Hard-to-borrow stocks and short locates are terms used by active traders who are looking to short stocks which don't have readily available shares to short with most brokerages. Many popular large caps like Apple, Google, Tesla, and others typically don't fall under this category as they are very liquid stocks.

In this post, we'll discuss what hard-to-borrow means for stocks and shorting. Plus, we'll answer a lot of common questions around the topic of locating short shares in stocks that are hard to borrow.

What does "hard-to-borrow stocks" mean?

Hard-to-borrow stocks are companies whose shares are difficult to borrow for short sale trades. Usually, these are illiquid stocks that don't trade as many shares as more popular names in the market. However, there could be many reasons that make hard-to-borrow stocks challenging to borrow.

Most stocks that are hard to borrow are more or less small-cap stocks or penny stocks that gap up and then fade off after a pump and dump. But these aren't the only stocks that are hard to locate shares for shorting.

Hard-to-borrow stocks can sometimes indicate that a stock is running on momentum in the premarket. Often, stocks that don't trade many shares on average will gap up on a press release or other news. Active day traders will locate shares and pay a fee in order to borrow these shares from their brokerage for the day.

This allows them to short the stock for the "locate fee" and then return those shares to the brokerage when their trade is finished.

Most brokerage firms maintain a list of hard-to-borrow stocks, which mentions names of those stocks that are difficult to borrow for the purpose of executing short sale transactions.

What is a short locate fee?

If you want to short a company with hard-to-borrow shares, you'll have to contact your broker to locate and lend them to you. Stockbrokers charge a locate fee for finding those borrowable shares from clearing firms for you to short. If you accept those shares, you will be charged a flat, per-share fee, known as the "locate fee".

You should remember that the locate fee is charged when you accept the shares, irrespective of whether you short them or not.

There are differences between some brokers who offer short locates. For example, some brokerages may charge a per-share fee and allow you to trade those shares as many times as you want throughout the day as they become exclusive to you.

Other brokerages may offer a first-come-first-served approach, which only allows you to trade if the shares are available. In this second approach, if you decide to cover your shares, someone else might use them before you have another chance to. This resembles a "bucket" approach with respect to available shares within the brokerage's community.

