Uncover the intricacies of shorting the VIX in our detailed guide. Learn effective strategies for betting against market volatility, understand the risks and rewards of trading VIX-related instruments, and gain insights from seasoned traders.

Understanding the VIX: A Brief Introduction to the CBOE Volatility Index

The VIX is an acronym that represents the CBOE Volatility Index within the US Stock Market. This index measures market expectations for near-term volatility represented by S&P 500 stock index option prices. It is often referred to as the 'fear gauge' as it tends to rise during times of market uncertainty or fear.

CBOE Volatility Index Analysis

Investors use the VIX as a tool to gauge market sentiment and assess potential risks. By understanding the VIX, traders can gain valuable insights into market dynamics and make informed trading decisions.

One important aspect of the VIX is that it is an inverse measure of market volatility. When the VIX is low, it indicates low volatility and a relatively calm market environment. Conversely, when the VIX is high, it signals high volatility and increased market uncertainty.

In this blog, we will delve into the basics of the VIX, how it can be used to analyze market volatility, and the art of shorting the VIX.

The Basics of Shorting the VIX

Shorting the VIX involves selling VIX futures or VIX-related products with the expectation that the VIX will decline in value. This strategy can be profitable in a stable or declining market environment. However, timing is of the essence when initiating a short position in the VIX, especially when holding for a longer-term swing trade.

To short the VIX, traders typically sell VIX futures contracts or use VIX-related exchange-traded products (ETPs) such as VIX ETFs or VIX ETNs. These products allow traders to gain exposure to the VIX without directly trading the index itself.

Shorting the VIX can be a complex strategy that requires careful consideration of market conditions, timing, and risk management. Traders should be aware of the potential risks involved, as volatility can quickly spike, resulting in significant losses.

Let's explore the basics of shorting the VIX, including the mechanics of shorting VIX futures and the key considerations for implementing this strategy.

Vix Futures Trading

VIX futures are a means for investors to speculate on the future price of the Volatility Index. As the saying goes, “Buy fear and sell greed.” VIX futures contracts offer the opportunity to bank on stock market fear by going long on this contrarian indicator, or vice-versa. Instead of buying stocks, VIX futures allow you to bet on the volatility rising during times of uncertainty or correction in the market.

Why Trade VIX Futures?

VIX futures offer at least a few benefits to investors. For one, they are highly volatile and can offer massive swings in either direction. As long as you have an appetite for volatility, this instrument can lead to big gains in a hurry.

Secondly, futures offer leverage to investors with only a small investment. Again, this can lead to either big gains or big losses, so be sure to understand the risks involved or you may lose your pants.

Thirdly, VIX futures offer a hedge for heavily invested traders. If you plan to hold your investments through market downturns, it can be a vehicle to offset those losses while the market is correcting. For example, take a look at this chart of the 2020 Covid crash. A simple hedge in the VIX would have offset the rough ride of the crash.

Lastly, while not exactly a benefit, be sure to consider liquidity when trading VIX futures. You may find that a qualified VIX ETF could be more liquid for your trading needs. Liquidity becomes a factor when you need to get in and get out of a trade quickly and with little slippage.

Key Factors to Consider Before Shorting the VIX

Before shorting the VIX, it is important to consider several key factors that can impact the success of the strategy.

One important factor is market sentiment. Shorting the VIX is generally more successful in a bullish or stable market environment, as the VIX tends to decline during these periods. Traders should assess market conditions and sentiment indicators to determine the optimal timing for shorting the VIX.

Market Volatility Insights

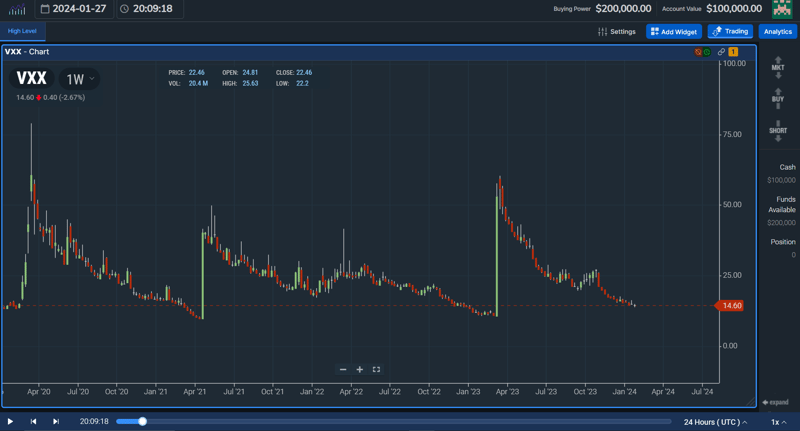

To help you visualize this, and practice on your own time, we have a screenshot of the TradingSim simulator below with a chart of the VXX that represents the VIX overlayed with a graph of the SPY, an S&P 500 ETF. Notice how we've drawn trendlines showing that when the SPY is rising, the VXX is falling, and vice-versa.

Another crucial factor is risk management. Shorting the VIX involves taking on potential unlimited losses if the VIX spikes unexpectedly. Traders should implement risk management strategies such as setting stop-loss orders or using options to protect against adverse price movements.

Additionally, traders should consider the cost of carry when shorting VIX futures or using VIX-related products. Futures contracts have expiration dates, and traders may incur costs related to rolling over positions. It is important to factor in these costs when evaluating the profitability of the strategy.

