Half the battle in day trading is actually being able to pick the best stocks for day trading. Unlike swing trading or long-term investing, you want to find the most volatile stocks for day trading. Day trading volatile stocks can give you the biggest opportunities to make money each day in the market.

That being said, there are many ways to "skin the cat," as they say. Volatile stocks for day trading can come in many sizes: large caps, small caps, micro floats, etc. So how to you know which day trading picks for tomorrow will work out? Each evening and each day, you need to learn how to scan for the top day trading stocks, add those to your watchlist, and then learn to trade them.

Learning to trade these stocks is the other half of the battle. You'll need a proper simulator in order to study the movements of the most volatile stocks. Trust us, these stocks can move whole dollars in just a few seconds or minutes. You don't want to get in the ring with the best day trading stocks today -- instead, you want to be a seasoned pro before putting your hard-earned money to work.

Along those lines, we'll spend the rest of this article showing you how to find the best stocks for day trading, which stocks are the most volatile for day trading, and how to pick the best stocks today!

What are the best stocks for day trading?

The best stocks for day trading are usually the ones that have the most momentum, most volume, and most volatility. Unless you want to get on the kiddy rides at the circus, you're going to want a stock that will move in either direction quickly and with a lot of force. We call it momentum.

Over time, you will learn to develop a keen eye for which stocks are the best to trade today or tomorrow. You'll learn to run scans in the evenings to find stocks to trade for tomorrow. Likewise, you'll run intraday scans to find stocks in play today.

Regardless of how you develop your scans, the best stocks for day trading have momentum. The worst stocks for day trading have low liquidity and don't go anywhere.

Let's look at two examples, one for a good stock for day trading and one for a bad stock for day trading.

