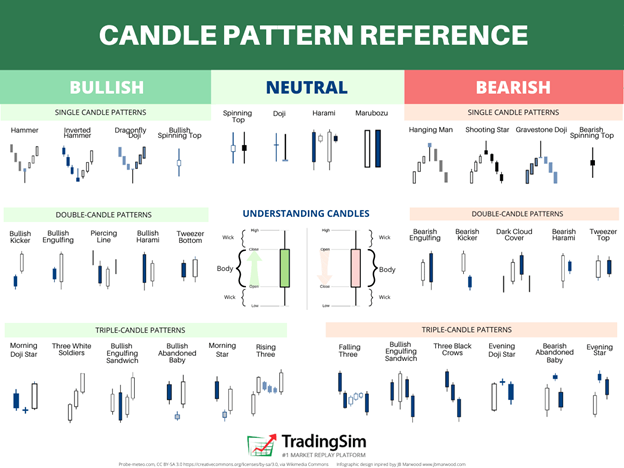

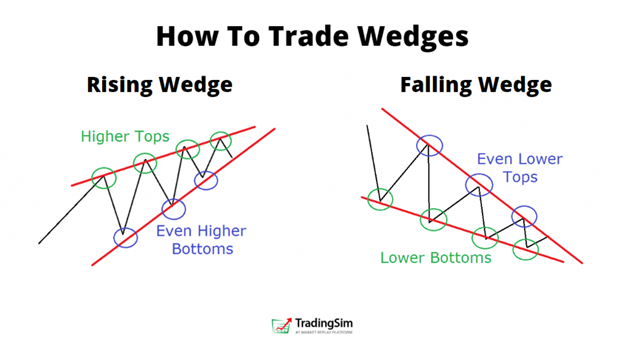

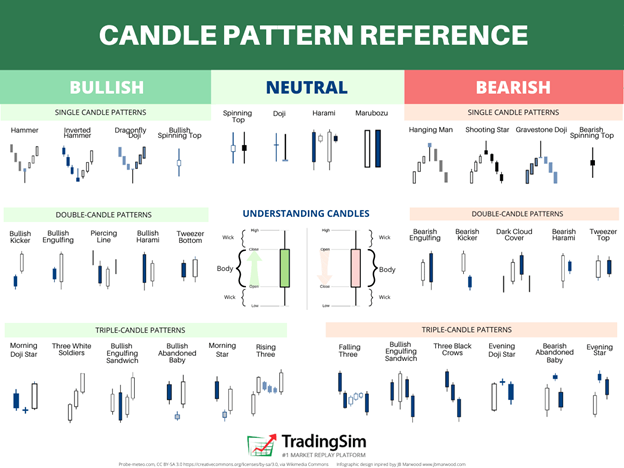

First, we enabled the 5-day moving average to simply find if there was a moving average minding the price trend. We played around with this to find the best fit for this particular crash. What do you notice about the moving average and the candlesticks? Is there any correlation between this moving average and the descending triangular trendline we drew? We've written about these patterns before.

In addition to the trendline, triangle, and moving average, notice you have a particular candlestick pattern that plays out the day before the SPY rallied to break above the descending trendline AND the moving average. That candlestick is called a morning star or abandoned baby. It gapped down and created an indecisive doji candle that then moved higher the next day, all while occurring at the end of a narrowing wedge pattern. If you studied our resources on candlestick patterns, you might have recognized this.

Now, you might be thinking, this is all good, but how would it benefit you to know this? That's the important question. You see, the market often rhymes. These patterns repeat themselves with subtle differences. The more you study past occurrences, observing more and more details and criteria, the more you'll be prepared for the next one.

Test Your Strategies:

Now, these patterns may not work all the time. So it is up to you to test when they do and when they don't. This comes from observation as well.

