What is stock dilution?

Stock dilution is generally seen as a negative characteristic for a publicly-traded company. Not only does it signal that the company might be in financial distress, but it also dilutes the shareholder equity in the stock. In other words, it becomes a less valuable stock to own, and therefore, the company itself can lose some intrinsic value in the eyes of the market.

The ways in which a company can implement stock dilution are numerous but the most common way is to increase the number of outstanding shares through some sort of secondary offering. The problem with adding more shares is that it reduces both the current shareholder stakes as well as the ownership stake in the company as well.

We also see a general principle of economics: as the supply continues to rise, the demand and therefore the price of the stock will likely fall. For companies that have an overly diluted outstanding share count, it is essentially creating more slices from the same pizza. While you still own slices of the pizza, you own less of the full pizza than you did before.

What causes stock dilution?

Stock dilution is caused by the company using one of many methods to increase the overall number of outstanding shares of its stock. While the dilution is generally seen as a bad thing, the actual mechanism behind the dilution might not be.

For example, a startup company that is in hyper-growth mode, might choose to do a secondary offering to raise capital to further reinvest into the company. Shareholders might not be happy, and we could see a short-term decline in the stock’s price as selling pressure increases. But over the long-term it could be that this capital reinvestment helps the company continue to grow into a larger and more successful business. In this case, the long-term price of the stock could rise.

Stock dilution is a decision that is made by the executives and ownership group of the company. One of the easiest and cheapest ways to raise capital for publicly traded companies is to issue new stock, particularly at a time when the stock is trading at a higher price. Unfortunately for shareholders, there isn’t much you can do to avoid stock dilution aside from investing in more established, blue-chip companies that generally do not need any additional capital.

Is dilution good for stocks?

| Pros |

Cons |

- If a company dilutes its stock to raise capital, it is likely in hyper-growth mode and will reinvest that capital back into the business. This is an overall net positive for shareholders.

- Most investors agree that over the long-term, an additional share offering can be beneficial for the company.

- A secondary offering might mean the stock is trading for more than the company believes it is worth. This could also be a sell signal for some investors.

|

- It dilutes overall shareholder and ownership equity in the company.

- The earnings per share for the company will also decrease, at least in the short-term.

- Voting rights and influence of shareholders is also reduced.

|

As you can see there are two sides to every coin, and that goes for stock dilution as well. In general, stock dilutions are seen as a negative event and this is evident because the stock will usually have a short-term sell-off after the dilution has been announced. The market typically has a short-term reactionary machine, so the potential long-term benefits for the company are usually not baked into the current price action.

What happens to a stock’s price during dilution?

Since most investors see stock dilution as a negative, the initial instinct might be to sell. While we do often see a near-term sell off, stock dilution itself doesn’t necessarily lead to the stock’s price falling. The sell-off is a market reaction and not a mechanism from the dilution that forces the stock price lower. How do we know this? Simple: the stock price doesn't always fall due to the dilution of shares.

However, it cannot be denied that the stock price has historically dropped following a stock dilution event. Many long-term investors take these opportunities to add shares at a discounted price, knowing that the dilution should be a benefit to the company a few years down the road.

Example of dilution of shares

As mentioned, there are multiple ways in which a publicly traded company can dilute its stock. Here are a few of the more commonly used methods.

Secondary Offering

This is probably the most common way in which companies can dilute their stock. As the name suggests, a secondary offering is another release of shares of the company’s stock. If we think of the IPO as the initial release of shares, a secondary offering is like another IPO except that the company has already been trading on the public market.

A secondary offering is typically a direct dilution of the existing shares. Here is a quick example with some round numbers for ease of understanding:

If the company had 100,000 shares outstanding, and then issued a further 100,000 shares, then the new share float would be 200,000 shares. Any shareholder who held the first 100,000 shares just saw a 50% dilution in their ownership of the company. Remember, the dilution of a stock doesn’t mean the value of your initial investment has changed, It just means your ownership stake of the company has been reduced.

