If you're thinking of shorting crypto, you're not alone. With the recent volatility in the markets in 2022, many investors are looking for ways to profit from downward price movements. And shorting crypto can be a great way to do just that. Despite what many HODLers think, crypto goes through bear markets just like stocks do.

There are a few different ways to short crypto. One is to simply borrow shares to sell when the price is high and then buy them back when the price goes down. This is known as short-selling. Another way to short crypto is to use a derivatives product like a futures contract or options on crypto-related stocks or ETFs. These products allow you to make money if the price of crypto goes down without actually selling your crypto holdings.

So, if you're looking to profit from falling prices, shorting crypto may be the way to go. Just be sure to do your research and understand the risks before you get started.

Can you short-sell crypto?

Many people are familiar with the concept of short-selling in the stock market, but fewer people know that it is also possible to short-sell cryptocurrency. Just like with stocks, shorting crypto allows investors to profit from price decreases. To short crypto, investors borrow coins from a broker and sell them short. When the price falls, they buy back the coins and return them to the broker. The difference in price is their profit.

Shorting crypto can be a risky proposition, but it can also be very lucrative for investors who correctly predict price movements.

Pros of shorting crypto

When it comes to shorting crypto, there are pros and cons to consider. On the plus side, shorting allows you to profit from a decline in the price of an asset. So, if you think the price of Bitcoin is going to drop, you can short it and make money when it does.

Additionally, shorting can help you hedge your portfolio against downside risk. If you're worried about a potential market crash, shorting some of your position can help offset losses in other parts of your portfolio.

Cons of shorting crypto

On the downside, shorting is a risky strategy since there's no limit to how much you can lose if the price begins to rise. You could get caught in a "short squeeze" or a "bear trap" and end up losing a lot of money. Additionally, shorting requires careful timing and discipline. You have to be right about both the direction of the market and the timing of your trade in order to make money. As such, it's not a strategy for everyone.

Shorting also requires a margin account with an exchange, which can be difficult for some investors to obtain. Overall, there are both pros and cons to shorting crypto. It is important to weigh these carefully before deciding whether or not to take this type of position.

Can you make money shorting crypto?

In short, yes you can make money shorting crypto. Shorting, or short-selling is a trading technique that allows investors to bet against the price of an asset, typically in the hope of making profits when the price falls. While shorting has been associated with more traditional investments like stocks and commodities, it can also be used when trading cryptocurrencies.

When shorting crypto, traders will typically open a position by selling an asset they do not own and then buying it back at a lower price in order to profit from the difference. Given the volatile nature of the cryptocurrency market, shorting crypto can be a high-risk strategy but it can also lead to impressive profits if done correctly.

How does a short work in crypto?

Cryptocurrency shorting, or shorting crypto, is a trading strategy that involves selling a cryptocurrency you do not own, in hopes of buying it back at a lower price so you can pocket the difference. Shorting allows traders to profit from downward price movements in the market, and it can be especially useful in volatile markets like crypto. There are a few different ways to short crypto.

Example 1

One popular method is to short-sell Bitcoin on a cryptocurrency exchange. This involves borrowing Bitcoin from the exchange and selling it at the current market price. If the price of Bitcoin falls, you can then buy it back at the lower price and return it to the exchange.

Example 2

Another way to short crypto is through contract-for-difference (CFD) platforms. With CFDs, traders do not actually own the underlying asset but instead speculate on its price movements. This can be helpful for short because it allows traders to take a short position without having to first find someone who is willing to lend them the asset.

Using Margin to short crypto

When it comes to short-selling crypto, you have a few options. You can either short sell crypto using margin or you can short sell crypto using derivatives. If you're new to short selling, then you might be wondering what the difference is. Well, when you short sell crypto without margin, you essentially have to short BTC futures or some other "off-exchange" route to bet on crypto going down.

On the other hand, if you short sell crypto using margin, you're borrowing money from a broker to finance your trade. This means that if the price of the crypto goes down, then you stand to make a profit by giving the tokens/shares back to the exchange. Of course, this also means that if the price of the crypto goes up, then you could lose a lot of money.

Either way, you risk losing money. So, which option is right for you? Ultimately, it depends on your risk tolerance and your investment goals as well as the resources you have access to for short-selling.

Bitcoin Futures

For those looking to short sell crypto, bitcoin futures can be a useful tool. By entering into a contract to sell bitcoin at a future date, you can lock in a price and then sell the coins when the price drops. This can be a risky strategy, as the price of bitcoin could continue to rise, but it can also be a way to make a quick profit if the market turns. And with the recent launch of bitcoin futures on major exchanges, it has never been easier to short sell crypto. So if you're bearish on bitcoin, consider using bitcoin futures to short sell your coins.

Along those lines, we have BTC futures available to trade in the simulator here at Tradingsim. With years of intraday data and the ability to test your strategies, there is no better way to practice shorting Bitcoin than with our TradingSim application.

Contract for Differences

Another lesser-known way to short crypto is through the use of a contract for differences, or CFDs. With CFDs, you don't actually own the underlying asset -- in this case, cryptocurrency. Instead, you're essentially betting that the price will go down. If it does, you make money; if it doesn't, you lose money.