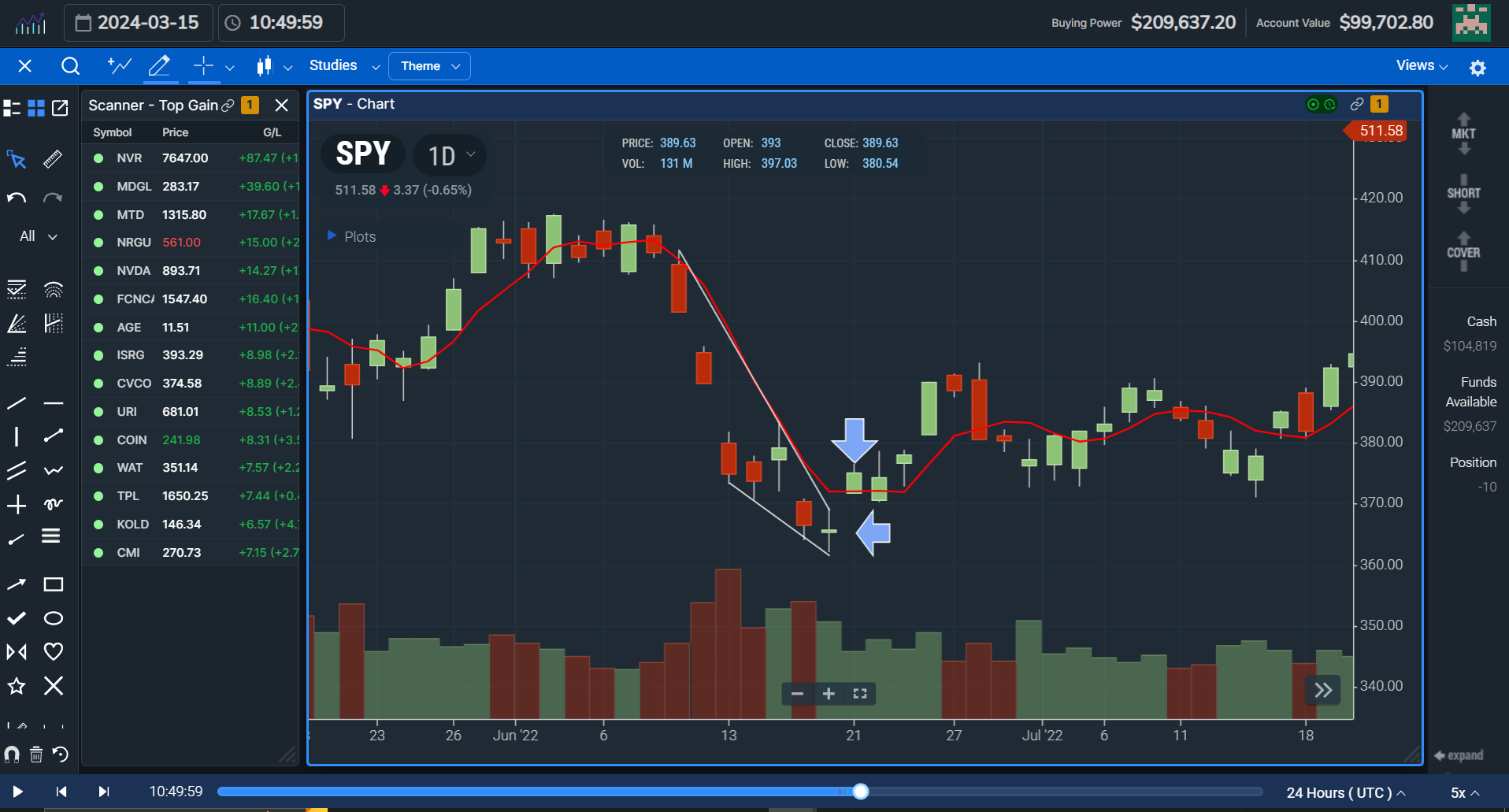

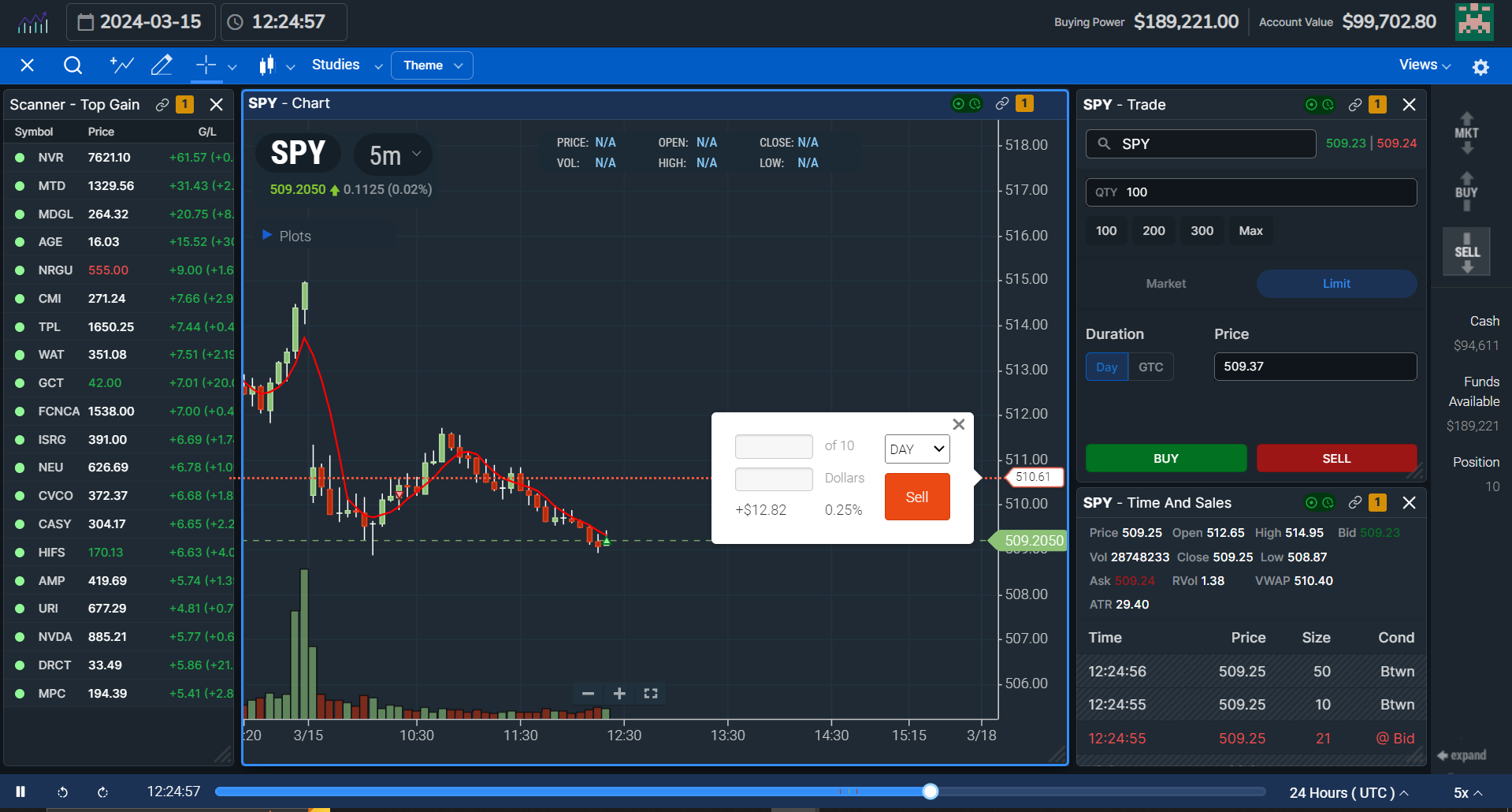

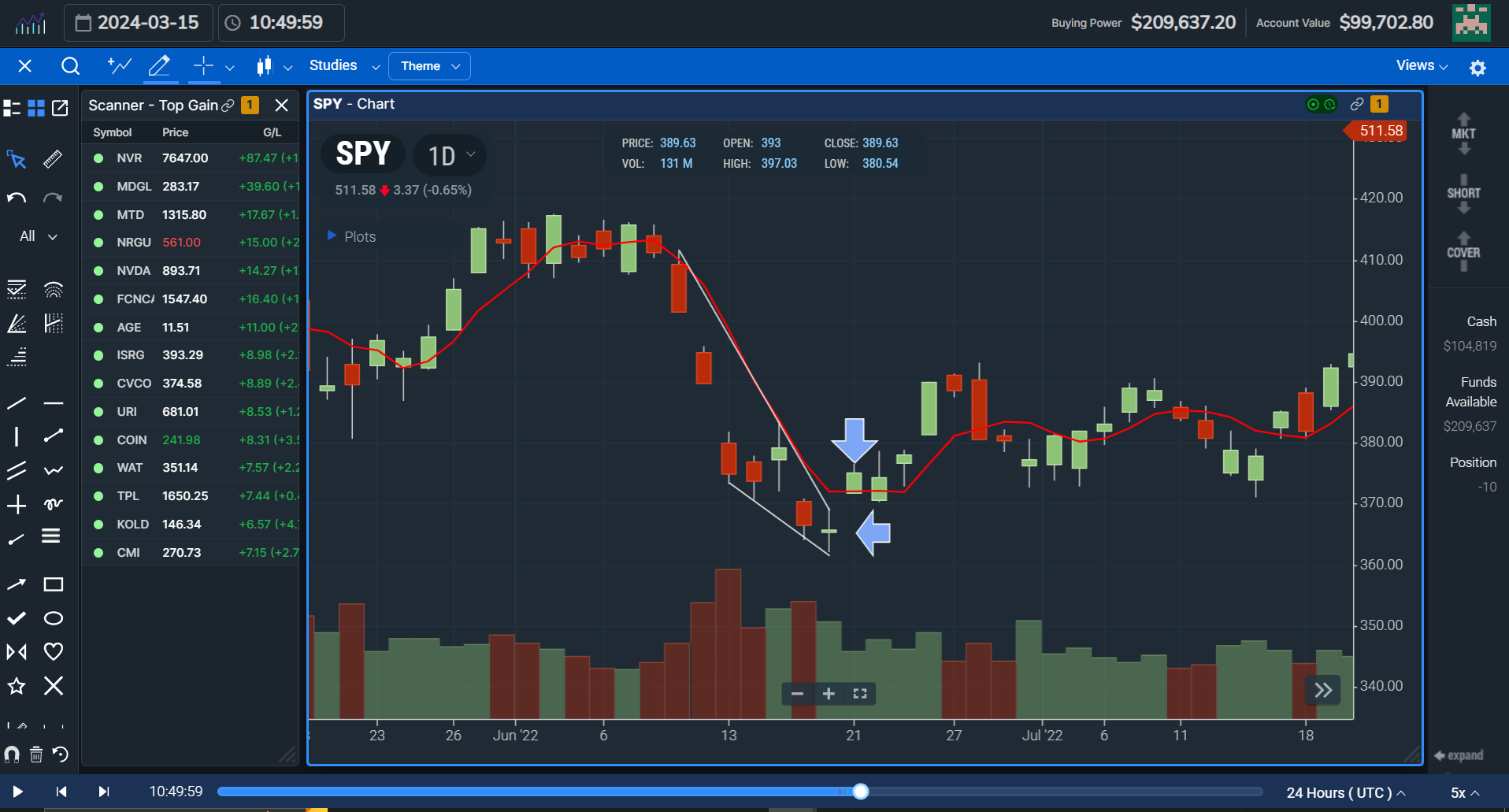

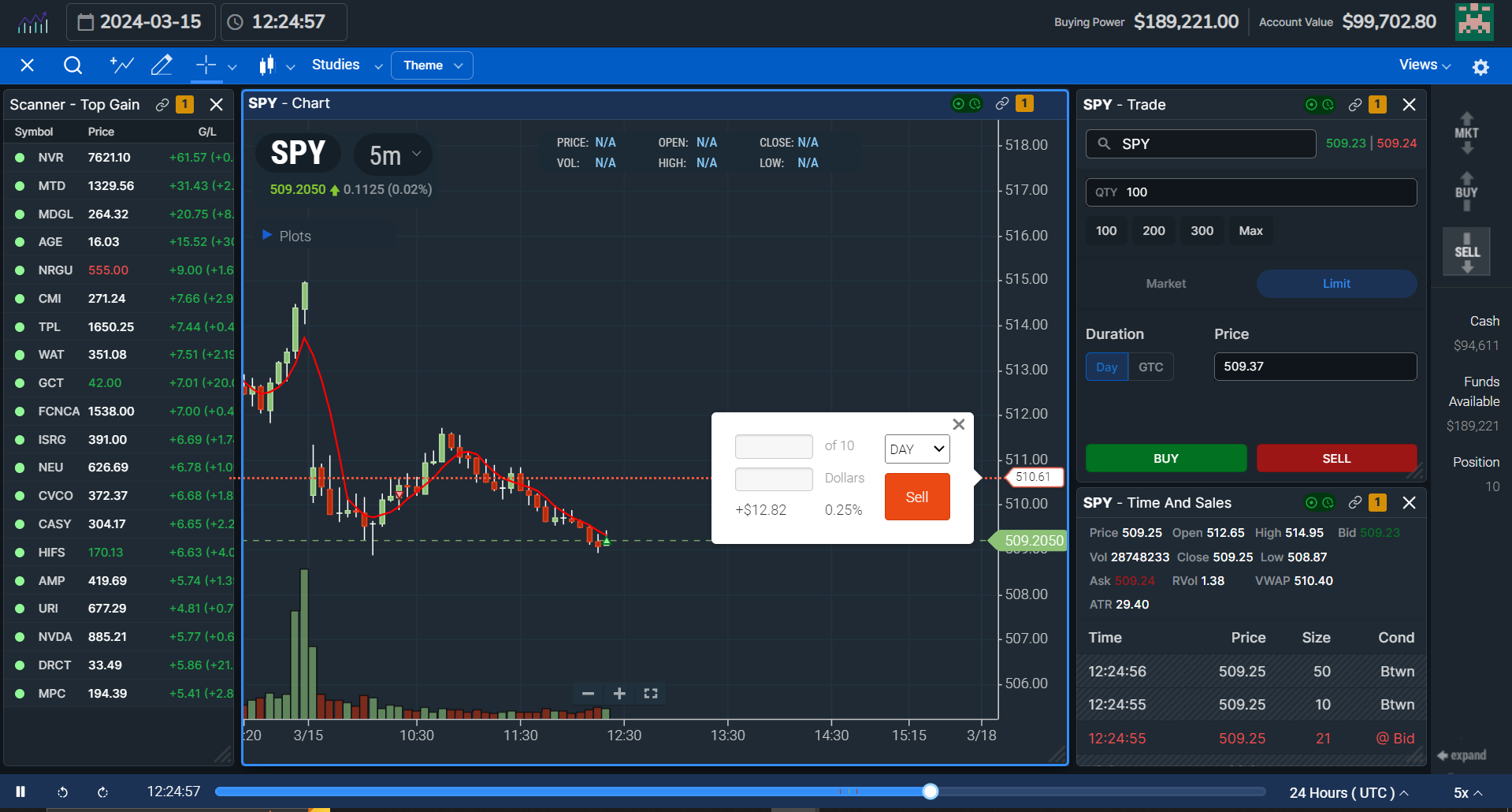

Let's take a look at another market correction in 2022. During this period, the stock market experienced several selloffs. During these selloffs, the moves downward in price were often violent. Knowing how the market responds to market analysis tools can prepare you for a trade in the future. Here's a chart from 2022. Do you see any similarities:

What is one of the first things you notice? The steepness of the selloff is similar, but not as prolonged. However, the daily