Exercising Options on the Stock

This one is a bit more complicated than a secondary offering, as it involves financial derivatives known as stock options. A stock option is a financial contract that provides the owner the right, but not the obligation, to buy or sell the asset at a predetermined price by a predetermined date. Why do stock options play a role in stock dilution? Here’s an example:

A lot of startups and newer companies will pay their employees with stock-based compensation. This means rather than taking cash bonuses, the company will pay them in shares of the company or in some cases in stock options. This means that these employees have the right to cash in these options when they see fit, generally when the stock is priced higher than the strike price of the option.

What this means is that the employee can exercise these options and buy current shares at the lower strike price. Typically they will then resell these shares for a large profit to the open market. Since options contracts trade in blocks of 100 shares per contract, this can lead to a large number of shares entering the market at once. This has the same effect as a surge in selling pressure, which can potentially cause the stock price to fall.

Convertible Debt and Equity

This is another method that happens fairly frequently on the public markets and results in a near-term sell-off for the stock. Convertible debt is when the company borrows debt from a lender and instead of paying them back in cash, they will pay them back in a predetermined amount of company stock.

This essentially has the same effect as the stock options dilution, except that it happens with common shares and not options contracts. When the lender wishes to cash in on its loan, it can exercise the convertible debt and sell those shares back for a profit. Public companies will often use the stock as a form of capital.

Stock Splits are an Exception

You might be wondering why stock splits are not listed as a way of diluting the stock. If a stock splits 5 to 1, doesn’t it have five times as many shares as it did before? Yes, this is true, stock dilution refers more to the value of the share rather than the total number of them. In the case of a stock split, shareholder equity would be multiplied by five times in this split, rather than reduced. This is the main reason why a stock split does not lead to stock dilution.

How dilution of shares works

Here is a quick rundown of how the dilution of shares works so that you can learn the process behind the event:

- The company looks to raise capital, usually for further reinvestment in the company or in times of distress, to save the company altogether.

- The company issues a new stock dilution. This could be via methods like a secondary offering or convertible debt offering.

- The share float absorbs the new shares of the stock, although the market cap does not change due to the dilution.

- The stock might see some short-term volatility to the downside following the stock dilution.

- As you can see, stock dilution itself is a relatively straightforward process. Stock dilution is typically seen in newer companies that are not yet profitable and need to rapidly raise capital to grow the business.

What stock dilution means for investors

The relationship between the company and its shareholders always has an interesting dynamic. On one hand, the company needs shareholders to want to invest capital into the stock. On the other hand, the company needs to continuously balance shareholder trust and what is best for the long-term success of the business.

To be frank, stock dilution is generally seen as a negative for investors. Why? Because following the dilution, the investor’s stake in the company has been reduced. Again, this does not have an effect on the value of the initial investment. It does have an impact on how much of the company you now own.

A great example of this was during the meme stock short squeeze when companies like AMC were trading at all-time high prices. AMC and other stocks like Sundial Growers took the opportunity to perform secondary offerings to raise capital for the businesses which were in financial distress.

AMC managed to save the company through the process, and Sundial managed to erase its debt. While those are two positives, both stocks are trading at lower prices now. They also have an extremely large amount of shares with AMC having 513 million shares outstanding, and Sundial with 2.3 billion according to Yahoo Finance.

How does dilution affect penny stocks?

Penny stocks and the Over the Counter markets are well known for stock dilution and stock manipulation. How are these two things connected?

Let’s think about it for a second. There is very little regulation from the SEC on the Pink Sheets where many penny stocks are traded. Companies are looking to get a higher stock price by any means necessary and that could include the artificial pumping of a stock by paid pumpers. As more people are convinced to buy into the stock, the price rises.

So it is always suspicious when the company is able to execute a well-timed stock offering once shares have reached a certain price. From there, the stock price usually falls back to Earth, but the damage has already been done. The company has managed to raise its capital through stock dilution, and the paid shiller has sold their shares at a profit long before the company announced its offering.

