Copper futures are one of the few financial derivatives that track an underlying asset that actually has practical use in the real world. Copper or high grade copper (HG) is widely used in water pipelines, building materials, power lines, electrical motors and appliances, healthcare and many more. In short, copper is used in industries that are known to shape the future.

Trading high grade copper futures is not everyone’s cup of tea. The larger contract size means that traders can either make it big or lose it big within a day’s session of trading. Unlike trading the more familiar futures such as indices (E-mini Dow, S&P500, etc.) or currency futures, trading high grade copper futures requires the trader to be more diligent in understanding the overall landscape of the copper market and how the market stands at the time.

Even for day traders, trading high grade copper futures will require a lot of homework to understanding the various factors that play a role in shaping the prices of the base metal. At the end of it all, despite the large amount of legwork that needs to be done, trading high grade copper futures can be profitable if a trader is able to approach the copper markets with discipline and with precision.

Copper is said to be one of the few commodity futures that has the potential to predict turning points in the global economic growth. Some even go as far as to call copper, the metal with a PhD. For a commodity that has such a high impact on the global playing field, trading copper futures without first understanding the factors or challenges that come with trading this base metal futures can lead to losses, something a trader could have easily avoided had they paid more attention to the current economic conditions.

For the day trader and even for futures swing traders, here are the six most common challenges of trading high grade copper futures.

#1. Copper futures and the global economy

Copper is an important commodity to the global economy. Industrial metals are one of the most sensitive metals and can be susceptible to the economic trends because of their far reaching uses. From building to manufacturing, copper is one of the most commonly used metal as it is a good conductor of heat and electricity. Due to being resistant to corrosion, copper is used in plumbing, heating and cooling, both in residential and commercial sectors.

A steady upward price trend in copper futures typically signifies an expanding economy. But copper futures trends are not as straight forward as it seems. Rather, copper futures tend to lead or lag the pace of economy, which is an important factor to bear in mind. Conventional wisdom tells that rising copper prices signal an expanding economy and falling copper prices signal a slowdown. But depending on the economic cycle this can change and the relationship isn’t how it is made up to be.

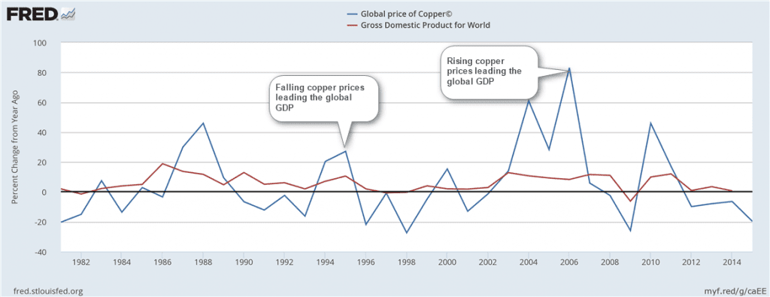

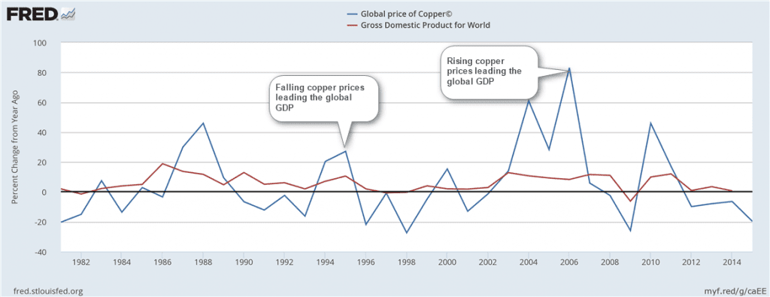

Copper prices leading the global GDP

The first chart above shows how copper prices lead the global GDP into the troughs and peaks. The two areas marked on the chart shows copper prices rising ahead of the GDP, which eventually see’s the global GDP rising. Similarly, after forming a peak, copper prices start to decline sharply which is later followed by weaker global GDP.

For the day trader, it is essential to understand at what stage of the business cycle the world is in currently. Typically, the peaks and troughs in the copper prices can play a role in helping the trader to determine at what stage of expansion or contraction the global economy is at. This can be determined by looking at the trends in both the global GDP as well as the long term trends in the copper prices.

#2. Copper production trends

The top five countries leading copper production are Chile, China, Peru, United States and Australia. The production trends can play an important role on the supply side of the markets. Copper prices have been in a downtrend for the most part of 2015 and managed to regain some of the losses in 2016. However, copper prices remain well below the $3 per pound region on account of reduced demand from China.

