Are you interested in trading the markets but don’t know where to start?

Well, let me be the first to tell you that the last thing you should do is fund an account and start placing live trades. So, what are your options?

Well, let me suggest you take the step of joining a stock market game or using a stock market simulator. In this post, I will discuss the eight reasons for taking this path is great for anyone just starting.

#1 – You Need the Reps

You Need the Reps

The most important piece of trading when first starting out is just getting your reps up.

Reps to me are defined as just getting out there and placing trades. You are not overly concerned with getting everything right in the beginning. It’s more about understanding how your mind works and gaining clarity on which system will work best for your trading style.

Now, if you decide to immediately go out and place real trades, there are two things working against you. For starters, it will cost you money in the form of commissions and losing trades.

Secondly, you could have your confidence damaged even before you get started.

#2 – Stock Market Analysis for Past Data/Trading Days

Historical Trade Data

Traders feel that they need to trade live data to improve. But there is also value in practicing with historical data.

You will need the ability to conduct your stock market analysis not only on current market conditions but historical ones as well. For example, how would your strategy hold up against a major sell-off or a rally?

If you think you can just run a backtesting simulation, think again. This backtesting items only show you what you want to see; an equity curve that goes up and to the right.

This is the furthest thing from reality. Either you will execute your trades differently, or the market conditions will shift in the future.

So, it’s critical that you take the time to see if your system can hold up regardless of what the market throws your way.

#3 – Benefits of Using a Stock Simulator

If you can’t make money using a simulator, you will not be able to make money in the real world. This is where a simulator comes into play. It allows you to see if you can turn a profit on a consistent basis.

Remember, it’s not about making money on any one trade or over a week. Can you turn a profit over a quarter? A simulator will allow you to accomplish trading months in a matter of weeks or even days. This all comes down to how much time you are willing to invest in placing the trades.

If you decide to only trade a live simulator and you want to get six months of trade data, it will take you six months to see if things work.

Again, a simulator would allow you to condense this to a much shorter time frame without the risk of losing real money.

#4 – Exposure to Features Required for Proper Market Analysis

There are games where you can only see the end of day data, and you can place your buy and sell orders at this point. The problem with this approach is that you do not get the real feeling of trading the market.

You will need technical indicators and off-chart indicators such as level 1 and a market scanner to find the top plays. This will give the most realistic market experience and provide you with the necessary tools to analyze the market.

#5 – You Are Not Using Real Money

Cash Money

There are those that wills ay without trading with real money you will not be able to recreate the emotional aspect of trading. Well, this couldn’t be the furthest thing from the truth.

You can create other key metrics such as keeping your drawdown to a minimum or not having any blow-up trades. If you are unable to hit these metrics, you will feel the same level of frustration that you do when you are losing money.

Anyone that tells you that you need to lose money to make it in trading is someone that has likely lost significant money. Coming from a person that had to lose money to make money, if you can skip this part of the process, you will be better for it.

#6 – You Need to Prove it to Yourself

A big part of trading success is mental. As we all know, confidence can come in many shapes and sizes. There are some of us that need to perform at the highest level in the biggest game to know we have the goods.

For others, we build up our confidence by practicing and not just practicing for the sake of practicing, but rather leaving it all on the field.

So, it’s important when you are trading with a simulator or participating in a stock market game, that you take it seriously. It has nothing to do with the fact if the trades are real or not; what you are practicing is your discipline.

#7 – Find a Trading Community

Trading Community

Trading can be one of the most isolating professions on the planet if you let it. You can sit in a room all day and never have to speak or even chat with someone over messenger to get your work done.

All you need is your computer and an online broker.

But what is the point of making money at the expense of losing human connection? This is where a stock market game can help.

Unlike other communities where people are there to push their ideas or convince you to get on the wrong side of the trade so they can profit.

Within a stock market gaming community, there is no monetary incentive for getting you to do anything. This is a place where you can come to discuss trading strategies and express where you may need help working through a tough trading spell.

#8 – A Stock Market Game is Great for All Ages

Stock Market Game – Great for All Ages

The market can be a scary place if you are not a professional. However, it’s not the boogie monster.

A great way for kids all the way up to retirees to gain exposure to the market is through a trading simulator or market replay tool. This will allow the young to not set themselves up for financial ruin before they even start.

It also prevents would-be traders in retirement from risking their nest egg.

How Can We Help?

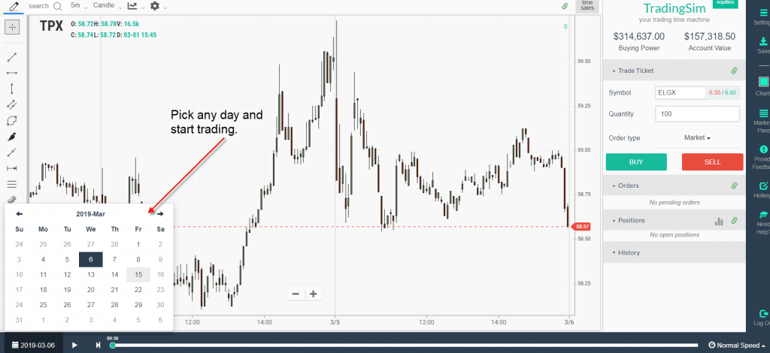

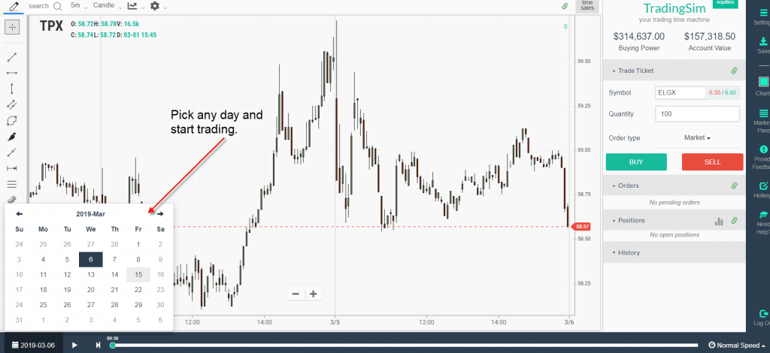

Tradingsim is the most realistic market replay platform in the world. You can practice trading over 11,000 stocks without risking a dime. Where we separate ourselves from other market simulators is that we have real data. So, when you place a trade it’s not an AI engine simulating market activity, you are actually seeing the market stream before your eyes, just as it did on that respective day.

If you are a teacher or educator, please feel free to check out our homepage to view our latest offerings.

Photo Credit

Photo by Cesar Galeão

https://www.pexels.com/@pixabay

https://www.pexels.com/photo/person-gather-hand-and-foot-in-center-53958/

Awesome Day Trading Strategies

Awesome Day Trading Strategies