Stock dilution affects penny stocks in a much more significant way than with listed stocks. There is always a chance that penny stocks never recover from a stock dilution. Penny stock markets lack the liquidity and interested buyers to be able to overcome ongoing dilution of the shares.

How to trade around stock offerings?

Despite all the negative affects that stock dilution and offerings present in the market, many short-sellers target these type of stocks, knowing that they will likely fall in price.

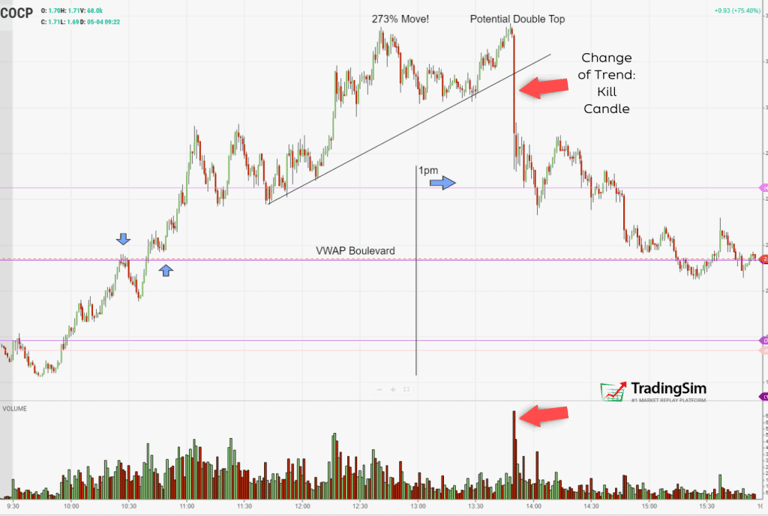

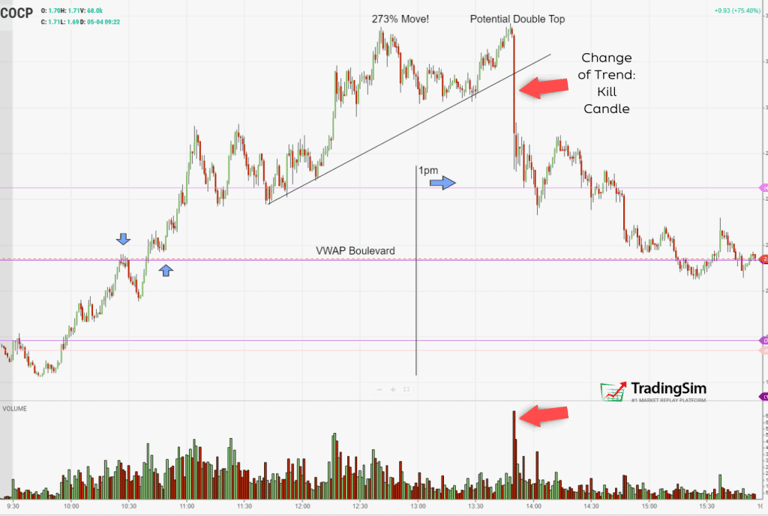

Despite many of these stocks being hard-to-borrow for short selling, they present lucrative opportunities for day trading. One of our favorite strategies for trading around stock offerings is the late day offering. This strategy is called the 1-3pm bloodbath.

As the name suggests, if an offering is announced late in the afternoon, or the pumpers decide to walk after a large gain that day, the selloff can be extreme. We discuss this strategy in detail in our 1-3pm Bloodbath tutorial.

Whatever strategy you employ around dilution events, we hope you'll test out your technical prowess in our simulator before putting your hard-earned money to work.

Where to find stock dilution data?

We are big fans of dilutiontracker.com. While they don't include data for larger cap stocks, they do have a huge repose of data for the stocks that matter, like penny stocks, biomed stocks, and more. Their staff collects data from places like SEC.gov and Edgar, then compiles it into a very user-friendly and updated format for quick searches.

If you aren't keen to pay for a service like this, you can always do your own research using your broker, news, and the EDGAR site on sec.gov.

Day Trading Basics

Day Trading Basics