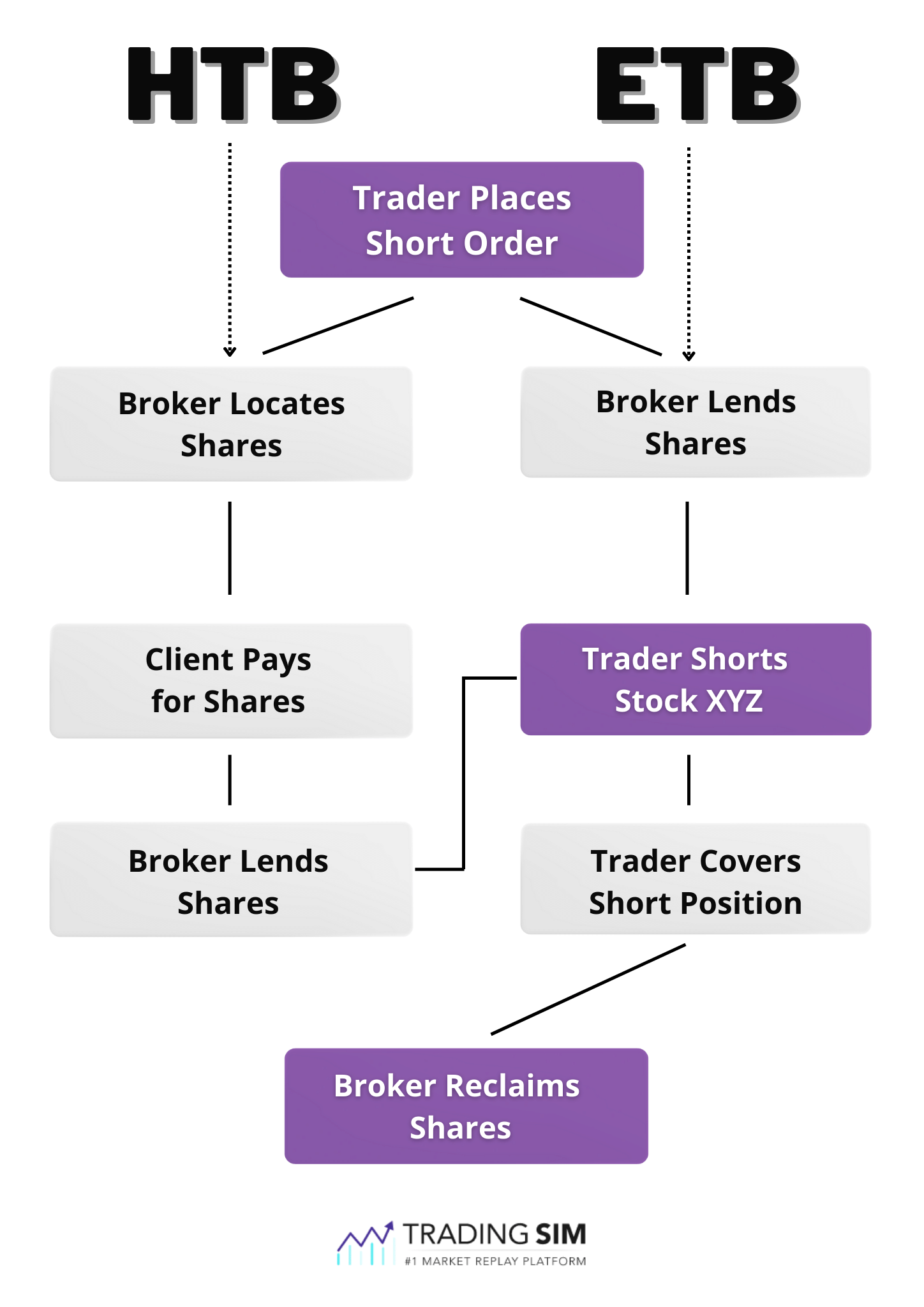

What is the difference between Hard-to-borrow and Easy-to-Borrow stocks?

Hard-to-borrow stocks, as the name suggests, are hard to borrow because of different reasons. Stockbrokers usually label such stocks to indicate that they might be available in limited quantities and that the stockbrokers might have to locate these stocks from clearing firms to lend them to traders for short selling. Brokers charge Locate Fees on HTB stocks along with margin and borrowing fees.

In contrast, easy-to-borrow (ETB) stocks can be easily borrowed for the purpose of short selling without any added fees. Brokers also maintain a list of such securities, allowing traders to determine whether they can quickly short sell a particular stock. Unlike HTB stocks, the ETB stocks entail low or zero fees as they are highly liquid stocks that are readily available for trading and do not require brokers to locate them for lending to short sellers.

What does shorting mean on Wall Street?

Shorting refers to undertaking a short sale transaction. A short sale occurs when a trader borrows a stock from a stockbroker and sells it intending to buy it back later at a lower price, thereby generating a profit. After buying back the stock at a lower price, the stock is returned to the broker, and the transaction is closed.

Suppose that a stock is trading at $20 and you predict that it would decline to $15. To profit from the opportunity, you can borrow the stock from a stockbroker and sell it at $20. If your prediction turns out to be accurate and the stock plummets to $15, you can buy it to cover and generate a profit of $5 per share. You can then return the stock to the stockbroker to settle your trade.

Of course, all this happens with a simple click of a button on your trading software. You wouldn't be "sending" any borrowed shares back to a broker -- they simply reclaim the inventory once you buy them back. If you want to learn more about short selling, check out our in-depth guide.

What does hard-to-borrow mean on ThinkorSwim?

Hard-to-borrow (HTB) on the ThinkorSwim platform tells you that a security is hard to borrow. With ThinkorSwim, you have to apply for their HTB program and be accepted. Sometimes there is a limit as to who can apply based on your account size.

Once approved, you can submit your short-sell order for securities labelled as HTB, but the order fulfilment would be subject to the availability and daily inventories held by the broker. Short sell orders for HTB securities are open for one day and are not categorized as GTC (good till cancelled) because of the changing inventory of shares with the broker.

ThinkorSwim falls into the "bucket" category of brokers who allow short locates. There is no running inventory of short locates that you can readily access from your platform. You must simply "try" to short these stocks and if the shares are available, the order will go through and you will be charged a corresponding locate fee.

Why are some stocks hard to borrow?

There could be many reasons for a stock to be added to the hard-to-borrow list. High volatility, short supply, low liquidity, and bullish momentum are common reasons why some stocks are hard to borrow.

Take for example a penny stock running up over 100% in the premarket on millions of shares traded. Often these massive gappers become the target of short-sellers wanting to take advantage of a sell-off in the stock.

However, before the current day's momentum and volatility, there usually aren't that many shares traded in the stock. In order to short the pump in expectation of the dump, more often than not, the trader must locate and pay for shares to short the stock.

