Candlestick Patterns

Learn about the importance of using candlestick patterns to make successful trades, the fundamentals of candlestick charting and reliable tips and tricks for everyday use.

.png?width=594&height=198&name=CANDLESTICK%20PATTERNS%20(1).png)

Why Do Candlestick Patterns Matter?

After all, there are traders who trade simply with squiggly lines on a chart. Astonishingly, some don’t even look at the charts! Instead, they pay attention to the “tape” — the bids and offers flashing across their Level II trading montage like numbers in The Matrix.

No doubt, there are countless ways to make money in the stock market. In fact, there is no right or wrong way to read a chart. But unless you are just a gambler, you need some form of data to make informed decisions.

We believe the best way to do this is by understanding candlestick patterns.

For newer traders, even reading candlestick charts can seem like an insurmountable learning curve. There appears no rhyme or reason, and no end to the amount of price and volume data being thrown your way.

It’s daunting, for sure. Especially when you’re just getting started.

But be of good cheer! There is a method to the madness. The method is in the patterns. The patterns reveal probabilities. And the right probabilities create opportunities.

More importantly, the right opportunities can create profits.

This is where candlestick patterns come in handy. They help us to decipher the patterns of the market. They’re like little road signs on crowded streets. And with enough repetition, enough practice, you just might find yourself a decent chart reader.

That’s why you’re here, right? To learn to navigate the murky waters of the market?

Trust us, it is a worthwhile endeavor.

Who Discovered the Idea of Candlestick Patterns?

According to Investopedia.com, it is commonly believed that candlestick charts were invented by a Japanese rice futures trader from the 18th century. His name was Munehisa Honma.2

Honma traded on the Dojima Rice Exchange of Osaka, considered to be the first formal futures exchange in history.3

As the father of candlestick charting, Honma recognized the impact of human emotion on markets. Thus, he devised a system of charting that gave him an edge in understanding the ebb and flow of these emotions and their effect on rice future prices.

Honma actually wrote a trading psychology book around 1755 claiming that emotions impacted rice prices considerably.4

When all are bearish, there is cause for prices to rise.

Munehisa Honma5

In recent history, Steve Nison is widely considered the foremost expert on Japanese candlestick methods. After all, he wrote the book that catapulted candlestick charting to the forefront of modern market trading systems.

Beyond Candlesticks: New Japanese Charting Techniques Revealed, is one of his most popular books and a definitive resource for candle patterns.

Since the 90s, this method of charting has become pervasive throughout all financial markets: equities, futures, forex, and more.

In his books, Nison describes the depth of information found in a single candle, not to mention a string of candles that form patterns. It truly puts the edge in favor of a skilled chartist.

The Story That Candlesticks Tell

Emotions and psychology were paramount to trading in the 1700s, just as they are today. This is the foundation of why candlesticks are significant to chart readers.

How so?

Every candle reveals a battle of emotions between buyers and sellers.

As the great trading psychologist Brett Steenbarger notes, “proper training is the best source of discipline and the most effective safeguard against intrusive anxiety and impulsivity.”

With this in mind, understanding the emotional story within candlesticks is a great place to start that training.

How are Candlesticks Formed?

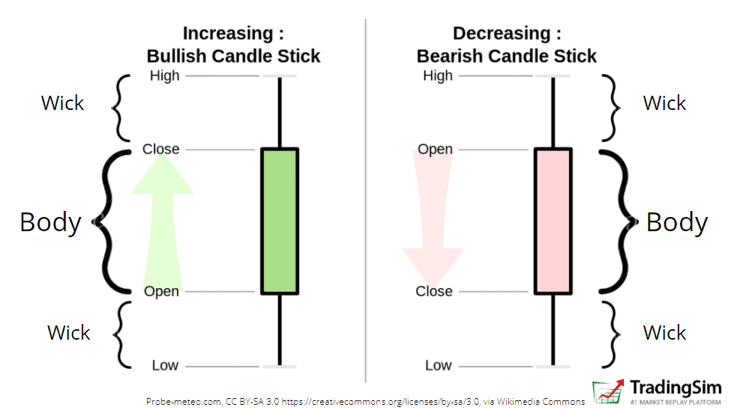

There are three types of candlestick interpretations: bullish, bearish, and indecisive. This is painting a broad stroke, because the context of the candle formation is what really matters. But for all intents and purposes, we’ll stick with these three categories.

