Learn to Trade

Faster, Smarter, Without Headaches, without Losing Money

With TradingSim

Do in minutes what takes the markets days!

Your Last Trading Simulator

Welcome to TradingSim, where active traders come to practice trading the market. This could range from a seasoned hedge fund manager to your stay-at-home mom. The great thing about our investment simulator is that you can practice 24-hours a day and there are pause, play, and fast forward controls so you don’t miss any of the action. So, what is stopping you from becoming a better trader today? All it takes is the determination to succeed and an internet connection.

Simulate Trading 24/7/365

Practice on your schedule

Our trading features provide the ability to simulate day trading 24 hours a day from anywhere in the world. TradingSim provides tick by tick data for every symbol on the Nasdaq, AMEX and NYSE.

No downloads required

Work Safely in the Cloud

TradingSim’s cutting edge technology allows you to replay the market over the web browser, without the hassles of downloading any software.

No barriers to entry

Learn on Your Terms

It is no longer required that you sign up for a brokerage account with lofty funding requirements. No platform fees, no commissions, no pressure.

Full control over your day trading experience

Trade at the Speed of Life

Use the fast forward and pause trading features on our investment simulator to analyze your trading decisions with more precision.

GREAT FOR

NEW AND EXPERIENCED TRADERS

-

New to Trading?

If you are new to trading and don’t really know where to start, TradingSim is the right place for you to learn stock market trading. Think about it, why go risk thousands of dollars in the market before you are ready? You can log in to the application and start practicing trading today. Get a feel for what works for you without the pressure of other gurus or pushy salespeople.

- Learn what works for you before risking a dime

- Trade-in a stress-free environment free of pushy salespeople and brokerage firms

- See if trading is right for you

- Learn the basics of what makes a successful trader

- Sick of complicated trading platforms; give us a try. We have learned over the years keeping things simple is the key to turning a profit.

-

Experience with Trading

If you are actively trading, TradingSim can take your skills to the next level. Below are some of the top ways other experienced traders use our application:

- Review trades placed during the day with our market replay tool. This allows our clients to dissect their trades to improve their trading systems.

- Before placing a trade in a particular stock, our clients will simulate trading the security to better understand how the stock moves. This is proving extremely helpful for our clients that trade in the volatile biotechnology industry, as it helps them understand such things as how the stock trades in the morning or the average size of the bid and ask prices.

- When in a slump our experienced traders will use TradingSim to trade their way out of a hole. This provides our clients a safe environment to work through their slump, versus over-trading.

Why Trading Sim?

-

Affordable

In today’s economy, we all feel a bit squeezed. As I look around the web I see a number of trading sites and stock market investment simulators that provide really cool features and free offers; however, the one thing they all have in common is overpriced monthly platform fees and data fees. On average the data fees alone will run anywhere from $35 – $49 per month. In addition, you will have to pay some sort of hefty platform fee which will range from $80 to well north of a $100 per month. When you add it all up you will end up spending close to $1,000 per year just to practice trading. If you don’t believe me check out Ninjatrader.

We at TradingSim provide you access to real historical tick data for over 11,000+ symbols and affordable access to our stock market investment simulator for less than $25 per month. Why would we do this? Simply put, we know how hard it is to make money in the market and we want to provide the most affordable means for you to master your craft. Odds are, before you end up at a site like ours, you have spent hundreds if not thousands on trading books, seminars, and workshops. Why should you spend another $1,000?

-

No Data Fees

Data is the key item for any trading simulator. Without data, you pretty much are looking at a blank screen. At TradingSim, all data fees are included in our price. Other trading simulators will require you to purchase a data subscription with a third-party data provider. These costs which are monthly, add up to a pretty penny by the end of the year. All of our pricing represents the total cost of ownership, so you can keep more of your money in your pocket.

-

Only 10% Make it

Let me splash a bit of cold water in your face. For every 10 of you who become a stock trader, only 1 of you will be profitable. This does not mean exceptional, I just mean profitable. The market is one of the hardest beasts to tame. It only allows a select few into the club. So, now that I have managed to offend you, please hear me out before you click away.

TradingSim allows you to practice for free 24/7, 365 days a year before you become a stock trader and risk a dime in the market. Your risk is fixed at our annual subscription rate. These other so-called best online trading sites will dazzle you with free access, but in reality, their only mission is to have you fund an account to begin trading. Knowing that only 10% of traders are profitable, why would they do such a thing?

Well, it comes down to self-interest; the brokerage firms want you to trade so they can make money on your trading commissions. We, at TradingSim, have elected to build our business on the foundation of helping traders discover their strengths before placing money in the market. So, trade or not, we still want your business.

-

Historical Data

TradingSim provides two years of historical tick, level 1, and time and sales data. You heard me correctly, TWO YEARS! Simply put, you can’t find this much intraday tick data anywhere on the web. Having this much historical intraday stock data will provide you the ability to perform extensive research prior to placing your money in the market.