Following production trends is an important factor when trading high grade copper futures as the copper prices can be influenced by rising or falling production levels in relation to the projected demand. When following copper production trends, traders need to focus on weather and other factors that can disrupt production. For example, Chile’s production fell 50 tonnes in 2015, from a year ago as the country was hit by earthquakes and heavy rains.

On the production, there has been a slow by steady decline especially as discovery of high grade copper deposits have become increasingly less frequent. The underground mine production capacity also plays a major role as reduced production could result in shortage of copper.

Strikes at the mines also play a major role in shifting the price dynamics in high grade copper prices. Mining strikes are nothing new to the markets and can affect in the short term the supply of copper. Mine strikes typically last for a few weeks to a month at the most but can tend to impact the short term prices of copper futures.

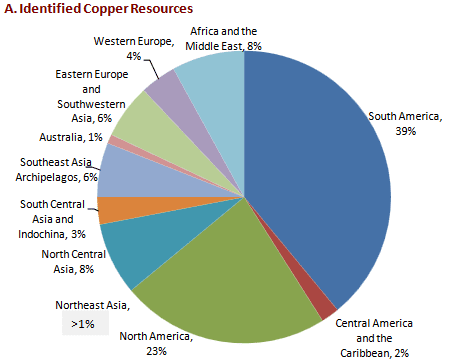

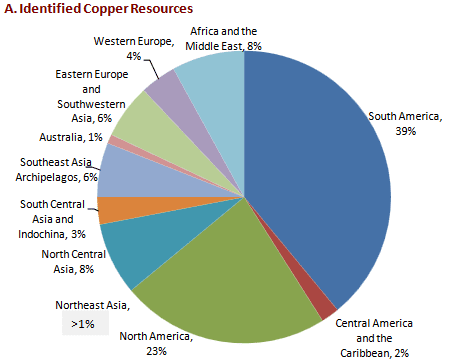

As of 2015, the identified copper resources have been said to be heavily concentrated in South America, accounting for nearly 39% of the world’s identified copper resources.

World copper resources-2015 Source icsg.org

As copper futures traders, it is essential to keep an eye on the region and also the individual countries (Chile, Peru, Brazil and Mexico) in South America by following potential supply increase or decreases that could bring short term impact on copper futures prices.

#3. Copper usage by sectors

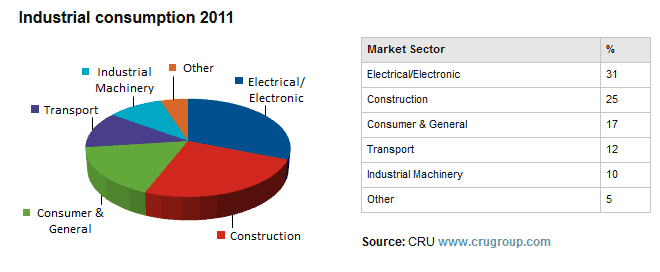

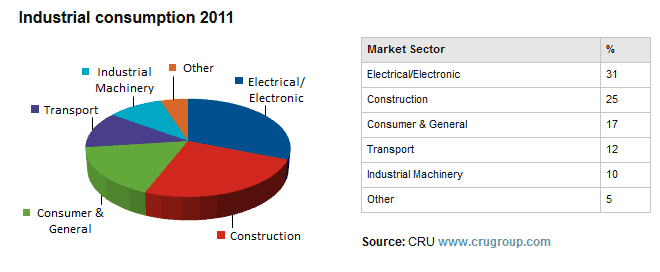

Because of the wide reaching uses of copper, the seasonal cycles in the various industries can also influence the price of copper futures. For high grade copper futures speculators it is a challenge to keep track of the sector wise business cycles. Copper is a widely used element in transportation, heating, telecommunications, electrical purposes and so on. Not all industries behave in the same way and there are times when a downturn in one industry could be offset by increase demand in another industry.

For copper futures traders, it is always important to keep track of the broader economic factors that can influence the price of copper. Among the various industries, copper usage is heavily consumed by the housing construction sector.

Copper usage by industry (Source LME, CRU group)

Copper futures day traders can look at short term cycles in the U.S. construction sector to ascertain the potential demand for the metal. Looking at the economic reports such as the ISM’s manufacturing PMI report released every month can offer traders insights into how particular industry sectors are performing and also gives an outlook on the coming month’s business prospects.

