If you do a search on the web for stock market simulators, you will get a laundry list of sites. Some are free and others can cost quite a penny. I will lay out in this article a couple of key things you should consider when trying to find the best stock simulator money can buy.

For me, simulating the current day is critical, but the true value of a stock simulator is the ability to go back weeks, months or even years. Think about it, your system may work well in a bull market but may have horrible returns when the market gets a little nasty. Remember, it’s not just your individual stock out there, one of the major drivers for how your baby will perform is the trend of the overall market. If the stock simulator only offers a week or a few months of data, the accuracy of your backtesting will only be as good as the type of market trading at that given snapshot. Your is simulator should provide fresh data regularly, preferably daily and should have a minimum of 6 months of data. This will allow you the benefit of doing some extensive research prior to placing your money in the market.

Data Used in Stock Market Platforms/Simulations

The key thing with any simulation is practicing in an environment that simulates the real trading world as much as possible. There are times when you are trading a stock and the tape will speed up dramatically or the entire market will catch a bid and bounce suddenly. It’s key that your stock simulator provides you with that level of authenticity. The only way you will be able to achieve this same feeling is if the simulator has real-tick data. To take this a step further, the tick data should pipe through the application in milliseconds. This is the standard for most large brokerage firms. When you are talking milliseconds, this is quicker than what the human eye can actually process. It may not sound like a lot, but believe me when I tell you the speed of the market can be shocking at times if you are not ready. Some simulators will only update their data every 5 or 10 seconds, which doesn’t sound that bad, but there are a lot of trades that can execute within that time frame. So, while it may be “free” to use BATS data, there will be a cost down the line when you are faced with trading at true market speed.

Is the Data Included in the Price

Data is the key item for any trading simulator. Without data, you pretty much are looking at a blank screen. As you assess the stock simulators available in the market, remember to pay close attention to their data fees. It’s unfortunate, but most will require you to purchase a data subscription with a third party data provider as the simulator sites often do not provide data directly. These costs which are monthly, add up to a pretty penny by the end of the year. Make sure you keep a close eye on these hidden fees.

What Type of Simulation is Provided?

Simulation can mean a lot of things to a lot of people. There are some very basic stock simulators out there that only show the last value of the stock and an option to buy or sell the security. There may be little information provided in the form of technical analysis or a charting engine. For me personally, I use technical analysis as my “edge” when analyzing the market. For most day traders and swing traders, technicals are their source for how to analyze the market. So, when assessing a simulator ensure the application provides you with whatever tools you need to gain your “edge”.

Don’t Over Analyze

I have been reading a number of books related to trading psychology over the last few months. The one thing they all have in common is that successful traders do not fall in the endless cycle of analyzing the market to find their edge. If you really decompose trading down to its most basic elements, it is truly a profession of odds. The problem most traders face is when the market sends them a losing trade or two, instead of just accepting the loss and moving onto the next trade, the trader begins the cycle of analyzing the market. The level of analysis is often directly linked to the negative trend in the trader’s equity curve.

Most traders begin changing their system as they receive feedback from the market in terms of profits or losses. This constant changing of the system never allows the trader to establish a solid baseline of their trading methodology. To counter the need to constantly refine your system, try logging into your stock simulator to see if your last few losing trades are just the market odds playing out, or if you really need to reassess your overall approach.

When are you able to Simulate?

This is a key factor that most people don’t think about when assessing stock simulators. The vast majority of simulators only allow you to practice during market hours. This is good if you are generally free during the hours of 9:30 and 4:00 pm; however, most people are trading or working their day jobs during this time. The more you are able to practice the greater chance you will have of finding your zone and staying in it. So, make sure your simulator provides 24/7 practice trading.

What Stocks can You Simulate?

A great market replay tool will allow you to trade every stock available on the major exchanges. This ensures you are able to trade the entire universe of stocks as each exchange will have different characteristics. For example, Nasdaq stocks move quickly, while AMEX securities are for ETFs.

Lastly, the NYSE will have more blue chip stocks with lower volatility.

So again, it’s important that you are able to trade all types of stocks to ensure you get a feel for the broad market.

Does the Stock Simulator provide Penny Stocks?

Most stock simulators are used as a means for companies to upsell a much larger ticket item. Therefore, some companies will skim on the amount of data the store and/or collect. An example of this is penny stocks. Now, I’m not just talking about stocks that trade below $5 per share, I am referencing those that trade OTCBB. What most newbies don’t realize is that a lot of penny stocks do not trade on the NYSE or Nasdaq. Due to their volatility and low share price, these securities trade over the OTCBB or also known as Pink Sheets.

It’s critical that your stock simulator have this data as many newbies are attracted to the thrill of making quick money in penny stocks. I personally do not advocate trading these types of securities, because the moves are often so violent that most traders are unable to sit through the gyrations. Which is again more reason to have them in your simulator of choice, so you can determine if you have an edge with penny stocks.

Fantasy Trading is for Games not Trading

The primary driver for fantasy trading is to measure yourself up to other would-be traders. While this is great for entertainment purposes, this is horrible for trading. Trading is about you; this is a one person game. Focusing on other traders is a sure way to lose yourself in the game of trading. This is not fantasy football or family feud. You have to figure out what makes you money; worrying about the fact you are 22nd out of 1,000 traders adds no value to your trading skills. If you want to compete with others, try picking up a copy of Call of Duty.