-

Gain Loss Tracking

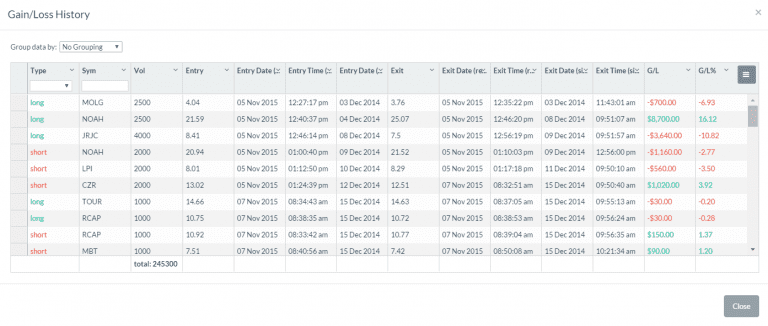

Gain Loss History

Want to see if you are improving over time? Simply take a look back at your investment gains and losses to spot strengths in your trading system. The more trades you place, the more traders gain loss tracking data you can accumulate, which can help you identify where you need to improve. Learn to master yourself and you will learn to master the market.

-

Biggest Market Movers

Market Movers

TradingSim provides you lists of the biggest market movers, in percent and dollars, up or down, refreshed in real-time for a given trading day. Don’t worry about trying to figure out which stocks are hot for the day. All you have to do is display the market movers widget and cycle through the symbols.

TradingSim provides you lists of the biggest market movers, in percent and dollars, up or down, refreshed in real-time for a given trading day. Don’t worry about trying to figure out which stocks are hot for the day. All you have to do is display the market movers widget and cycle through the symbols.Want to see what stocks were trending at 11 am, 2 years ago? Well, you can in TradingSim!