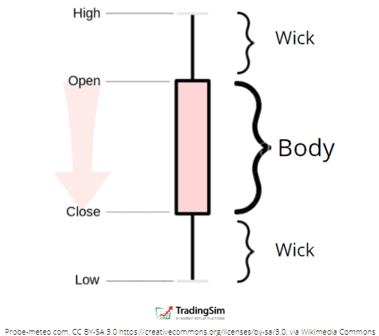

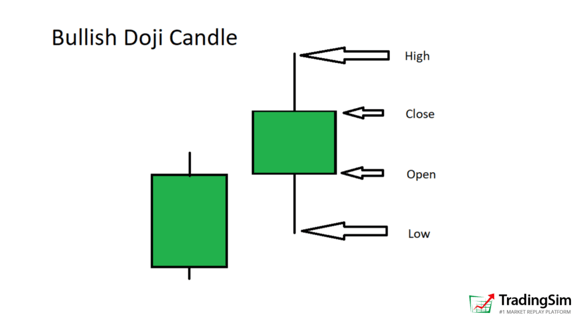

What Is a Candlestick?

The formation of the candle is essentially a plot of price over a period of time. For this reason, a one minute candle is a plot of the price fluctuation during a single minute of the trading day. The actual candle is just a visual record of that price action and all of the trading executions that occurred in one minute.

Similarly, a daily or weekly candle is the culmination of all the trading executions achieved during that day or that week.

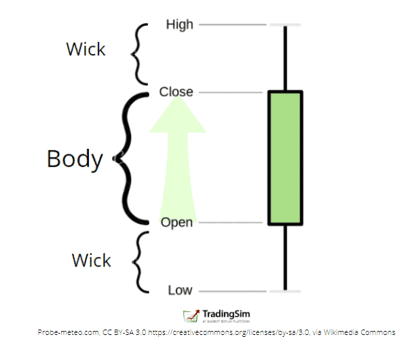

The open tells us where the stock price opens at the beginning of the minute. The close reveals the last recorded price of that minute. The wicks (also known as shadows or tails) represent the highest and lowest recorded price from the open and close.

According to Nison, the Japanese placed much less emphasis on the highs and lows of individual candles. For them, as it is for modern technicians, the opening and closing prices were more relevant.6

Essentially, the broader context of candles will paint the whole picture.

What Is a Bullish Candle?

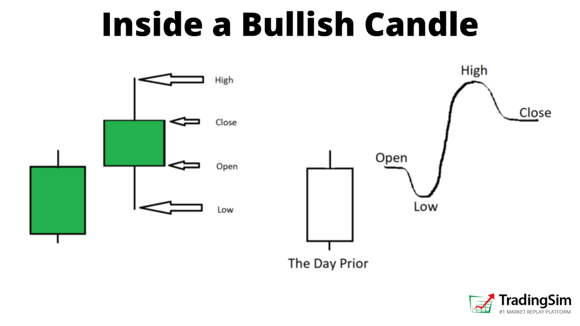

A bullish candle is formed when the price at the closing of the candle is higher than the open. This can be on any time frame: from a 1-minute candle to a 1-month candle. It will all be the same.

Typically these candles close with a green or white body color, though most charting platforms allow for customization these days.

What Is a Bearish Candle?

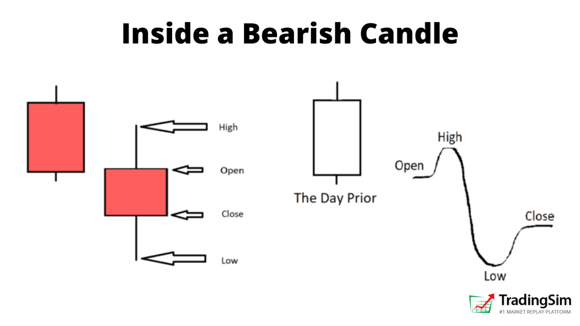

Conversely, a bearish candle is assumed when the closing price is lower than the opening price. In other words, the price dropped in the amount of time it took for the candle to form.