Best Stocks for day trading Examples

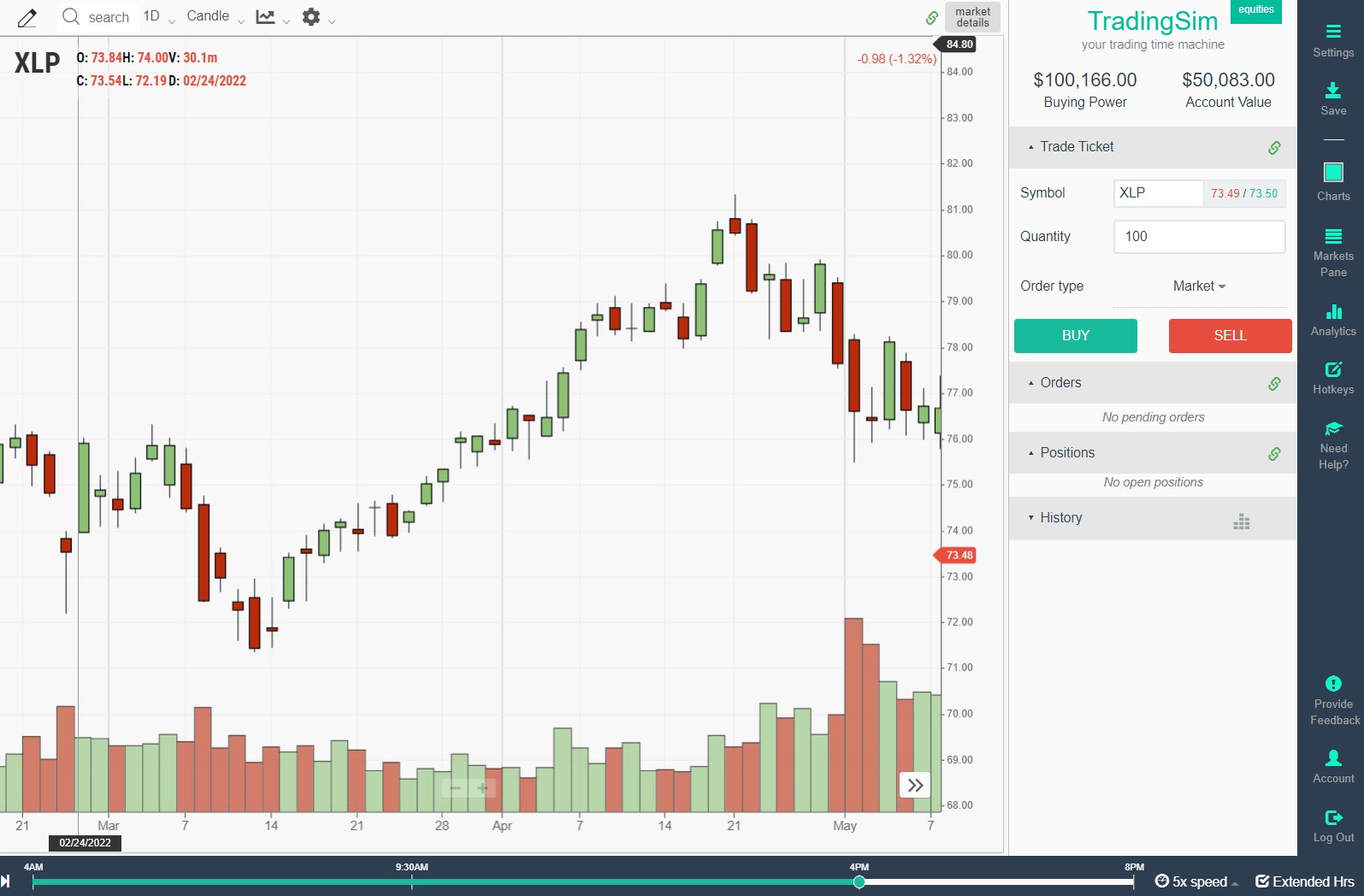

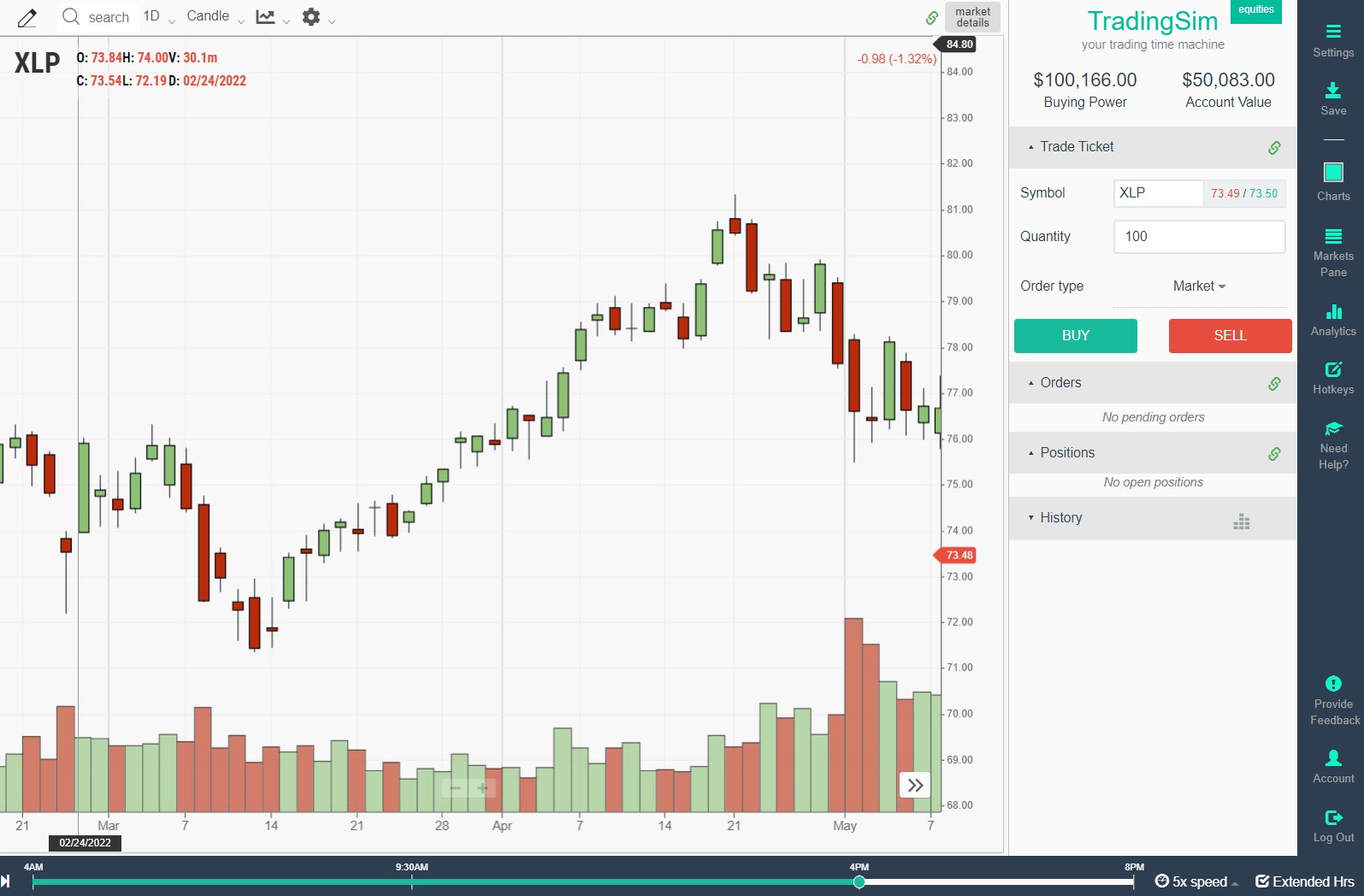

In this first example, we have a stock that has lackluster momentum for day trading. This doesn't necessarily mean it is a bad stock. It just isn't one that we would consider good for intraday volatility and momentum. Perhaps it would be a good swing trade, but when you're lucky to get $0.50 to a dollar out of each day, you're probably going to get bored really quickly. Not only that, but it will be hard to build into a sizeable position.