-

Watchlist

-

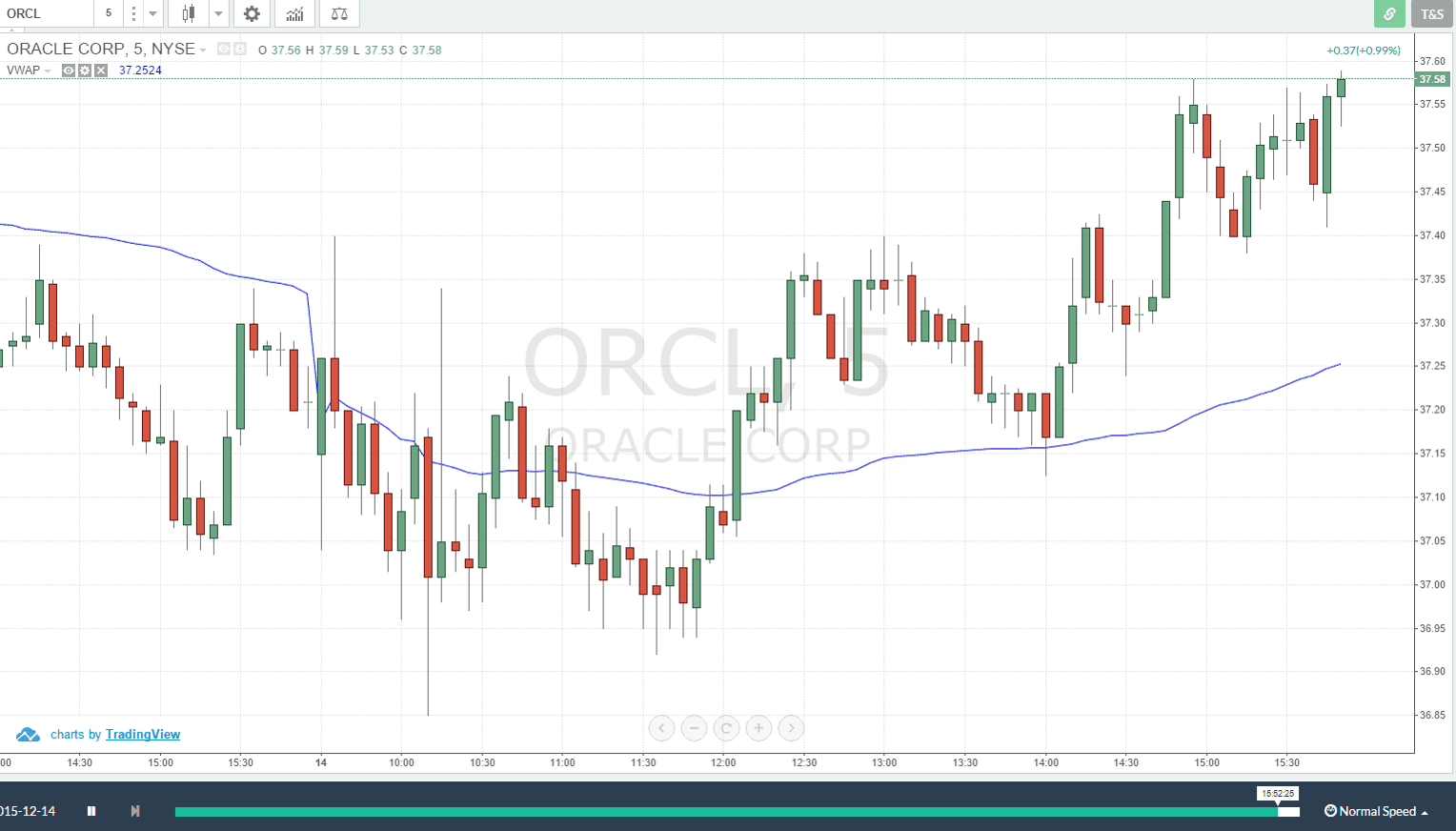

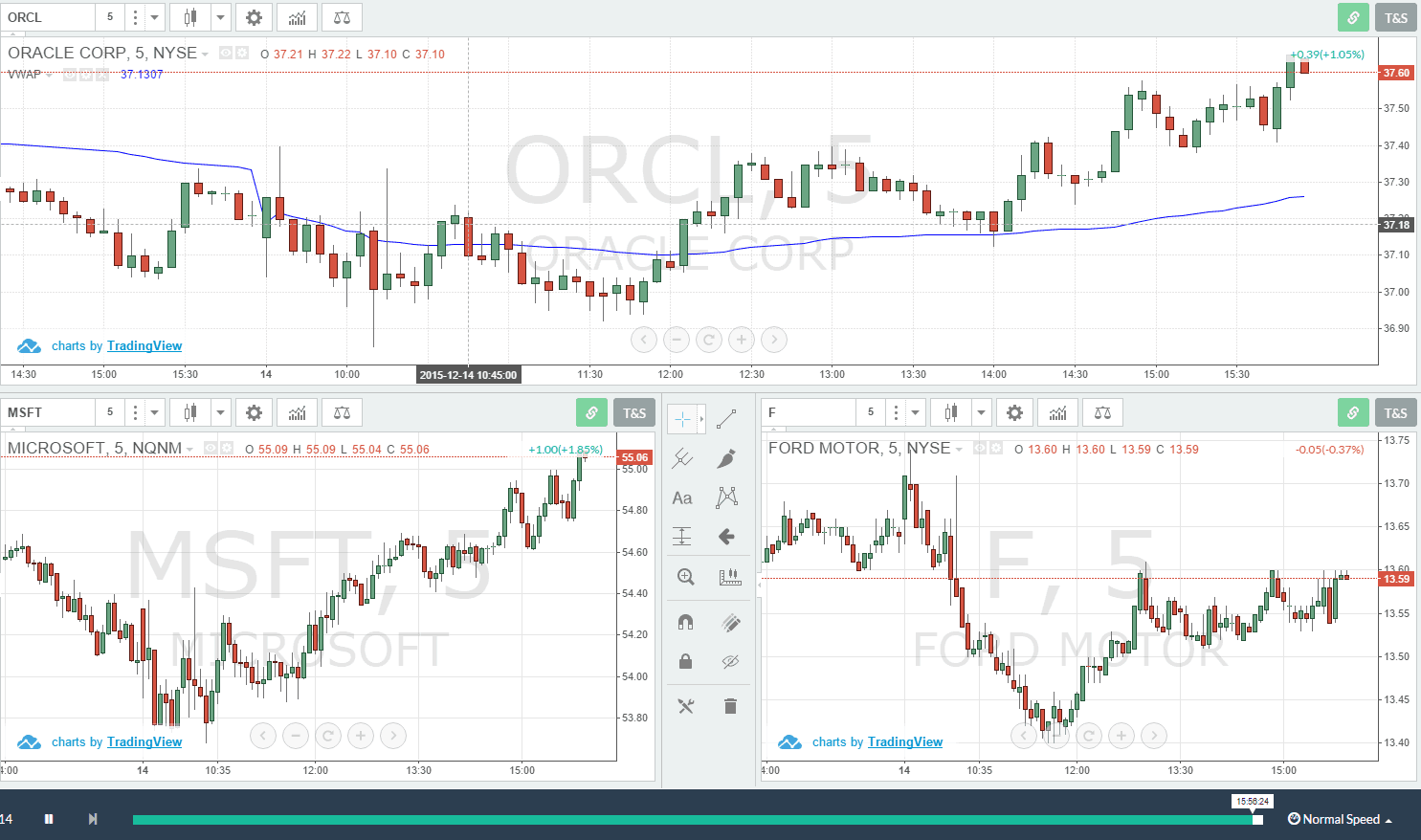

Market Replay

Playback Controls

Day trading is fast; however, by using the Tradingsim playback controls, active traders can pause, play and fast forward through the market action. The fast-forward mode allows traders to see if positions would have gone in their favor without sitting through every tick.

