Unless you have been living under a rock for the past year, you’ll know that GME is the ticker symbol for the wildly popular meme stock, GameStop (NYSE:GME). Why is GME GameStop stock so popular? It is the stock that created a new retail movement against hedge funds and institutional investors. If you are an investor, you will never forget where you were in January of 2021, when absolute chaos broke out on Wall Street.

What is GME in stocks?

GameStop is best known as the brick-and-mortar video game retailer that has about 3,000 locations that are still in operation across the United States. However, as the technology in the video game industry continues to advance, retail stores may be facing a lot of pressure. Both Microsoft (NASDAQ:MSFT) with its Xbox and Sony with its Playstation consoles, have adopted digital game downloads directly from their online stores.

While GameStop still sells video games, it has attempted to pivot to other markets. This includes toys and collectibles, electronics, apparel, and even new and refurbished mobile phones. But the most significant change to GameStop happened when the former founder of Chewy (NYSE:CHWY), Ryan Cohen, took over as Chairman of the company later in 2021.

Ryan Cohen

Ryan Cohen was an activist investor in GameStop, and wanted to see the company change before risking going bankrupt. In June of 2021, Cohen became the Chairman of the Board at GameStop and began to implement a digital transformation plan.

Cohen wanted to leverage GameStop’s existing supply chain to change it into an Amazon (NASDAQ:AMZN) for gaming and electronics. He also had a plan to modernize GameStop by bringing the company online in the next generation of the internet. GameStop has a gaming NFT or Non-Fungible Token marketplace that it has developed along with the blockchain company, Immutable X.

GameStop stock still remains one of the most talked-about stocks on social media sites like Reddit and Twitter. Members of subreddits like r/WallStreetBets are still waiting for the day the MOASS or Mother of All Short Squeezes will come for GameStop. Will it ever come? That remains to be seen, but one thing we do know is that the original short squeeze changed Wall Street forever.

What happened with gamestop stock?

GameStop stock is so popular because it was at the center of a highly orchestrated retail short squeeze. The stock has become iconic amongst the retail trader community. It has become synonymous with the little guy in retail trading and symbolizes the ongoing struggle between hedge funds and retail investors.

The GameStop stock story begins back in 2019 when famous investor Michael Burry took a stake in the company because he believed it was an undervalued stock. If that name sounds familiar, Burry was the investor who shorted the US housing market and was the main character in the movie, the Big Short. Although Burry sold his position before the big short squeeze came, it was the first move that put GameStop on the radar of most investors. One of these was r/WallStreetBets legend, Keith Gill.

Gill, also known as Roaring Kitty on YouTube and DeepF*ckingValue or DFV on Reddit, provided in-depth posts on the platform that detailed his idea behind investing in GameStop. As early as September of 2019, Gill posted screenshots of his position in GameStop: 50,000 shares of GME and 5,000 call option contracts. His dedication to the stock convinced other members on Reddit to invest.

Fast forward to January of 2021 when GameStop names the aforementioned Ryan Cohen to the Board of Directors. This sent a shockwave through the Reddit community as Cohen was already well-admired by investors as someone who could make a major change to the company.

The initial push came on January 13th when the stock surged by nearly 50%. Something peculiar was happening, and Wall Street was starting to take notice. Firms that held a short position in GameStop stock were beginning to sweat and as the price continued to inch higher, there was a decision that needed to be made. This was the start of the most famous short squeeze in stock market history.

How does a short squeeze Like GME work?

The short squeeze for GameStop happened in the same way any short squeeze does. Most, if not all, stocks on the stock market have investors who hold a short position against the stock. This means they are making a calculated bet that the stock price will decline over time.

Shorting a stock refers to first borrowing shares at the current price, selling them, and then repurchasing those shares at a lower price. If the stock price declines, the short seller will profit from the difference between what they sold the original shares at and what they are buying back those shares for now.

The problem with short selling is that since shares are borrowed, there can be a rare situation where more than 100% of the outstanding share float is sold short. This is exactly what happened with GameStop’s stock. In January of 2021, nearly 140% of GameStop’s shares had been sold short. This was the spark about to light the fire on Wall Street.