CFDs are popular because they offer leverage, which means you can put up a small amount of money and control a much larger position. For example, with a 2:1 leverage ratio, you could short $10 worth of bitcoin by putting up $5. Of course, leverage can work against you as well as for you, so it's important to understand the risks before you short sell crypto using CFDs.

Bitcoin Binary Options

Short selling is a popular investment strategy, and it can be especially profitable when trading cryptocurrencies. Bitcoin binary options are a type of short-term contract that allows you to bet on the price of bitcoin falling within a certain time frame. If the price of bitcoin does indeed fall during that time frame, you will earn a profit.

To short sell crypto using bitcoin binary options, simply choose a short-term contract and place your bet. If the price of bitcoin falls within the specified time frame, you will earn a profit.

Predictions Market

Prediction markets (like Augur or Gnosis) allow you to short crypto without actually owning any of the assets. This can be helpful if you don't want to tie up capital in something that could go down in value. Shorting bitcoin can be a risky move, but it can also be very profitable if done correctly. So if you're feeling bearish on the market, shorting crypto might be worth considering.

Crypto short selling example

Let's say you think the price of Bitcoin is going to drop. You could short sell Bitcoin as a way to profit from that price drop. To short sell crypto, you would enter a sell order with a broker who allows margin, sell it at the current price, and then buy it back at a lower price. Generally speaking, you don't have to "return" the tokens or shares to the exchange you borrowed them from, it simply happens automatically when you hit the "buy back" button.

The difference in price would be your profit.

For example, let's say you short-sold Bitcoin at $10,000 per coin. If the price dropped to $9,000 per coin, you would buy it back. Then, you would keep the $1,000 difference as your profit. $1,000 times the number of tokens you shorted would be yo ur profit, minus commissions.

ur profit, minus commissions.

Of course, if the price of Bitcoin goes up instead of down, you would still need to buy it back at that higher price in order to return it to the exchange you borrowed it from. So, short-selling crypto can be risky since there is no limit to the losses you can incur if prices rise. But if you're right and the price does go down, you can make a nice profit.

Where can you short crypto?

If you're looking to short crypto, there are a few exchanges that you can use. For example, Kraken allows you to short bitcoin by opening a margin account. You can also short other cryptocurrencies on Kraken, like Ethereum, Litecoin, and Bitcoin Cash. If you're looking to short Ethereum, Binance is another option. They offer both margin trading and derivatives trading. However, these are not the only exchanges that offer shorting.

What platforms can you short crypto in the US?

Some of the most popular platforms for shorting crypto in the US include Bitfinex, Kraken, and FTX. These platforms allow you to borrow crypto from other users and then sell it on the open market. When you're ready to buy it back, you simply need to repay the amount you borrowed plus any interest or commission that's accrued. However, this is done automatically when you click buttons, so don't worry about physically returning anything.

Can you short crypto on Robinhood?

Shorting crypto does not appear to be available on Robinhood yet.

Can you short crypto on Coinbase?

Shorting crypto on Coinbase is possible, but it is not possible using a margin account. Margin accounts allow you to borrow money from Coinbase to short sell cryptocurrency. The alternative way to start short selling on Coinbase is without leverage using futures.

The functionality of the derivative is easy, you buy an asset now that you foresee will have a smaller value later.

Can Dogecoin be shorted?

Yes, you can short Dogecoin (DOGE). To short Dogecoin, you simply need to place a sell order on a cryptocurrency exchange. This will allow you to sell your crypto for fiat currency or another cryptocurrency (usually they need you to convert USD to USDT). The exchanges that allow DOGE to be shorted are

- Binance

- Bitfinex

- ByBit

- Coinbase Pro

- Kraken

Can Ethereum be shorted?

The short answer is yes, you can short Ethereum. In fact, you can short almost any cryptocurrency, including Bitcoin. Shorting is a process by which investors bet that a particular asset will decrease in value. When shorting Ethereum (or any other asset), you are essentially borrowing it from someone else, selling it at the current market price, and hoping to buy it back at a lower price so you can return it to the person you borrowed it from and pocket the difference.

Alternatively, since Ethereum is exchanged in pairs such as BTC/ETH, you could simply go long in one of the other pairs in order to bet against Ethereum. Short-selling can be a risky proposition, but it can also be profitable if done correctly. Of course, like any investment, there is no guarantee of success.

How do you know when to short crypto?

When it comes to shorting crypto, there's no easy answer. It really depends on the market conditions and your own personal investment or trading strategy. However, there are a few general things to keep in mind when considering shorting crypto.

You need to have a sound understanding of technical analysis and the risks involved with shorting. You should also have a clear exit strategy in place before you enter a short position -- that means, knowing when to stop out for a loss as well! Additionally, it's crucial to stay disciplined and patient when shorting crypto, as prices can fluctuate rapidly. Finally, don't be afraid to take profits when the opportunity arises. By following these simple guidelines, you'll be well on your way to successfully shorting crypto.

