Flags and pennants are foundational chart patterns of technical analysis. What I mean by this is most technical traders have heard of the patterns, as these are easy to recognize. Most of the trading strategies documented for flags and pennants are straightforward and somewhat boring to be honest.

In this article, I plan to challenge the norm and coming up with some creative ways you can start to trade these patterns.

Let’s first ground ourselves on the definitions of flags and pennants.

Definition of Flags and Pennants

So, when you think of a flag, it is literally talking about the shape of a flag. This is why when you search for flag patterns on the web, you will often see in the search results flags of countries for sale.

US Flag

As you can see in the above picture of the American flag, a flag blows in the wind. It’s not like a note card, with a perfect rectangle. The flag is in motion and will drift towards the direction the wind is blowing, which essentially is the same as trading in the direction of the primary trend.

Pennants again are another common shape that we see not only in the trading world, but also in the real world. It’s a triangle that is converging tightly on both sides to a point. As a kid, I remember my Dad buying me pennants at the Orioles game so I could cheer on the hometown team.

Pennant Flag

If you can understand these two images, you will be able to recognize these patterns on a price chart.

Now that we all have the same base understanding of the pattern, let’s dive into the three strategies for trading the flag and pennant patterns.

Strategy #1 – Trade Flags and Pennants that retrace less than 23.6%

If you are not familiar with Fibonacci, 23.6% is part of the Fibonacci series and is in the default series for most trading platforms including Tradingsim.

The point of looking for patterns with less than 23.6% retracements is a way to only identify the flags and pennants, which are trending strongly.

Let’s take it to the charts to really drive home this concept.

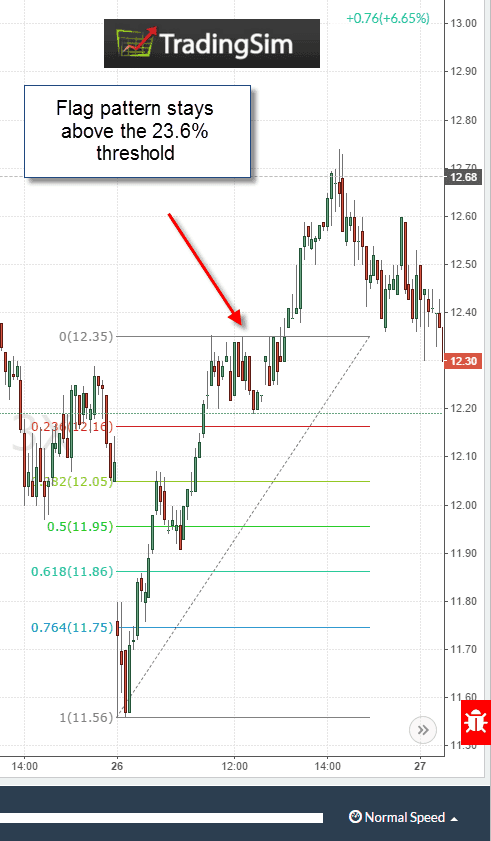

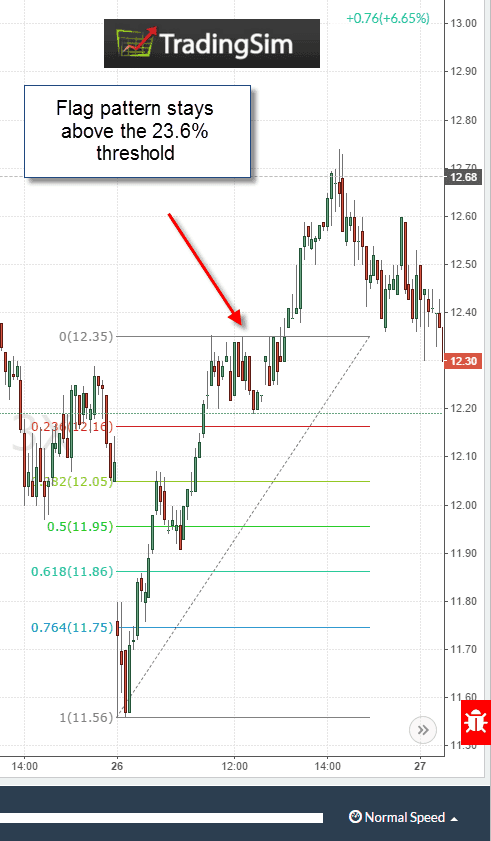

Flag Pattern

In the above example, we have a flag pattern, which had an impulsive move higher. Then the stock began to trend sideways for a few hours on the 5-minute chart. As you can see, RUSS never broke the 23.6% retracement line, before screaming higher.