If you would like to pause the market action to take out the trash or watch your favorite show, simply click the pause icon. When you are ready to finish trading, click on the play icon. If you want to fast forward through the action, click on the fast forward icon. There are currently 7 fast forwards speeds for you to flash through time.

-

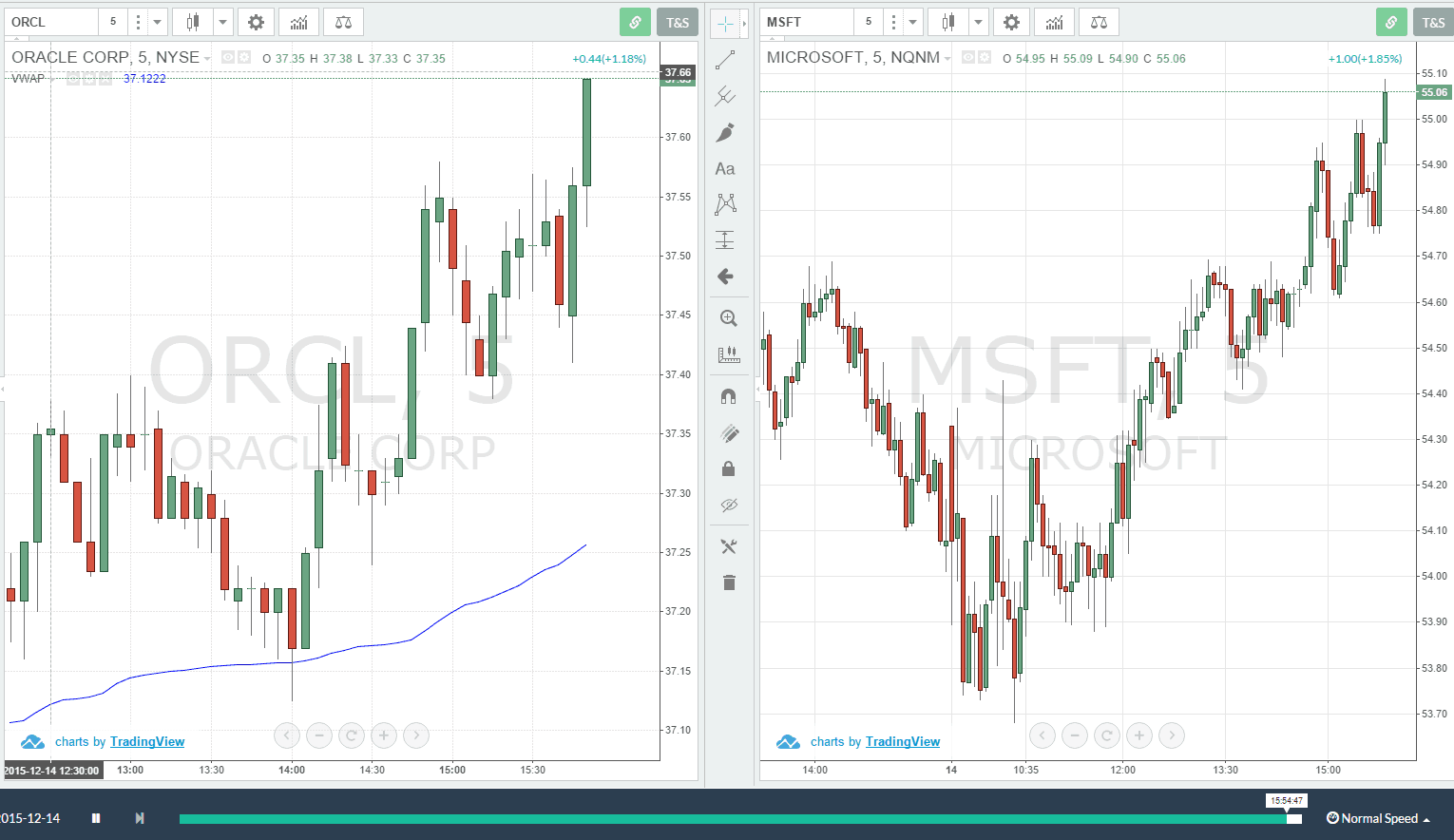

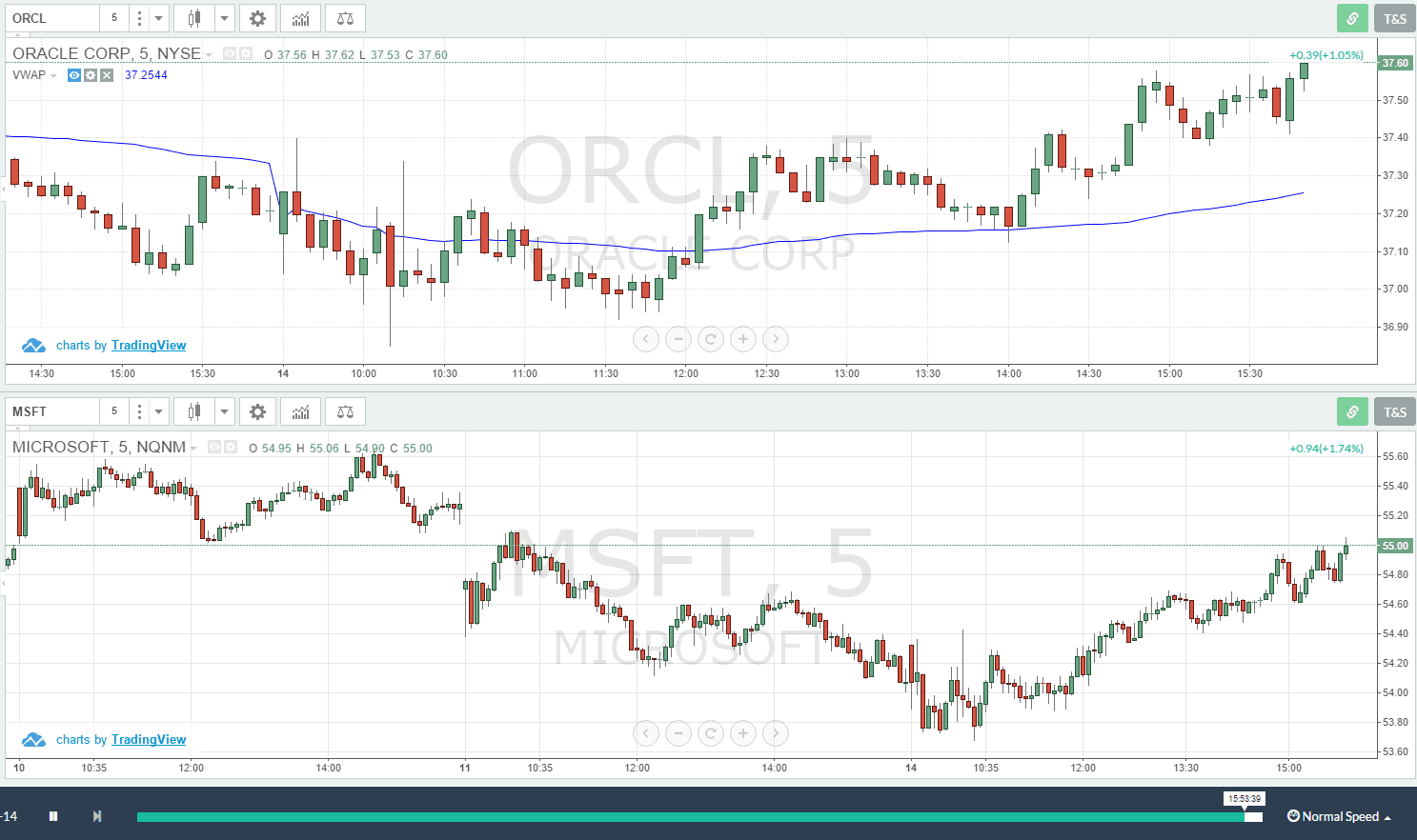

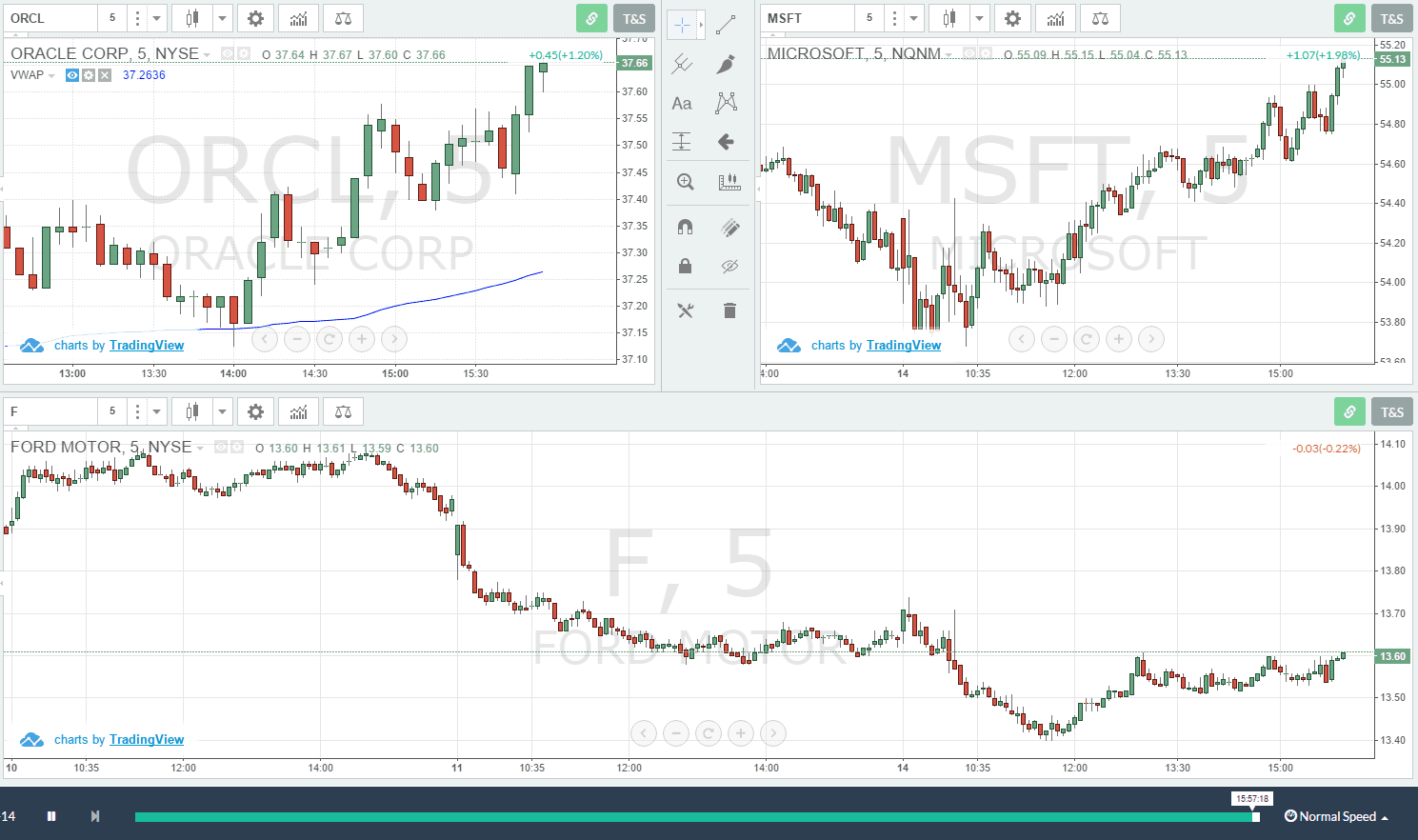

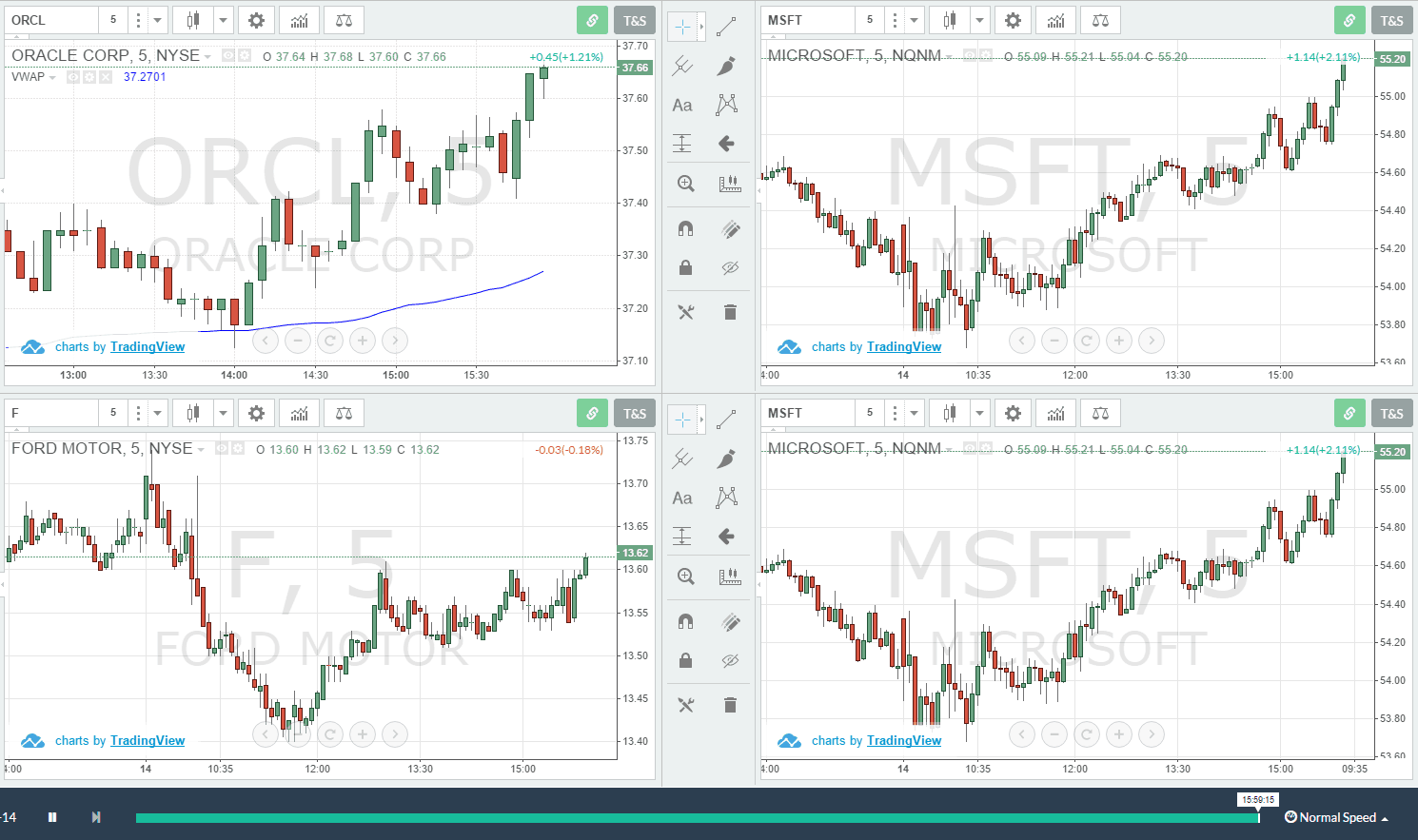

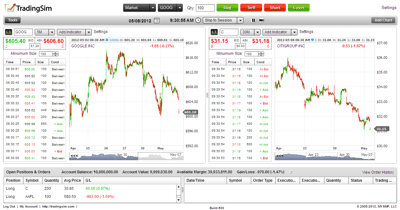

Multiple Charts

Trading with Multiple Chart Windows

TradingSim allows you to view multiple stock charts on a single page within the platform. This will allow you to track a stock’s performance relative to the broad market or an ETF. You can also display multiple time frames to make sure your stock is performing on all fronts.

One Chart

Two Charts

Side-by-Side

One Over Another

Three Charts

Two on Top

Two on Bottom