Short strategies in crypto trading

Shorting crypto can be a high-risk strategy, but it can also lead to big profits in a short amount of time. For this reason, it has become increasingly popular among traders in recent years. However, before taking a short position

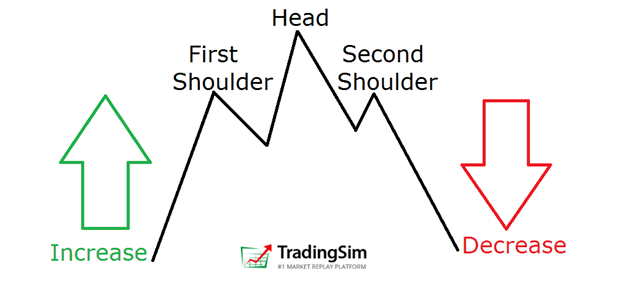

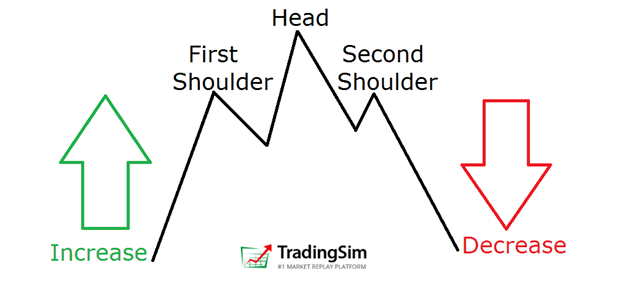

Head and Shoulders pattern

If you're interested in shorting crypto, you'll want to be on the lookout for a head and shoulders pattern. This is a technical indicator that often signals a reversal in a trend, and it can be a good opportunity to short sell.

To spot a head and shoulders pattern, you'll look for three consecutive peaks, with the middle peak being the highest. The "shoulders" should be roughly equal in height, and the formation is usually followed by a drop in price. If you see this pattern forming, it's a good time to consider shorting crypto.

Of course, you'll need to do your own research to confirm that the trend is indeed reversing before shorting. But if you're able to correctly identify a head and shoulders pattern, it can be a lucrative way to short crypto.

Double Top pattern

Another great way to short crypto is by looking for a double top pattern. This happens when there's a significant price increase, followed by a period of consolidation, and then another price increase that fails to reach or sustain new highs. This signals that the uptrend may be reversing and that it could be a good time to short.

Can crypto have a short squeeze?

Cryptocurrencies have been on a roller coaster ride over the past year, and the wild swings in price have made them a favorite target for short-sellers. But what happens when prices start to surge and short-sellers are forced to buy back their positions at a loss? This is known as a short squeeze, and it can have a major impact on the market.

In theory, a short squeeze is possible in any market, but it is particularly likely in the volatile world of crypto. This is because short-sellers are often more leveraged than other investors, and they may be forced to liquidate their positions if prices start to rise too quickly. This can create a self-reinforcing cycle, as rising prices attract more buyers and further increase the pressure on short-sellers.

If you're thinking of shorting crypto, be aware that a short squeeze could send prices soaring and leave you with hefty losses. On the other hand, if you're bullish on crypto, a short squeeze could provide an opportunity to make some big profits. Either way, it's important to keep an eye on the market and be prepared for anything.

Is shorting crypto halal?

Is shorting crypto halal? Well, that depends on who you ask. For some Muslim Scholars, anything related to gambling is out of the question. And since crypto is a volatile market with a lot of speculation, some people would say that shorting crypto falls into that category (haram).

Should also be considered that many commentators on the following hadith have interpreted it as “you are not allowed to sell something which you do not possess”.

Hakim ibn Hizam (Radiyallahu ‘Anhu) narrates that he said, “O Prophet of Allah, a person asked me to sell him something which I do not possess, may I sell it to him?” the Prophet of Allah replied, “Do not sell that which you do not possess.”

Or, other scholars think about short selling as a sort of Al-Maisir (Gambling):

“O you who believe, intoxicants, Maysir, sacrificing for idols and making decisions based on games of chance are sicknesses from the work of Satan, so avoid these things so you may prosper. Satan desires to create enmity and hatred amongst you through intoxicants and Maysir and to stop you from praying and remembering Allah. So will you abstain from these things?”

Others, however, argue that shorting crypto is similar to shorting any other asset, like stocks or commodities. As long as you're not using leverage and you're not gambling on the price going up or down, they say it's permissible.

So, it all comes down to how you define "gambling." If you consider shorting an asset to be gambling, then no, shorting crypto is not halal.

Shorting Crypto Summary

In shorting crypto, you're essentially betting that the price of crypto will go down. To do this, you borrow crypto from a broker or exchange, sell it, and hope to buy it back at a lower price. All of the "borrowing and returning" happens at the exchange level automatically and you profit the difference.

Shorting Bitcoin is the same as shorting any other cryptocurrency; the only difference is the asset you're shorting. When the price of bitcoin falls, you make money; when it rises, you lose money. Short-selling crypto can be a risky proposition, but if done correctly, it can be a profitable way to trade cryptos.

We encourage you to practice your bitcoin shorting strategy in our trading simulator with BTC futures before you put your hard-earned money at risk.

Day Trading

Day Trading