Let me first congratulate you on taking your trading game to the next level by researching how to short sell.

In this article, I am going to give you a brief overview of short selling, strategies for short-selling and most importantly the personality type or mindset best suited for shorting.

Before we go into these topics at length let’s first dive into how to short a stock.

How to Short a Stock

The topic of short selling was confusing for me when I first started out in trading.

I understood I would make money when the stock went lower. But I still had questions like “where did the money go?” and “can the brokerage firm lose money on the trade?” were beyond me.

So, let me break the process of shorting down into a few steps:

- First identify a stock you believe is headed lower.

- Enter the stock symbol in your order entry form of your trading platform and select sell.

- Enter the amount of shares you would like to short and at what price.

- Your broker will allow you to borrow the shares to sell; key word is borrowing.

- You then receive cash for the proceeds of the sell. Now this is not like cash in hand that you can use to buy other goods and services. It is more of an accounting ledger item showing you have sold x amount of stock at a set price. This net value of number of shares multiplied by the price is your break-even point

- When you are ready to close your position, you enter a buy order for the shares you have shorted, thus returning the shares.

- If the stock has loss value, then you are returning less money than you borrowed and hence turning a profit. If, however the stock has increased in value, you will owe more than you borrowed and will take a loss. Lastly, you need to deduct interest paid to your broker when calculating profitability on the trade.

Before we move, let me address one question, “can brokers lose money on short sales?”. The answer is no.

The broker is acting as a lender. Your broker just wants to control a certain number of shares and makes profits based on the interest they can charge for the shares outstanding to traders.

So, what happens if a stock rises significantly and you cannot cover the balance? Well you my friend now owe your brokerage firm the difference and will need to work out a payment arrangement.

History of Short Selling

Short selling has been around since the 1600s and likely was invented by Dutch businessman Isaac Le Maire.

Le Maire at one point worked for the Dutch East India Company and was removed from the company. In order to seek his revenge and make a profit, he decided he would short the stock.

Why short Dutch East India Company – sit was literally the only stock trading at the time.

Le Maire went further than just shorting the stock, he began to spread rumors that ships were sinking. Unlike today where you get real-time updates, these ships were out at sea for many months with no way of communicating back to the mainland.

So, as Le Maire planned, the stock of Dutch East India Company began to drop.

Well the Dutch government stepped in and put a partial ban on short selling and Le Maire was not able to access his shares – hence losing his entire fortune.

This is where shorting all started.

As the financial industry has progressed over the years short selling is now available on most securities (futures, stocks, etc.) and on all major global exchanges.

To learn more about the history of short selling check out this awesome Wikipedia page

Are Short Sellers Evil?

Short Seller – Evil People

This is a matter of public opinion.

There are people that feel short selling is unpatriotic as you are betting against the demise or at least the short-term setback of a company. Therefore, if you are for shorting then you are for hurting the economy.

I can honestly see it on both sides.

Longs are not complaining when short sellers are stepping over one another to buy back their shares, which leads to some of the best short-term rallies you will see in the market.

But if the economy is in the tank, should short sellers further exasperate an already dire situation by applying more downward pressure on the markets?

The answer is somewhere in the middle.

Which is why we have the Government that will step in when the economy is in bad shape and apply partial bans of shorting the same way the Dutch Government did in the 1600s.

For those of you with short-term memory as recently as 2008 many world Governments instituted partial shorting bans during the housing crisis to reduce the risk of a global collapse. Check out this study from Princeton that evaluated the effectiveness of the short selling ban.

I will say to categorize short selling as evil or unpatriotic is likely going too far. Remember, everyone short selling is not looking to crush a company, there are traders that take on short positions as a hedge against their long positions.

Also, short selling provides liquidity to the market with traders that need to buy back shares to close open positions.

What if we began to turn the conversation on itself and began to think of short sellers as heroes or the police of the stock market sifting through and exposing worthless companies.

That’s how the pure short sellers view themselves. They are not evil villains but rather the people brave enough to expose companies practicing illegal behavior or inflating their value.

These short sellers feel they do the economy a service by exposing these companies and weeding them out of our financial system, ultimately protecting would be investors.

