What are over the counter stocks?

Over the Counter or OTC stocks are equities that trade on the OTC market which is a broker-dealer network rather than a centralized exchange like the NASDAQ or NYSE. The OTC markets do not have a physical location like centralized exchanges on Wall Street and have characteristics like lower trading volume and less regulation. They are also called Pink Sheet Stocks or Penny Stocks because a vast majority of them trade for well under $1.00 per share.

Over the Counter stocks are typically smaller companies that might not meet some of the listing requirements of larger, centralized exchanges. While some companies choose to list primarily on the OTC markets, many of them are seeking to eventually uplist to the major exchanges where it is much easier to raise larger amounts of capital.

Alternatively, some of the largest international companies in the world also trade on the OTC markets. It is an easier and cheaper way to get exposure to US investors, and many don’t want to deal with the red tape that is required to list as an ADR on the NYSE or NASDAQ. For foreign OTC stocks like Tencent (TCEHY), Roche Holding AG (RHHVF), and Softbank Group (SFTBF), the market maker will buy these shares from the domestic exchange and offer them to US investors as F-shares.

Why are some stocks listed and some over the counter?

Stocks that are listed mean that they are trading on the major centralized exchanges like the NYSE or NASDAQ in the US. There are several reasons why stocks will trade Over the Counter instead of a major listing exchange. The most common reason? The company simply does not qualify under the listing requirements.

The NYSE has the strictest requirements for companies to list. Some of the requirements include an aggregate pre-tax income of over $100 million for the past three years, with each of the past two fiscal years requiring at least $25 million. They also need to have $100 million in revenues in the most recent 12-month period. You can see why many pre-revenue and smaller growth companies chose to trade on the NASDAQ index instead. Other requirements include a minimum share price of $4.00 and a market value of $60 million.

Over the Counter requirements are much looser. The ‘lowest’ of the OTC markets is called the Pink Sheets where companies only have to fill out some paperwork and pay a fee to list their company on this market. Things get a little stricter when we move up to the OTCQB and OTCQX which have more regulations on which companies can list. The OTCQX is considered one step below the NASDAQ.

How to buy over the counter stocks?

Luckily, in the age of internet trading, you can buy Over the Counter stocks at most online brokerages. It is typically the same process as buying listed stocks, even though your brokerage will need to go through a market maker rather than directly through the major exchange. Make sure you read the fine print for your brokerage before diving into OTC stocks. Some may have additional fees or regulations on trading OTC stocks compared to normal listed stocks.

You can even trade options on some Over the Counter stocks, although this is usually not allowed at most brokerages. These options are called exotic options and are traded directly between the buyer and seller.

Trading derivatives on Over the Counter stocks is rare as low liquidity and potential stock manipulation can work against a trade in a hurry.

Where to buy OTC stocks?

You can generally buy OTC stocks in the same place you buy listed stocks when it comes to your preferred online brokerage. Most of the major American brokerages will offer OTC stocks like Fidelity, TD Ameritrade, Charles Schwab, and Interactive Brokers. Be mindful that there are definitely some brokerages who will not offer OTC trading, especially for the Pink Sheets stocks.

Is it safe to buy OTC stocks?

This is a common question when it comes to trading OTC stocks. As with most equities, it is generally safe to buy these stocks for your account. However the risk with OTC stocks always depends on which stocks you buy. The chances of buying a bad company is much higher in OTC land.

As a general rule of thumb, the OTCQX stocks are the safest to invest in because of the stricter listing requirements. The Pink Sheets stocks are the most volatile and are the most often linked to stock manipulation and pump and dump schemes. As with any investment, do your research and choose your stocks wisely.

How to trade over the counter stocks?

Trading OTC stocks is the same process as trading listed stocks on most brokerages, with some caveats. Trading OTC stocks will usually require that you place limit orders. There are no market orders in OTC trading. For this reason, you must be aware of liquidity issues and learn to time your orders properly so that you get filled. There aren't any "panic" buttons to help you get out of OTC stocks.

Always make sure that the brokerage you use will even allow OTC stock trading. Some popular new digital brokerages like Robinhood or the Cash App do not offer OTC stocks for trading. Just like with most investments, we recommend researching the companies and industry before diving into trading Over the Counter stocks. If you want to be safe, then stick to the OTCQX market for the least volatile penny stocks.

What are examples of OTC stocks?

Perhaps the most recognizable OTC stocks will be the large foreign multinational companies that are listed there. In addition to the ones mentioned earlier, other foreign companies that trade on the OTC include Chinese EV maker BYD (BYDDY), Bayer AG (BAYRY), Volkswagen AG (VWAGY), and Adyen (ADYEY).

You might also notice in your research that many of the foreign companies are listed on the Pink Sheets, rather than the OTCQX. Remember, when foreign OTC stocks are traded on the Over the Counter markets, it is usually the market makers selling the shares to US investors.

One very popular line of OTC stocks are the cryptocurrency funds from Grayscale. The Grayscale Bitcoin Trust (GBTC) and Grayscale Ethereum Trust (ETHE) are just two of the funds that are operated by Grayscale.

