Unlock the secrets of cryptocurrency trading with our in-depth guide on free paper trading. Ideal for both novices and seasoned traders, learn to navigate the crypto market and refine your strategies without any financial risk

Crypto is now a household name. It has become so popular that many are searching for ways to invest in it, quickly replacing the popularity of gold and silver as a bygone hedge for fiat currency. Even grannies are asking how to get involved in crypto trading these days.

However, there is a lot of risk involved in trading crypto. Unless you simply want to buy and hold forever, to trade crypto actively, you'll want to start by paper trading. There aren't many options available for this, except at TradingSim.com. So let's dive into what it takes to find free paper trading simulators and make the most of your journey to trade crypto successfully.

Introduction to Crypto Trading Simulation

Cryptocurrency trading simulation allows aspiring investors to practice trading in a risk-free environment. It provides a virtual platform where users can experience real market conditions without investing actual funds. Cryptocurrency simulation helps traders understand the dynamics of the crypto market and test their strategies before executing them in the real market.

Is There a Crypto Trading Simulator?

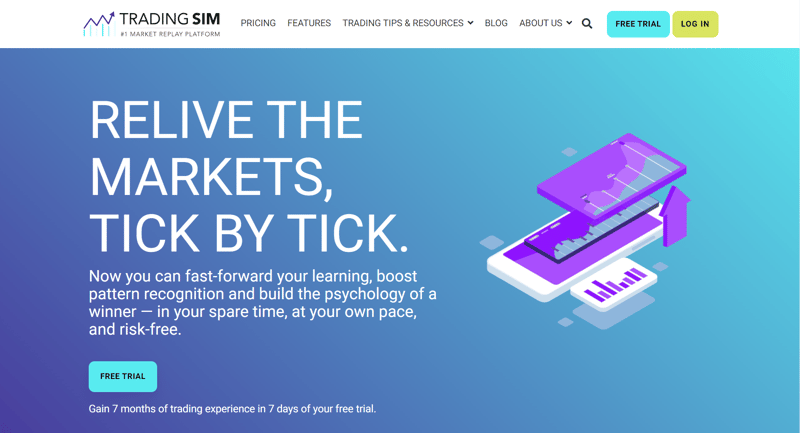

Yes, there are a handful of crypto trading simulators. TradingSim offers a free trial for crypto paper trading that allows you to choose from most cryptocurrencies available today, replay their charts for any given day in history, and practice your trading strategies. It is as realistic as virtual crypto trading gets.