Four Charts

-

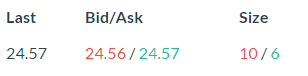

Real-Time Bid/Ask Quotes

Level 1

If you plan on calling yourself a day trader, you must interpret supply and demand forces present in the market. To help decipher the market action, TradingSim provides Level 1 data.

The buy and sell orders displayed in Level 1 are all of the orders as they occurred in real-time for a given market day. For some stocks, this represents over a million data points on a daily basis! Not only do we display this data, but it is also the engine behind our order execution process. So, if you plan on coming in and placing fake orders and watching them execute, please think again.

Bid Price

This is the price at which buyers are willing to execute an order.

Bid Size

The bid size refers to the number of shares buyers are willing to purchase.

Ask Price

This is the price at which sellers are willing to execute an order.

Ask Size

The ask size refers to the number of shares sellers are willing to sell.

-

Technical Indicators

Technical Indicators

Technical stock indicators are the staple for any active trading career. Well, we at TradingSim have you covered with over 50 technical indicators! You can configure the time periods as well as the look and feel for each indicator. You can also adjust the height of each indicator so you can zoom in on the action.

-

Changing Time Frames

-

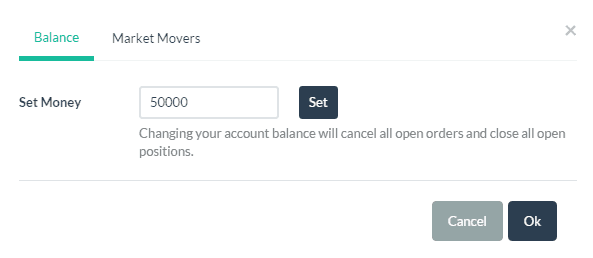

Change Account Balance

Ability to Change Account Balance

Have you ever wanted to change your account balance on the fly to see how well you would do with $250,000 or maybe even $10,000,000? Well, now you can simply update your account balance to the number of your choice.

-

Integrated DrawingTools

When analyzing the market you will need to identify support and resistance levels, Fibonacci retracements, and Elliott Wave to name a few. TradingSim provides you with over 60 visual analysis tools to help you analyze the market. Below is a list of just a few of the visual analysis tools provided in the TradingSim platform:

When analyzing the market you will need to identify support and resistance levels, Fibonacci retracements, and Elliott Wave to name a few. TradingSim provides you with over 60 visual analysis tools to help you analyze the market. Below is a list of just a few of the visual analysis tools provided in the TradingSim platform:Pitchfork, Schiff Pitchfork, Modified Schiff Pitchfork, Inside Pitch Fork, Pitchfan, Gann Box, Gann Square, Gann Fan, Fibonacci Retracement, Trend Based Fibonacci Extension, Fibonacci Speed Resistance, Fibonacci Time Zone, Trend Based Fibonacci Time, Fibonacci Circles, Fibonacci Spiral, Fibonacci Wedge, Fibonacci Channel, Trend Line, Trend Angle, Horizontal Line, Horizontal Ray, Vertical Line, Ray, Extended Line, Parallel Channel, Disjoint Angle, Flat Top/Bottom, ABCD Pattern, Triangle Pattern, Time Cycles, Elliott Impulse Wave, Arrow, Text Label – just to name a few!

