Cattle Futures

Cattle futures are part of the livestock futures category. Just as with any other futures contract, cattle futures contracts are legally binding agreements between the buyer and seller, to take and make delivery of cattle.

There are many different types of livestock futures contracts that can be traded which have significant enough volumes so that you can day trade the cattle futures contracts with relative ease.

These futures contracts are all standardized contracts with the cattle futures prices being negotiated at a futures exchange such as the CME group or electronically negotiated and settled on the Globex platform. Cattle futures first started trading at the Chicago Mercantile Exchange in 1964 and have a long history in the futures markets.

Cattle futures are popular due to the fact that cattle have many uses from milk and meat to commercial uses such as leather and labor. The major participants of cattle futures are primarily hedgers who are very likely involved in a business related to livestock such as ranchers, manufacturing industries in leather and other similar sectors.

Although dominated by hedgers, speculators and intraday futures traders can trade cattle futures, but it is essential to close the futures contracts to avoid taking delivery of the livestock. Of course this is quite rare in this day and age as your futures broker will most likely inform you about closing out your long or short positions on the futures contracts that you might hold before the contract expiry date.

Before you begin trading cattle futures, there are at least five things you must know.

- Types of cattle futures contracts

- Cattle futures contract specifications

- How are cattle futures contracts priced?

- Fundamentals governing the cattle futures prices

- The USDA’s monthly Cattle on Feed report

#1 – Types of cattle futures contracts

Cattle futures contracts come in two main categories or contract types.

- Live Cattle

- Feeder Cattle

The difference between the two sub-sectors is the age and weight of the underlying (cattle).

Live cattle category is made up of cows from the calf stage and up to 600 – 800 pounds with about 6 – 10 months for the calf to grow to the estimated weight group. Cows above this age and weight group are designated into the Feeder cattle category. The feeder cattle are fed with the goal of gaining weight before processing.

The feeder cattle must be mature enough to be fattened and it takes usually 3 to 4 months for this process. Corn is one of the main foods used to fatten the cattle and therefore corn prices also have an indirect impact on the price of feeder cattle.

#2 – Cattle futures contract specifications

The contract size for the cattle futures are 40,000 pounds or 50,000 pounds respectively and priced in cents per pound and approximately representing 35 head, of cattle. The tick size is $0.00025 per pound or $10 per contract for Live Cattle and $12.50 per contract for Feeder Cattle.

The Live cattle contracts come with physical delivery while Feeder cattle can be settled for cash. Both the cattle futures contracts have different contract months.

The table below gives a summary of the Live and Feeder cattle contracts.

| |

Live Cattle |

Feeder Cattle |

| Contract Size |

40,000 pounds |

50,000 pounds |

| Price Unit |

Cents per 100 pounds |

Cents per 100 pounds |

| Min. Tick Size |

0.025 ($10 per tick) |

0.025 ($12.50) |

| Delivery Type |

Physical |

Cash |

| Contract Months |

Feb (G), Apr (J), Jun (M), Aug (Q), Oct (V), Dec (Z) |

Jan (F), Mar (H), Apr (J), May (K), Aug (Q), Sep (U), Oct (V), Nov (X) |

| Ticker Symbol |

LE |

GF |

As with any futures contracts, trading cattle futures contracts also requires an initial performance bond followed by a maintenance margin. This can vary from one futures brokerage to another, but on average, the initial margin required is around $1225 for Globex Feeder cattle and about $825 for Globex Live cattle.

#3 – How are cattle futures contracts priced?

