In this post, we will uncover the pros and cons of interchange fees legislation in the United States and around the globe.

The policy conversations were in full swing from 2005 with the initial filing from consumers to the final judgment in 2011. We will walk you through the early days of the litigation and bring you forward to today.

Why is this important to you?

Well, it can impact the costs banks pass on to you the consumer in the future, so it’s great to have an understanding of the laws on the books.

2005 – 2011

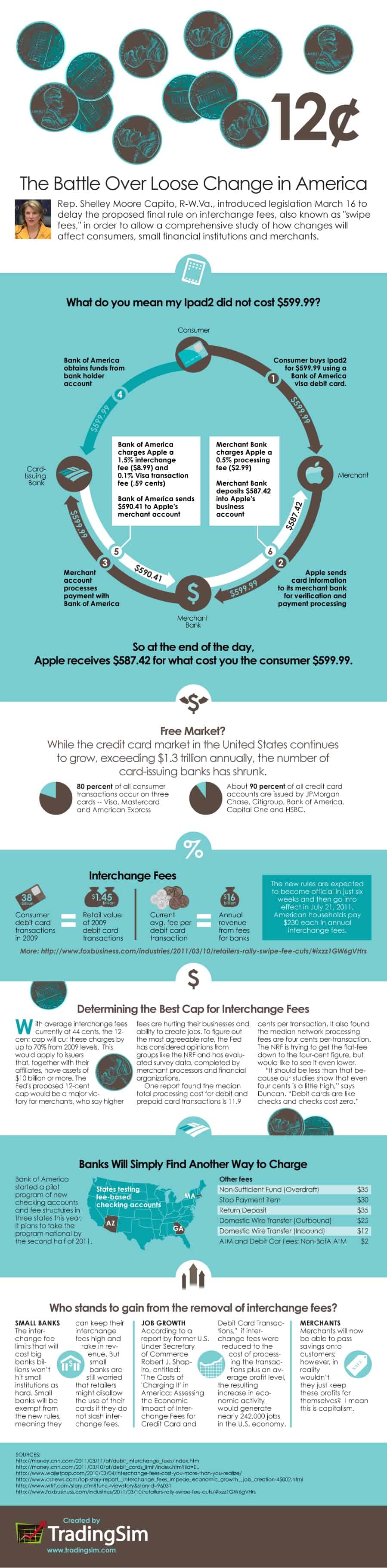

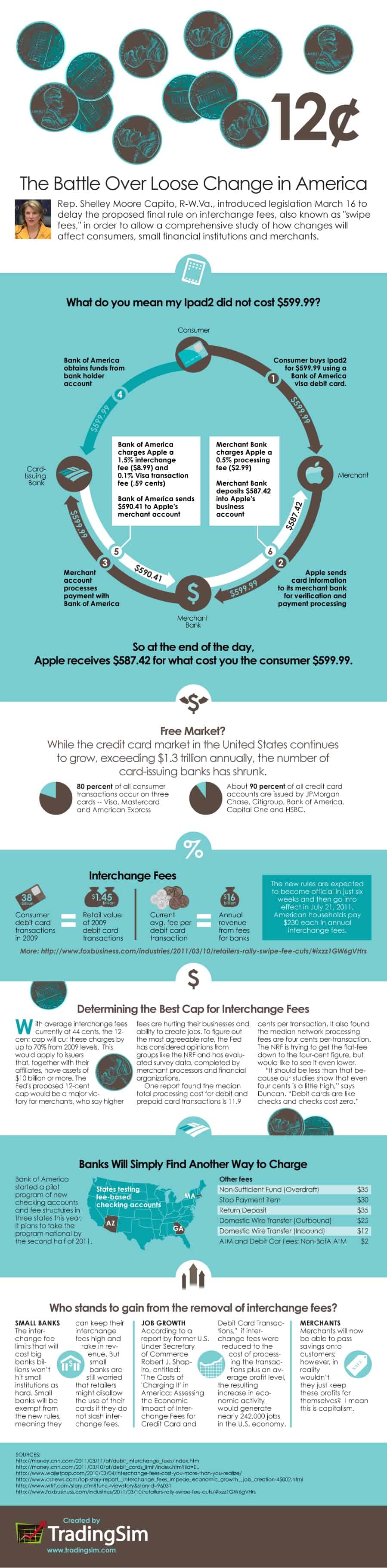

The new law known as the Durbin Amendment reduced the interchange fees for debit transactions to a flat 12 cents instead of the ~1.14% average fee of the sales price. In typical fashion, the banks found other ways to recoup these potential losses.

Even though Republican Congresswoman Shelley Moore introduced legislation on March 16, 2011, to delay the Durbin Amendment until a comprehensive study could be performed, banks went on the offensive. JP Morgan Chase announced on Monday, March 21, 2011, that they will no longer offer debit-card rewards for the majority of its customers in July of that year.

The elimination of the debit-card rewards program by Chase was reported by Bloomberg. The July cutoff is no coincidence as the flat interchange fee becomes law on July 21, 2011.

The below infographic provides both sides of the story. On one hand, there are people that believe the reduction in fees will lead to cost savings for the consumer. In 2003, Australia removed interchange fees and there was no uptick in the economy or reduction of goods and services.

In actuality, many Australians complain that prices stayed the same, while they did see an increase in banking fees, loss of free checking, and the elimination of debit-card rewards programs.

Interchange Fees Infographic

Interchange Fees

Present Day

Flash forward to today and a judge ruled in favor of both the merchants and customers. How is this possible?

The customers saw a decrease in their fees, while merchants have protection against future class action lawsuits.

While it is painful for consumers, it appears interchange fees are a cost of doing business. Interchange fees are not only in the United States.

The European Union has also put measures in place to curb the fees. In 2015, the Union capped the fees to .2% for debit cards.

The credit card companies are still not going without a fight. As governments further restrict interchange fees, companies are finding ways to leverage processing fees, not on regulator’s radar. In addition, American Express has lowered their reward fees in Australia on cards in response to Australia’s decision in 2017 to further cap interchange fees.

In Summary

As a consumer, you should be aware of the fees on your debit cards or credit cards. Continue to ask the tough questions before you signup for another card.

Also, stay on top of what changes your credit card company may be making to your rewards programs. The last thing you want is to have your points reduced or eliminated altogether. Especially when this is likely the main reason you initially signed up for the card.

Lastly, if you are against these fees, write to your fellow representatives. Remember, it’s not just about the interchange fees, but all of the fees. Until governments protect consumers against all fees, companies will continue to use fuzzy math to make up their losses. As you can see from this

infographic of the top bonuses for banking CEOs, these fellows always find a way to win.

Commodity Futures

Commodity Futures