15 Things You Need to Know Before You Begin Trading

Stock trading for dummies is such a broad topic that I could honestly write an epic novel on the subject.

But since you are searching for a dummies article, too much detail is likely overkill.

This article is honestly a gateway into trading. You will have enough information to know how to learn trading and where to go deeper, but not enough to start placing trades. I will provide links to additional resources across the web and articles on TradingSim that will help you with this journey.

In this post, we will cover the 15 things you absolutely need to know and/or consider before diving into the world of trading.

So, let’s go ahead and get started. For each section, I will list various subsections which you can use as a decision tree to derive how to learn trading in a way that meets your needs.

#1 How Often Do You Plan on Trading

How Many Trades Are You Planning on Placing Per Week

If you are planning on day trading, meaning more than 3 round trip trades per week, you will need $25,000 cash in your account. If you have never heard of the term round trip trade, it means to open and close a position. A day trading account also has 4 times buying power in the US. This means you can invest up to $100,000 with your initial investment of $25,000.

This is strongly discouraged when you are first starting out, because you want to get data from your trades and we don’t want to blow up the account early on.

If you are looking to place trades infrequently, meaning less than 3 per week, then a standard account will do. This means you are trading with only the cash you have on hand and are not looking to go short.

Which leads me to my next question.

Will You Only Go Long?

Going long means buying a stock with the expectation it appreciates in price and you make a profit. However, shorting is selling a stock without ownership and you profit as the stock goes lower.

To go short, you will need a margin account to borrow stock from your broker to sell the stock short. This is called a standard margin account and allows you to trade twice the amount of cash you have on hand.

So, what will it be, day trading margin (4 times buying power), margin account (2 times buying power), or a standard account (cash only)?

#2 Technicals or Fundamentals

Next, you need to decide if you are going to base your trading decisions on technicals (stock charts) or fundamentals (financial reports).

Full disclosure, I am a technical trader but there is more than one way to make money in the market.

You can try doing both, but these methods, at times, are at odds with one another and could trigger more confusion. So, my recommendation to you is that you pick one method to master before placing a trade.

If you like reviewing numbers and crunching spreadsheets, fundamental analysis is likely a better method for your working style.

Fundamental Analysis

If you consider yourself a visual learner and are good at recognizing patterns, technical analysis is likely your best bet.

Technical Analysis

Regardless of which method you land on, just know that neither one is perfect or has the ability to provide you a magic bullet for the market. You will need to put in the hard work of analyzing each opportunity, proper money management and sticking to your trading plan to reap positive results.

#3 You Need A Trading Strategy

Trading Strategy

What types of securities will you trade? Stocks, cryptocurrencies, options, futures? This article is centered around stock trading for dummies obviously, but once you start trading other product types will be made available to you.

How many trades will you place per day or month?

Where do you place your stops? What are your profit targets? How will you pay yourself as you make money in the market?

What price range will you trade? Are you open to trading penny stocks?

How much volatility is right for your risk profile?

These are all the questions you need to ask yourself as you build out your strategy.

Building out your trading strategy is by far the hardest part of kicking off your trading activity. My recommendation to you is you sit down and write everything out.

Create a Trading Plan

This will generate a written trading plan for you. Think of this trading plan as a business plan.

Trading is no different than any other business. At the end of the day, you need a plan for how you plan on making money in the market.

#4 You Need to Open a Brokerage Account

You are ready to trade, but you need a place to enter your trades.

Brokerage Firms

Image Courtesy of Beyond Debt

Day Trading

If day trading, you want to find a brokerage firm with awesome execution capabilities and low commissions. If you are trading with a small amount of money, high commissions could make the difference between you finishing up or down for the month.

You likely want to go with a broker that will allow a tiered commission structure which offers competitive pricing as the volume of trades you make increases.

Swing Trading/Investing

Trade execution is always important, but it’s not the end of the world if you plan on swing trading or long-term investing. When looking for a brokerage firm, you want to focus on low flat rate commissions.

There are literally dozens of brokerage firms you can choose from, but don’t let the number of choices overwhelm you.

You can always move funds from one institution to another with a little paper work. It’s not quite like opening a 30-year mortgage.

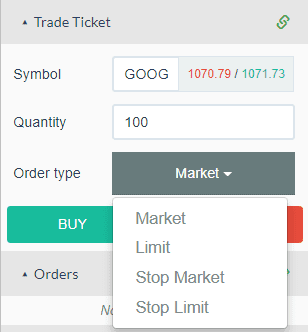

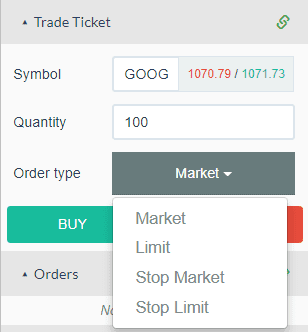

#5 Placing Trades

There are literally over a dozen type of orders you can place. However, in this article we are only covering the basics. Below are the primary order types you need to know of when trading:

- Market Order – places an order to execute at the best bid or ask price. This is the quickest way for you to enter/exit a position, but your entry price is not set.

- Limit Order- you set the price you are willing to execute your order. If the price is hit and there is enough trade volume, your order will trigger.