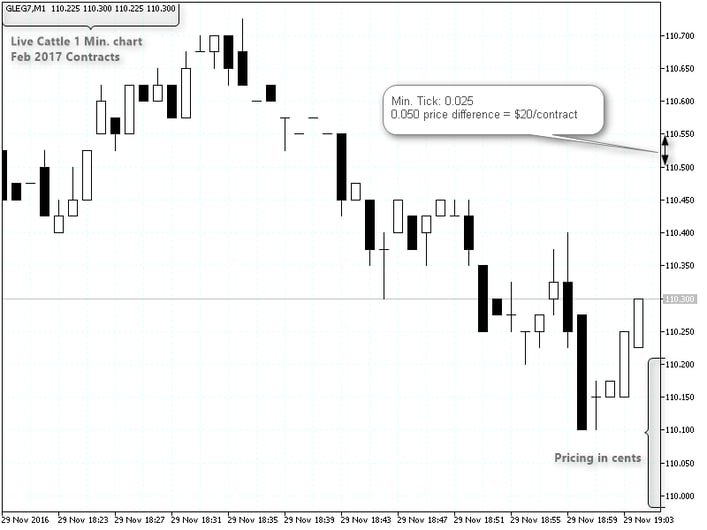

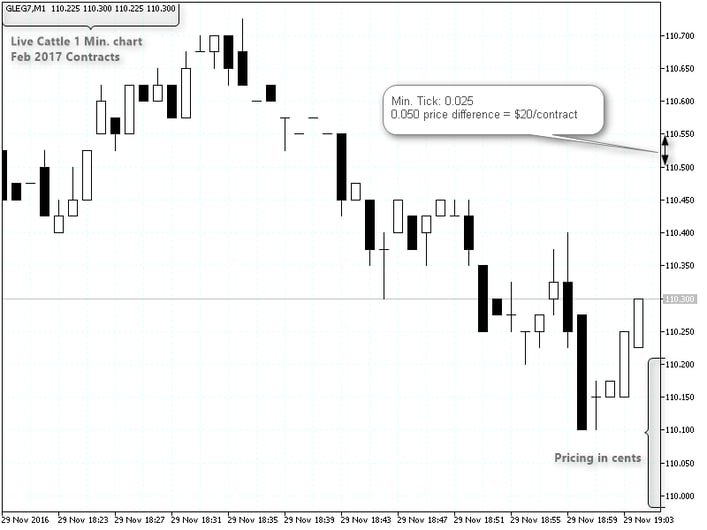

Live Cattle 1 Minute Chart

The pricing for cattle futures contracts can be a bit confusing to understand as it is not as straight forward as say trading crude oil or gold futures.

The price you see on the cattle futures charts is for a per pound basis, priced in cents; meaning that the current price of 110.300 in Live cattle futures chart is 110.300 cents (or $1.10300)

Therefore, a minimum move of $0.00025 equals to 110.325 cents. On your chart, this would be displayed at 110.325.

So if you purchased one contract in Live cattle futures, and price moved from 110.300 to 110.325, that is a 0.025 tick move and with each tick priced at $10 per contract, that results in $10 profit.

#4 – Fundamentals of trading cattle futures

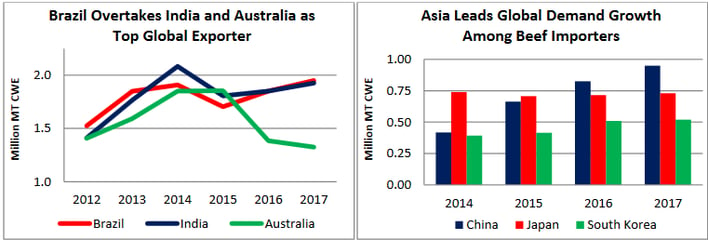

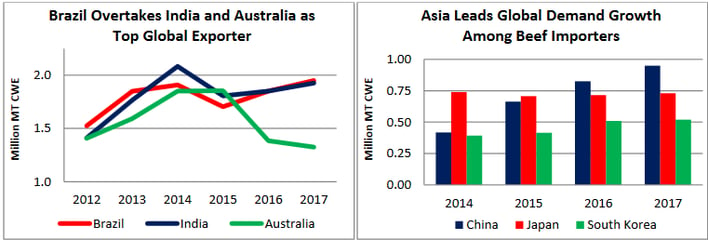

The biggest cattle production countries in the world include India, Brazil and China which combined is estimated to have around 300 million cattle, followed by Africa (200 million). The United States accounts for nearly 25% of the world’s beef production despite representing just 10% of the world’s cattle.

When trading cattle futures contracts, it is important to understand the fundamentals responsible for shaping the market sentiment and thus prices. The cattle futures prices can be susceptible to various factors. Some of them include diseases such as mad cow which you may have already heard of. Below are some factors to bear in mind when you day trade cattle futures.

Environmental effect: The United Nations says that cattle farming contribute to at least 18% of greenhouse gas emissions with methane being the primary pollutant. The harmful gas produced in the digestive system of the cattle is said to be worse than carbon dioxide.

Diseases: Cattle often see periods of infectious diseases and outbreaks, with mad cow being the most well known. The technical term for this disease is called Bovine Spongiform encephalopathy (BSE) with frequent outbreaks leading to ban on imports and exports from the affected regions as well as countries. For example during the height of the mad cow disease, Japan which is a large importer of U.S. beef had temporarily put a ban but later lifted the ban but imposed heavy restrictions.