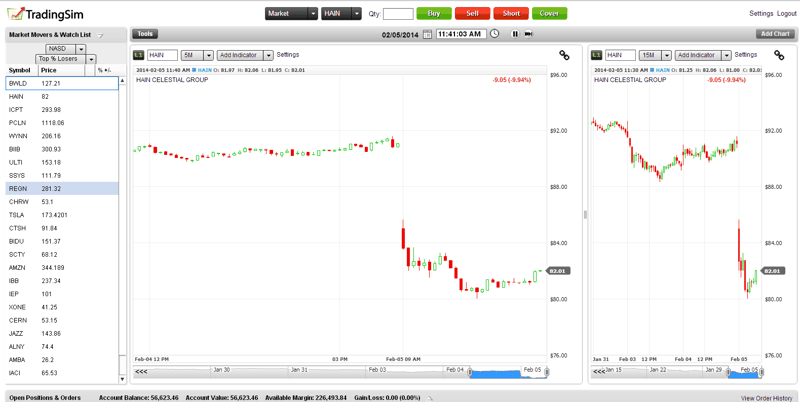

Is the Charting Application Easy to Navigate?

There are a number of trading simulators that have simply added feature after feature over the years. It’s funny because when you open these applications up for the first time your initial reaction is to run for the hills. There are flashing lights everywhere and it’s almost as if the screen is going to attack you. The more features and indicators do not equal profits. Some of the most successful traders have made fortunes using one or two indicators. When you are assessing your trading simulator, make sure the user interface is clean and straight forward. I know what you are thinking, more is better. Actually, this is the furthest from the truth. As you progress through your trading career you will experience a few bumps in the road. The key thing during these times is to not over analyze your system as stated earlier in this article. When you have a platform that offers you endless combinations of how to analyze the market, you will likely fall victim to this cyclical behavior.

Is the Stock Simulator Web Based?

The last thing you want to do is have to download your stock simulator to every computer you own. This will become especially challenging as you try to explain to your manager at your job why you have just tried to download the latest trading application to your computer. A much easier solution is for your stock simulator to be a lightweight web application that you can login on any machine from anywhere in the world.

Is the Stock Simulator an Upsell Tactic?

Trading simulators at times are an upsell for other services. Brokerage firms are notorious for this technique. The brokerage firm will lure you in with a heavily discounted simulator in hopes that you will switch from simulation mode to trading live. Their motivation for this is to get as many trading commissions out of you before you go bust. The company that provides you your simulator should be firewalled from you and the live market. Your stock simulation company should have a vested interest in making you a better trader and not simply in getting you to trade in the market. Remember if the simulator appears to be extremely cheap or almost free, make sure you are prepared for the upsell that is likely around the corner.

Combat the Need to Over Trade

Overtrading is one of the many challenges you will face as a trader. Overtrading can start from trying to dig yourself out of a hole or simply fighting the market. These periods of over trading are normally short but can be disastrous to your equity curve. Instead of channeling your energy into trade after trade, you can use a stock simulator to get the bug out of your system. When you feel the urge coming on to go on a trading binge, log into your stock simulator and trade away until you feel the urge to leave your system. This again ties back into my earlier point of why your simulator should be firewalled from your brokerage firm. I can’t tell you how many times I would be off my game and would switch from simulation mode to live trading while I was in the middle of a trading slump.

How to Perform Stock Market Analysis with a Stock Simulator

For newbies, it’s best that you use a trading simulator to get a feel for the market. A stock simulator will allow you to determine your risk profile and win/loss ratio which is critical to determining how to use your edge to consistently make money.

For active traders, you can use a stock simulator to review your trades. Most traders perform their review by looking at static charts. The real power in a stock simulator is reviewing your trades with a replay tool that can display every tick. This will allow you to relive the moment to see the speed of the tape and overall market action.

Lastly, you can use a stock simulator to review how a stock trades before you enter a position. How many times have you looked to day trade a stock, only to find out that the stock has really high spreads between the bid or ask price or the intraday action is erratic? This sort of tick-by-tick action may not reveal itself on a minute or daily bars and may come as a surprise when you look at the stock in real-time. This sort of feel for the stock only comes from actively monitoring or trading the stock. Using a simulator with real tick data allows you to gain a level of understanding of how a symbol trades without having to monitor the stock during the trading day or risking any money.

What’s the Difference Between a Stock Simulator and Day Trading Simulator

The main differences between a stock simulator and day trading simulator will come down to a few items.

Lower Timeframes

A day trading simulator will focus on smaller timeframes such as 5-minute, 1-minute, and sub-minute charts. Such as 15-second and 30-second charts.

Level 1 and Level 2 Data

A day trading simulator will also have market depth data. This will come in the form of level1 and level 2 data which present the pending orders.

This will allow you to further dissect the order flow in the market.

In Summary

An online stock simulator is a must have simply because it allows you to practice. Just as athletes practice in the off-season, you also need to continue to practice your craft outside of market hours. To see why we believe Tradingsim is the best stock market simulator, please visit https://www.tradingsim.com.

Basics of Stock Trading

Basics of Stock Trading