Trade Setup

For the trade setup, you could place a buy order on a break of the high, with a stop below the low of the range. Again, the stock cannot retrace more than 23.6%.

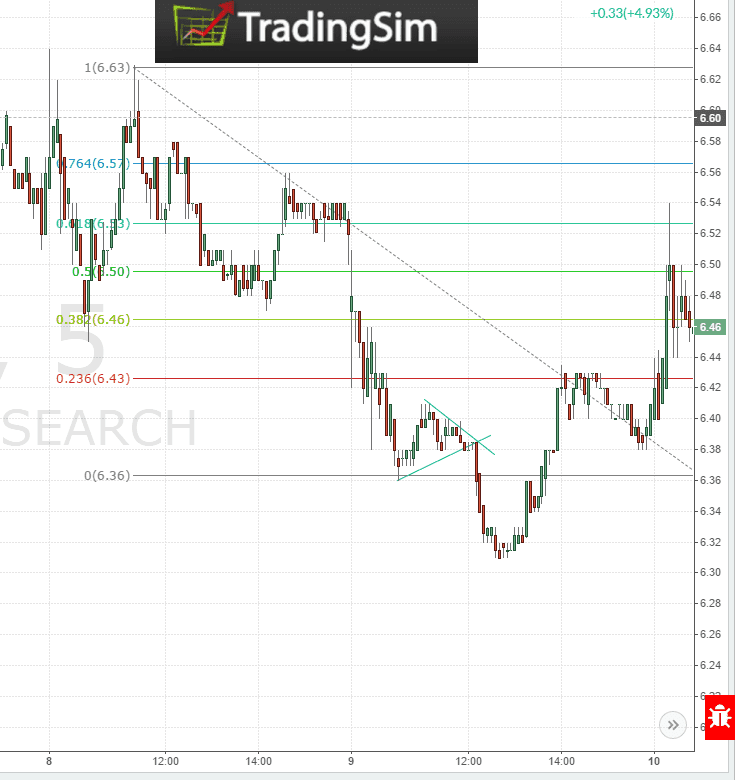

In the next example, we will be covering the same setup, but on the bearish side.