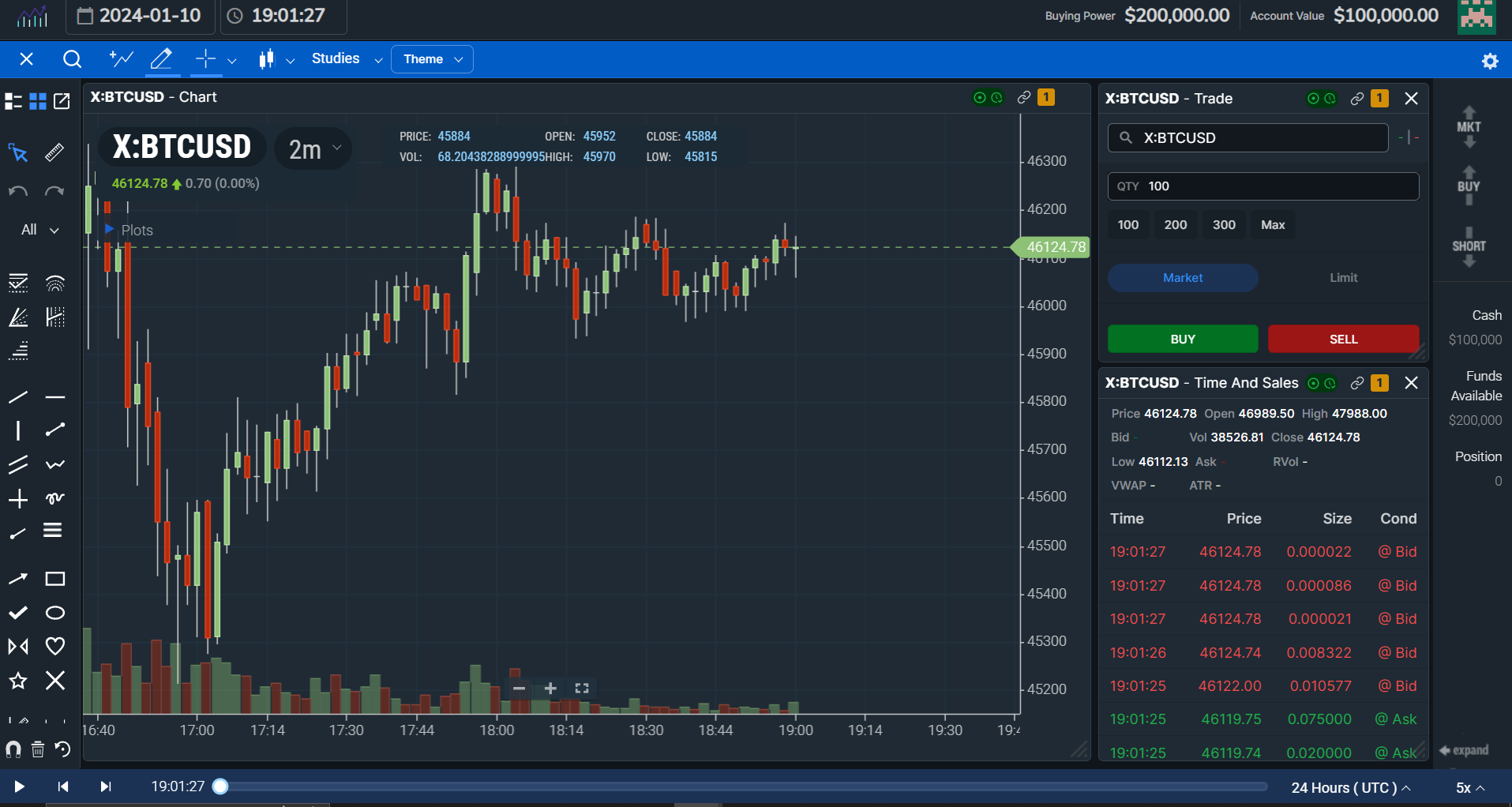

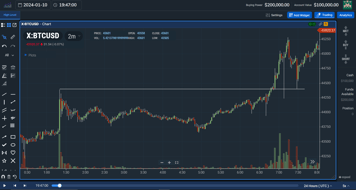

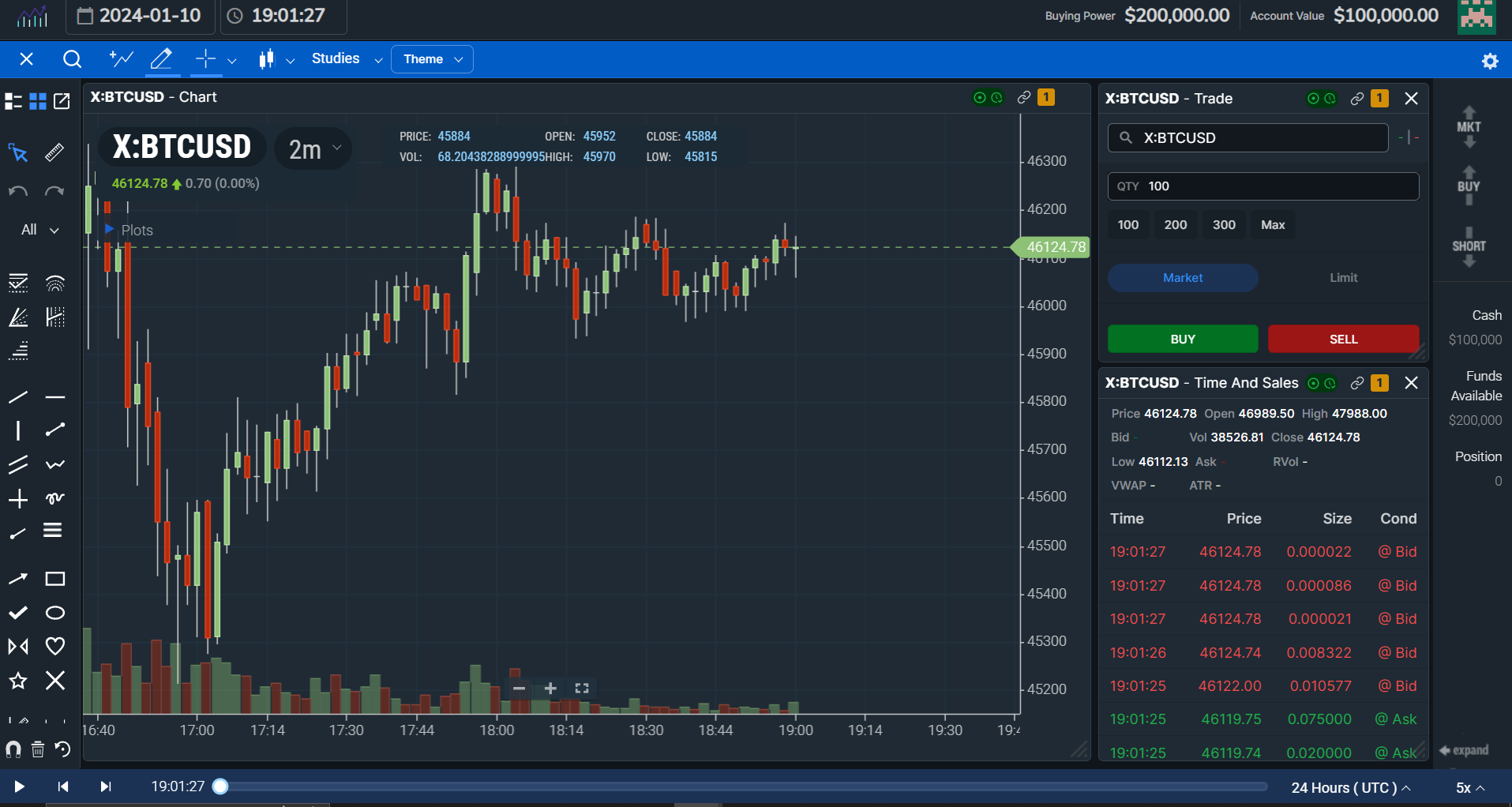

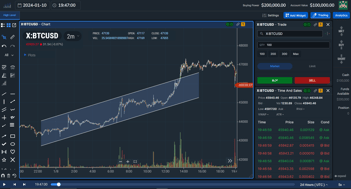

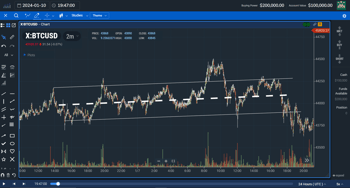

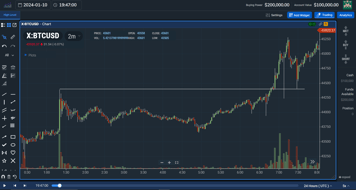

For example, let's say you want to explore Bitcoin price action on the day that the SEC approved the Bitcoin ETF. This occurred on January 10th, 2024. In a proper crypto trading simulator like TradingSim, you would be able to locate this day and choose to replay the real-time price action for that day. Here is what it might look like:

Within the simulator, you should be able to buy and sell virtual money and see the time and sales data for whatever cryptocurrency you are trading.

Discovering Free Paper Trading in Crypto

Free paper trading in crypto refers to the practice of trading virtual currencies without risking any real money. This method is ideal for beginners who want to learn about cryptocurrency trading without financial consequences. With a free paper trading account, you'll be able to explore various trading strategies, analyze market trends, and gain practical experience in a simulated environment.

Free paper trading can also be a misnomer, as not all paper trading platforms are free. In other words, they are usually offered as a subscription service. At TradingSim, we do offer a free 7-day trial for our crypto trading platform. This gives traders enough time to play with the platform and discover whether or not it will be useful for them.

Benefits of Using Risk-Free Crypto Practice

There are several benefits to using risk-free crypto practice through paper trading. Firstly, it allows traders to hone their skills and develop effective strategies without incurring any financial losses. Additionally, it helps you gain confidence in your trading abilities and understand the intricacies of the crypto market. By practicing risk-free trading, traders can refine their decision-making process and improve their overall performance.

Let's breakdown the benefits a little more for you:

Learning & Experimentation:

- Zero risk: The most significant benefit is the ability to learn and gain experience without risking real money. This allows you to explore the crypto market, understand basic trading concepts, and experiment with different strategies before putting your own funds on the line.

- Familiarize yourself with the platform: Practicing on a simulated platform lets you get comfortable with the interface, order types, charting tools, and other functionalities before investing real money.

- Test trading strategies: You can try out various trading strategies, such as day trading, swing trading, or long-term holding, to see which ones resonate with your risk tolerance and goals.

- Develop emotional control: Practicing in a risk-free environment allows you to learn to manage your emotions, like fear and greed, which can significantly impact real-world trading decisions.

