Day trading is defined as an approach to trading where the trader opens and closes the trade during the same trading day. Day trading is sometimes referred to also as scalping or intra-day trading. No matter what it is called, day trading doesn’t involve keeping positions open overnight, even if it is for a day.

Swing trading on the other hand is another approach and the name comes from the fact that traders here take advantage of the price swings in the markets. Swing trading involves keeping a position open over night, at times even for few days or weeks at a stretch. With swing trading, there are considerable risks as the trades are subject to market forces during the period of time that they are open.

Many traders often ask the question as to whether it is ideal to, day trade futures or to swing trade futures contracts. The answer to this question is subjective and in honesty, there is no right way or wrong way to trade. You can make a profit day trading the e-mini futures contracts and you can also make a profit swing trading the e-mini futures contracts. What determines the success of your trading is a mix of you trading capital, your risk tolerance, the markets you trade and the trading strategy that you use. Therefore, to simply assume that day trading is better than swing trading, or vice versa is like generalizing the concept without accounting for the factors that actually play a role in determining the outcome of these approaches to trading.

Needless to say, there are some risks involved and some factors that traders need to bear in mind when it comes to both day trading as well as swing trading. In order to understand what is a better way to trade futures, one should first know the characteristics of the futures contracts, outlined below.

Futures contracts come with fixed trading dates

Unlike stocks, with futures contracts there are fixed trading dates. If you were trading stocks for example, an investor can buy a few shares hold their positions for weeks, months and years at a stretch. You cannot however expect to see a similar trading pattern emerge with futures. This is because just about any futures contract has an expiry time before which the contract must be rolled over into a new contract month or risk closing the expired contracts.

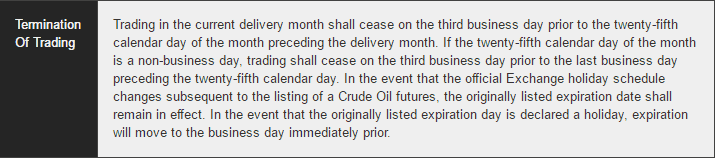

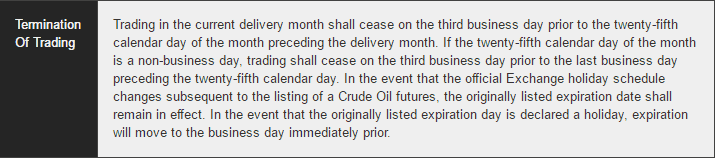

CME Group – Termination of trading example for Crude Oil Futures contracts

Therefore, if you want to swing trade futures, traders must pay attention to the contract specifications which signal the last trading day of the contract before which the position must be closed a new position taken in a new or forward contract month.

Swing trading futures contracts require higher margin requirements

When you day trade futures, the margin that you pay as the initial margin is not more than $1000, if you trade commodities such as Crude Oil or Gold futures. For the more popular trading contracts such as e-mini S&P500 or other similar index futures, the initial day trading margin requirement is under $500.