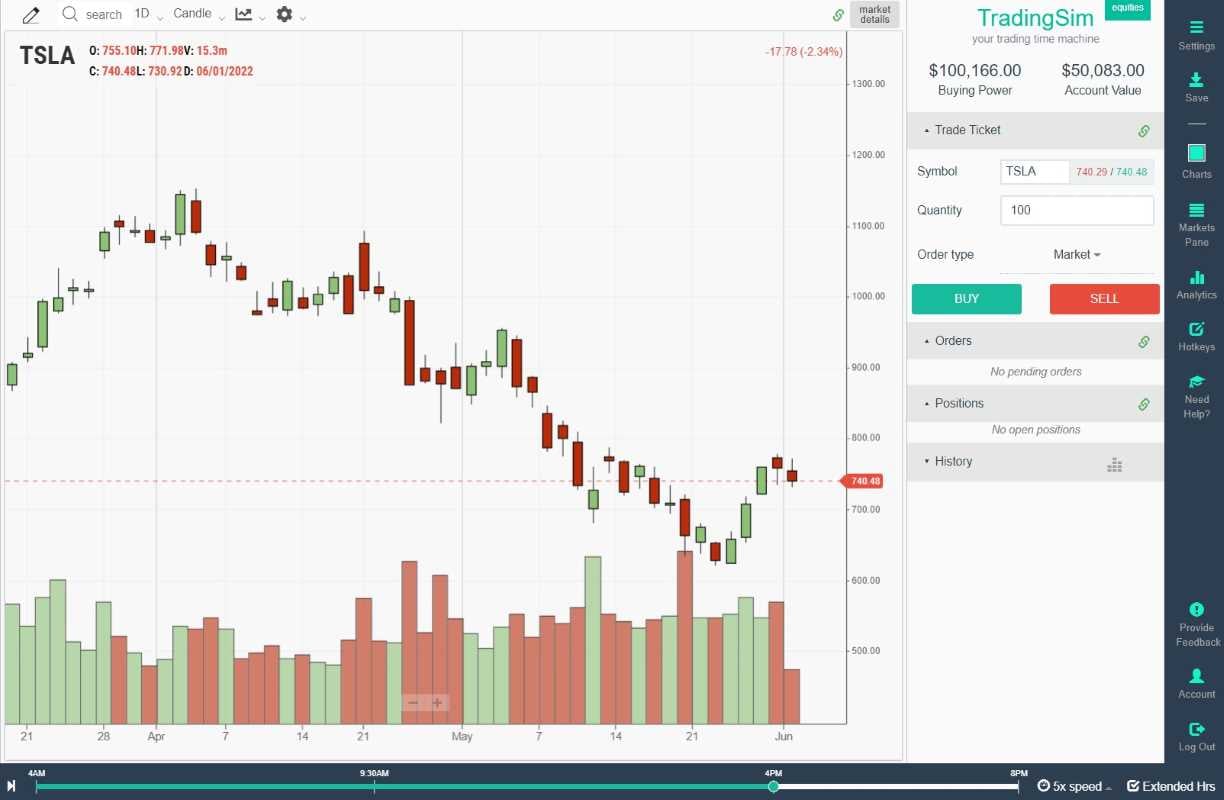

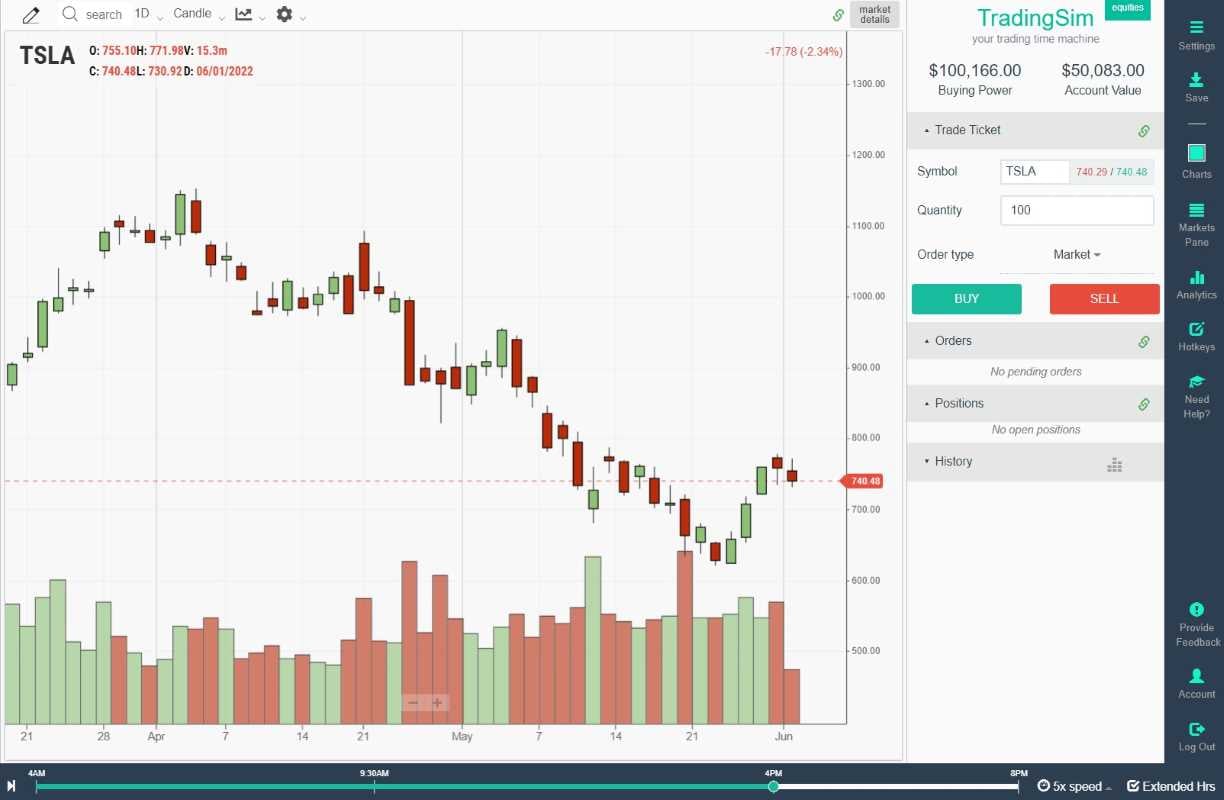

Now for our second example, we have the infamous TSLA chart. Notice how broad these intraday swings are in TSLA. Unlike the small percentage moves in XRP above, TSLA can swing anywhere from 3% to 12% on any given day. That's a lot of range!

Now that we've seen the daily chart of TSLA, let's dive into the intraday chart to see just how volatile this stock can be for day trading, and why we WANT that!

