Getting started as a day trader can seem like a daunting task. There are so many ways to day trade, so many resources available, and so many gurus willing to lend a helping hand along your journey. Sometimes it might feel like information overload.

Here at TradingSim, we like to take the "long-game" approach to beginning a day trading career. Yes, education is great, gurus can offer invaluable insights into the market, and technology makes our lives as day traders great. But to be successful at day trading, it takes a lot of time, effort, patience and resilience. Being a successful beginner at day trading is rare.

To that end, we recommend that you take your time, plan out your goals, and be consistent. In this guide, we'll outline much of what you need to know as a beginner starting out in day trading. You've probably got lots of questions, like:

- Day trading stocks

- Day trading futures

- Is day trading easy for beginners?

- How to learn day trading?

- Best day trading education course and books?

- Day trading podcasts

And many other questions you're sure to have. We'll give you the low down on how to get started in day trading as a beginner.

How to start day trading?

Getting started in day trading is rather simple. It only requires a few easy steps to place your first day trade:

- Open a brokerage account

- Transfer money into the account

- Choose a stock to buy and sell

- Click a few buttons

Yes, it is that easy. But, that doesn't mean it is easy to make money! Far from it actually. Without proper education, a trading plan that you can trust, and a foundation of experience in technical analysis, you will more than likely lose money. Most traders are actually gamblers because they don't understand what it takes to start day trading AND be consistently profitable. They are two very different things.

So, what does it take to start day trading and be consistently profitable at it? That's the question you should be asking. Here's what it takes:

You may not like the sound of this, but it takes practice, practice, and more practice. Simulated trades are the fastest way to find your edge in the markets. The more time you spend studying charts and chart patterns, the faster you'll find success. Ultimately, you'll have to observe your own patterns and the natural ebb and flow of the markets. Not all patterns will work all the time. However, it is your job to discover when and how they work, and exploit them when the odds are in your favor.

Day Trading Stocks for Beginners

Since you want to day trade, you've likely looked at the stock market. Famous companies like Apple, Tesla, Microsoft, and others are listed on the stock market -- either the NASDAQ or the NYSE or another exchange. There are plenty of other stocks to choose from each day in the market -- smaller penny stocks, large corporations, and everything in between. In total, there are thousands of stocks to choose from.

Day trading stocks is a great way for beginners to get their feet wet. However, there are a to of things you should watch out for. For example, there are certain rules in place for day trading stocks that don't affect other assets or commodities like futures and forex. For example, in trading stocks, you must maintain a minimum balance of $25k in order to day trade more than 4 times in a 5 day period. We call this the Pattern Day Trade rule.

You might also run into rules on how you can place short trades if a stock is labeled as a Short Seller Restriction stock. We've written about most of these rules, so be sure to follow the links in this post.

As you learn to day trade stocks as a beginner, you'll likely have questions like:

Feel free to follow those links when the time is right. There is a wealth of information that you'll need to consume at some point. But you shouldn't be overwhelmed. It's best to simplify things and set a goal with yearly progress targets. Yes, we said YEARLY progress targets. Be realistic.

Day Trading Futures for Beginners

Day trading futures is another great way for beginners to get started. Futures, unlike stocks, allow you to bypass the rules associated with small accounts. In fact, you can get started day trading futures with many brokers with as little as $500. With that amount, you can begin trading as much as you want.

That isn't a recommendation to trade as much as you want, just to be clear. As we've said before, less day trading as a beginner is actually more. Be selective and start with a VERY small account, and spend most of your time in the simulator testing your strategies first.

As a beginner in futures day trading, you'll want to focus on a handful of names. There are fewer assets to trade in the futures market than in the stock market. We recommend focusing on the names with the best liquidity, like S&P 500 futures, NASDAQ futures, Gold futures, Crude Oil futures, or some of the more popular commodities like soybeans, etc. Heck, you can even trade Bitcoin futures nowadays.

Once you've studied your futures closely, the strategies for day trading futures are much the same as with stocks. There may be some differences in that futures aren't as susceptible to pump and dump schemes as stocks are.

The best way to get started trading futures as a beginner is test your knowledge and observation skills in a simulator. Here at TradingSim, we have both stocks and futures with over three years of tradeable, historical intraday data. Not only that, but you can simulate trades and track your progress in our built-in analytics page.

Is day trading easy for beginners?

Absolutely not. That's the quick and honest answer. Most new traders do not make it in this industry. In fact, most traders, in general, do not make it. It is a very difficult path to consistency and takes time, effort, and resiliency. Some of the best traders admit that they lost money for many, many years until they found something that worked for them.

Sure, there are a few exceptions. We've interviewed many successful traders in our podcast called The Simcast. A few of them reached success in a short period of time, but they are not the majority. Either way, it wasn't easy for any of them and it required copious amounts of study and discipline to get where they wanted to be no matter how long it took.

Day trading is not easy. It is a performance activity much like a performance sport. We've interviewed the most prolific trading psychologist in the world, Dr. Brett Steenbarger, and he has this to say about beginning as a day trader:

If what an actor is interested in is applause, he won’t be particularly motivated to practice on an empty stage. If what a trader is interested in is profits, he/she won’t be particularly motivated to practice in simulation.

