Overview of 52-Week Highs

The 52-Week high is a key metric used by investors to measure the health of a security.

Why 52-weeks, well for starters it is a full calendar year. This is not a fiscal calendar or earnings calendar for a company, but 52 weeks on a look back period.

Why Do Traders and Investors Focus on This Metric

We are Conditioned to 1-Year Look Back Periods

Well, we all rate ourselves at times on a year-over-year performance. For example, at your job, your rating or bonus is tied to your annual review.

If you are a company you will compare your performance to the previous year’s quarter to see how well your company is doing.

The One Things Technical Analysts and Fundamental Traders Agree Upon

The other special element of the 52-week high is that it is something both fundamental traders and technical analysts both focus on.

This is rare in trading as these two demographics rarely agree on analysis methods or metrics.

It’s such a big target that it’s hard to deny. It’s also similar to another metric, the 200-day moving average, which traders use to determine if a stock is bullish or bearish.

How to Find Stocks Near 52-Week Highs

Finding stocks near 52-week highs is one of the easiest scans in the market and does not require an expensive scanning service.

Within Tradingsim, we are building scans that can identify both 52-week highs and lows.

If you are not a subscriber to Tradingsim, you can use any of the following free services to identify stocks breaking their yearly highs.

Nasdaq 52-Weeks Highs

Bar Chart – you will need to locate the 52-Week High link on the page

How to Trade Stocks at 52-Week Highs

Now that we have covered how to identify stocks making new highs for the year, let’s talk through some basic trading strategies.

#1 – Finding the Right Patterns

Every new 52-week high is not created equal and the last thing you want to do is buy every stock making a high.

The key thing you want to assess is the quality of the pattern going into the breakout.

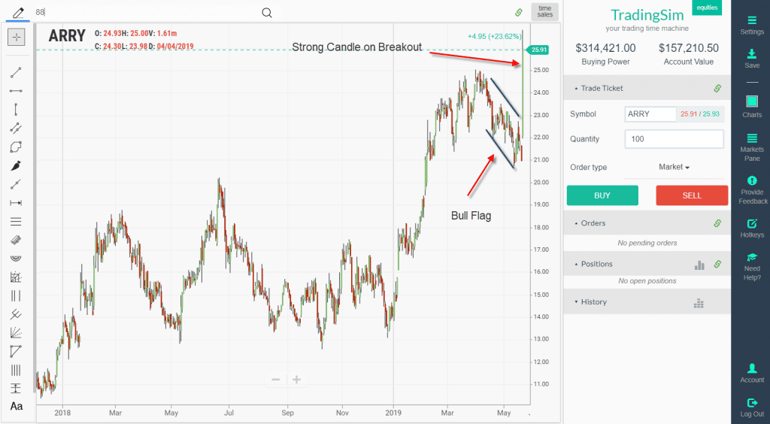

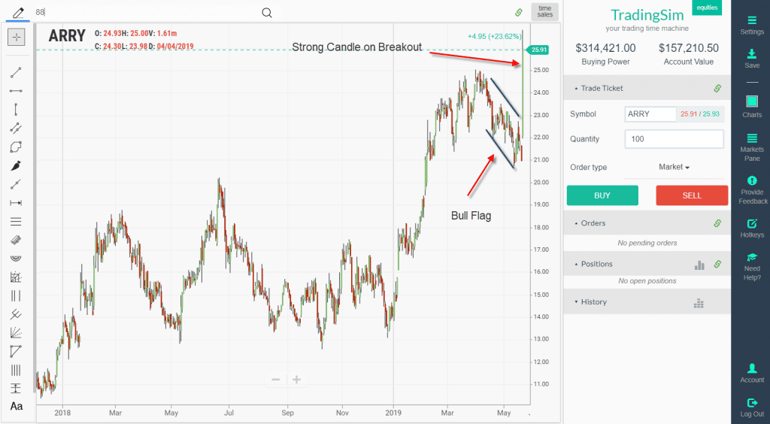

Bull Flag

One of the simplest patterns to recognize is the bull flag pattern. In the below example, you can see how the stock began to develop a flag near the 52-week high, followed by a strong breakout that held the highs of the day.