By default, most platforms will show a red or black candle as bearish.

What Does the Candle Formation Tell Us?

This is the real question we need to ask ourselves. It isn’t enough to know that the candle opened and then closed lower, or vice-versa.

As renowned trader and best-selling author Dr. Alexander Elder explains, “The main advantage of a candlestick chart is its focus on the struggle between amateurs who control openings and professionals who control closings.”7

Dr. Elder may be referring to daily candles, but his point is still important. The candle represents a struggle between buyers and sellers, bulls and bears, weak hands and strong hands.

Armed with that knowledge, let’s dig in and see what picture those little candles are trying to paint for us.

The High of the Candle

The high of each candle, whether it is the tip of the wick at the top, or if the body closes at the top, represents the maximum effort of bulls. If it is a daily candle, buyers could not push the price of the stock one cent more during that day.

Why is that important? There are two reasons:

- This could represent a near term level of resistance which will have to be broken for the price to move higher.

- In order to find enough demand to push through that resistance, the stock may need to consolidate lower until enough shares are accumulated.

The Low of the Candle

Just as the high represents the power of the bulls, the low represents the power of the bears. The lowest price in the candle is the limit of how strong the bears were during that session.

Why is this important? Again, two reasons:

- This could represent a near term level of support where bulls were able to stop the downward momentum

- To move lower, more supply may need to enter the market at higher prices.

The Closing Price of Each Bar

This is where the story gets interesting.

When a candle closes above its opening price, we can assume that the bears won in some form or fashion. How much it closes above the open tells us with what intensity the bulls were in control during that session.

Let’s look at few examples to better understand this:

In this chart, we see the “Three White Soldiers,” which is a candlestick pattern describing three bullish candlesticks in a row. What can we interpret from this?

It is clear to see that the candles open low and close high. Bulls were clearly in control during each session with very little energy from the bears.

Now contrast that with what we see in the next example. Ask yourself, who was in control during this session?

Apparently there is indecision as to who is in control. How do we know? Think about the story behind this “Spinning Top” candle:

The stock opens, proceeds lower as bears are in control from the open, then rips higher during the session. But after putting in a decent high, the bulls settle back and give the bears some control into the close.

Are you beginning to see how the story unfolds?

These are the stories that candles tell us on charts. Who is in control (greed), who is weak (fear), to what extent they are in control, and what areas of support and resistance are forming.

The Range between the Open and Closing Price

This is one of the most important aspects of interpreting candles. As Dr. Elder notes, the range between open and close “reflects the intensity of conflict between bulls and bears.” 8

In day trading, momentum is everything. On this token, the character of the candles can tell us if there is demand or if a stock is sleepy and uninteresting — whether we are about to launch, fall off a cliff, or just grind sideways.

Additionally, the nature of the candles can tell us when to enter with tight risk. Or, when to take profits into climactic candles.

In the end, it all boils down to context and the story of buyers and sellers behind the tape.

5 Real Examples of Reliable Candle Patterns

Without practice, none of this information really matters. It takes screen time and review to interpret chart candles properly. There are no free lunches in the markets.

With that being said, let’s look at some examples of how candlestick patterns can help us anticipate reversals, continuations, and indecision in the market.

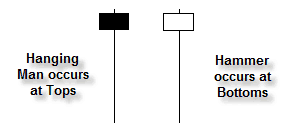

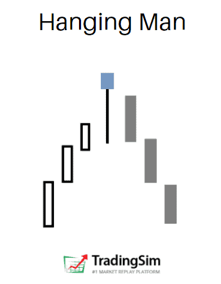

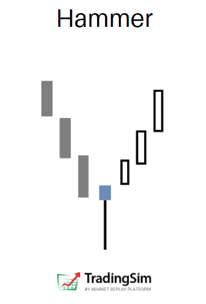

1. The Hammer / Hanging Man

The Hanging Man is a candlestick that is most effective after an extended rally in stock prices. The story behind this candle tells us that there were extensive sellers in the formation of the candle, signified by the long wick.