When the stock price rises, the trade goes against the short seller. They can do one of two things in this situation: hold the short position or cover the position. Covering a short position means closing it out by buying the shares back at a loss because the stock price is higher than what you sold them for.

And when 140% of a stock’s float is sold short, yet demand is high, there is a lot of closing out that begins to happen.

This turns into a cascading effect where short sellers keep buying shares to cover their positions. When there is this much buying pressure, the stock inevitably continues to rise. If you add in call option contracts to this short squeeze, it is called a gamma squeeze.

Within two weeks of that first rise in price, GameStop stock hit $500 per share in pre-market trading.

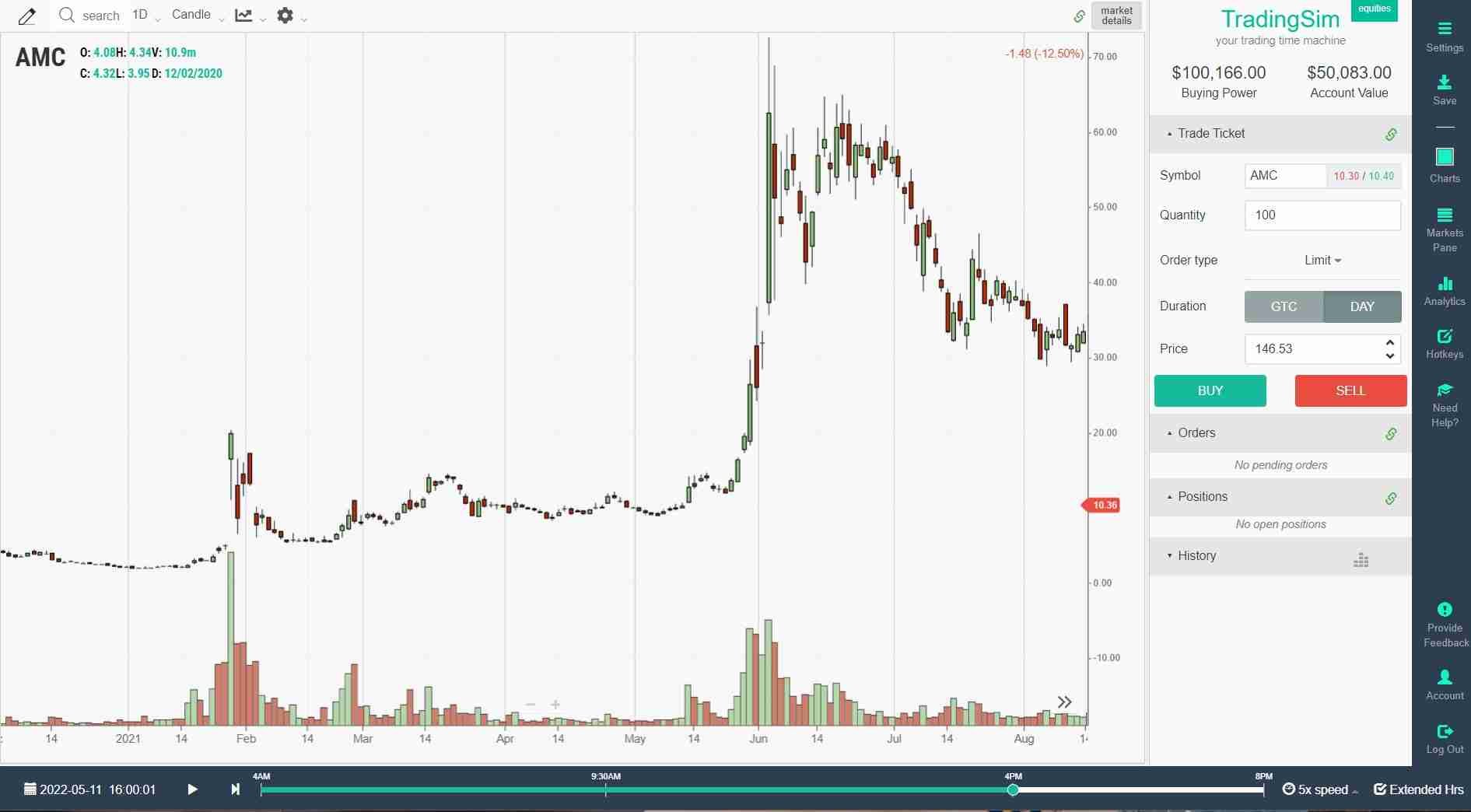

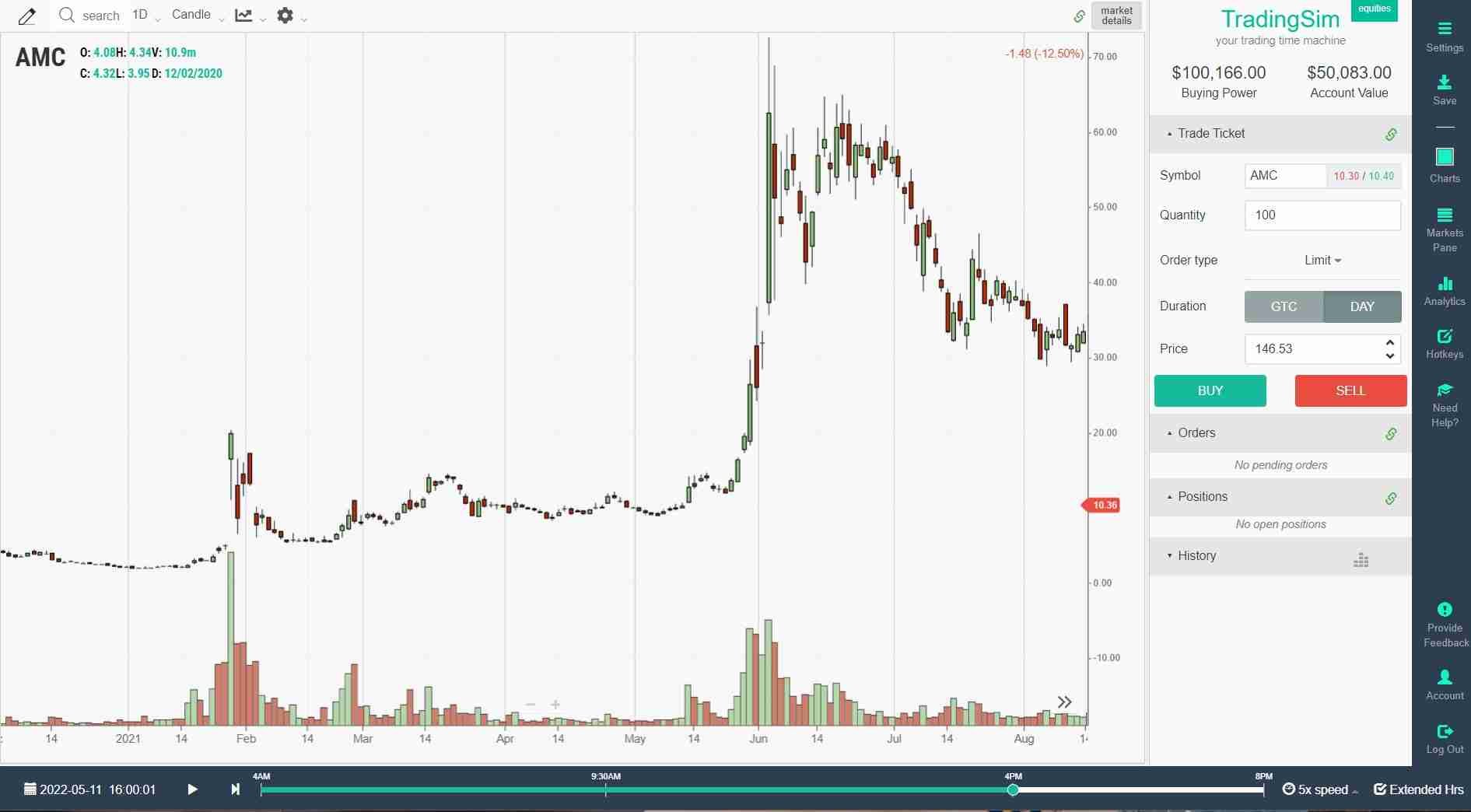

GME and AMC

If you know about GME GameStop, then you also know about its meme stock running mate AMC (NYSE:AMC). While GameStop was the first company to get bailed out by a short squeeze, AMC also benefited from a timely squeeze from retail traders.