SPY candles continue to mind the 5-day moving average, staying below it until the downward-sloping wedge tightens. At the end of the descending triangle, another doji star forms. The next day, what happens? We break above the 5-day moving average and breakout of the triangle pattern. Voila!

Bridging the Gap: Real-Time Market Integration

If you're going to day trade with real-time markets, then you to practice in a dynamic, realistic environment. Not all market simulators integrate real-time market data. This is a drawback to your learning process because it won't properly prepare you for the speed and execution required for trading. Think of it this way: if a pilot has trained for landing or takeoff at realistic speeds and wind conditions, how delayed might her responses be in when she takes off in a real plane?

True market simulation with realistic data feeds allows you to experience the fast-paced nature of trading and make decisions based on live price movements. It helps you develop a sense of urgency and practice reacting to sudden market shifts.

Refining Your Risk Management

Simulators allow you to experiment with stop-loss orders and position sizing. By testing these tools in a realistic setting, you can develop a risk management framework that protects your capital in real-world trades. Let's take a look at the TradingSim order montage and the types of orders you can create.

-

Stop-Loss Order (Market Order): This is the most common type. You set a price (the stop price) below your buy price (for long positions) or above your sell price (for short positions). If the market price reaches the stop price, the simulator will automatically sell your long position or buy back your short position. This is designed to limit your losses.

Important: Since this is a market order, the execution price might be slightly different from your stop price due to market volatility or low liquidity.