It is usually accompanied by heavy volume.

The Hammer is another reversal pattern that is identical to The Hanging Man. The only difference is the context. The Hammer occurs at the end of a selloff, signifying demand or short covering, driving the price of the stock higher after a significant selloff.

Like the Hanging Man, you want to see a solid volume signature associated with these candles.

2. Engulfing Patterns

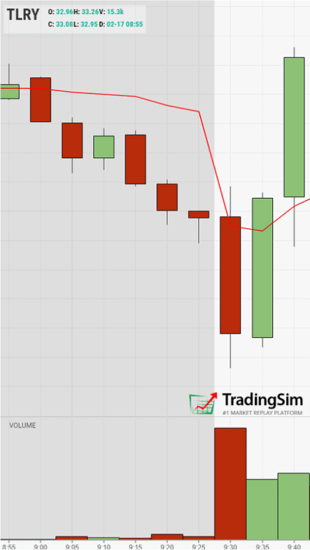

Engulfing patterns offer a great opportunity to go long while keeping risk defined to a minimum. As you can see in the example below, the prior bearish candle is completely “engulfed” by the demand on the next candle.

Another example of engulfing patterns is the Bearish Engulfing Sandwich. Here we have what appears to be a bearish reversal, but the next candle completely swallows the supply from that red candle:

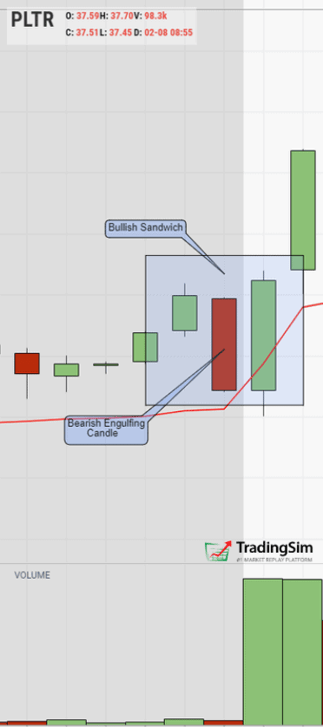

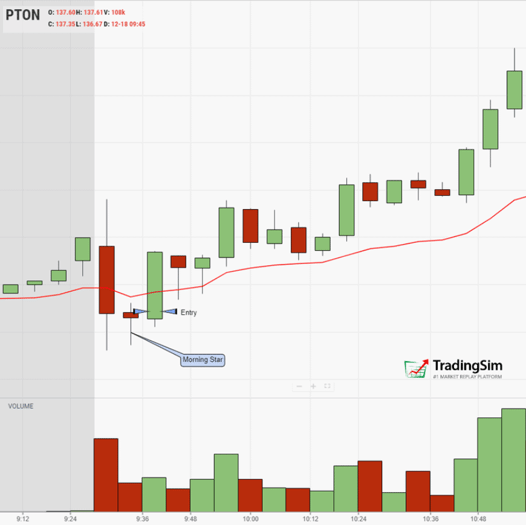

3. The Morning Star

The Morning Star is yet another reversal signal. It can be found at the end of an extended downtrend or during the open. It takes 3 candles to confirm the setup.

-

The first candle must be a strong downtrending candle.

-

The second candle is the star. It’s usually a narrow body candle that, ideally, does not touch the body of the prior candle.

-

The third candle is a strong bullish candle confirming the new uptrend.

The morning star candlestick pattern at the open

The morning star candlestick pattern at the open

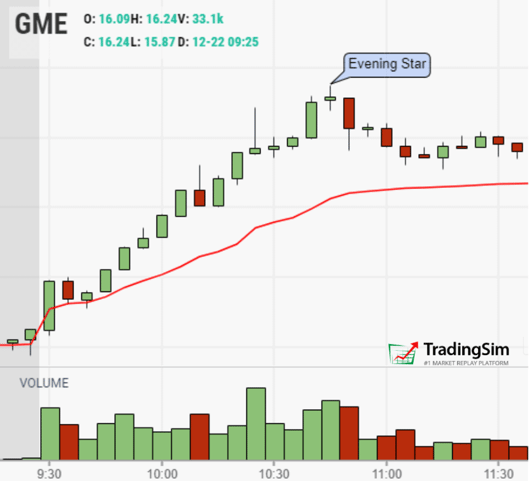

4. The Evening Star

Similar to the Morning Star, the Evening Star is its bearish cousin. It forms at the top of parabolic or extended bullish runs. Much like the Morning Star, the body of the candles should not touch.