Skills & Confidence:

- Build technical skills: You can practice using technical indicators, analyzing charts, and identifying potential trading opportunities, honing your technical analysis skills.

- Improve decision-making: By actively making trades in a simulated environment, you can learn to make informed decisions based on market data and analysis, improving your overall trading judgment.

- Boost confidence: Gaining successful simulated trades can increase your confidence and comfort level before entering the real market with actual capital.

Beyond Basics:

- Access historical data: Some platforms offer access to historical data, allowing you to backtest strategies and see how they would have performed in past market conditions.

- Develop risk management plans: You can experiment with different risk management techniques, such as stop-loss orders and position sizing, to establish safe trading habits.

- Explore advanced features: Certain platforms offer paper trading for features like margin trading and futures contracts, allowing you to safely explore these more complex aspects of the market.

However, it's important to remember that paper trading doesn't fully replicate the psychological and financial aspects of real-world trading. Therefore, treat it as a valuable learning tool, not a guarantee of future success.

Paper Trade Cryptocurrencies

Paper trading cryptocurrencies involves simulating real trading scenarios without using actual money. Traders can buy, sell, and trade various cryptocurrencies in a virtual environment to understand how different assets perform in the market. By paper trading cryptocurrencies, you can experiment with different trading techniques, analyze price movements, and track your portfolio's performance without risking any capital.

Top Free Paper Trading Platforms for Crypto

Paper trading cryptocurrencies is a fantastic way to test the waters of the volatile crypto market before risking any real money. It's like having a sandbox to play in, where you can experiment with different strategies, learn the ropes, and gain confidence before taking the plunge into the real deal.

Choose a paper trading platform:

There are many platforms out there that offer paper trading for cryptocurrencies. Some popular options include:

- TradingSim: The most realistic and in-depth standalone market replay application on the web.

www.tradingsim.com

www.tradingsim.com

- Binance: A major cryptocurrency exchange with a user-friendly paper trading platform.

Binance paper trading platform

- Kraken: Another well-established exchange with a robust paper trading platform.

Kraken paper trading platform

- Coinbase: A beginner-friendly platform with a paper trading option.

Coinbase paper trading platform

- TradingView: A charting platform with a paper trading feature for various assets, including cryptocurrencies.

TradingView paper trading platform

-

- Bitsgap: A crypto trading bot platform with a paper trading feature.

Bitsgap paper trading platform

Tips for Successful Paper Trading in the Crypto Market

To succeed in paper trading in the crypto market, budding traders should set realistic goals, maintain a trading journal to track their progress, and experiment with different trading strategies. It is important to treat paper trading seriously and simulate real market conditions as closely as possible to gain valuable experience and improve trading skills. By staying disciplined and continuously learning from mistakes, you can hone your skills in the crypto trading markets.

7 Beginner Tips for Crypto Trading

For beginners entering the world of crypto trading, it is essential to start with small investments, conduct thorough research on different cryptocurrencies, and stay updated on market trends. Additionally, beginners should focus on learning the basics of technical and fundamental analysis, practice trading through paper trading platforms, and seek guidance from experienced traders.

By following these tips, beginners can lay a solid foundation for their crypto trading journey:

1. Create a demo account:

Once you've chosen a platform, sign up for a demo account. This is usually a free and straightforward process.

2. Fund your demo account:

Most platforms will give you a virtual starting balance of play money to trade with.

3. Start exploring:

Familiarize yourself with the platform's interface, including the order types, charting tools, and other features.

4. Experiment with different strategies:

Try out different trading strategies, such as the volatility contraction pattern, abcd pattern, etc.. See what works best for you and your risk tolerance.

5. Analyze your results:

Track your performance and analyze your trades to see where you can improve.

6. Don't get discouraged:

Remember, paper trading is a learning experience. Don't be afraid to make mistakes, that's how you learn and grow.

7. Graduate to real trading (when you're ready):

Once you feel comfortable and confident, you can consider transitioning to real-world trading with a small amount of money. But remember, the crypto market is inherently risky, so always invest responsibly and never trade more than you can afford to lose.

Here are some additional tips for successful paper trading:

- Set realistic goals: Don't expect to get rich quick with paper trading. Focus on learning and improving your skills.

- Manage your risk: Even though it's virtual money, treat it like real money and practice good risk management techniques.

- Be patient: Learning to trade takes time and practice. Don't get discouraged if you don't see results immediately.

- Have fun: Paper trading should be a learning experience, but it should also be enjoyable.