#4. Demand from China

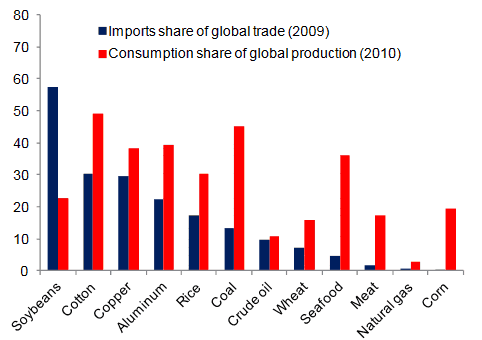

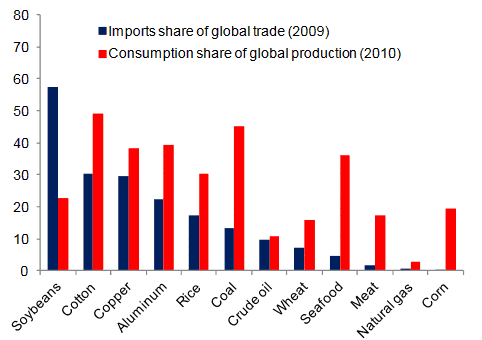

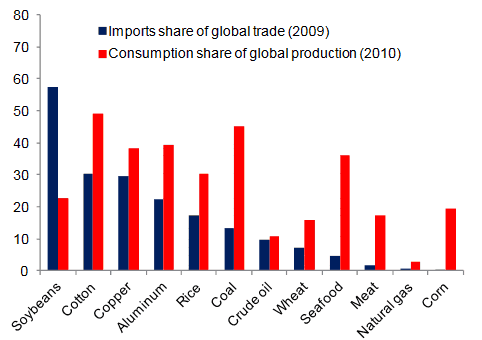

Demand for copper from China is one of the biggest single factor that can heavily influence the price of copper futures. China is considered to be a major participant in the world commodity markets which in turn tend to influence the world’s terms of trade and even affecting inflation. Day traders in the copper futures markets should understand the scale of China’s impact on the global commodity market to help better assess the balance of risks for prices. Copper ranks the third in the list of commodities heavily consumed by China.

China, global commodity imports 2009 – 2010. (Source United States Department of Agriculture, United Nations COMTRADE database, World Metal Bulletin Statistics, IMF

It is estimated that China’s consumption during 2010 accounted for nearly 40% of base metals, reflecting the rapid growth in the region, which has started to slowdown over the past few years. China’s demand for copper is accounted for by the heavy infrastructure development and investment in the construction sector during the rapid growth years which helped to keep copper prices in a steady uptrend.

#5. Mining companies

Copper futures day traders also need to go to the source of the commodity, which is mining to get a better idea on the supply/demand dynamics. Some of the major mining companies to keep an eye on include Cochilco (Chilean Copper Commission) from Chile, Rio Tinto Group, Freeport-McMoRan Inc. These mining companies are heavily invested in the mining sector which also includes mining for copper. At regular intervals these companies release key market data and forecasts which can affect the copper futures prices in the near term and could potentially trigger a shift in trends as well.

With Chile ranking as the top copper exporting nation, Cochilco’s industry reports and market trends are some of the key reports to keep an eye on if you want to trade copper futures.

#6. Trading the copper futures

Finally, the biggest challenge in trading copper futures is of course, the commodity itself and the technical or fundamental approach used to day trade the high grade copper futures markets. Traders should bear in mind that the minimum tick size in Copper futures is $0.0005 having a tick value of $12.50. The day trading margin requirements for copper futures are slightly higher than the easy and higher liquid futures instruments such as the E-mini indexes or currencies.

Trading copper futures purely based on a technical approach can be risky as the trends in the market tends to be strong and entering a trade without looking at any potential upcoming market reports could mean entering on the wrong side of the market with the potential to get whipsawed. There are days when clear intraday trends are formed on the copper price charts and then there are days when copper price simply trade in a range. Therefore, day trading copper futures requires a bit more homework from the futures trader to account for all the potential possibilities ahead of entering a trading position.

While trading copper futures might pose a few challenges, the rewards can also be very encouraging for the day trader especially if they pay careful attention to the fundamental factors that shape the copper futures markets on a day to day basis. With a decently priced tick size, trading copper futures, part of the commodities/base metals markets can offer impressive rewards.

Commodity Futures

Commodity Futures