AMC’s business was in trouble due to the COVID-19 pandemic. When GameStop’s short squeeze took place, retail traders looked for other stocks with high short interest against them. AMC also had a high short interest and looked like a prime candidate for a short squeeze.

AMC took a backseat to GameStops squeeze in January. But in May of that same year, AMC started to squeeze on its own. Shares of the movie theater company hit an all-time high price of $72.62 per share in a matter of days.

AMC traders began to call themselves Apes and AMC CEO Adam Aron was the Silverback. As enthusiastic as AMC investors are, the stock has erased any gains from that short squeeze just one year later.

Is GME in a short squeeze?

GameStop is not currently in a short squeeze. In fact, the stock is mostly in decline along with the downward selling pressure from the broader markets. GameStop stock is down by more than 41% in 2022, and is down by more than 45% over the past 52-weeks.

The stock has fallen from its high price of $500 per share in January of 2021 to just below $90 per share at the time of this writing in mid-May of 2022. Even though GameStop still has a 20% short interest float against it, the stock is not currently in the middle of a short squeeze.

Are GME shorts covered?

At the moment the GME shorts are not completely covered because over the past year, the stock has been falling, which is exactly what a short seller wants. In January of 2021 at the original GME short squeeze, all of the investors who held short positions against GameStop stock covered their short positions. This is what caused the meteoric rise of the stock’s price in such a short period of time.

However, once those "weak hands" were eventually covered, the patient short sellers waiting for the top were able to come in and profit handsomely from an overpriced black swan event.

When is the GME short squeeze?

Will there be another GME short squeeze? Again, it’s difficult to predict if this will ever happen again. Even though retail traders are waiting for the MOASS, most of the hedge funds and short sellers have learned their lesson from last January’s squeeze.

There is currently only about a 20% short position against GameStop, which is minimal compared to the 140% last January. If history is any indicator, the GME short squeeze has already come and gone.

When will GME short Squeeze end?

The GME short squeeze ends when short sellers close out or cover their short positions in the stock. Usually, this means that the stock will need to surge in price again, something that hasn’t been happening much since the original GME short squeeze.

In theory, as long as there is a short position against GameStop, the short squeeze potential will never end. Whether it can happen again is another story altogether.

As with any potential move in the market, we highly recommend that you rely on technical analysis more than just "holding on for dear life." When a stock like GME reaches epic proportions, it is time to take profits. Likewise, when a stock is in a clear downtrend, it is time to look elsewhere for buying opportunities.

The GME short squeeze was a black swan event that occurred because of a handful of variables all aligning at the same time. The context of its short percent, the market rally, and the easy money environment during the covid pandemic all led to the epic squeeze. Consider carefully whether or not the current market environment is ripe for such an event to happen yet again.

How high can GME short squeeze?

Theoretically, a short squeeze can go to infinity, although this isn’t really a reasonable answer. The GME short squeeze can see the stock price continuing higher until all of the short positions who want to cover have bought shares back at a higher price. Without the shorts covering their positions, the stock price will eventually plateau as the buying pressure dries up.

The first GME short squeeze hit as high as $500 per share during pre-market trading, and this was with a short interest of over 140%. This can be used as a comparison for all future potential GME squeezes.

Similar short squeezes have occurred throughout history, like the Volkswagen short squeeze, which we profile here. In the case with GME, it could have been market tampering that ended the squeeze and gave some brokers and short-sellers an "out". We cover this below in our discussion on how Robinhood stopped allowing trading for GME.

How did reddit cause the GME short squeeze?