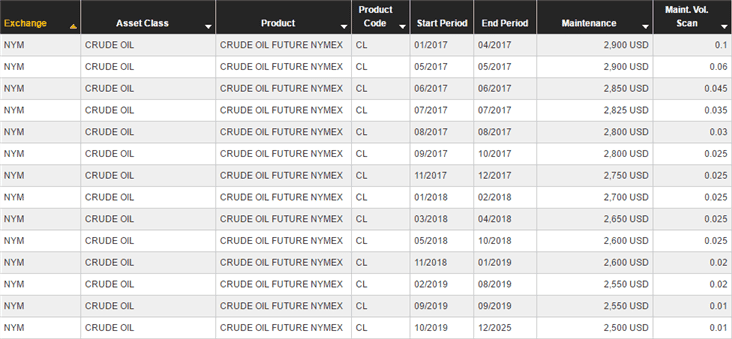

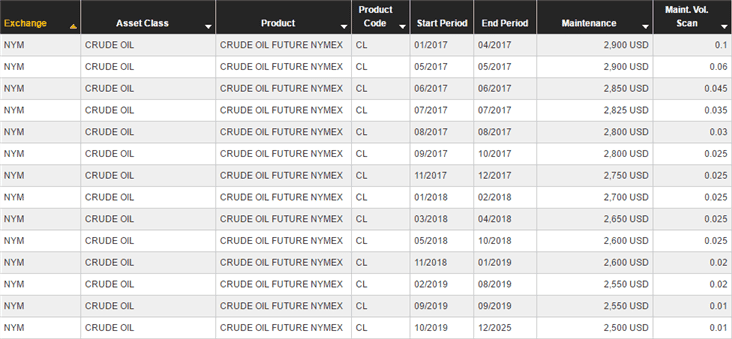

Margin requirements (maintenance margin) for Crude oil futures swing positions

The low margin requirements make it easy for traders who do not have to put up heavy capital upfront. For swing trading however, the margin requires are automatically higher. On top of the initial margin requirement, swing traders also need to have adequate funds for the maintenance margin. As futures contracts prices are marked to market on a daily basis, the maintenance margin is essential, failing which it could either result in a margin call or a liquidation of the trades.

Futures trading volumes are never constant or consistent

When you trade stocks, during the normal defined trading hours, you have a sense of consistency in the stocks’ volumes. For example, you know that Apple’s average trading volume is around 35 – 40 million and this gives you a fair sense of the liquidity in the markets.

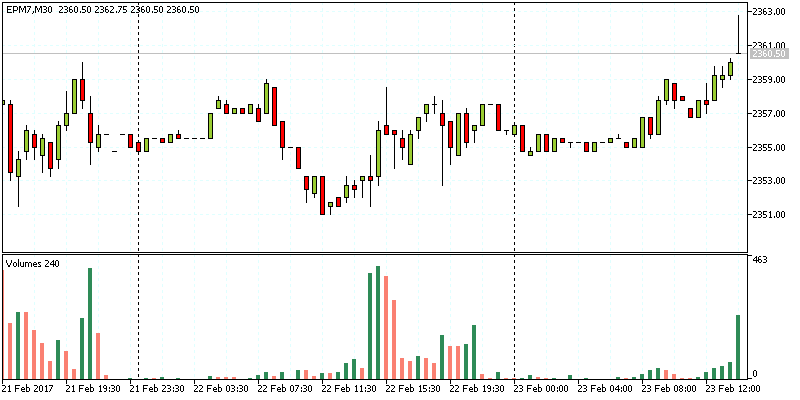

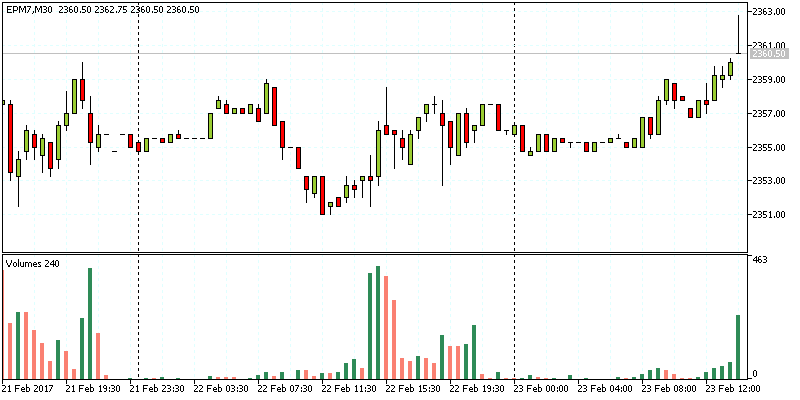

Example of rising and falling volumes for E-mini S&P500 futures

With futures contracts, the volume changes significantly because of the nature of the markets. Typically, you can see increased volumes during official trading hours and once the markets move into the off-peak or after hours or pre-market trading hours, the volume significantly falls. This means that liquidity is also not the same. Lower volumes mean that swing traders in futures will have to also consider any adverse price movements that can occur, taking advantage of the low liquidity conditions in the markets.

With day traders, this can be avoided because the trading is usually confined to the normal trading hours, or even if a trader prefers to day trade during unofficial trading hours, they can still be able to monitor their trades.