It’s not simply a matter of discipline. It’s about the underlying motivation driving performance efforts.

If you’re motivated to learn and master markets, you’ll enjoy simulation and playing with trading ideas. If you’re motivated by making money and showing off pictures of your new cars on social media, simulation won’t hold much appeal.

When surgeons learn new techniques, they practice on models and cadavers before “going live”. If a surgeon told me he didn’t think such practice was important, I’d likely look elsewhere for my procedure….

Dr. Brett Steenbarger Ph.D.

HOw to learn day trading

Learning how to day trade is a four-step process. It requires education, practice, a focus on the process, and training for your mindset. In a recent podcast, we discussed the process to trading mastery with Roman Bogomazov, the lead educator at WyckoffAnalytics.com. According to Roman, these are the four steps to mastering trading or day trading:

- Knowledge

- Skill

- Process

- Mindset

These four components can be broken down into their individual parts, but the foundation is the same.

1. Build upon your day trading Knowledge

This will require you to study. Books, podcasts, youtube videos, paid courses, and mentorship are all great ways to build your knowledge base. You'll want to discover the best indicators, the best strategies, the best time frames, the best applications, and any other resource for day trading. The more you learn in this phase of your career, the better.

The quality of your education is what matters as a beginner in day trading. You want to focus on getting the most out of each and every resource that you use. If you aren't being fed in a chat room, then move to the next. If you've soaked up all you can in one resource, look for another.

However, there must come a time in your education that you compile all that you have learned and put it to good use. There will be some things you likely discard, and others that you cling to. Every trader is different, yet we're all playing the same game. Just like a soccer player has some moves that he likes, others will try other moves. It's up to you decide what works for you and your personality.

2. Develop your skills

Developing your skills as you start out in day trading is of utmost importance. All the knowledge in the world will not prepare your for the fast-paced environment of day trading. Just like a soccer player can practice moves on a practice field, you must also put those skills to use in a realistic game -- whether its a scrimmage or match play.

Simulation and trade replay is the best way to develop your skills. Successful trading is all about pattern recognition and implied learning. The more patterns you see and the more criteria for those patterns you recognize, the more reliable your senses become when the patterns repeat. Just like a stage actor who knows his lines and queues, you need enough practice to learn your trading setups and queues.

It is never enough to simply follow someone into a trade. You need to develop your own eye for charts and exploitable patterns.

3. Focus on the process

Most day traders like to focus on the outcomes. In other words, they focus on the profits. And that is likely why most day traders lose money. If you want to be a successful beginner day trader, you want to focus on the process rather than the outcome. Outcomes take care of themselves.

As a process-oriented trader, your focus should be on how well you execute your trades, how well you manage risk, and how well you follow your plans and rules. If you like to trade "to see what happens" without a plan, without a pattern, and without any rules, you won't last long in this industry.

Take the time necessary to develop a trade plan and treat your trading like a business. It will pay you in the end.

4. Mindset Training

Mindset training is often the most overlooked aspect of trading. Is is perhaps the most important part of your training. Day trading as a beginner presents enough hurdles with education, but your own mind will make or break you in this business.