What are the Best Times to Short Sell

Trading Times

Swing Trading

For swing traders and long-term investors, you will want to focus on shorting when a stock is below their 200-day moving average. The 200-day moving average is the industry standard for assessing hen a stock is in a bullish or bearish trend.

You should wait for reactions where the stock experiences a bounce back to the 200-day moving average to add to a short position.

You can try shorting as a stock is making a new low, but this is often when smart money will run stops only to turn the stock around and go higher.

The last thing you want to do is enter a stock right as a squeeze is beginning to take off.

Day Trading

For day traders in the US, the best time to short stocks is between 10am and 10:30am. From what I have observed from looking at thousands of charts is the high set by 10 to 10:30 am is often the high of the day and if that price is breached later in the day, it’s likely a bull trap.

I have personally placed over 1,000 trades in Tradingsim to test this theory out. From those tests I would say over 70% of trades where you short the morning pop will return a profit.

So, if you plan on trading morning breakouts, it’s best you get them earlier in the morning. The further you march towards 10:30 and beyond, the lower the success rate for long opportunities on breakouts.

Short Selling Example

Building upon the topic of the best times to sell a stock short, below are a few working examples for both swing traders and day traders.

Swing Trading – Short Selling Examples

Short Selling Daily Charts

Short Selling Daily Charts 2

As you can see it’s best to identify stocks that are in strong multi-month downtrends. This way you do not have to focus on being a stock picker; rather you just need to ride the wave.

