Overview of Swing Trading

Swing trading is a form of active trading. The goal is to make a profit on a trade from a time span as short as a few days to a few months.

You can place trades on both the short and long side to make profits and can do so in any market.

For the purpose of this article, I will discuss how to make money in the stock market.

#1 – What is Considered a Swing Trade?

The first question I need to address up front is what constitutes a swing trade? You first have two options; you can either go long or short.

If you are just starting out in trading I would recommend you stick to the long side of the house. This is because there is unlimited risks on the short side and requires different money management skills.

So, a swing trade is where you purchase a stock with hopes of selling it at a higher price in a short period of time for a profit.

Examples of a Swing Trade

Swing Trade

Please note this is the ideal trade setup, but no one is able to nail the tops and bottoms cleanly. Your goal is to profit on the action between these two points.

Does this make sense?

#2 – How Much Money Do You Need to Swing Trade?

This is going to come down to a number of variables, which we will breakdown below.

Are You Swing Trading for a Living?

First, you need to prove to yourself that you are able to make consistent profits at scale for at least 6 months to a year. Trading for yourself as an independent business owner sounds very glamorous, but if not done properly can lead to a lot of emotional and financial pain.

If you are trading for a living you will need to have multiples more of your living expenses before stepping out on your own.

Unlike day trading, you will not be able to see how much you have made on a daily or weekly basis. Therefore, you will need to have the concept of float like a traditional business, where it may take weeks before you see profits from a trade.

The last thing you will want is to kill a trade prematurely because you need to pay bills and are short on cash.

So, I would recommend you have ten times what you need in monthly expenses in trading cash. Therefore, if your monthly expenses are 2,500, you should have $250,000 cash.

This sounds like a lot and it should. This will ensure that you have enough cash to weather any downturns in the market and also give you enough cushion that you are able to hold your positions for the necessary time to let them play out. Most importantly, it will allow you to not concentrate your cash into a few positions in order to turn a healthy profit.

Having this much cash will allow you to trade from a place of strength versus trying to swing for home runs and turn a small amount of money into some massive fortune.

The other option, of course, is to drastically lower your monthly expenses, which will reduce this figure.

Are You Swing Trading on the Side?

This is a much better approach for getting started in swing trading. Unlike day trading, you do not need to sit there monitoring the trade to look for signs to exit.

Most importantly, you have another income source which doesn’t make trading the only way you feed yourself. Now, this has many pros of course but has a few cons.

One major con is that since you have a job, the money from the market may not be your top priority. From my personal experience, unless you have real skin in the game, whatever goal you are trying to achieve will have a tough time coming to fruition.

So, you will have to create personal hacks that give you the same passion to master the craft of swing trading, even though you know everything will be ok financially whether you make money or not.

#3 – What is the Profile of a Swing Trader?

If you are thinking about swing trading but are trying to figure out if it’s a good fit for you, below are a few questions you should ask yourself to see if it’s right for you.

- Does day trading feel too fast or risky?

- Do you like your day job or run a business and don’t have the time to monitor the market frequently throughout the day?

- Do you have less than 25,000 you want to use towards swing trading (highly recommended)?

- Would you feel more comfortable analyzing the market after the close or on the weekend?

If you have answered yes to all of these questions, swing trading on the surface is likely a good fit.

#4 – What is the Best Time Frame for Swing Trading?

There are a few time frames you will want to focus on. Below are those timeframes listed in priority:

- Daily

- Weekly

- One Hour

- Four Hour

You may be surprised to see the two intraday timeframes listed. The reason is you need to have some idea of what traders are thinking on different time frames.

One Hour Facebook Chart

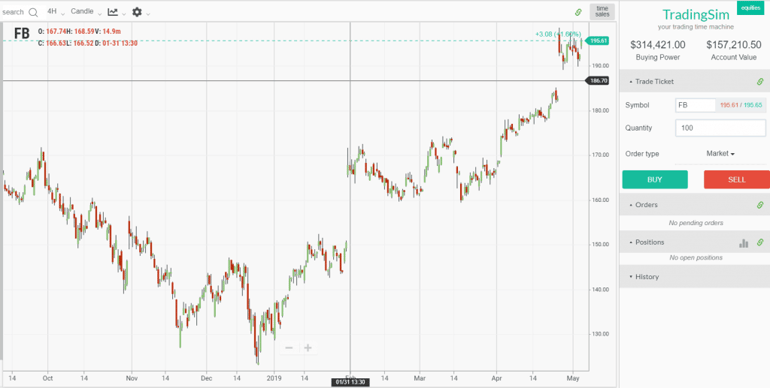

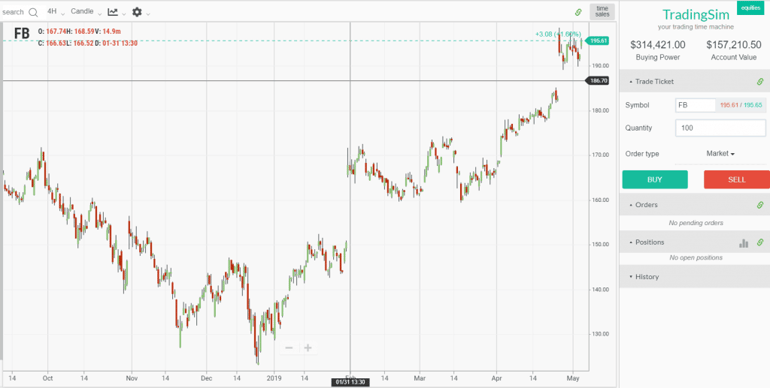

Four Hour Facebook Chart

The daily chart is your primary, as you will need some compass of where things are going over the next few days or weeks.