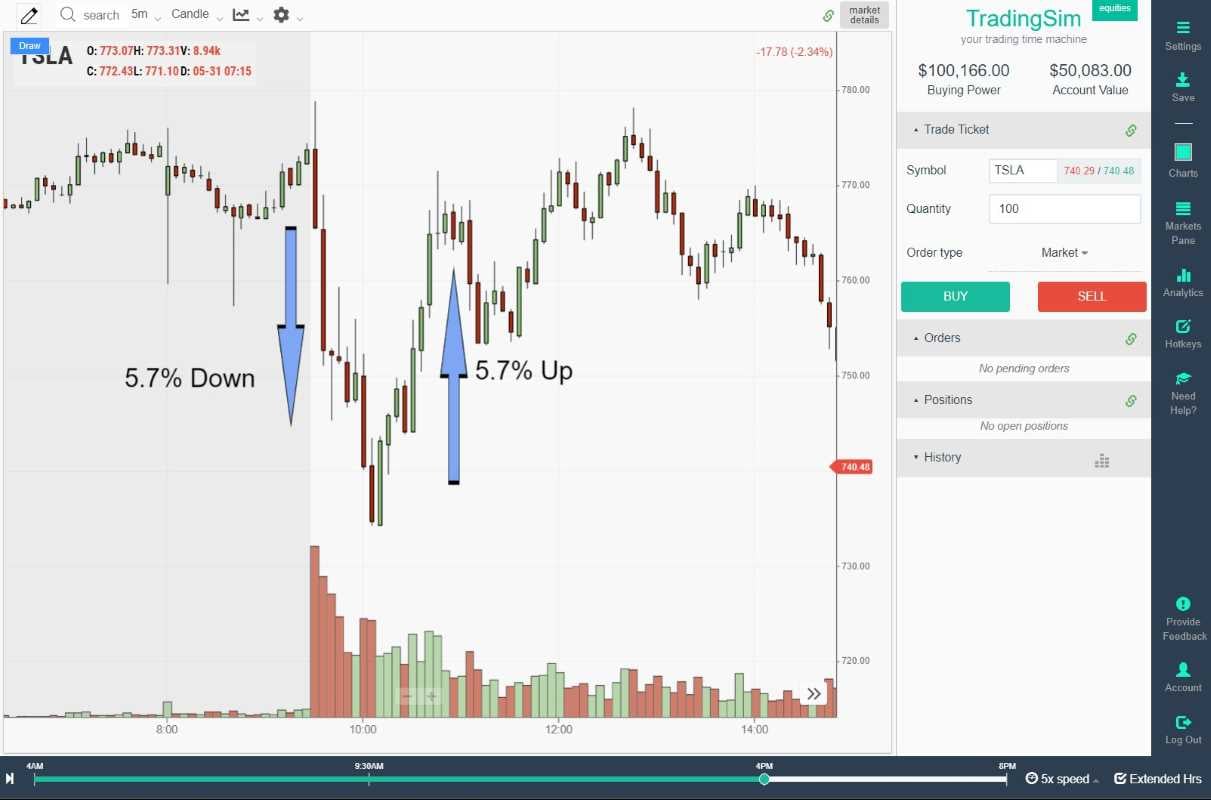

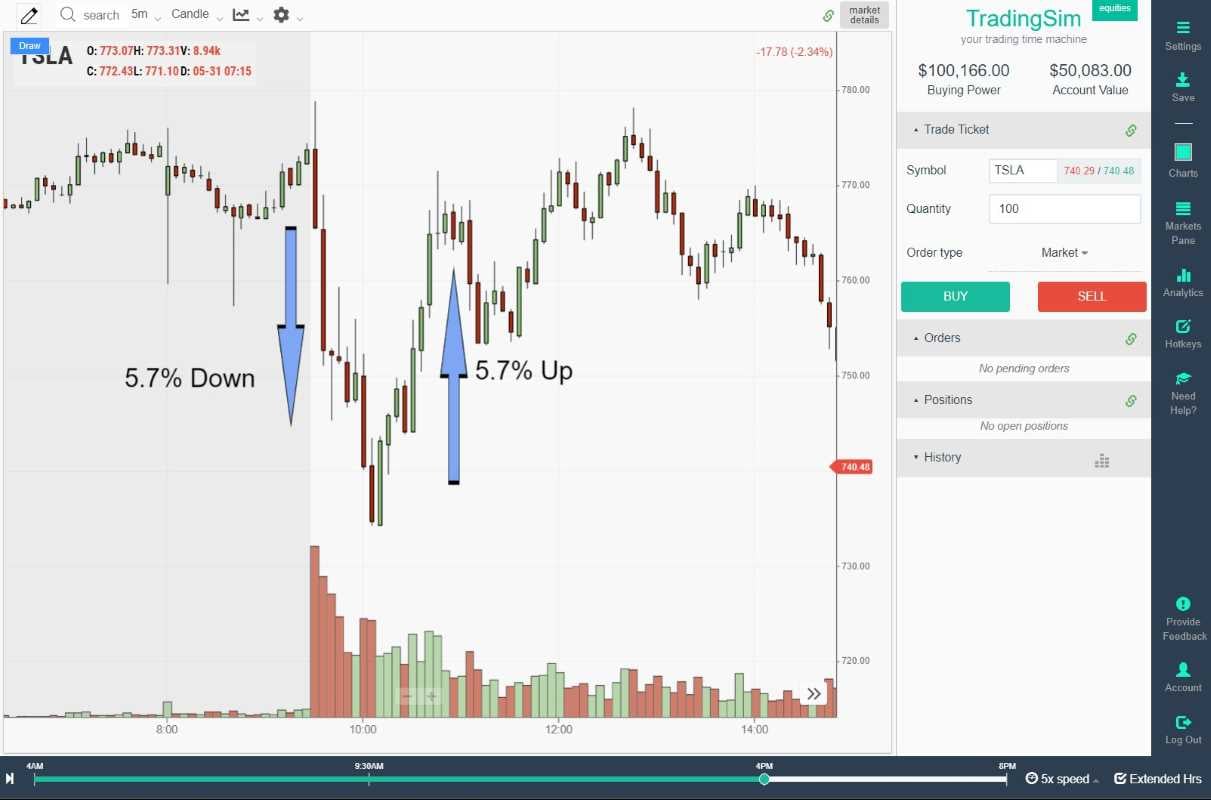

Notice how TSLA's volatility off the open on this day created a 5.7% washout in just about 30 minutes. It then reversed and regained that 5.7% in about an hour or less. That is the kind of volatile stock for day trading that you want. Fast moves, liquid names, and directional momentum.

How to find the best stocks for day trading?

The way to find the best stocks for day trading is by having a scanner that sorts and filters stocks based on volatility and volume. Another way is to keep tabs on the most volatile stocks in the market on a regular basis and keep these on your watchlist. To this second point, TSLA is always known for its volatility, so you might always keep it on your perma-watchlist.

Aside from simply observing the market daily and keeping track of the most volatile and liquid names, there are plenty of stocks that pop up on the scanners each day. These are what we would call the "best day trading stocks today." This is because they are often the subject of a press release or some other news for the day.