The volume levels can also be inconsistent as under normal circumstances an investor who has exposure in the cash markets doesn’t feel the need to hedge the risks. However, this might change as the risks increase, which will compel such investors to hedge the risks by purchasing long or short contracts in the futures markets, thus accounting for unusual volume.

Why day trade futures?

Firstly, there are many approaches to winning in the futures markets; day trading is merely one of them. Day trading however gives you the flexibility to position trade, scalp for a few ticks, take advantage of market imbalances that are more common during the intraday sessions, as well as allowing you to use more complex strategies or approaches to day trade successfully.

Although day trading might give the impression of staying glued to the trading screens and trade the whole day, many successful day traders spend less than an hour trading. Of course, this is a result of years or testing and getting familiar with a trading system, but it goes to show that day trading doesn’t have to be an all day affair. This makes it a lot more convenient and also partly dismisses the myth that day trading is only for those who want to trade full time.

Compared to swing trading, day trading is the most simplest way to trade as it involves managing positions during the day and exiting by or before the end of the day’s trading session. Trading decisions are also more easily quantifiable with day trading with two certain outcomes; you are either making money or losing money. Given the current day volatility in the markets, day trading can be profitable when viewed from the perspective of risk and reward.

But, day trading is of course not for everyone, especially when one has a full time job or other commitments during the day or in most cases the temperament to day trade. Day trading requires the trader to usually be quick on their toes and know when to cut their positions quickly. Not every trader is suited to such type of trading which is why some traders are better suited to swing trade the markets.

Despite this limitation, day trading doesn’t have to stretch during the full trading session, but can last for as little as 10-minutes of trading a day. Day trading can help many traders to overcome the odds of surviving in the market when one is swing trading, especially when volatility driven market moves can quickly erase whatever gains that were made during the previous days.

In the futures markets, day trading brings the additional benefit and flexibility for the trader. For example, you can choose to time your day trading during the U.S. official trading hours, thus coordinating trading the index futures such as E-mini S&P500 alongside the U.S. stock market trading hours. Or for futures traders who are trading another index such as the Nikkei 225 futures can time their trades during the Tokyo trading session so that they can take advantage of the higher volume during those trading hours.

For the swing trader, this can be a big disadvantage as it means risking their positions during off-market trading hours which could mean that an erratic price movement could potentially wipe out any gains that their position might have made previously. Even if the swing trader employed any techniques such as using trailing stops to lock in some of the profits, the trader would have to risk a good winning position no matter what.

Why swing trade futures?

Swing trading futures brings its own set of advantages. For starters, you can swing trade your positions such as that you hold the trade within the constraints of the first and last trading day. This way, you can be sure that you do not have to risk your positions by closing them and opening new contracts on the next month. But this can depend from one instrument to another. For example, index futures contracts come with quarterly contract months, thus 90 days is good enough for a swing trader to hold their positions.