We've written about penny stocks and their characteristics in this great guide.

How to find hard-to-borrow stocks?

Most brokers have a hard-to-borrow list, containing the names of stocks that are hard to borrow. Some brokers also allow you to put forward a short locate request through their trading platforms. However, if your broker doesn't provide you with this facility, you need to contact your broker's trading specialist or a customer support officer to locate your desired shares for you for short-selling activity.

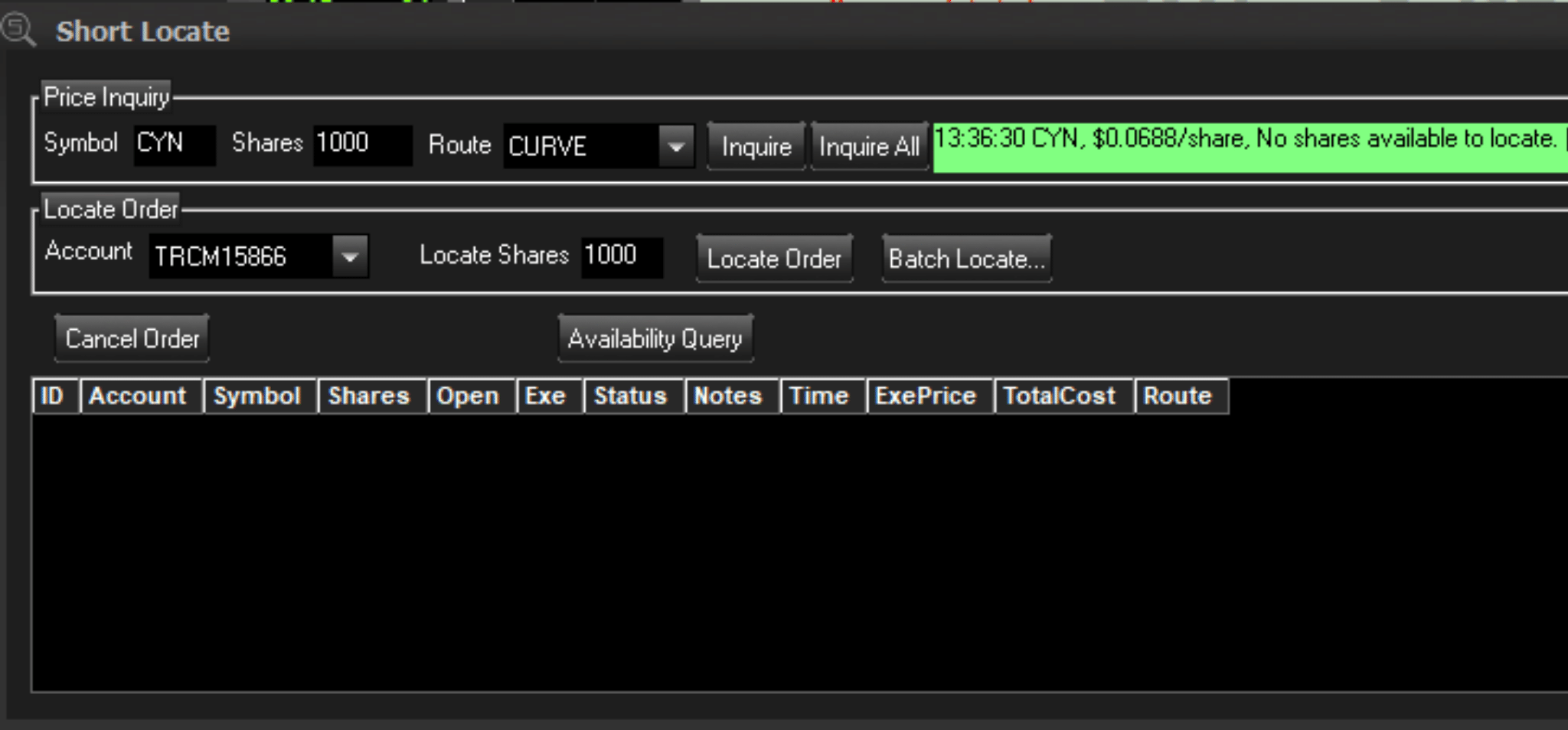

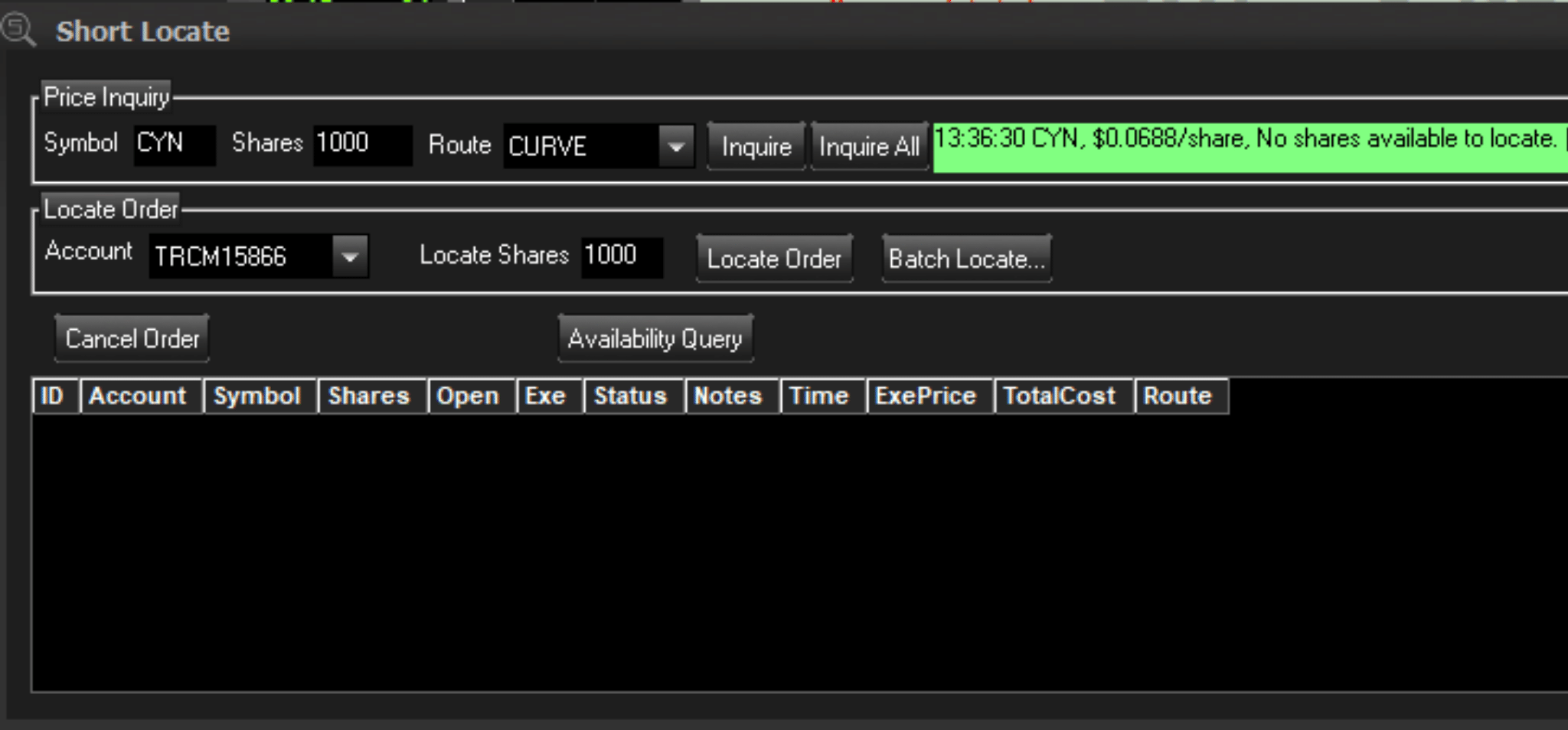

Here is an example of a short locate window within the DAS Trading Platform:

The only other option is for brokerages that allow for shorting HTB stocks but don't keep an inventory list. In this case, you simply push the sell button and hope that shares are available.

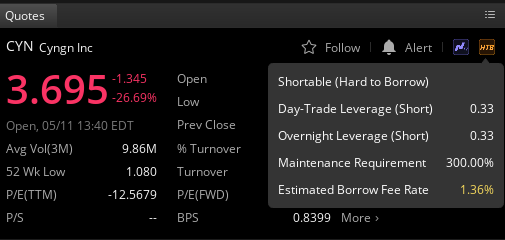

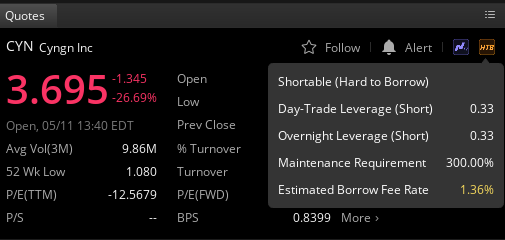

Here is an example inside WeBull of whether a stock is HTB or not. The difference with WeBull, like ThinkorSwim, is that you don't know the inventory of shares available. This can make it difficult to plan your trade.