Reddit acted as the home base during the GameStop and AMC short squeezes. Since Keith Gill started to discuss his GameStop stock theory on Reddit, it was one of the first places on the internet where the potential of a short squeeze was seen.

Subreddits like r/WallStreetBets where Gill posted, have used the platform as a rallying point for retail traders. Social media sentiment has become a true metric in the stock market, and Reddit is where most of this sentiment begins.

Who was shorting GME?

GameStop had quite a few hedge funds and institutional investors with short positions against the stock. Just as with AMC, it wasn’t necessarily a bad trade or position to be in. Both companies were struggling and the chances of the stock continuing to decline were quite high.

If it wasn’t for this black swan event for GameStop and AMC stock, then those short sellers might still be holding their positions to this day. A couple of well-known hedge funds that had short positions include Citadel and Melvin Capital. Citadel and its CEO Ken Griffin became the antagonist in the GameStop short squeeze story.

Is the GME short squeeze over?

If you ask retail traders and Apes, the answer is a firm no. While these Reddit traders continue to hold out hope for another GME short squeeze, the chances are slim that it will ever hit those levels again. As long as there are short sellers who are shorting GameStop, the GME short squeeze potential will never die.

As mentioned earlier, many traders are still waiting for the MOASS. However, the further we get from the initial short squeeze in January of 2021, the less likely another GME short squeeze of that magnitude will ever happen again.

5 Lessons we can learn from the GME short squeeze

When such an event takes place, there are always lessons to be learned from both sides of the trade. Here are five that stand out as important ones to take away from the GME short squeeze:

Don’t Mess with Retail

The GME short squeeze was one of the first times in history that retail traders stood up to Wall Street hedge funds. While big money may always win in the end, Wall Street certainly took notice when retail traders started to fight back. If there’s anything to learn from the GME short squeeze, it’s not to underestimate the power of the little guys.

GameStop Short Squeeze was a Black Swan Event

This means that even though short squeezes have become a popular target for retail traders, they shouldn’t be a recurring event on the stock market. The GME squeeze is a short squeeze of the highest magnitude, and will likely go down as one of the most significant squeezes of all time. But the truth is, it was a black swan event that organically happened.

Investors Need to Take Profits

We're all for long-term investing, but when you hold a stock that gains nearly 2000% in a couple of weeks, it’s time to take some profits. It doesn’t matter how much you think the MOASS is coming or that it’s cool to have diamond hands. Those gains that you made are unrealized until you sell at the top. Hopefully, next time something like this happens, traders can benefit from it.

There are always losers in every trade

As much as the GME short squeeze is portrayed as retail beating Wall Street, we don’t often talk about retail traders that are still holding the bag. Let’s not forget some traders bought the stock at the absolute top, thinking it will rise even higher. There are likely a lot of retail traders who are actually holding a loss on their GameStop short squeeze trade.

Leave Shorting to the professionals

Sure, most of the ‘professional’ investors lost millions, if not billions, covering their short positions in GameStop. But they had the capital to do so. Retail traders, especially inexperienced ones, should not be shorting stocks because if it gets away from you, the losses are potentially endless.

Unless you have studied short selling and have a sound strategy with definable risk criteria, we don't recommend shorting right away.

Why did robinhood remove gamestop?

During the GME GameStop short squeeze, the popular retail trading platform, Robinhood (NASDAQ:HOOD), froze GameStop's trading due to market volatility. What Robinhood had actually done was freeze buying, but not selling, thus artificially lowering the stock price.

Robinhood has a payment for order flow system, which means it sells order flow to the highest bidders. It turns out, some of its customers include the "evil empire," Citadel. The resulting investigation led to the highest FINRA financial penalty in history for Robinhood, which paid a staggering $70 million for its role in halting trading for GameStop.

Arguably, this was a small price to pay for the clearing firms and brokerages like Citadel who were losing billions on the short squeeze. As we mentioned before, a short squeeze can theoretically go to infinity. If that had happened, those businesses would have gone out of business.

The shady practice of limiting buy orders through brokers like Robinhood bought enough time and price destruction to allow the "big boys" to cover their shorts.

Retail traders got hosed.

Day Trading Basics

Day Trading Basics