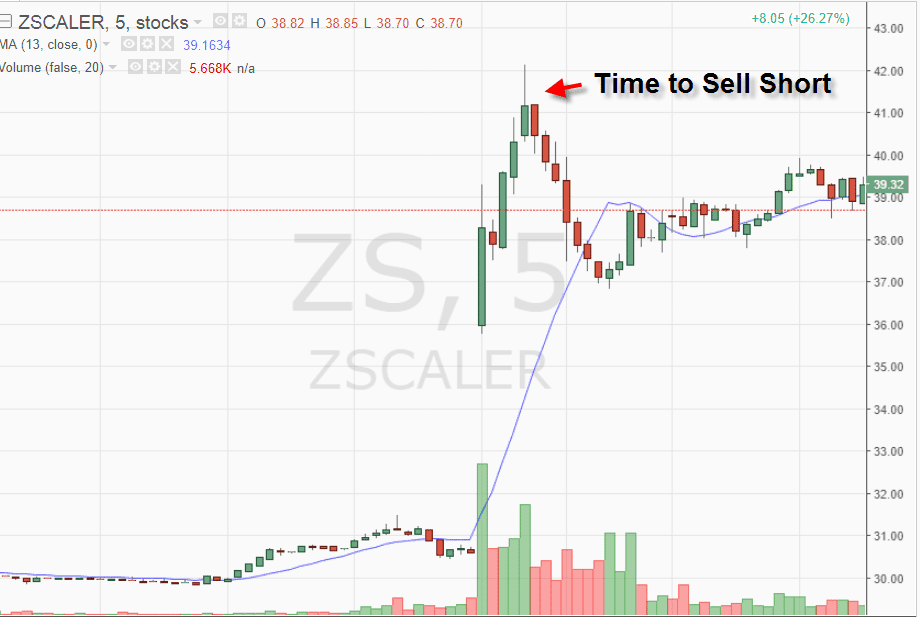

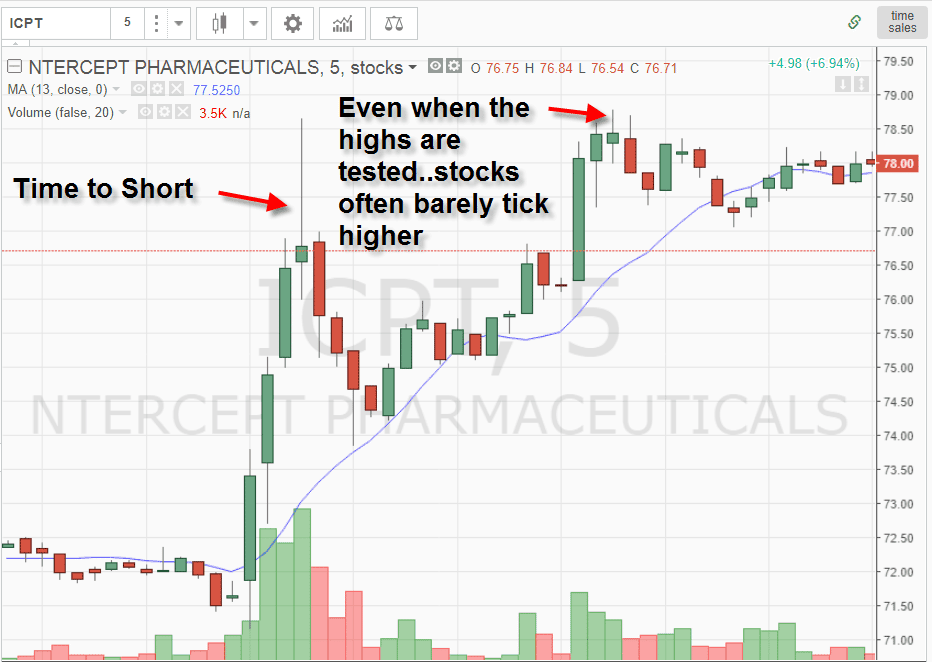

Day Trading – Short Selling Examples

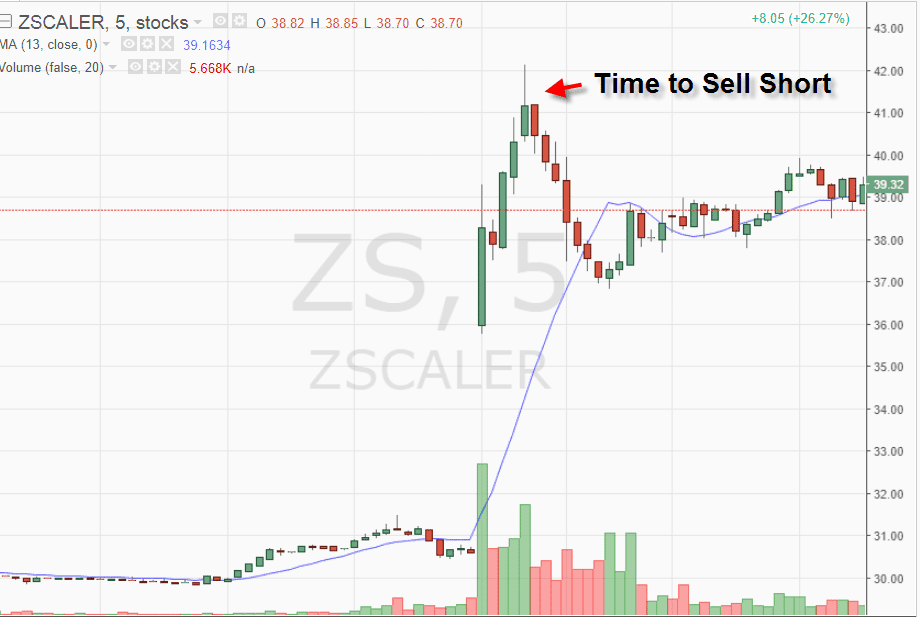

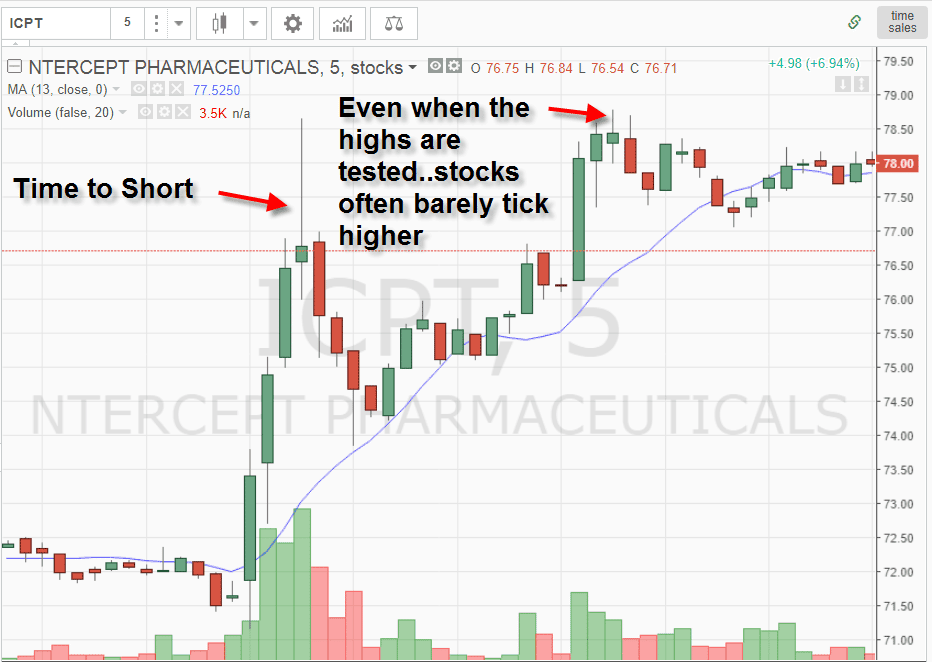

Short Selling Example 2

Short Selling Example 3

I’m telling you from experience, these topping patterns in the morning occur all time!

The last chart I am displaying where the stock makes a new daily high may occur 20% of the time. But even when these new highs occur, they often only last a few minutes before the stock rolls over.

Now shorting stocks as they rally up is not without risks. As you can see you may not get a free fall down; at some point the stock will find support. Therefore, you need to catch the run up and as things are hitting a feverish pitch, take a short position.

Do not get greedy; remember you are going counter to the primary trend.

Who are the Greatest Short Sellers of All-Time?

Over the years there have been some star short traders that have made a name for themselves.

It’s likely their courage to go against the entire market and somehow win which makes them so popular.

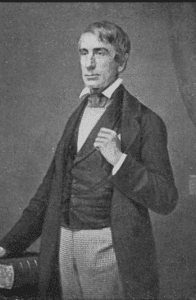

Jacob Little (Early 1800s)

Jacob was one of the first real speculators in the US that profited from short selling and cornering markets to then create a short squeeze. Over the course of his career Jacob made many millions but died penniless after himself being cornered.

Jesse Livermore (Early 1900s)

Jesse Livermore

For any new traders starting out there is something about Jesse that makes him a crowd favorite. It’s probably because he was not educated at an Ivy League school and just came out of nowhere.

I think it’s the fact Jesse was able to successfully bet against the market during one of the worst selloffs of all-time – the 1929 market crash. When adjusting for inflation estimates put Jesse’s profit in the range of $100 million from the 1929 crash alone. Similar to Jacob, Jesse also died penniless after an illustrious career