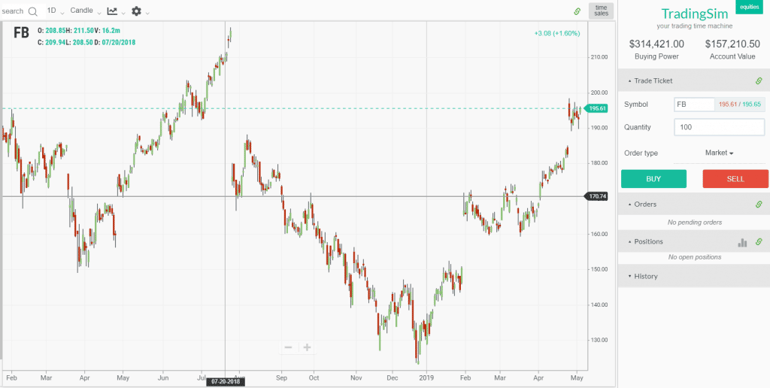

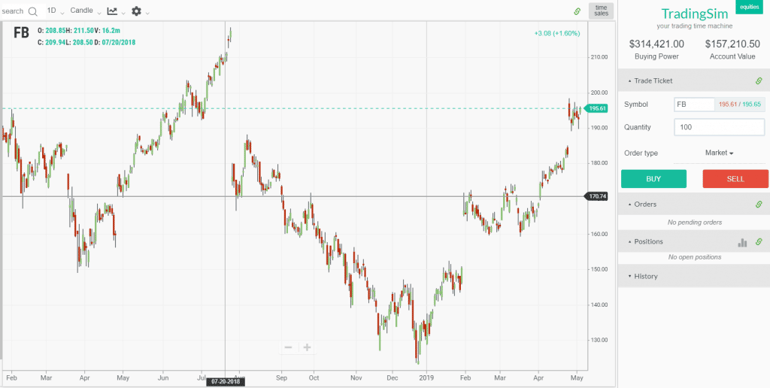

Daily Facebook Chart

Lastly, the weekly chart view will allow you to see the bigger picture in order to know where to exit your position.

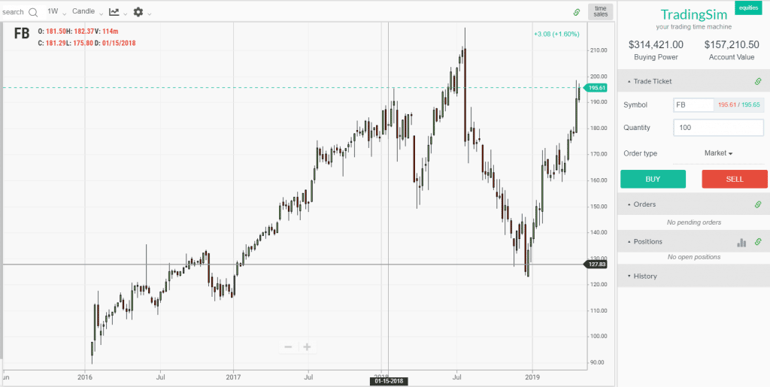

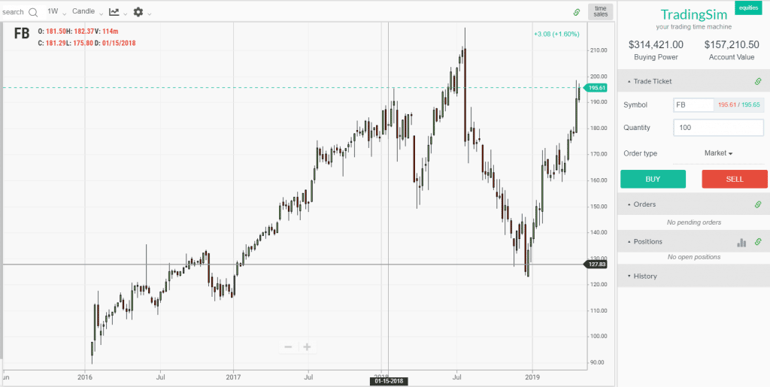

Weekly Facebook Chart

#5 – How Long Should You Hold a Swing Trade?

This all comes down to the data you collect. Traders always want a holy grail indicator or some guru to tell them where to get in and out of trades.

Trading is completely mental for discretionary traders. The way you perceive risks or profits is completely different than the next trader.

Therefore, you have to put in the hard work of tracking each one of your trades to figure out what price action rules make sense for your trading styles.

#6 – What are Some Swing Trading Strategies?

There are a few strategies that are very popular.

- There is the golden cross which tracks when the 50-period moving average crosses above the 200-period moving average. This is a major bullish signal that can produce trading opportunities.

- There is the opposite of the death cross which is the inverse of the golden cross.

- There is the break of the 200-day moving average by the price. This is another major signal which is tracked by the street for the major indexes to determine if the market is in a bullish or bearish trend.

- Focus trading during earnings season. Earnings season can provide volatility which can provide great trading opportunities.

#7 – Swing Trading versus Day Trading

You can check out my article here where I go into depth about this topic, but to quickly summarize this is purely a personal decision.

For me, I like day trading because I like to know each day whether I have won or lost.

Again, this is completely a personal decision and comes down to which makes you money and which one gives you a sense of joy.

How Can We Help

We have daily and weekly charts in Tradingsim which you can use to practice trading. Remember, learning to trade is a process and you need to give yourself time to see if swing trading matches your trading style.

Intro to Chart Patterns

Intro to Chart Patterns