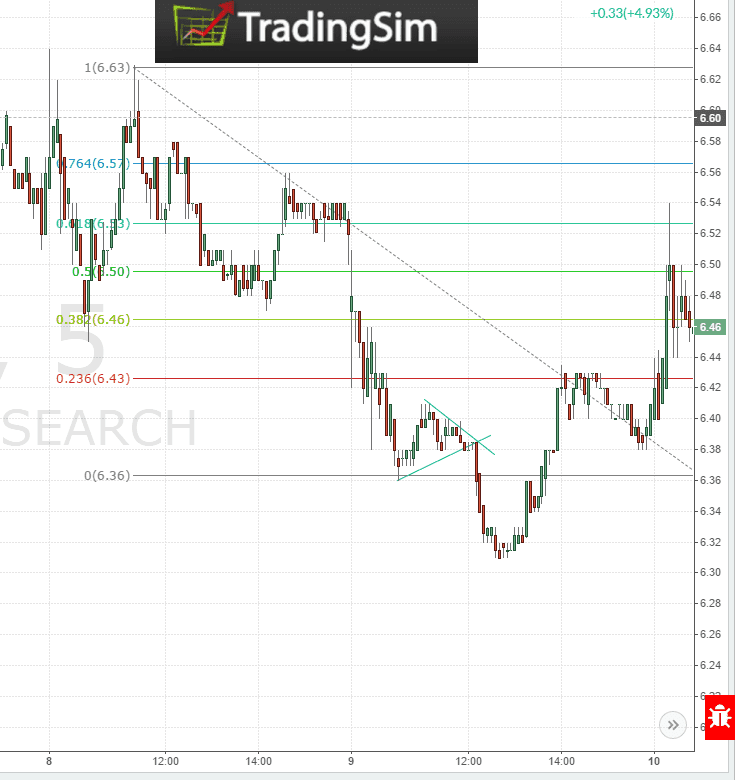

Pennant Charts

After the pennant developed on the chart, ARWR experienced a breakdown right after lunch.

The key thing to remember in both the flag and pennant formations is that there was an impulsive move with little to no retracement. Jumping on this bandwagon reduces the likelihood of the trade going against you.

Pennant Trade Setup

In the above example, you would want to short the break of the pennant trend line, with a stop above the middle of the upper trend line. The reason you should use the middle of the trend line, is due to the possibility of a quick fake out before resuming the direction of the breakout.

Strategy #2 – Buy a break of the Flag or Pennant on the Open

In full disclosure, I do not trade during the first 20 minutes; however, this doesn’t mean there aren’t opportunities for other traders. A formation that I have noticed over the years is one that blends both day trading and swing trading.

The setup consists of an impulsive move in a stock that lasts over 2 or 3 days. The stock will run all day and then towards the end of the day, form a flag or pennant pattern. The next day, the stock will gap through the resistance or support levels and then repeat the same trading pattern.

To illustrate this point, have a look at the below chart:

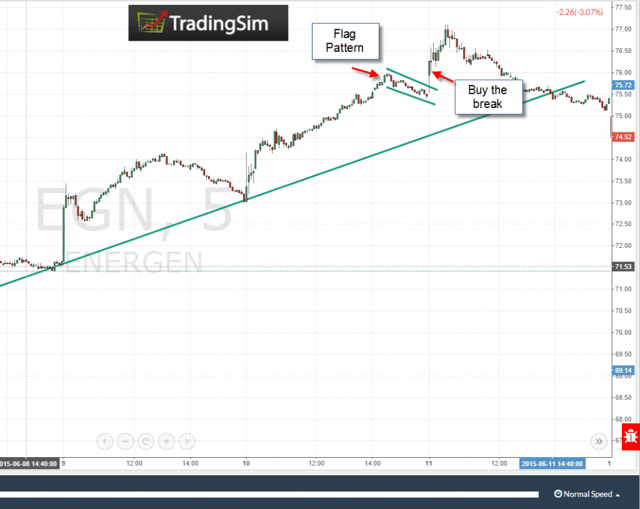

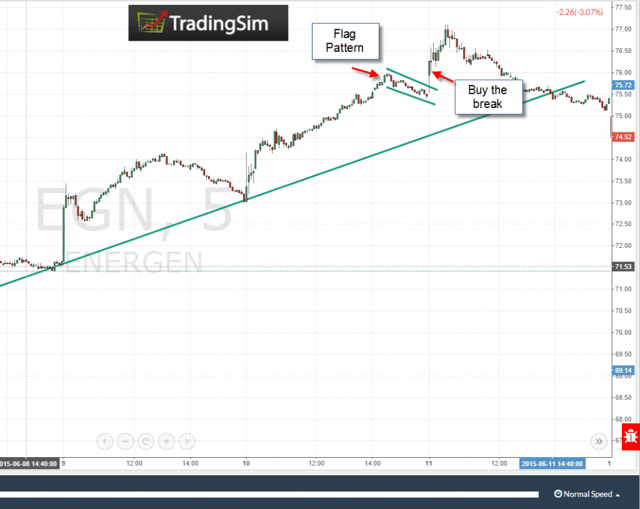

Multiple Day Breakout

Notice how the stock was stair stepping higher and higher throughout the week. Finally, a flag pattern developed and on the open of 6/11, EGN gapped higher through the previous day flag pattern.

The Trade Setup

Identify a stock that has been trending over a number of days. Look for the trend line to help define the trend to ensure there is continuity over multiple days. Once you can see the larger formation, look to buy the open of the stock once it gaps through the previous day’s flag or pennant.