In order to find the best day trading stocks for today, you need to narrow your scans to the following criteria:

- Top volume in the premarket

- Highest percentage gainers or losers

- Market cap

- Float size

- Relative volume

- Price

- Gap percentage

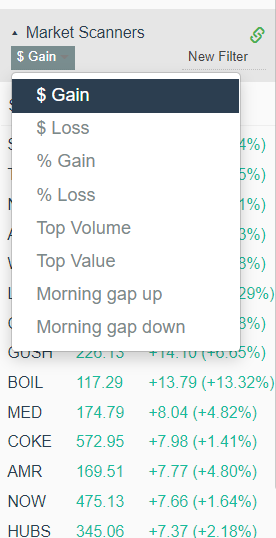

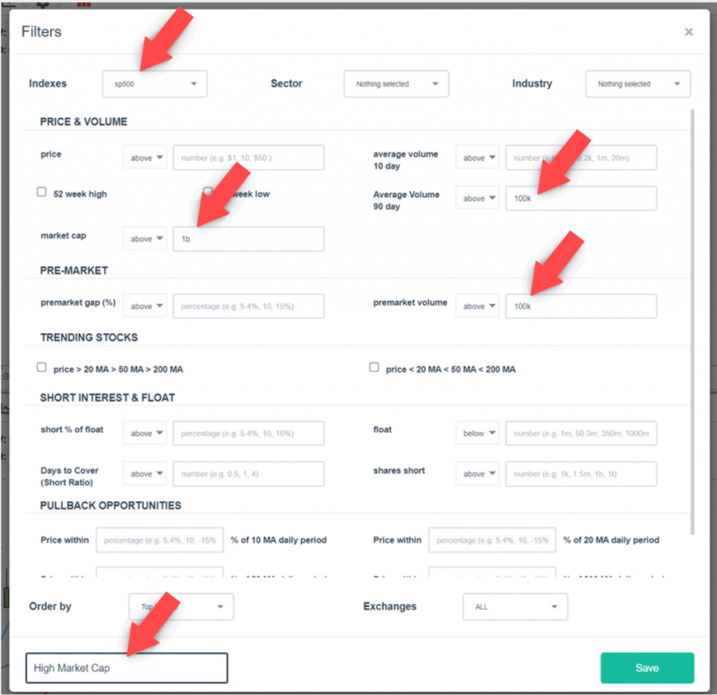

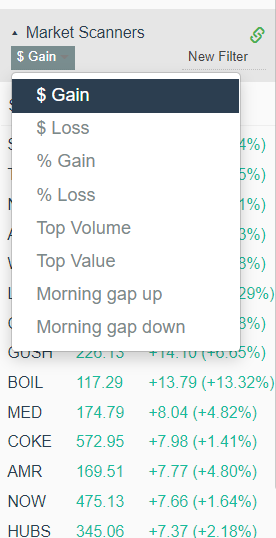

Sounds simple, but these 7 characteristics will more than likely give you the best stocks to trade each day. The reason they are the top day trading stocks is that they will be "in play." As an example, here is what that filter would look like inside the TradingSim app:

What are the "stocks that are in play today?"

"Stocks that are in play today" simply means that these are the stocks that are the most volatile stocks and best day trading picks for a specific day. More often than not, they are the gappers for each morning -- though they aren't limited to that.

Sometimes the stocks in play can be a stock that is overextended on a daily chart. Or, it could be a stock that is setting up nicely and tightly along a moving average on a pullback. It could also be a stock that is poised for a breakout. There are many ways to determine whether a stock is in play today or not. It will depend, in large part, on what your favorite trading strategies are and how flexible you are with adapting to the market and what it gives you as a setup.

Ideally, you are looking for a stock that is about to make a big move. Like we mentioned above, you want a stock with momentum, volatility, and a setup that you can trade effectively. We've written about a lot of these type of moves, like parabolic reversals, head and shoulders patterns, and more. So do your homework and find the ones that work best for you!

How do you pick the best stocks for day trading?

So you know how to find the best stocks for day trading using a scanner and a watchlist, but how do you pick the best stocks for day trading? In other words, with so many options, how do you pick the best ones to day trading today or tomorrow? Well, the answer isn't cut and dry. You have to go with your instincts. Let's explain.

In order to pick the best stocks for the day you want to trade, you need a good feel for the stock. Once you observe the markets for long enough (we mean months, years) you will begin to pick up on which stocks are about to make big moves. Maybe they are breaking down on a daily chart, or breaking out instead. Perhaps they are hitting long-term resistance like an old vwap boulevard level. Whatever the impetus, you'll learn to spot these opportunities.