Is it good if a stock is hard to borrow?

A hard-to-borrow stock can fall under this category if it is not readily available for borrowing to carry out a short sale transaction. Such stocks also involve additional fees on top of margin fees and interest charges on borrowing them. So, when a stock makes it into the hard-to-borrow list, it could be more appropriate for executing short-sale trades because of its high demand and limited supply.

Many times hard-to-borrow stocks are more likely to drop in value because of a high number of traders betting on their downfall, which puts a premium on them in the form of Locate Fees.

This comes with a caveat, however. Not all stocks that are HTB are going to simply fall into your lap. These are actually some of the riskiest stocks to trade in the market because of their volatility. In fact, many bullish traders will target these stocks for short squeezes if they sense there are too many bears.

If you plan to trade HTB momentum stocks, you would do well to study them intensely and understand your risks before employing real money and shorting real shares.

How to short hard-to-borrow stocks?

Hard-to-borrow stocks can be traded just like any other stock. However, you need to first determine whether the stock is available on the trading platform for short selling. If the stock is available for shorting, you can sell it at a higher price and, subsequently, cover (buy) it at a lower price to return it to the broker and realize a profit.

If you are looking for specific strategies, then we would recommend you start with a few of our resources on vwap boulevard, the head and shoulders pattern, and penny stocks.

What are the best brokers for HTB stocks?

Generally, Direct Market Access (DMA) brokers that use numerous independent clearing firms are more suitable for trading HTB stocks. These firms have relationships with different clearing firms to get their desired number of HTB securities.

However, the availability of hard-to-borrow shares largely relies on market conditions and your broker's clearing firm. Not all clearing firms are equal nor do they accommodate all participants in the markets.

Traditional brokers with a predominantly retail and risk-averse client base can also have access to HTB securities that fulfill the needs of their customers. The only issue is that most of these big box brokers do not have an excess supply of HTB shares. They make their money catering to a different clientele than active day trading short sellers.

On the other hand, some popular direct access brokers for short locates include CentrePoint Securities, TradeZero, Cobra Trading, Guardian, and perhaps even Interactive Brokers -- though they tend to be more retail-based.

Which broker has the best short locates?

This is a bit subjective as many of the direct access brokers we mentioned above should have good access to multiple locating firms.

CentrePoint Securities broker offers one of the best short locates and fees in the industry and is widely used in the professional day trading community. However, TradeZero is also known for having plenty of locates, though you will likely pay a premium during certain times.

We don't recommend one broker over another, but advise you to ask around in some of the trading communities on the web. You'll likely find that most brokers are comparable. Just keep in mind that availability of shares can often fluctuate during trading hours depending on how popular a stock is and how many shares your firm has located from clearing firms.

How much do short locates cost?

Locate fees vary according to the demand and supply conditions and are charged on a per-share basis. Generally speaking, a good price per share of a shortable stock will be pennies, if not fractions of a penny. That being said, the more popular a stock is during the trading day, or the more volatile it becomes, the more you will likely pay.

The law of supply and demand applies to short locate fees just as they do with stocks. Brokerages and clearing firms have turned short locates into a profitable business. If they see that inventory of shortable shares is low and demand to short the stock is high, they can jack up the price per share to as high as many dollars per share.

Most professional traders will usually try to predict the momentum stocks in the pre-market when locate fees are much less. As a cost of doing business, they will gobble up shares when locate fees are low. Then, with luck, if the stock continues to skyrocket, they will use their shares to short it back down during normal trading hours when other traders are scrambling to locate shares and paying astronomical per share fees.

Conclusion

Trading hard-to-borrow stocks can be very difficult. We do not recommend you try it as a beginning trader. Instead, what we recommend is that you study this type of stock in the simulator here at TradingSim. We provide three years of intraday, realistic replay where you can study the movements of hard-to-borrow stocks by using our intraday gap scanner.

Once you've had time to understand how these stocks move and fluctuate, create a strategy that you can be confident in. Then, calculate your risks and rewards knowing that you'll have to pay a fee just to "play the game" every time you borrow shares to short.

Here's to good fills!

Basics of Stock Trading

Basics of Stock Trading