These funds allow traders to own a piece of Bitcoin through shares of GBTC or Ethereum through shares of ETHE. While it isn’t exactly the same as holding these cryptocurrencies in a digital wallet, it provides exposure to investors who do not want to through the hassle of buying cryptos from a centralized exchange.

There are plenty of other OTC stocks worth mentioning amongst the more than 11,000 that trade on the US OTC markets. Whether they are energy or mining companies or startup biotechs, OTC stocks can have a place in your portfolio as long as it is the right company.

Best trading strategies for OTC stocks?

When trading Over the Counter stocks, it always pays to do your due diligence. In fact, you probably want to dedicate more time and research to these companies than you normally would for larger, listed stocks. It’s no secret that the OTC markets can be a place where stock manipulation can take place since these exchanges are less regulated by governing bodies like the SEC.

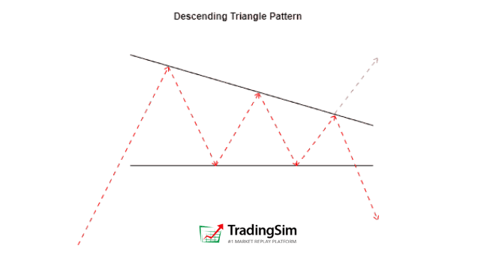

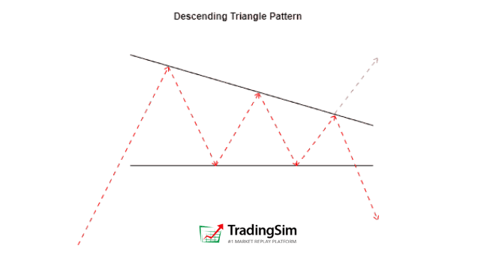

That being said, you can employ many of the same technical chart patterns to OTC stocks as you would for listed stocks. For example, you might find that an OTC stock is creating an inverse head and shoulders, or a classic volatility contraction pattern, or a descending triangle. All of these patterns can help you determine proper risk-to-reward entries for your OTC strategy.

Just make sure that no matter what, you understand the liquidity issues with these stocks. More often than not, they are pump-and-dump schemes. Once the big buyers sell, the volume can dry up and leave you out to dry with very little chance of selling easily. We recommend taking profits into strength and climactic selling opportunities.

Can you make money with OTC stocks?

Absolutely! Like with any investment or trade, if you can do your research and find the right stocks, the right patterns, and the right strategies, then there is always a chance to make money. Since the shares of Over the Counter stocks generally trade for under $1.00, traders can buy large chunks of stock if the liquidity is there. If the company ever sees a major surge, then you could be potentially sitting on a fairly large gain.

Also, if the OTC stocks you do invest in get uplisted to a larger exchange like the NASDAQ, there is the potential to make money. Because of the higher liquidity and more institutional ownership through assets like ETFs and Mutual Funds, stocks on major exchanges can potentially see steadier growth.

At the same time, there are plenty of ways to lose money when trading Over the Counter stocks. Penny stocks have long been tied to pump and dump scams where less regulated markets fall victim to stock manipulation. While there is always a chance to make money when trading OTC stocks, it is generally too risky and volatile for most investors to attempt.

Do OTC stocks trade after hours?

Yes! Just like centralized exchanges like the NASDAQ or NYSE, the OTC markets also trade in extended hours. This means that after the markets are closed for the session, traders still have the ability to buy or sell shares, often to a limited extent.

For the Over the Counter markets, the extended trading hours have a pre-trading session from 6:00 AM to 9:30 AM EST, and a post-trading session from 4:00 PM to 5:00 PM EST, Monday through Friday. The OTC markets are closed on the weekends as well as the same statutory holidays that close the larger exchanges.

Can you short OTC stocks?

This question has an interesting answer. Yes, you technically can short Over the Counter stocks in that there is no law forbidding you from doing so. The problem with this comes from the mechanism of shorting itself. Typically you need to borrow these shares from a brokerage to start your short sell. Well, most brokerages will not have the liquidity in the Over the Counter stock to even allow short selling.

With lower liquidity for the stocks, it is definitely easier to manipulate the price action on the OTC markets. This means that short sellers can take advantage of this and potentially initiate a short sell that could decimate the OTC stock. Because of this, there are some brokerages that will forbid you from short selling an Over the Counter stock.

How to find OTC stocks list?

There are plenty of different places to get an OTC stocks list in the age of the internet. One of the best places to visit is the homepage of the OTC Market itself. Other sites include Google Finance, Yahoo Finance, and Bloomberg Finance.

Virtually any finance app or website will allow you to read up on the financials of the company, but for the best research you should visit the website of the company itself. Here you can usually find everything you need on the Investor Relations page including financial filings, investor presentations, and recent quarterly earnings calls.

Over the counter stocks summary

We hope the information in this article proves helpful in your decision to trade or not to trade OTC stocks. Keep in mind that OTC land is often considered the wild west of the stock market. With much less regulation and much lower liquidity, you can get in trouble with your investments quickly.

Keep this in mind and always employ a sound strategy when you trade in order to manage your risk. Study the markets and the stocks you want to trade before you make any decisions.

Day Trading Indicators

Day Trading Indicators