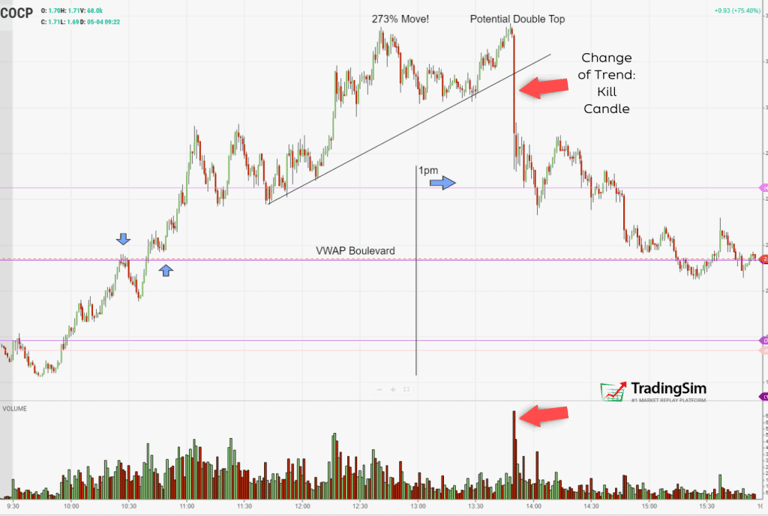

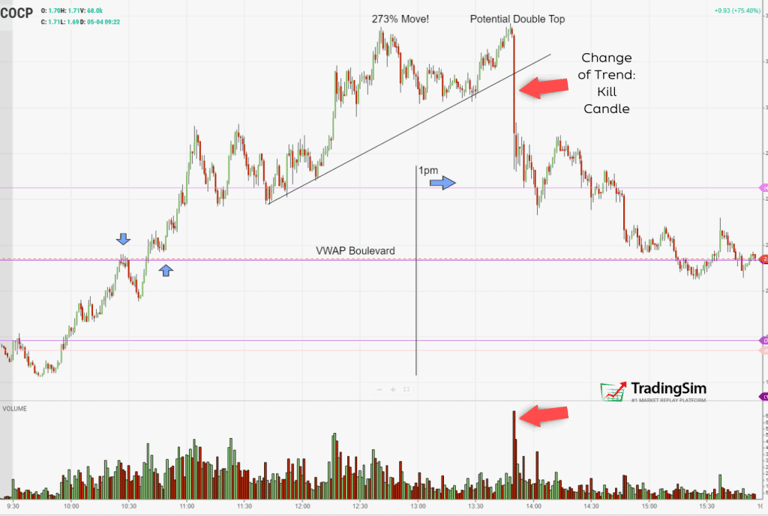

Let's take a 3pm blood bath as an example. As many know, a lot of low float pump and dumps tend to fall apart by the afternoon as the main "players" in the stock have done their duty and pumped the stock. Often, these are crappy companies just looking to raise cash and become targets for short-sellers.

In order to "pick" a stock like this to day trade, you need to keep your eye on the scanners that morning and be watching the stock by the afternoon. If you see a lot of churn, highly overbought conditions, and some form of manipulation, you might have a good candidate for an afternoon selloff that we call the 3pm Bloodbath.

Day trading volatile stocks

Day trading volatile stocks comes with risks. You must be experienced and accustomed the emotional swings that day trading volatile stocks brings with it. Often, the most volatile stocks in day trading will test your resolve as your PnL swings become violent throughout the day.

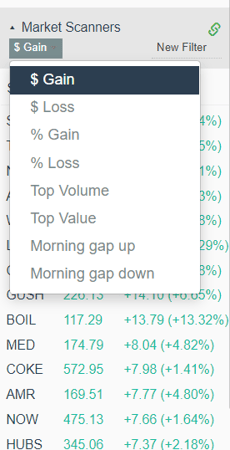

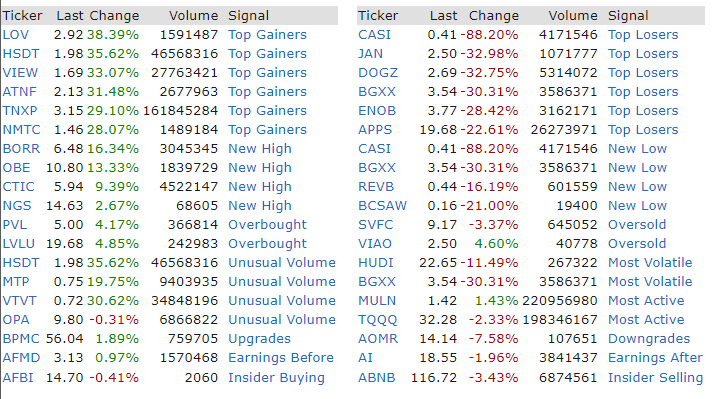

If you are looking for the most volatile stocks in the market, most brokers include these in their built-in scanners. All you have to do is adjust the filters for the highest % gainers or losers for the day. Many brokers or charting platforms will also include criteria like highest % turnover, top volume, and other key metrics that will help you identify where the money is flowing each day.