-

Stop-Limit Order: This type offers more control over the execution price. You set two prices: the stop price (as before) and a limit price. Here's how it works:

- If the market price reaches the stop price, the order converts to a limit order at your designated limit price.

- The simulator will only execute the order if it can buy/sell your position at the limit price (or better).

- This protects you from getting a worse price than intended due to sudden market movements. However, there's a chance the order won't trigger at all if the price jumps past your stop price without ever reaching your limit price.

In TradingSim, you can place chart orders that will trigger these stop-limit orders by simply dragging and dropping the order on the chart as you can see in the image below. In this example, we have placed a buy order already and are now setting our sell order if the price rises.

Beyond the Basics:

Some simulators might offer additional stop-loss variations like:

- Trailing Stop-Loss: This dynamic stop-loss automatically adjusts itself as the price moves in your favor (up for long positions, down for short positions). This helps lock in profits while still providing some protection against sudden price reversals.

- Bracket Orders: These combine a stop-loss order with a take-profit order (an order to automatically sell at a specific profit target). This allows you to define both your risk and reward parameters in advance.

Simulator Tools for Deeper Insights: Market Analysis Powerhouse

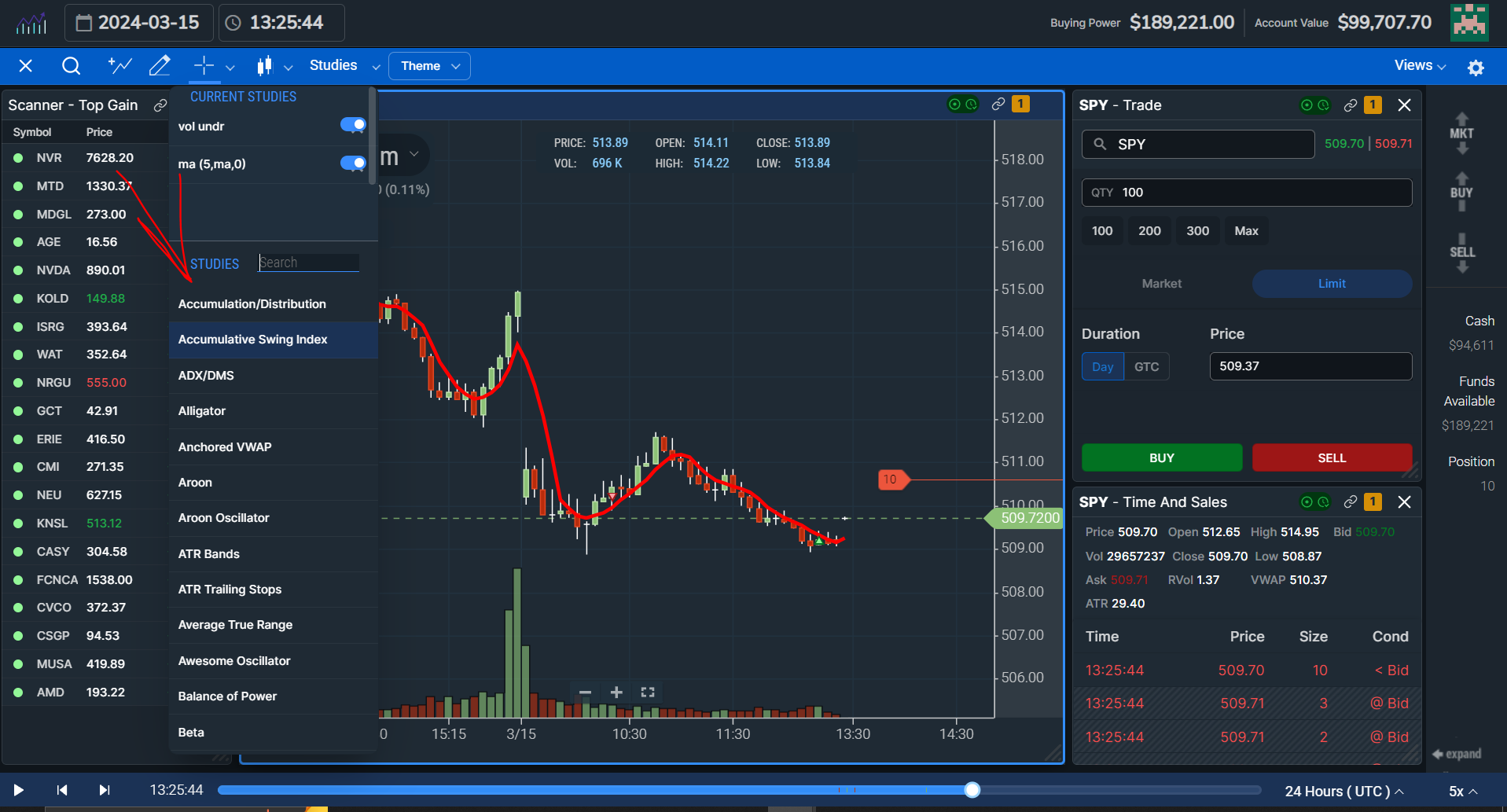

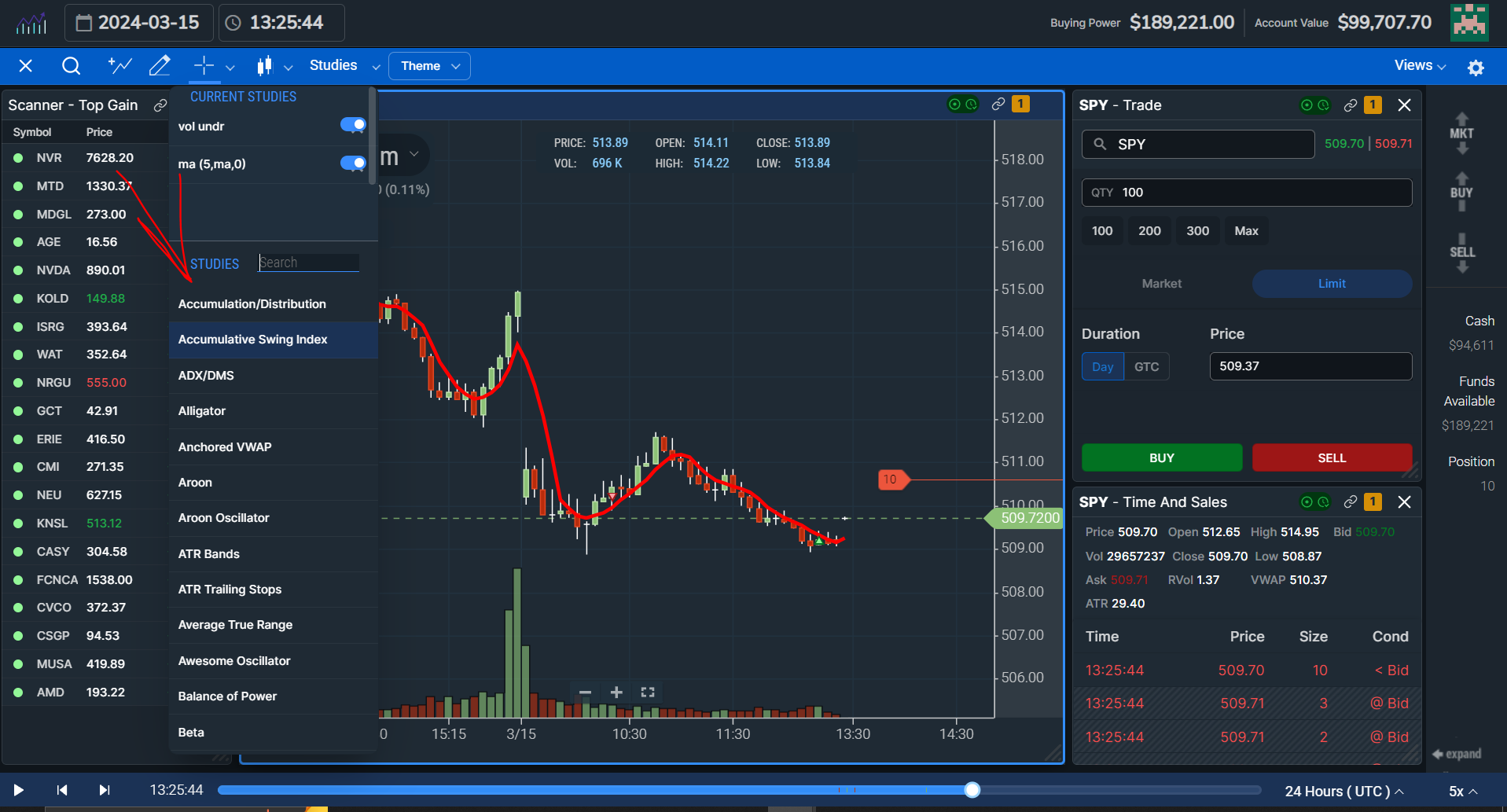

Simulators should come equipped with charting tools and technical indicators. Practice using these tools to identify trends, support and resistance levels, and potential entry/exit points for trades. Additionally, some simulators allow you to incorporate fundamental data like company earnings reports or economic indicators. This lets you practice factoring these elements into your trading decisions, leading to a more well-rounded approach.

