We have all enjoyed it, and later suffered from it. Yes, the experience of placing the first order in the market has been often like the first kiss. You do not know what to expect, yet you believe there is an endless world of opportunity within your grasp.

We all start our journey in day trading in much the same way, with our eyes full of hopes, dreaming to reach the land of milk and honey.

At first, you feel so much confidence in your technical system you are certain that financial independence is right around the corner and buying that beach house is just a few clicks.

However, as soon as you experience a loss, you start to doubt your strategy. After facing consecutive losses, your confidence level returns back to earth, if not six feet under.

You immediately go back to the drawing board and try to figure out what went wrong. Why is your proven strategy, which was set to make a killing in the market, suddenly putting a major dent in your wallet?

If you are one of the lucky ones, you will end up in a vicious cycle of trying out strategy after strategy making small profits, only to give it all back in a few large losses. If you are unlucky, you will start trading recklessly with large amounts of money and lose everything in your brokerage account.

Most day traders end up quitting trading because they cannot stick to a proper money management plan on a consistent basis.

Do You Set a Daily Profit Target or Profit Target Per Trade?

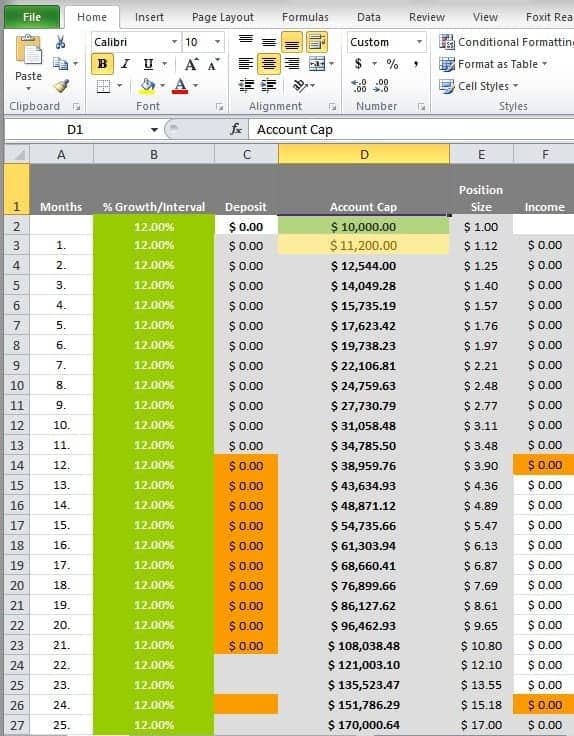

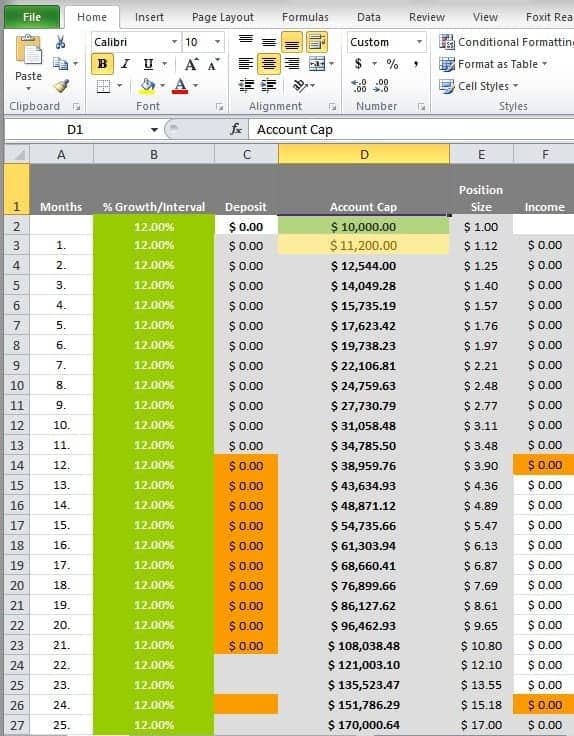

When you first started trading, you probably have read a few books that said if you made X percent of profits every day, the compounding profits would make you a millionaire in no time. Then, you plug a few numbers in an Excel sheet and come up with how much money you would need to make every day to reach your goals.

Compound Return

The reason most of us think of setting daily day trading profit targets is because since our childhood, we were nurtured to become an employee. You work a certain number of hours per day; you are paid a fixed amount. Right?