- Stop Order – this is an order to exit a trade after it has gone against you by a predetermined amount.

- Trailing Stop Order – this order follows your winning position by a set percentage or profit amount. This ensures you secure your profits as the market rewards you for being right on the trade.

Order Types

The next question I imagine you would have is what orders should you use when trading?

This will largely depend on your technique. Limit orders are my personal go to, because market orders can throw off my profit margins due to the unknown entry/exit price I will receive on the trade.

Stop orders are an absolute must as this commits you to a point where you say the trade is not working. If you don’t set boundaries for what is acceptable, you are open to anything.

#6 Controlling Your Emotions

When you first start trading, you will go through an array of emotions. These emotions will range from fear, superiority, self-doubt, pain…and this is all before lunch.

You will need to find ways to manage these emotions, so you are always trading in the moment.

Traders do everything from exercising to sitting in complete silence when trading in attempts to control their emotions.

The method I have found that will keep you as close to peak performance as possible is meditation. I personally meditate for 10 minutes before the market opens to help me find my center and erase whatever thoughts are floating around in my head.

#7 Get a Mentor

Mentor

This is something I never did, which has resulted in my trading journey taking probably 10 times longer than it needed to.

Now, this mentor needs to be someone that has a proven track record trading and are not in it to just sell you a course. You can find mentors by following the top traders on StockTwits, speaking to other traders or doing a search on the web.

Do not consume yourself with becoming an exact replica of these seasoned vets, but rather pull from them the key essentials of what makes a successful trader.

#8 Trading Equipment

Day Trading

If you are day trading, you will need a more powerful machine and will want to consider dual monitors to track the action. A high-speed internet connection is also required, and you may want to have a backup internet connection to prevent any unexpected outages.

Now that cell phone carriers offer hot spots, having a backup connection is extremely affordable.

Investing

You can likely use your existing home laptop or desktop machine. You can even consider investing using mobile apps as every tick is of little consequence and you can trade on the go.

#9 Stock Trading for Dummies Goals

Stock Trading Goals

What are you looking to accomplish on a quarterly or annual basis? Are you trading for additional income or is this your next career opportunity?

These are the types of questions you need to ask yourself before you start trading.

I will caution you that whatever goals you first set, cut them in half so that they are obtainable. If you make goals that become tough to reach, you may end up taking these frustrations out in the market, which is not a good thing for your bottom line.

#10 Trading Performance

Measuring your performance is key. You will need to monitor your winning and losing percentages and average profits per trade.

You will need to be methodical about your numbers. The same way a small business owner knows all their numbers, you also need to know everything about your trading business.

The key point to remember is that the only performance you need to worry about is your own. Do not start counting another trader’s money or winning percentage.

Trading is about bringing out the best you and not about stacking your results up against any other trader.

The only person you are competing against is yourself.

#11 Journaling

Journaling

Knowing your numbers is half the battle. You also need to know what you were thinking and your overall mental state at the time you made the trade.

You will want to define the type of strategy you used during the trade. What you saw that made you open the position. What you did right while in the trade and what you did wrong.

Document how well you were able to stick to your trading rules.

This process of journaling and trade review will help you identify flaws in your trading game before these issues materialize in your trading results.

#12 Treat Your Portfolio Like Your Grandmother’s Savings

Grandmother’s Savings

This is a statement I learned from a mentor during my consulting days.

You must look at your account as if your grandmother on fixed income has entrusted you with her financial future.

Start slow and focus on steady returns. When trading, your capital is your blood source.

You are out of the game once your account prints 0.

#13 Money Management

This is probably the most important item to consider when starting out in trading. No matter how perfect your system, if you do not manage your money properly, your account will suffer.

You need to set a maximum amount of money you can lose per trade.

If you are day trading, you will want to have a set amount you can lose per day and per week before you stop trading.

Trading is a game of mental toughness and discipline.

We have built these money management triggers into the TradingSim platform, but most retail brokerage firms lack this capability to configure your account to shut off if you are in a slump. It’s not mandatory that your brokerage firm have this option, but you will at least need to have the discipline to honor these money management rules manually.

You need to put yourself in the position to make consistent money without the risk of a blowup trade that erases weeks or months of work in a flash.

#14 Times You Will Trade

Day Trading

I do not recommend trading all day. If you follow this blog, you know I trade in the morning and call it a day around 11.

There are few if any day traders that can make money all day. Even if you manage to enter this class of elite traders do you really want to sit in front of the computer all day?

Swing Trading/Investing

Like day trading, swing trading also has peak times of year where the trading action is prevalent – quarterly earnings season.

Earnings season is when volume picks up and stocks are constantly in play for about 3 weeks. This window reduces the work required on you to identify stocks that could potentially move.

Just make sure you have some downtime baked into your trading strategy, so you are not always on. Remember, this is a marathon and not a sprint.

#15 Support from Family

Family

If you are single and have complete control over your finances, this is not applicable to you.

However, if you are married or live with your loved one, you will need to make sure they are on board with your desire to trade.

This support comes in the form of giving the thumbs up for a portion of the family funds going towards your trading activity. Also, this person will need to provide you emotional support during low times and act as a reality check when things start to go well.

As much as possible, you will need to keep your emotions in check. Remember they love you…not the market.

Day Trading Basics

Day Trading Basics