In TradingSim, a whole suite of tools is available at your disposal to practice with technical analysis. We've got everything from Anchored VWAP to moving averages and Bollinger Bands. You'll find drawing tools and indicators to fill your analyzing heart's desire.

While so many indicators and analysis tools exist, it's not always a best practice to use them all. From our own experience, a chart full of indicators can often be a distraction. We advise that as you learn and develop your own strategies, you learn to simplify. Sometimes the best indicators are simply price and volume. It'll be up to you to decide how effective indicators are for your own purposes.

Tips for Effective Simulator Training

As we've shown you above, simulators are a fantastic tool for learning the ropes of market analysis. But they don't do the work for you. Just like any training program, you'll get out of it what you put into it. In order to maximize your simulator training experience and hone the skills you need to be a successful trader, here are a handful of key tips to follow:

1. Set SMART Goals and Track Your Progress:

Don't go into simulator training with vague aspirations of making millions. Instead, set S.M.A.R.T. goals that are Specific, Measurable, Achievable, Relevant, and Time-Bound.

For example, instead of saying "I want to make money," a S.M.A.R.T. goal could be something as simple as "I will achieve a 10% return on a specific strategy within my simulated portfolio over the next 3 months." This gives you a clear target to work towards and a way to measure your progress.

As you progress through your training, keep track of your results. Monitor your wins and losses, analyze your trades, and adjust your strategies accordingly.

2. Master the Basics Before Diving In:

It's tempting to jump straight into complex trading strategies, but building a strong foundation is crucial. Start by familiarizing yourself with the basics of market analysis, such as technical indicators, chart patterns, and fundamental analysis principles.

Many simulators (like TradingSim) offer tutorials and educational resources to help you get up to speed. Utilize these resources and gain a solid understanding of the core concepts before moving on to advanced techniques.

