#1 – What is a Market Correction?

A trading correction is a common term used in the financial community to signify a market taking a breather but not one on life support. Think of a correction as a rain shower, while a bear market would be a hurricane.

Corrections are something that are discussed in terms of the broad market mostly. Stocks experience them as well, but when you hear the term correction floating around on CNBC, the broadcasters are not referring to a stock but the market at large.

The common rule of thumb is a correction is a pullback greater than 10% but less than 20% from the recent peak. Corrections can occur in both bull and bear markets.

Lastly, the market is able to stay above its 200 day moving average (in bull markets). This average is looked at by even fundamental traders as a clear line in the sand for who is in control of the trading activity.

However, when investors are discussing corrections it is often in the context of a pullback during a strong bull market. This will be the lens we discuss this topic within the article.

#2 – When is a Market Correction Over?

This is the holy grail of trading if you can figure this out. To answer the question, no one really knows. The true definition that everyone can agree on is when the market is able to exceed its prior high before the start of the correction.

Let me ask you, does this really help you as a trader? Probably not, since you are likely asking this question so you can time the market bottom in hopes of making a solid return as the market regains its way.

There are a few things you can look for that can further illuminate if the correction is on its last leg:

Fundamentals

- Companies are starting to report better than expected earnings and their current levels are below fair value

- Earnings season has passed and market volatility is starting to dry up

- The market is through typical seasonally weak periods such as May thru October

Technicals

- Volume is drying up as the market continues with the correction

- The leaders in the market are starting to trade sideways or higher

- The market is able to hold it’s 200-day moving average

#3 – What Sectors are Best Protected During a Market Correction

Gold Market

This one is a little easier to answer. When there are bear corrections, you will see a flight to what are considered safe havens for investors. These include gold, blue chips, and dividend-paying stocks.

Now, this doesn’t mean you are completely shielded from any pending doom and gloom, but it does mean these staples will keep you whole during the downturns.

#4 – What Sectors are Most Vulnerable During a Market Correction?

This is a moving target and depends on the reason for the correction and the stocks closely associated with this root cause. The one common theme you will see is weak stocks will get weaker during a correction not stronger.

Remember, cheap stocks can become cheaper.

To figure out the stocks or sectors most impacted, take a macro to micro-filtering approach.

You do this by comparing five or more major indexes. For example, take a look at the Dow Jones, S&P 500, Biotech Index, etc.

This will give you some indication of which sectors are over or underperforming relative to one another.

Once you have identified the sector impacted the most, then drill down into the individual securities that make up that sector. This will give you a list of stocks

#5 – How are Day Traders Impacted During a Market Correction?

There is little impact on day traders during market corrections. If anything, the market is actually providing greater trade opportunities. Remember for day traders it’s all about volatility at the end of the day.

Therefore, day traders should look for short opportunities during these periods of market weakness (again, assuming the correction is a slight bear pullback).

If you are a day trader that prefers to go long you will likely need to focus on the following instruments:

- ETFs that are the inverse of the index

- Gold and other precious metal related stocks

- Stocks in the news (their volatility is often enough to push thru market weakness)

#6 – Should Long-term Investors Continue to Invest During a Correction?

The definition of long-term investing is that you don’t need the money right now. Meaning you are socking money away for your future to ensure the financial well-being of you and your loved ones.

So, if the market is having a pullback, what do you think you should be doing? That’s right, buying.

Reason being, you are going to be able to average in at a lower dollar cost average when adding to your portfolio. This is just a no-brainer as the market on average appreciates better than any other asset.

#7 – How Long Do Market Corrections Last?

Market corrections are generally quick. These corrections can last a few weeks to a few months. If you see a market correction that is lasting a year or more, this is likely a new market trend setting in. This may not be the start of switching from a bear to bull market, but rather a trending market to a sideways pattern.

I was able to find an article on marketwatch that discussed a research effort from the Schwab Center for Financial Research that has cited over 22 market corrections since 1974. Of these corrections, only four resulted in a bear market, 1980, 1087, 2000 and 2007.

#8 – What’s the Difference Between a Market Correction and a Crash?

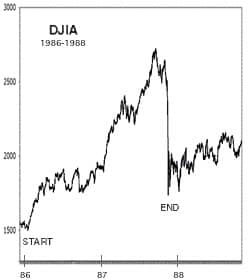

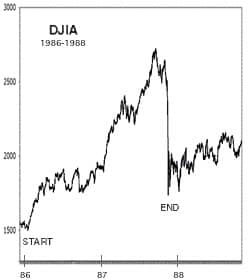

Check out this image from The Bubble Bubble.

1987 Market Crash

Do you see how fast the market fell and how large of a percentage drop? Can you see the difference? Can you feel the pain?

If not, the first way you know the difference is in your bank account. With a market correction, you are going to see a slight dip in your statement over weeks or months. When there is a crash, you are likely checking your account statement every couple of hours and are having thoughts of putting all of your money in cash.