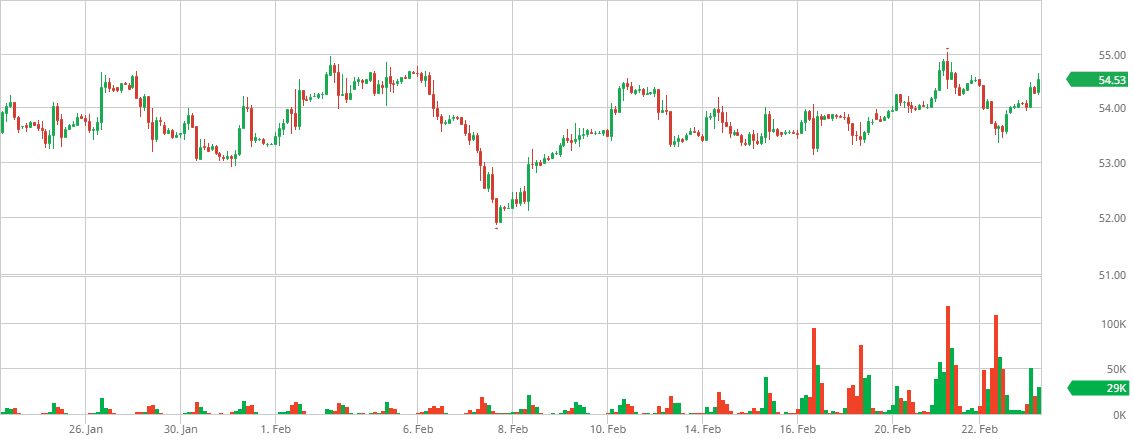

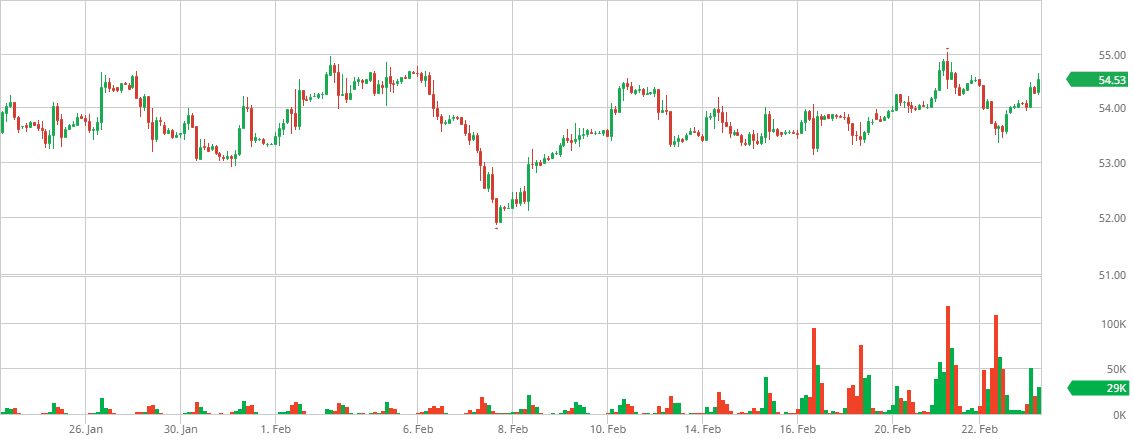

Crude Oil futures rolling or continuous contract chart

On the other hand, swing trading on commodity futures such as Crude oil or gold can be risky as the contracts expire every 30 days making it tedious if not risky to swing trade such contracts.

Swing trade is ideally suited for traders who have large capital and can manage to combine position trading and scaling so as to maximize their efforts and reward the trader for the risks taken. Thus, swing trading puts many retail traders out of the equation. While stock investors who are usually well capitalized make for a good candidate, the futures markets volatility is often a deterrent for many.

With the rather limited choice for swing trading in the futures markets, one might consider why a trader would want to swing trade the futures markets in the first place. For starters, investors who have exposure on the long side on the equities can find that hedging their positions in the futures markets, especially on the index futures can yield additional profits and can work out as insurance. This is true when the fear index or the VIX volatility index starts to rise.

Investors are usually faced with a choice of either liquidating their positions, or to purchase options and gain exposure accordingly. With futures markets, investors can have an additional choice of market that they can use to hedge their exposure.

Therefore, when you see the markets posting a correction, which can at times last a few days to a week or more, swing trading the futures contracts can be ideal. But, futures traders will still no doubt have to pay attention to the futures contract expiry dates which can result in forcing the trader to liquidate their positions pre-maturely.

In conclusion, to answer the question as to whether swing trading or day trading futures is better, the trader should first understand what their trading goals are. If you are trading the futures markets as a way to hedge against the risks from the underlying cash market, then swing trading the futures contracts is more ideal. On the other hand, and in majority of the cases, day trading futures markets is more suited as it gives you the benefit of trading on small margin, thus allowing most of you trading capital towards managing the maintenance margin requirements.

The fact that most of the futures contracts are leveraged, also makes it a risky proposition to keep the positions open over a period of time. A momentary lapse of judgment can result in the trader incurring huge losses. There are many recorded instances where the brokerage failed to inform the trader to close out their positions Holding, long contracts or even worse, short contracts into expiry and especially for the commodity markets can mean that you will have to meet the obligations of sourcing and delivering or taking delivery of the underlying commodity, which is a risk in itself.

In contrast, day trading futures can make it easy for retail traders to focus on their trading strategies and looking at making consistent profits day in and day out.

Day Trading Basics

Day Trading Basics