Paul Tudor Jones

Paul used technical analysis, which in the 80s was still picking up steam, to predict the selloff of the US market in the ’87 crash. He went heavily short and was able to net himself a $100 million-dollar payday – similar to Jesse who was able to capture the selloff of 1929.

The one key difference – Paul was able to retain his wealth.

George Soros (Present Day)

George Soros is a modern day trading Titan. He is best known for his short trade in 1992 when he shorted the British pound and made 1 billion dollars.

John Paulson (Present Day)

John was one of the few investors that anticipated the collapse of the mortgage market. He convinced banks to write him credit default swaps that would pay him based on their own demise. Well, John was right and net himself a payday in the range of 3 to 4 billion dollars.

What Personality Traits work well with Short Selling?

Personality Traits

Short sellers are the types of people that when an expert tells them something which is gospel, the short seller asks the question – why? They are by design are skeptical of any stock move, especially those that are moving a little too high, too quickly.

Short sellers also have the need to be right. The market by definition is setup to go higher. Most retail investors are in the market through their retirement plans which are only long.

So, there has to be a part of yourself which enjoys going against the establishment.

Here is a small quiz you can take to see where you fit on the shorting spectrum:

- When looking at a chart, do you think how high can it go or it has gone too far?

- When you hear news reports of record sales, is it your first reaction to disagree with the announcement?

- Do you get more satisfaction out of being one of the few people that can see through the nonsense in the market and get to the truth?