Strategy #3 – Use Ichimoku to Validate the Breakout

Because flags and pennants are such common patterns, you need to have a method for weeding out the noise. One method you can use to filter out the possible trading opportunities is to use an on-chart indicator like the Ichimoku Cloud.

The definition of the Ichimoku Cloud is out of the scope of this article, but to quickly summarize, above the cloud is bullish and below the cloud is bearish.

Therefore, when reviewing flag and pennant patterns you can look to see how the price action is trending relative to the Ichimoku Cloud.

To further illustrate this point, let’s take it to the charts.

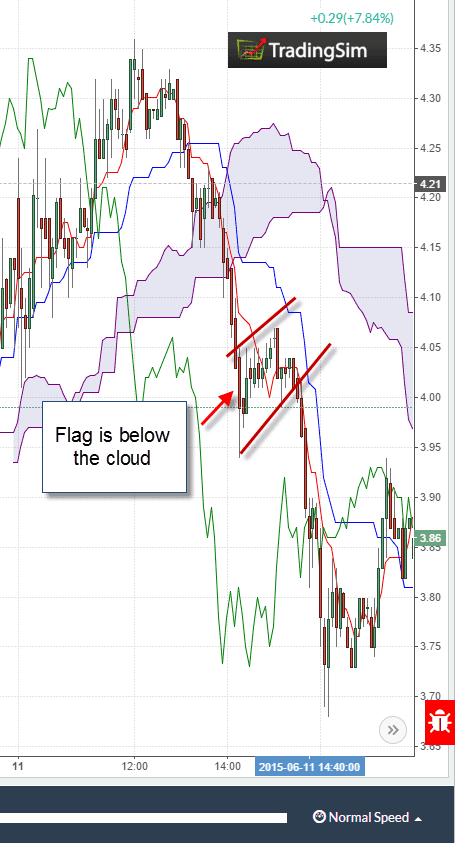

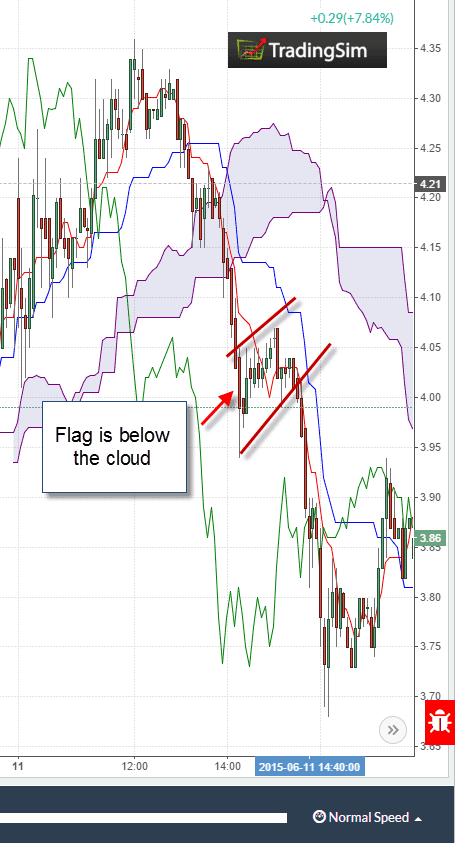

Flag below the Cloud

If you are not familiar with the Ichimoku cloud, the chart is going to look really busy. The only thing you need to focus on in the above example is that the break down through the flag occurred while price action was below the flag. As a trader, this gives you additional confirmation that the bearish trend will continue and you are less likely to be caught in a bear trap.