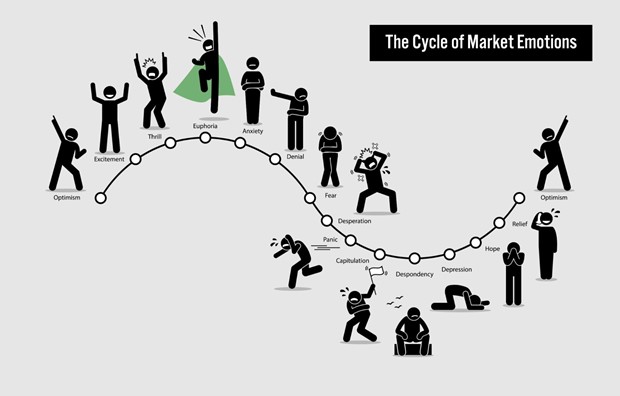

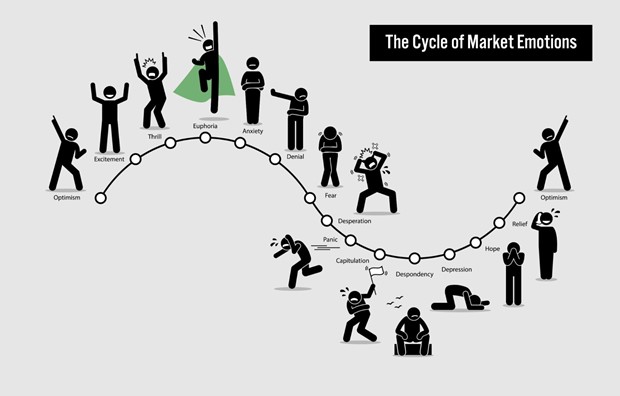

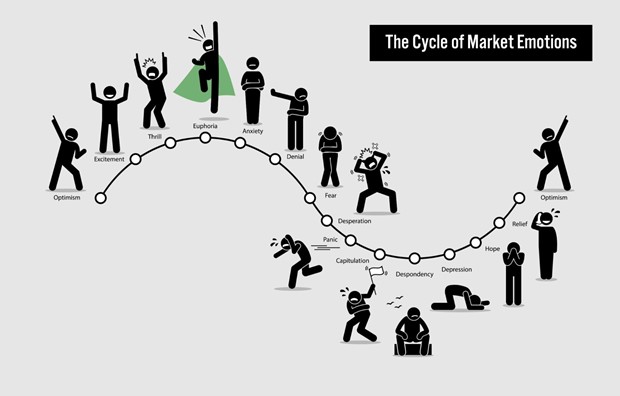

Your mind will run the gamut as a day trader. Be prepared for it. We have an entire resource dedicated to trading psychology that you should check out. In it we discuss the type of things you should ask yourself before you start trading. These things may affect your ability to make proper decisions in the heat of the moment.

- Are you trading because you need to make income?

- Are you risking all of your money plus margin on a single trade?

- Do you have any idea what the outcome is of your strategy?

- Is the stock you are trading very volatile?

- Do you like to share your winning trades and not your losing trades?

- Are you placing undue pressure on yourself to become rich quickly?

Referring back to our friend, Dr. Steenbarger, he puts it best when he describes why we need to focus on proper mindset in trading above all else:

“Indeed, it’s often because of our need to make money and our overconfidence that we pursue shortcuts in our learning processes as traders and take too much risk. That leads to volatility of P/L and losses, which in turn trigger our nervousness, tension, stress, fear, and worry.”

Dr. Brett Steenbarger, Ph.D.

Like we said in the beginning. Take the "long-game" approach to trading. Start small and work your way up.

Best day trading books for beginners

If you're just getting started in trading, one of the best and cheapest ways to educate yourself is to read books. Sure, there are great resources on YouTube, and you can just buy a course from someone online if you want, but books usually stand the test of time. In fact, we believe that the markets very rarely change. And, for that reason, the books that were written in the past have just as much application to today's markets as they did back then.

The best technical analysis day trading books for beginners

These are our favorite books for learning technical analysis for day trading. Some will teach you patterns, others will teach you volume and price analysis and trends.

A Complete Guide to Volume and Price Analysis: Anna Coulling

Charting and Technical Analysis: Fred Mcallen

Trades about to happen: David H. Weiss

Jesse Livermore's Methods of Trading in Stocks: Richard Wyckoff

In depth guide to price action trading: Laurentiu Damir

While we don't advocate for one over the other, these are a great starting place to build your knowledge of how price action and technical analysis works in the stock market. Take your time, and explore other authors and resources that you find. After all, education in the stock market is endless.

The best books on day trading

Many times, the best books for day trading deal with trading at large. After all, the concepts associate with day trading can be applied to higher time frames, and even long term investing. The principles remain the same no matter what. That being said, the following are some really great trading books that can easily apply to day trading for beginners.

How to make money in Stocks: William J. O'Neil

In the Trading Cockpit with the O'Neil disciples: Gil Morales & Dr. Chris Kacher

Market Wizards: Jack D. Schwager

Reminiscences of a stock operator: Edwin Lefevre

All of these books are great depictions of how successful traders became successful. While not focused on the minute details of day trading, they will encourage and motivate you along your journey as a beginner in day trading.

The best books on trading psychology

Last but not least, we must include the best books on trading psychology in this list. After all, it is the most important aspect of trading. As with any other book on this list, the trading psychology books are worth reading over and over again throughout your career. Mindset training is always a work in progress as you meet new challenges as a day trader.

The daily trading coach: 101 lessons for becoming your own trading psychologist: Dr. Brett Steenbarger

Trading Psychology 2.0: Dr. Brett Steenbarger

Trading in the zone: Mark Douglas

Will it make the boat go faster: Ben Hunt-Davis & Harriet Beveridge

While the first three are geared towards trading, the last book is a favorite. It details the journey of an Olympic rowing team who had little chance of winning, at first. It's certainly worth a read.

Day trading podcasts

Day trading podcasts are a great way for beginners to learn about the struggles that day traders face. We have our own podcast here at TradingSim called the SimCast, but there are plenty of other podcasts that do a great job of profiling the successes and failures of great traders.

We encourage you to head over to our review of the 8 best trading podcasts and fill up your free time with some really great interviews. Trading podcasts are a great way for budding traders to experience the emotions of more experienced traders as they recount their trading experiences. At a minimum, it will remind you that we are all human, and we all face the same trials on this journey as day traders.

Day Trading Tips for beginners Summary

We hope this quick guide has served you well as you decide to embark on a journey to become a day trader. We also encourage you to use our free education resources for day traders here at TradingSim. We've got a lot of great content covering trading strategies, chart patterns, indicators, and psychology tutorials.

If you want to be successful as a beginner day trader, please give our simulator with replay a try. It's free for seven days and you'll thank us later for saving you the heartache of painful losses with real money. Stay in the sim until you've reached the confidence you need to try out the real markets.

Day Trading

Day Trading