Based on your answers to these questions…I think you know where you stand.

What are the Dangers of Short Selling?

Short selling can be an exciting and rewarding trading strategy as stocks will often fall faster than the time it takes for them to climb. However, there are a few hot spots you will want to either avoid or at least be aware of before you start shorting stocks.

Penny Stocks

There are traders that have made lots of money shorting penny stocks – Timothy Sykes is one of them.

The one thing you must be aware of when shorting penny stocks is that they are extremely volatile – meaning you could have a stock run against your position by 30% or more in a matter of hours.

If you are using sound money management techniques and tight stops, there is nothing to be concerned about.

However, if you are reckless and have not quite learned how to quiet your inner voice, then you could end up in a perilous situation of a margin call or owing your broker money if things go against you too quickly.

Too Much Exposure

It’s one thing to hedge a trade with a short, but it’s another to go all-in on a short.

Winning in the market goes beyond being right, it’s also about timing. If you are too heavily short, your broker could exercise a margin call and force you to exit or reduce your position size.

Not to mention if things go against you, there is no limit to the upside risk if you are shorting a stock and holding it overnight.

Imagine if you are heavily short a biotech right before the stock announces the successful completion of a drug trial – not a good look.

Beware of the Short Squeeze

If you decide to short stocks, there is one formation you need to be aware of and make sure you are not on the losing side of the trade. That trade setup is known as the short squeeze.

For those of you unfamiliar with the concept of a short squeeze, you can review the article we posted here on Tradingsim titled ‘Short Squeeze – Imbalance of Supply and Demand‘.

There really isn’t a way to prevent a squeeze from happening. If you happen to go short enough times, at some point you will be caught in one. Below are the key ingredients that can start a short squeeze you should be aware of.

- The stock has low float. Essentially this means there is a limited number of shares trading in the public.

- High percentage of shares short. For each stock, you can see the percentage of shares short. This data is not updated daily, but you can see month over month stattistics.

- Low priced stocks. Low priced stocks have more interest because more people can afford to buy shares and lots of them.

If you find yourself in a squeeze, just exit the position. The market can continue to run higher longer then you can wait to be right.

Special Margin Requirements

Special margin requirements are not something advertised by brokers. Essentially special margin requirements require you to have more cash on hand then normally required when trading certain positions.

For example, if a stock is under 5 dollars and extremely volatile, your broker may require you to have 70% of your position in cash and limit the amount of shares you can borrow.

So, before you start calculating all the money you are going to make shorting the market, make sure you fully understand the margin requirements for the stocks you plan on shorting.

Shorting Foreign Stocks

This is probably limited to a special number of you like me that need to trade their home country exchange and a little at night (Nikkei for me). In addition to special margin requirements for certain stocks, your broker will also have restrictions about shorting stocks outside of your home country. This is likely something setup by Governments of this respective nations to prevent foreigners from raiding their exchanges.

When trading the Nikkei I was only permitted to short a handful of stocks with historically low volatility.

Again, this will likely not apply to many of you reading this article, but something else to think about if you plan on shorting stocks on other major exchanges.