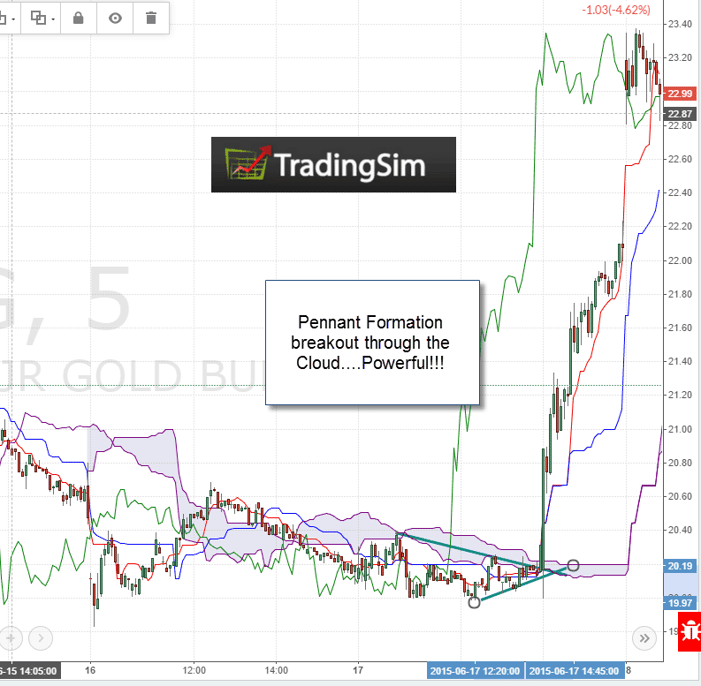

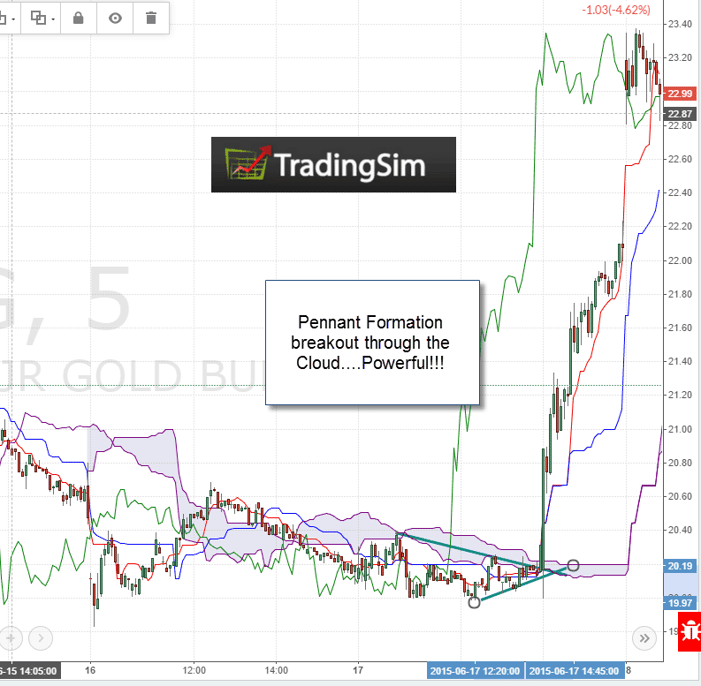

Pennant Ichimoku Cloud Breakout

Just to level set your expectations, it’s extremely difficult to find charts that converge into a pennant and then break through the cloud with such momentum as the above example. However, if you are able to identify the setup, you will be able to recognize you may have a real winner on your hands.

The Trade Setup

Identify a stock that has developed a flag or pennant. If the stock is breaking out of the pattern and is going in the direction of the cloud, then you have confirmation the trend will likely continue.

If you are looking to trade a trend reversal, wait for the flag or pennant to line up directly below or within the cloud. Then wait for the market to send the stock screaming higher through the cloud. At this point, you are essentially entering the position right as the trend changed, which will leave a number of traders trapped and covering their positions.

In Summary

Trading flags and pennants isn’t anything new to most traders. However, if you are able to identify another perspective on the formation, you essentially can develop an edge over other market participants.

To quickly recap, in this article we covered three strategies for trading flags and pennants:

- Identify the strongest trends with retracements less than 23.6%

- Identify multi-day trends that break through a flag or pennant on the open

- Use the Ichimoku Cloud to validate flag or pennant breakout

Much Success,

Al

Photo Credit

American Flag by Mike Mozart

Pennant Flag by Toronto History

Chart Patterns

Chart Patterns