-

Zooming In & Out

Zoom In

Zoom Out

-

Hold Multiple Positions

In Tradingsim you have the ability to hold as many open positions as your account can handle. Holding multiple positions at once will allow you to gauge your capacity for juggling multiple stocks.

In Tradingsim you have the ability to hold as many open positions as your account can handle. Holding multiple positions at once will allow you to gauge your capacity for juggling multiple stocks. -

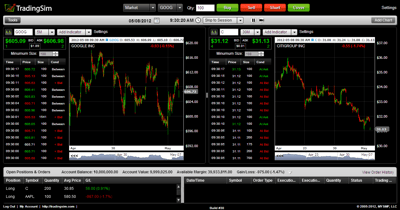

Customizable Background

For every trader that likes a solid black background, there is another one screaming white is easier on the eyes. Well let’s settle this debate once and for all; Tradingsim offers you both. Click either of the charting images to see a full-screen view of the Tradingsim platform.

Exchange Trade Funds

ETFs are Exchange Traded funds that hold assets such as stocks, commodities, bonds, indexes, and trades close to the asset value during the day. Did you know TradingSim has over 1,000 ETFs?

Are you interested in trading in the gold market but do not want to buy the commodity directly? Well, you can purchase a number of gold ETFs which track the gold bullion. This will give you the opportunity to practice trading without taking on the risk.

Does the idea of trading a new stock every day seem a bit overwhelming? No problem, you can trade the SPY which mirrors the price of the S&P 500.

Do you like the idea of trading bonds as a safer investment, but don’t know where to actually buy them. We have you covered, TradingSim has a host of bond ETFs that you can use to learn how the bond market works.

Below are just a few of the ETFs available in TradingSim’s real stock market simulator:

-

Indices

- SPDR Trust Series I (SPY)

- iShares Russell 2000 Index Fund (IWM)

- Diamonds Trust Series I (DIA)

-

Large-Cap

- iShares MSCI USA ETF (EUSA)

- Vanguard Russell 1000 ETF (VONE)

- Schwab U.S. Large-Cap ETF (SCHX)

-

Gold Oriented

- iShares COMEX Gold Trust (IAU)

- PowerShares DB Gold Fund (DGL)

- Market Vectors Gold Miners ETF (GDX)

- iShares COMEX Gold Trust (IAU)

-

Real Estate

- Schwab U.S. REIT ETF (SCHH)

- SPDR Dow Jones REIT ETF (RWR)

- Vanguard REIT ETF (VNQ)

- Schwab U.S. REIT ETF (SCHH)

-

Municipal Debt

- iShares California AMT-Free Muni Bond ETF (CMF)

- iShares New York AMT-Free Muni Bond ETF (NYF)

- iShares Short-Term National AMT-Free Muni Bond ETF(SUB)

- iShares California AMT-Free Muni Bond ETF (CMF)

-

Natural Resources

- Vanguard Energy Index Fund (VDE)

- SPDR S&P Oil & Gas Equipment & Services ETF (XES)

- Energy Select Sector SPDR Fund (XLE)

- Vanguard Energy Index Fund (VDE)

-

Precious Metals

- Global X Silver Miners ETF (SIL)

- iShares Silver Trust (SLV)

- Direxion Daily Gold Miners Bull 3X Shares (NUGT)

- Global X Silver Miners ETF (SIL)

-

Small-Cap

- SPDR S&P 600 Small Cap ETF (SLY)

- Vanguard Russell 2000 ETF (VTWO)

- U.S. Small-Cap ETF (SCHA)

- SPDR S&P 600 Small Cap ETF (SLY)

-

Commodities

- iShares GSCI Commodity-Indexed Trust (GSG)

- PowerShares DB Base Metals Fund (DBB)

- PowerShares DB Commodity Index Tracking Fund (DBC)

- iShares GSCI Commodity-Indexed Trust (GSG)

-

China Region

- PowerShares Golden Dragon China Portfolio (PGJ)

- iShares MSCI China ETF (MCHI)

- PowerShares Golden Dragon China Portfolio (PGJ)

-

Corporate Debt

- SPDR Barclays Investment Grade Floating Rate ETF (FLRN)

- SPDR Barclays Intermediate-Term Corporate Bond ETF(ITR)

- iShares 10+ Year Credit Bond ETF (CLY)