Imports and exports: Although the US produces 25% of the world’s beef, it is still a net importer of the product. Imported beef is primarily used as ground beef and the imports can be affected by various factors such as purchasing power, inflation or dietary habits.

Weather: Weather can also be a huge market mover in the cattle futures. High temperatures not only kill the cattle but can also make it difficult for the cattle to gain weight. Extreme weather conditions of course can wreck complete havoc on cattle and hinders the long term production.

USDA Projects Brazilian Exports

#5 – The USDA Cattle on Feed Report

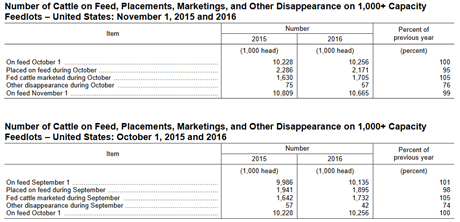

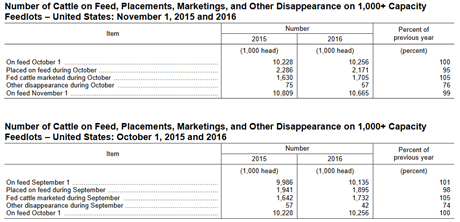

The United States Department of Agriculture releases a monthly report called the Cattle on Feed Report, which is an important report that cattle futures traders should follow. The monthly publication reports data on,

- the number of cattle in the U.S. feedlots,

- the number of cattle being placed in the feedlots and

- the cattle being marketed for slaughter.

The report is released every third Friday of the month at 3 p.m. Eastern Time and covers the period for the beginning of the month. The report is published by a survey from the USDA’s National Agricultural Statistics Service (NASS) and covers 17 states which approximately represent 98% of all the cattle on feed in the United States.

The USDA’s report has a strong influence on the cattle futures contract prices, including both live and feeder cattle. Therefore, if you want to trade cattle futures, mind the date and also pay attention to the data that is published.

The typical market response to the USDA’s report is the actual versus the estimates.

The higher the reported cattle on feed number relative to the estimates, the market sentiment is bearish, while if the reported cattle on feed number relative to the estimates in smaller than expected, it can be bullish for the cattle futures contract prices.

USDA Cattle on Feed Table

The picture above gives a snapshot of the table from the USDA’s Cattle on Feed Report. You can access the latest reports from this link with archives going all the way back to 1940’s.

#6 – The Hillary Clinton – Cattle Futures controversy

In a widely publicized news event, it came to light that Hillary Clinton in 1978 and having an annual income of $25,000 made significant sums of money trading cattle futures. The controversy comes from the fact that Ms Clinton managed to trade 10 cattle futures contracts with only $1000 in her account at the time.

At an initial margin of $1225, trading 10 contracts requires a total initial margin of over $12000 besides having to account for the maintenance margin. Therein lays the controversy about how Hillary Clinton managed to get away and also ended up making around $100,000 without having enough funds to cover the costs and requirements for trading cattle futures contracts.

Some call it a “success” but the details are still murky.

It is said that her first cattle futures trade was a short sale for 10 contracts at a price of 57.55 cents a pound and a day later she closed out the contracts at 56.10 cents making a profit of $5,300. Ten months later, her futures trading account up was $99,541, which was about 10,000 percent return on her initial investment. Her success in cattle futures trading put her in a league that of the legendary George Soros.

However, during a press conference many years later, Mrs. Clinton attributed her success to her advisor James Blair who was a lawyer for Tyson Foods Inc.

When Washington issued an investigation into Clinton’s futures trading records, Leo Melamed the former chairman of the Chicago Merchantile Exchange and Jack Sandner the current chairman did not find anything irregular expect of course trading on insufficient margin with Melamed famously calling it “tempest in a teapot,” noting that anyone could have done as well.

Whether Mrs. Clinton traded all by herself or with help of a “very good” investment advisor the main takeaway is that while cattle futures are risky contracts to trade, there is potential to make big money.

Trading Cattle futures offers day traders the potential to make large sums of money, but it does come with the risk of price volatility. However, if you look at the profit potential, cattle futures, be it live cattle or feeder cattle futures contracts definitely offer bang for the buck. By paying attention to the fundamentals and applying some technical analysis, intraday futures traders can definitely look at making consistent profits trading cattle futures.

Commodity Futures

Commodity Futures