However, guess what you learn within a few weeks of trading with real money? The universe, and certainly not the market, could care less about your daily, weekly, monthly, or yearly targets.

Trading is so difficult for most people because they do not understand that setting an arbitrary day trading profit target amount per day or week does not work. As long as you keep thinking like an employee who needs to earn a certain amount of money within a certain amount of time, you will keep forcing yourself to make a trade, even when the market conditions do not fit your actual trading strategy. This method of chasing trades will lead to consistent losses.

If you do not set daily or weekly profit targets, you probably fall prey to the concept of setting a profit target per trade. Setting profits per trade is a much better way to systematically day trade. However, if you do it wrong, your expectations may not match the reality and you would end up losing money anyway.

If you change your mentality from setting periodic monetary goals or arbitrary day trading profit targets per trade, and just simply focusing on what is actually happening in the market, you would increase the odds of being successful in your day trading career.

When Should You Have a Fixed Profit Target Per Trade?

Look, there is no reason to feel bad if you target a fixed return from each trade you make. For example, even some professional traders set a profit target based on the amount of risks they take, like setting the profit target at $300, if they risk $100. This way, over a series of trades, they would end up making 3 times more profits compared to their losses with a 1:3 risk to reward ratio.

Moreover, this way, if they lose even 50 percent of the time, they still get to keep decent profits.

Although this strategy imposes certain expectations on the trading system and/or on the market, at least there is basic logic to support the approach.

Consider answering the following questions:

- Do you find yourself unable to hold onto trades until you are stopped out based on your strategy?

- Do you find it challenging to make a profit on a weekly and monthly basis?

- Do you have erratic trading results of up and down days?

- Are your emotions running wild when you are in your trades?

- Do you find that you are stopped out right before the trade goes in your direction?

If you find yourself saying yes to the majority of these questions, then there is a good possibility that you are going through a stage where traders often find it difficult to make consistent profits from day trading.

You might have set unrealistic daily or weekly profit targets that your trading system cannot produce, or your trading is suffering from personal psychological issues that are preventing you from flawlessly executing your technical trading strategy.

Regardless of the reasons, if you have said yes to more than a few questions, you would be much better off setting a profit target per trade.

Once your day trading performance improves and you gain back the confidence in your strategy to let your profits run, you can simply remove the profit target per trade and resume trading as usual.

How to Find the Optimum Profit Target per Trade?

What differentiates professional day traders using profit targets per trade and amateur day traders is how they come up with the profit target to set for each of their trades.

Profit Targets per Trade

Amateur day traders would simply set an arbitrary risk to reward per trade and try to impose that on their trading system. When you are trading with real money, and trying to impose some external expectations on the market, the result will always turn into losses.

Instead, you should print out the transaction history of your brokerage account, login to a trading simulator program and try to find out how far each of your trades would go if you did not close them prematurely. By simulating your own trading strategy and recording the alternative outcomes in a table, you can easily determine the optimum profit target per trade for your trading system.

Finding a Way to Flawlessly Execute Your Strategy

After using the trading simulator and finding the optimum profit target per trade, you should try it out with paper money on a demo account. As you approach your per trade day trading profit target, you will feel the urge to close the trade out early. You must fight this emotion and let each trade play out as you planned.

Profit Targets per Trade 2

After a month of trading with paper money, look at your trade log and compare it against your previous three months of trading activity. If you see that your results are not improving, you will have to adjust your per trade profit target and re-initiate the whole process until you are happy with the results.

Trading is simple, but you must not confuse simple with easy. Most successful day traders have written their destiny with hard work and patience, not arbitrary luck.

Conclusion

You may think you cannot make decent profits unless your trading system generates profits with a set 3-to-1 profit to risk ratio. However, think for a moment, if your system generates a winning trade 90 percent of the time, you would probably get away with a much lower profit to risk ratio and still make a decent profit from day trading, right?

That’s why it is imperative that you re-play your trades in a simulated environment in order to find out what percentage of your trades would go on to make profits compared to the risks you have taken, and only then, try to set the profit target based on your research.

You see, day trading can be as complicated or simple endeavor as you want it to be. By reducing your profit expectations from each trade to a fixed amount based on your risks and trading system’s capability, in essence, you are taking the ambiguity out of day trading. At the end of the day, making money from trading is what we are after, and it does not matter how simple or complicated your strategy.

Overlay Indicators

Overlay Indicators