Advanced Strategies for Shorting the VIX

Now that you have a solid understanding of the basics of shorting the VIX, let's explore advanced strategies to enhance profitability and risk management.

Options on VIX

One advanced strategy is using options to hedge short VIX positions. Options can provide downside protection and limit potential losses if the VIX spikes unexpectedly. Traders can implement various options strategies, such as buying protective put options or constructing spreads, to mitigate risk.

Note: If you're new to options, check out our guide to understanding and trading options here.

Technical Analysis for VIX Trades

Another advanced strategy is timing the entry and exit points for short VIX positions. Traders can use technical analysis indicators, market sentiment analysis, or a combination of both to identify optimal entry and exit points. Timing is crucial when shorting the VIX, as volatility can change rapidly.

Additionally, traders can consider diversifying their short VIX positions by incorporating other volatility-related assets or trading strategies. By diversifying, traders can spread their risk and potentially increase their overall profitability.

Trading VIX with Inverse ETFs

Lastly, there is an inverse ETF that offers traders the opportunity to short the VIX without actually shorting anything. In fact, you simply buy this inverse VIX ETF as you would any other stock or ETF in which you want to go long. The two most popular inverse VIX ETFs are the SVXY and the SVIX. Here's a look at the SVXY, notice how it is going up instead of down during the current market uptrend:

Risk Management in VIX Shorting

Effective risk management is crucial when shorting the VIX to protect investments and minimize potential losses.

One key risk management technique is setting stop-loss orders. Traders can determine a predetermined price level at which they will exit their short VIX positions to limit losses. Stop-loss orders help prevent significant losses in the event of unexpected market movements.

As an example, imagine if you had bought the SVXY on a breakout (the normal VIX would be going down). You might set your stop loss at 5-8% of your initial entry, like this:

Another risk management strategy is diversification. By diversifying their portfolio and incorporating other non-volatility-related assets, traders can spread their risk and reduce exposure to potential losses from shorting the VIX.

Additionally, traders should regularly monitor market conditions, news, and economic indicators that can impact the VIX. Staying informed helps traders make timely adjustments to their short VIX positions and adapt to changing market dynamics.

Hedge Fund VIX Tactics

Hedge funds use the VIX in much the same way that any investor would: for hedging larger investments, speculation, volatility targeting, income generation, tactical allocations, or simply for market sentiment. Let’s take a look at each one of these.

Hedging: This is the most common use of the VIX by hedge funds. Since the VIX tends to rise when the stock market falls, buying VIX futures contracts can act as a hedge against losses in their equity portfolio. This helps to stabilize overall returns and reduce downside risk.

Speculation: Some hedge funds may use the VIX for speculative purposes. They might buy VIX futures if they believe market volatility will increase, potentially profiting from rising VIX values. Conversely, they might short VIX futures if they anticipate a decrease in volatility.

Volatility targeting: VIX futures can be used for volatility targeting. Here, the fund aims to achieve a specific level of portfolio volatility regardless of market conditions. By adjusting their positions in VIX futures and other assets, they can fine-tune their overall risk profile.

Income generation: Some strategies involving options on VIX futures can be used to generate income regardless of market direction. These strategies require advanced understanding and involve selling options contracts and collecting premiums.

Tactical allocation: Some funds might use the VIX for tactical asset allocation. By analyzing the relationship between VIX and other asset classes (e.g., positive correlation with gold), they can adjust their portfolio allocation to capitalize on potential market movements.

Market sentiment gauge: The VIX can serve as a gauge of market sentiment. Rising VIX indicates increased fear and potential for market downturns, while falling VIX suggests investor confidence. Funds can use this information to inform their investment decisions across different asset classes.

VIX Short Strategy Based on Market Timing Models

One way to time the VIX on the short side is by using the Investors Business Daily market timing model. This model calls out market reversals as follow-through days. As IBD founder Bill O'Neill once said, you should never doubt a follow-through day in the market.

IBD emphasizes market cycles and uses various technical indicators to identify potential turning points. Some key indicators include:

- The Big Picture: This market index tracks the overall market trend and identifies confirmed uptrends and downtrends.

- The Accumulation Distribution Line: This indicator measures buying and selling pressure to gauge investor sentiment.

-

- The Moving Average Convergence Divergence (MACD): This momentum indicator helps identify potential trend changes.

While not an exact science, learning how to gauge market turning points using tools like these could help your overall investment in the VIX. As we’ve indicated above, the VIX is usually a contrarian indicator to the market. As the market falls, volatility typically rises. As the market grows, volatility usually decreases.

To that point, the closer you can get to timing the bottom or top of current markets, the better off you investments in the VIX are likely to be.

VIX Shorting Strategies Summary

Remember that no strategy is every fool-proof or will work 100% of the time. Here at TradingSim, we recommend using our simulator to practice timing strategies before putting real money to work.

For example, you could take a look at the times the IBD has called a market follow-through day, and what your strategy for shorting the VIX would have yielded until the IBD timing model called for a correction. Annotate your charts with these notes and dates. Would you have yielded a positive return on your VIX short?

In addition, keep these concerns in mind when shorting the Volatility Index:

- Short volatility strategies are risky and can result in significant losses if unexpected volatility spikes occur.

- These are just a few examples, and many other strategies exist with varying risk-reward profiles.

- Thorough research, risk management, and understanding of VIX dynamics are crucial before employing any of these strategies.

Always consult with a financial advisor before making any investment decisions.

Basics of Stock Trading

Basics of Stock Trading