EPISODE 22: DAILY PROCESS & BUY RULES WITH BRIAN SHANNON

Brian Shannon is one of the most well-known traders in the world. Having started in 1991, he's been through many major market cycles, has written two...

1 min read

![]() John McDowell

:

Feb 1, 2022 12:25:06 PM

John McDowell

:

Feb 1, 2022 12:25:06 PM

Last Updated: October 21, 2023

As Lead Content Strategist, John diligently searches for ways to connect with day traders and provides training and education to those in this space.

Kris Verma is a successful pharmacist and sports better turned day trader. After retiring from being a pharmacist, Verma decided to apply his statistical edge in sports betting to the markets. The result has been stellar, with over $1million in profits in just a few short years.

Kris Verma is a statistician of sorts. His approach to trading and betting is deeply rooted in mathematics. As the saying goes, an edge is nothing more than a probable outcome in your favor. Sure, you’re going to lose some, but as long as the winners outweigh the losers over time, you come out on top. Verma has taken this to a whole new level.

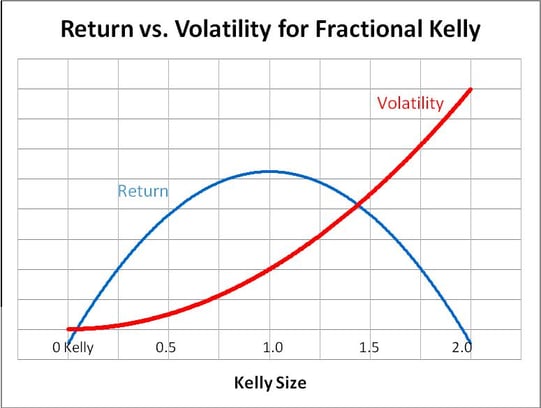

On Kris’s blog, he discusses the basis for his formulaic approach to the markets. It is based upon the Kelly Criterion, which allows Chris to calculate his statistical edge and optimal position sizing according to backtested data.

As you can see, there is a point of diminishing returns if you size in too much (blue line). Optimal position sizing keeps your risk (volatility) in check if your data is accurate. Kris mentions this at time stamp 53:18 in the interview.

In the video, Kris shares a link to a template for his strategy in a spreadsheet. You can find that link here:

Kris discusses this around 1:05:00 in the video.

Brian Shannon is one of the most well-known traders in the world. Having started in 1991, he's been through many major market cycles, has written two...

J from JTrader.co joins us for our first episode of 2024 to discuss a strategy that has worked well in 2023, namely smart money traps. J breaks these...

Gil Morales is a prolific trading author and educator with over 30 years of experience in the markets. His style is very no-nonsense and based...