In terms of market fundamentals, a crash occurs when the market sells off greater than 20% and does so in a hurry. Are you familiar with the crash of 87 or the selloff during the mortgage crisis?

#9 – What are Some Examples of Market Corrections from Recent Years

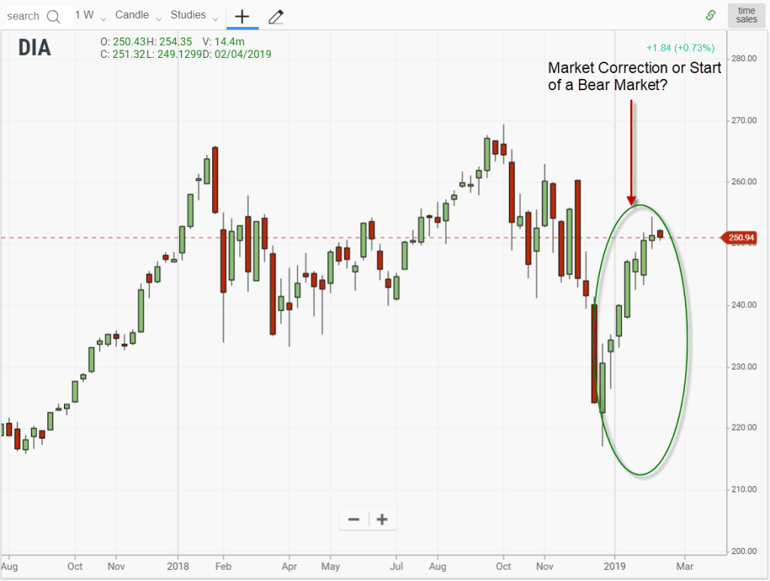

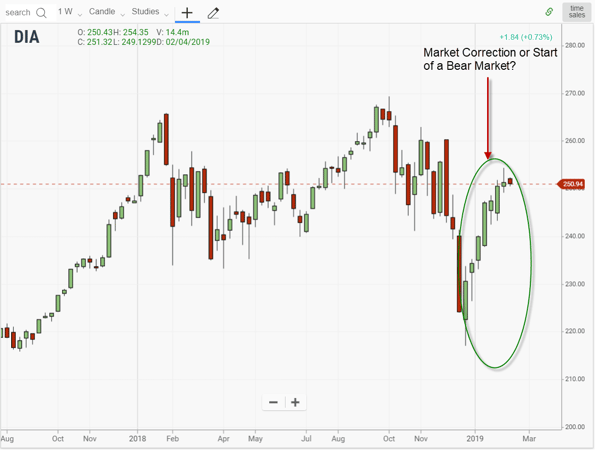

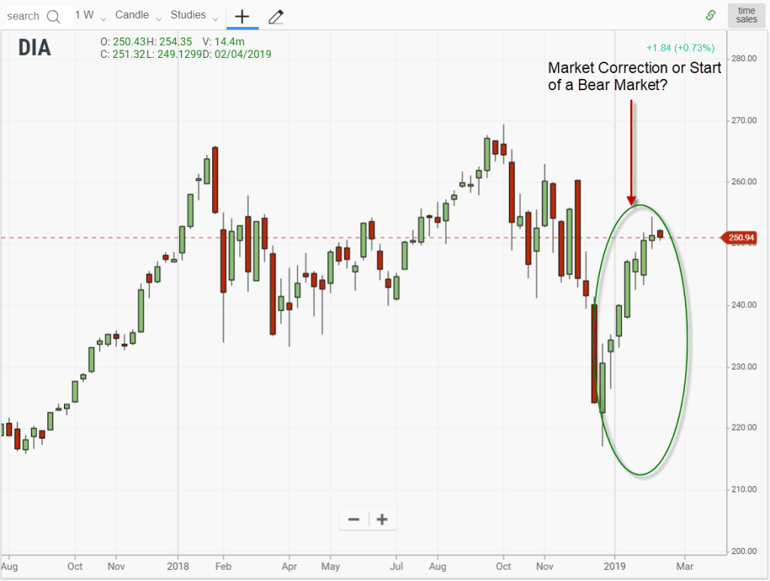

Market Correction or Bear Market

Do you see how hard this is in terms of locating a correction and then also determining whether it’s really a correction or the start of a bear market?

This is the chart of the DIA from early 2019. You can see how the market is starting to have lower tops and the last selloff was steeper. But is this the beginning of something sinister?

What do you think?

How Can Tradingsim Help?

Corrections occur quite often and are a natural part of market behavior. Don’t worry about trying to time some big sell-off as you saw earlier in this article, only 4 of 22 corrections resulted in bear markets.

So, if you are thinking of going over the top bearish, please think again.

You can practice trading market corrections in Tradingsim to work on identifying markers which will help you time and trade this setup. Remember, it’s not just about the market. You can also work on perfecting your ability to trade corrections in individual stocks. These corrections can occur on both a daily and intraday timeframes.

Good Luck,

Al

Basics of Stock Trading

Basics of Stock Trading