Here are three criteria for spotting the shooting star:

-

The bodies do not overlap

-

The third candle is a strong bearish candle closing into the body of the first candle

-

Volume should increase from left to right in the pattern

The Evening Star candlestick pattern on GME

The Evening Star candlestick pattern on GME

As with all of these formations, the goal is to provide an entry point to go long or short with a definable risk. In the example above, the proper entry would be below the body of the shooting star, with a stop at the high.

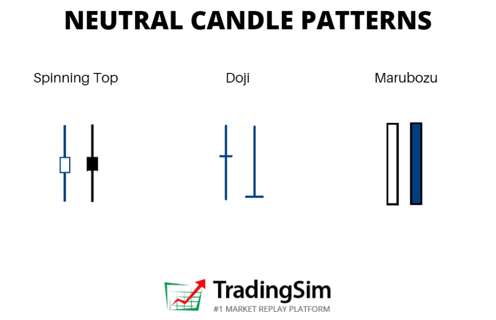

5. Indecision Candles

The doji and spinning top candles are typically found in a sideways consolidation patterns where price and trend are still trying to be discovered.

The “doji’s pattern conveys a struggle between buyers and sellers that results in no net gain for either side,” as noted in this great article by IG.com.

Will it continue upward? Go sideways? Or reverse?

With indecision candles, we typically need much more context to answer these questions.

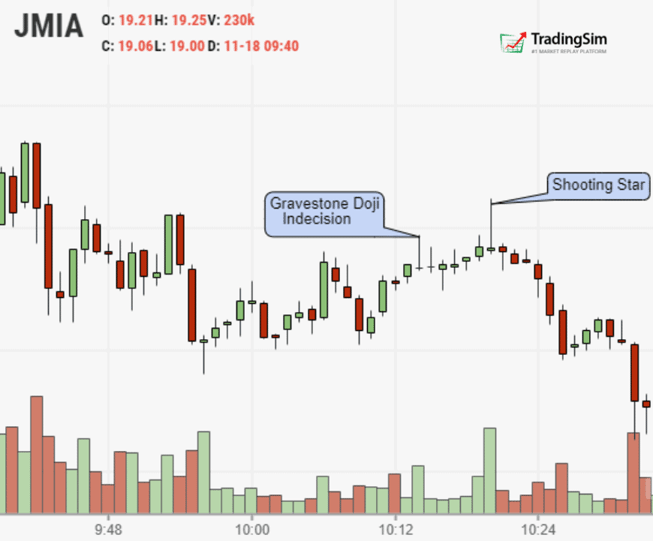

The Gravestone Doji is a perfect example of this:

Note the trend is mostly sideways in this first circled example. For this reason, waiting for the reaction to these candles is usually best for risk management.

Eventually, the price falls in this particular case as the trend becomes more extended into the rally. Correspondingly, the Shooting Star that occurs just beyond the Gravestone Doji is confirmation of that falling price action.

The Best Way to Practice with Candlestick Patterns

As always, it is best to practice a strategy before putting money to work in the market. There is no better way to do this than with a simulator.

One of the best methods to train your “chart eye” to see these patterns is to simply replay the market, noting each time you see a particular candle.

As you put in deliberate practice, ask yourself the following questions:

- What candle formation is this?

- What is the context? Uptrend? Down trend? Sideways?

- Does this candle meet the criteria for a proper reversal?

- Where could I enter with the least amount of risk?

- What would confirm the pattern?

We have a wealth of knowledge on many different candlestick patterns, so be sure to check out those lessons, too!

Love these and want more?

Stay in the know

Make the most out of every trade!