Bull Flag – 52 Week High

These are the types of chart patterns that can increase the likelihood of a 52-week breakout holding and going higher.

Rounding Bottom

Rounding Bottom – 52 Week High

Above is another common chart pattern – the rounding bottom.

On a 52-week breakout, the pattern will take over a year to develop, so patience is required. The first one or two breakouts will likely be head fakes as the smart money will use the opportunity to accumulate shares.

Then once the breakout occurs, the target is the depth of the rounding bottom formation.

#2 – Stop-Loss Management

As you can imagine 52-week highs are extremely popular and everyone can see them, so they come as no surprise.

For this reason, there will be those that will short the move and those that will buy long.

As a trader no matter how great your edge, things do not always go as planned.

So when do you know things have gone wrong?

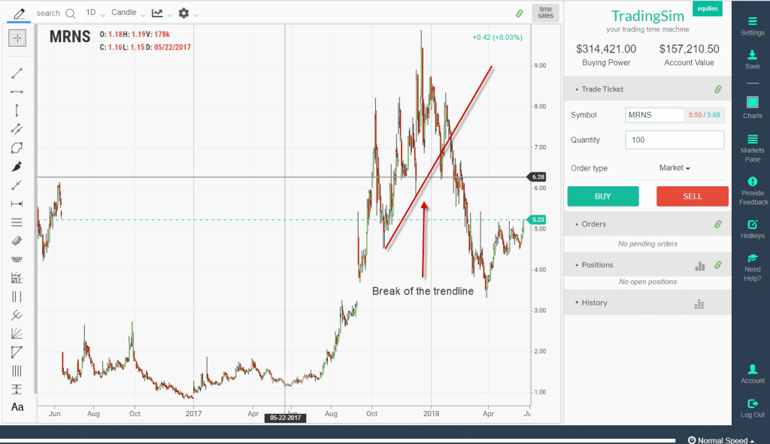

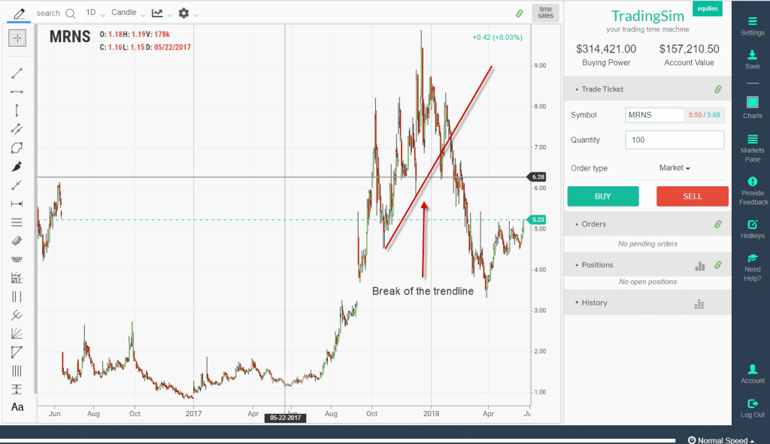

A simple stop management technique is to place your stop below the break of the trendline.

Break of Trendline after New 52-Week High

How to Avoid False 52-Week Breakouts

Again, you have to remember that every 52-week breakout will not go according to plan.

One way to avoid an unnecessary headache is to avoid stocks that are making new highs but in the context of a larger bear market.

New 52-Week High in Context of a Bear Market

Notice how the basing pattern ran you right into overhead resistance. Without having this greater context you would have been blindsided about why the bull run came to an abrupt end.

What are the Best Indicators for Trading 52-Week Highs?

Stocks making new yearly highs are what I would categorize as momentum plays. This essentially means the stock is moving in a parabolic fashion higher and not just dragging along.

To this point, momentum indicators and trend following indicators are suitable for these strong moves higher.

Stays Above Moving Average

In the above chart of Amazon, the stock not only made a new 52-week high but also an all-time high.

The key point to call out is the stock was able to stay above the moving average as it screamed above $1,000 per share.

How Can Tradingsim Help?

Tradingsim will provide you the ability to trade these 52-week highs on both a daily and intraday basis.

This will allow you to define your own custom trading rules and to utilize the indicators that work best for your trading style.

Trend Indicators

Trend Indicators