3. Focus on Developing a Sound Trading Process:

While profits are certainly enticing, the primary focus during simulation training should be on developing a disciplined trading process. This process should include:

By following a consistent trading process, you'll develop the discipline and analytical skills needed to navigate the real market.

4. Learn from Your Mistakes:

Everyone makes mistakes, and simulators provide a safe space to do so without real-world consequences. Analyze your losing trades to identify what went wrong. Was it a faulty analysis? Poor risk management? Emotional decision-making?

By understanding your mistakes, you can learn from them and refine your approach to avoid repeating them in the future.

For more tips on trading psychology, check out this guide we wrote.

5. Replicate Real-World Trading Conditions:

Treat your simulated portfolio with the same seriousness you would a real account. Don't chase unrealistic returns or make impulsive decisions based on emotions. Simulate real-world trading conditions as closely as possible, including factors like transaction costs and margin requirements.

This will help you develop the discipline and emotional control needed to succeed in the fast-paced world of real-world trading.

By following these tips, you can transform your simulator training into a valuable learning experience that equips you with the skills and knowledge you need to become a confident and successful trader.

Conclusion

Remember, simulators can't fully replicate the emotional stress of real-world trading. Consider incorporating a small trading account alongside simulation for a more holistic experience after you've achieved success in the sim. Markets are inherently unpredictable. While historical analysis offers valuable insights, it doesn't guarantee future performance.

By effectively using historical data, real-time integration, and analysis tools within a trading simulator, you can significantly enhance your decision-making skills and develop a sharper eye for interpreting stock market trends. TradingSim can help with this. We offer a 7-day free trial to get you started, risk-free.

Day Trading

Day Trading