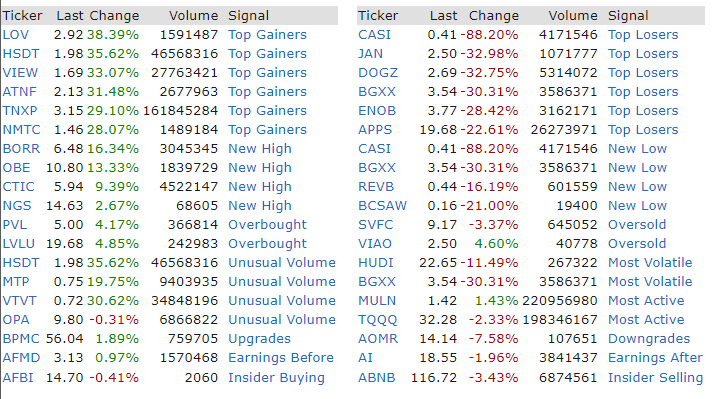

Sites like Finviz.com offer free scanners, though they are delayed. But you can get a good idea of what stocks are making new highs, which ones are the top gainers, and more. Here is a snapshot of some of the free data they offer on the homepage:

How to find volatile stocks for day trading?

According to Mike Bellafiore at SMB Capital the right stocks to day trade "have greater order flow than normal." This gives his traders three advantages:

- Increased liquidity which decreases risk for entries and exits

- Heightened volatility that can give "favorable risk/reward scenarios"

- Cleaner price movements if algorithms are overwhelmed by volume

Now, to find these, you have develop a specific skillset. You must observe the markets for countless hours, study beneath a mentor, and simulate your trades in order to find volatile stocks for day trading. This time in training will teach you what to do with these volatile stocks once you find them. Pattern recognition and chart patterns will help you with this.

Dr. Steenbarger calls it implied learning. The more you observe in the markets, the more you'll see patterns playing out over and over again. It is in these patterns that you find your proper setups and can exploit volatile stocks for day trading profits.

How to narrow your scan for the best day trading stocks?

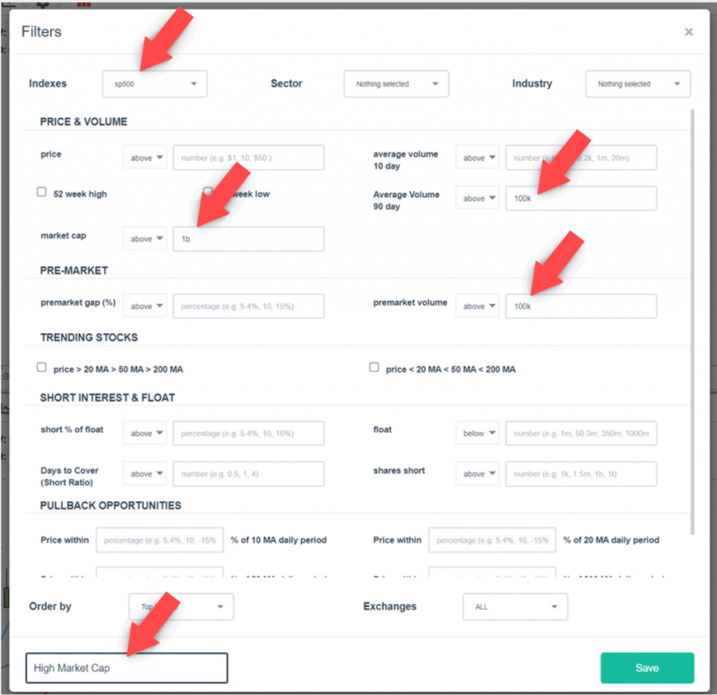

Inside the TradingSim application, we have a scan filter that will allow you to condense your scan results according to the criteria that you choose. If you prefer to trade larger-cap stocks, you can find that as a filter. If you want to find volatile stocks that have a low float, you can do that as well.

Generally speaking, you can narrow your scans for whatever setup you want to find. Let's look at an example of how this would work for scanning for high volume and liquidity:

In this example, we pick stocks with a minimum of $1 billion market cap or higher with a minimum of 100k shares traded over the past three months and 100k shares traded in the premarket. We’ve also limited the results to only stocks traded in the S&P 500.

We then sort those by highest volume, name the filter, then click save.

This way, you’re eliminating smaller cap stocks of lower valuation. Plus, the volume criteria eliminates a lot of the thinly traded stocks in the market.

We cover a lot of these scans in our tutorial on how to narrow your scan for momentum here. There you'll find how to narrow scans based on criteria like:

- Volatilility and Momentum

- Volume and Liquidity

- Short or Long Bias

- Short Squeezes

Choosing the best stocks for day trading summary

As you can see, if you want to self-sufficient in day trading, choosing the best stocks for day trading is going to be a work in progress. Veteran traders have a leg up because they've been watching and observing markets for many, many years. Over time, they develop a pattern for what they know and like to trade. They also get very good at anticipating volatility in stocks.

As you progress in your journey, we challenge you to track what works for you. In order to speed up the process and choose the best stocks for day trading, you'll need to do a lot of trading. But how do you do that when the market is only open from 9:30am EDT until 4pm? What about weekends?

To hone your skills and develop your eye for the best stocks to day trade, we recommend that you trial TradingSim. We have over three years of intraday trading that you can REPLAY whenever you want! This allows you to speed up the learning curve and test your scans to find top stocks to day trade.

Day Trading Indicators

Day Trading Indicators