How to go Short without Selling a Stock Short

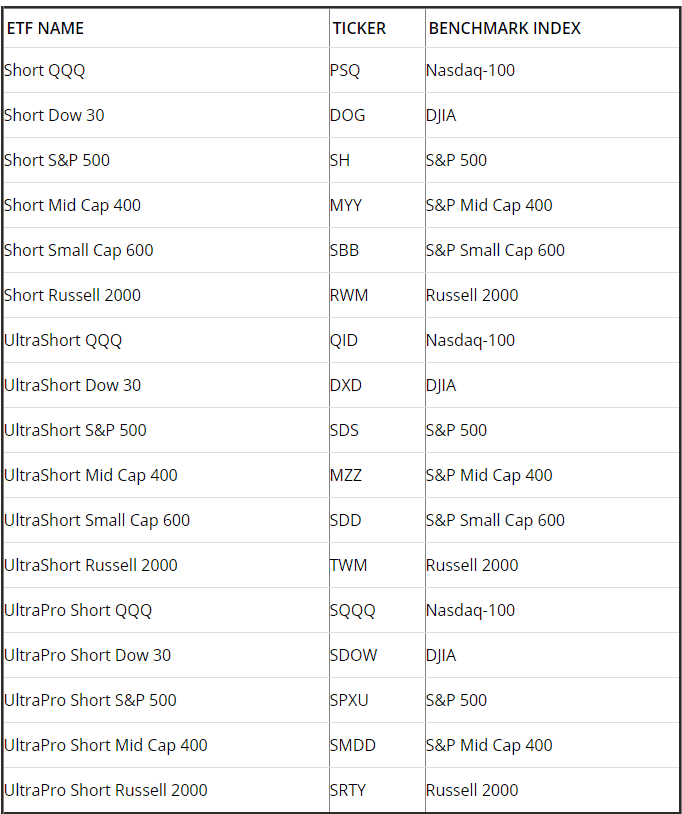

Buy Short ETFs

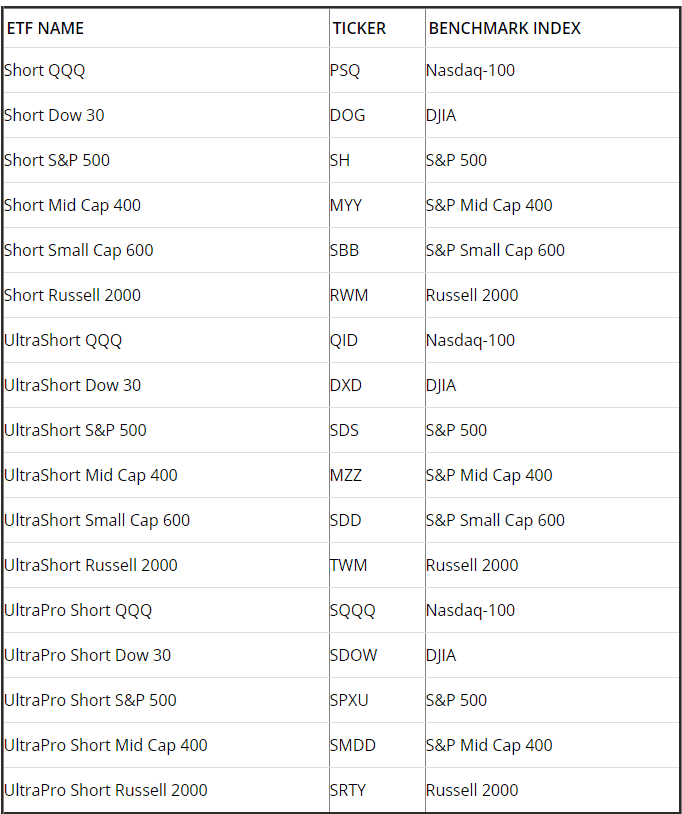

If you want to profit as the market goes lower without shorting, you can invest in an inverse ETF. Now you have the luxury of purchasing shares of a short ETF that covers literally every major market. Below is a snapshot of short ETFs from stocktrader.com

Short ETFs

To further expand on your opportunities to gain short exposure if you are looking to trade with margin without using a margin account – enter 2x and 3 x ETFs. Essentially for every 1 point move in the benchmark index, it will result in a 2 point move in the inverse index.

The resulting affect is you end up getting the same level of movement in your account up or down of a leveraged account without using margin. If you are really open to pushing the envelope you can use the 3x.

Short Selling Funds

If you literally want nothing to do with stock selection or even picking an ETF, your other option for gaining exposure to shorting the market is through short selling funds.

These funds are specifically setup to only short the market. Now these funds have had a tough go since late 2008 as the market has been on a strong uptrend.

The best part, you do not need large sums of money to gain access to these funds.

Here is a list of 19 managed funds that you can invest in when you feel the time is right – Top 19 Bear Market Strategy Funds.

In Summary

Short selling can be a profitable strategy if used properly. You will need to decide if short selling works for your risk profile and then you will need to determine how you want to gain exposure to selling the market. As you can see from this article; you have a plethora of options.

To practice shorting and the strategies detailed in this article, head over to the Tradingsim homepage to see our latest offerings.

Day Trading

Day Trading