By following these tips and putting in the time and effort, you can use paper trading to become a more informed and confident trader in the exciting world of cryptocurrencies.

Crypto Trading Education

Continuous education is key to success in the crypto trading market. Aspiring traders should invest time in learning about blockchain technology, understanding the fundamentals of different cryptocurrencies, and staying informed about regulatory developments.

Additionally, attending webinars, reading trading books, and following industry experts can provide valuable insights and help individuals make informed trading decisions. By prioritizing education and staying updated on market trends, you'll grow your trading knowledge and improve your trading performance.

However, if active trading is your goal, you'll want to learn more about technical analysis, how to read a chart, chart patterns, and price action trading strategies. To that end, let's look at some potentially explosive crypto trading strategies.

Crypto Trading Strategies

It's important to understand that there's no single "best" technical analysis trading strategy. The effectiveness of any strategy depends on various factors like market conditions, individual risk tolerance, and trading goals.

However, here are 5 popular technical analysis strategies for trading cryptocurrency that are worth exploring, keeping in mind that successful implementation requires practice and research:

1. Trend Following:

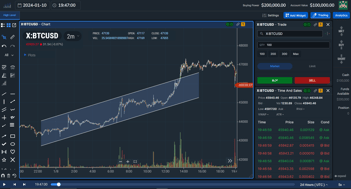

- Focus: This strategy identifies and capitalizes on established trends, buying in uptrends and selling in downtrends.

- Tools: Moving averages, trendlines, and volume analysis are commonly used.

- Pros: Relatively simple to understand and implement, can capture significant gains in trending markets.

- Cons: Can miss out on countertrend moves, suffers during choppy markets.

2. Mean Reversion:

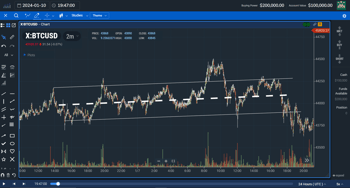

- Focus: This strategy assumes prices tend to revert to their historical averages and exploits deviations from these averages.

- Tools: Bollinger Bands, Relative Strength Index (RSI), and support/resistance levels are common tools.

- Pros: Can be profitable in ranging markets, offers defined entry and exit points.

- Cons: Reversal timing can be tricky, and requires patience and discipline.

3. Breakout Trading:

- Focus: This strategy identifies and attempts to profit from price breakouts above resistance levels or below support levels.

- Tools: Chart patterns, volume analysis, and volatility indicators are often used.

- Pros: Can capture large moves if the breakout is sustained, offers clear entry and exit points.

- Cons: False breakouts can lead to losses; requires quick reaction to confirmation signals.

4. Contrarian Trading:

- Focus: This strategy goes against the prevailing market sentiment, buying when others are selling and vice versa.

- Tools: Sentiment indicators, overbought/oversold oscillators, and contrarian indicators can be helpful.

- Pros: Can profit from market corrections and reversals, offers diversification from trend-following strategies.

- Cons: Requires strong emotional control, can be challenging to identify true contrarian opportunities.

5. Arbitrage Trading:

- Focus: This strategy exploits price discrepancies between identical assets traded on different markets.

- Tools: Specialized arbitrage trading platforms and software are typically used.

- Pros: Can offer risk-free profits if executed correctly, requires limited capital.

- Cons: Requires advanced technical skills and access to multiple markets, profit margins can be thin.

Remember, these are just starting points. Each strategy has its nuances and complexities, and mastering them requires thorough understanding, backtesting, and risk management practices. Never trade with real money before fully comprehending the associated risks and practicing extensively in paper trading environments.

Developing Your Trading Skills with Paper Trading

Paper trading is an excellent way to develop trading skills in the crypto market. By being consistent and using simulated trading seriously, traders can improve their understanding of market dynamics, practice risk management techniques, and refine their decision-making process. Remember that practice may not make perfect, but it is crucial to your success. Don't take our word for it, here is the most prolific author on trading psychology, Dr. Brett Steenbarger:

If you’re motivated to learn and master markets, you’ll enjoy simulation and playing with trading ideas. If you’re motivated by making money and showing off pictures of your new cars on social media, simulation won’t hold much appeal.

When surgeons learn new techniques, they practice on models and cadavers before “going live”. If a surgeon told me he didn’t think such practice was important, I’d likely look elsewhere for my procedure…

We hope you found this tutorial beneficial and will join us in the TradingSim Crypto Simulator with our free trial.

Day Trading

Day Trading