Trading Limits

Good traders are known to be masters of risk management. Risk management includes a detailed trading plan, setting stops and limit orders and managing trades without succumbing to emotions.

The focus for these traders is capital preservation with profits running a strong second.

Time Intervals for Setting Limits

The key to preserving profits is setting limits on a daily, weekly and monthly basis.

Trading with limits ensures that you “put the curbs” in when you are experiencing a losing streak.

When the daily loss limit is reached, disciplined traders shut the computer off. This same rule of shutting it down applies for weekly and even monthly periods.

How Trading Limits Help Tame the Beast

Setting a trading limit has many benefits. It may seem counterintuitive as the word limit generally mans restrictive.

As a trader, you will have times where your emotions get the best of you, and you begin to over trade and make poor decisions. Letting your emotions get the best of you is subtle at best and creeps up on you.

It’s not like you are screaming at your computer and throwing monitors. It’s more about slowly losing the discipline and letting slight deviations from your trading rules.

This may occur in the form of you widening your stops or adding too much size to a position. It’s these small diversions from your plan that lead to big losses.

This again is where the trading limits come into play as it stops you before you do too much damage to your account – hence taming the beast.

Reduce Emotional Pain

One thing that isn’t talked about enough in the trading community is the trauma you experience with big losers. All sorts of fight or flight, caveman level emotions will run through your body.

Let me be first to say trading does not need to carry this level of stress and worry. Limits will help you reduce the drawdown in your account.

You should never experience days where you are down 20% on your account. Again, beyond the drawdown, imagine the damage done to your confidence and psyche with that level of short-term loss.

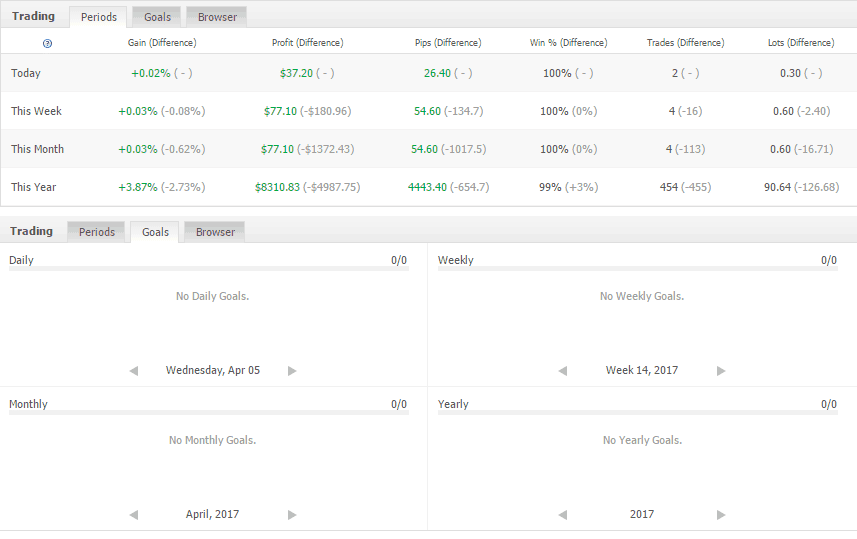

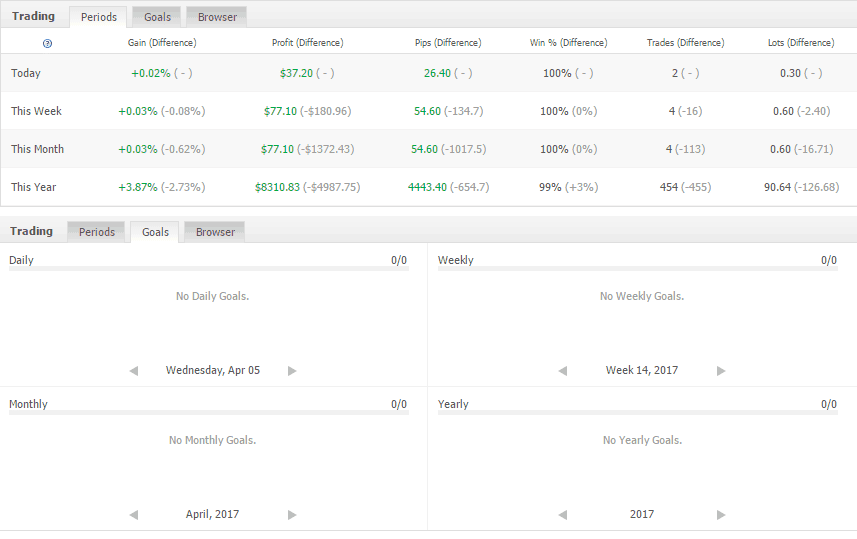

Tracking Your – Daily, Weekly, Monthly, and Yearly Limits

Setting trading Goals-Limits – Daily, Weekly, and Monthly (Source – MyFxbook.com)

In the above image, you can see the daily, weekly, monthly and yearly numbers in terms of profits and losses in this online trading journal. These online journals will have a setting to alert you if your trading limit is breached.

Ideally, your trading platform will automatically lock you out of your account, but most retail brokerage firms have no interest in protecting you our your money.

So, if your brokerage firm does not provide the alert, this is something you will need to do manually by having alerts trigger once you go beyond your limit.

Again, you can use an online journal which imports your trades like tradervue, or you can manually track your trades in excel. I will be the first to admit that when I have been on a losing streak in the past, I have not wanted to track anything. The sight of the market or my trades made me sick.

Just know your limitations and what system works best for you in terms of measuring yourself against your limits and make sure you protect yourself.

How to Set Trading Limits?

This is a value that only you can set. This limit should be determined based on your trading results.

Meaning if one person sets a trading limit of 1% of their portfolio for the day, you might hit a 1% intraday loss on one trade because your strategy calls for more volatility.

You just need to focus on figuring out the right number for the daily loss limit that works for you.

You can then take this amount and extrapolate it for the week and the month.

What Happens When You Hit Your Limit?

We have already made it clear that once you hit your limit, you stop.

But stopping alone is not going to fix the bigger issue that you are making poor trading and money management decisions.

Lower Per Trade Amount

Once it’s time for you to start trading again, the first thing you are going to want to do is lower the amount of money you are using per trade.

If you are unable to turn a profit, it’s already bad enough. But if you are hitting weekly down limits, the last thing you should be doing is trading with size.

The reduction should be severe. Such as a 50% reduction in the amount of funds per trade. If you are still unable to get a handle on things, you will want to increase your reduction to 90%.

It should get to a point you are even wondering why you are trading because your trade size is so small that even if you win, you won’t be able to take a date to the movies with the profits.

Remember, it’s about building the discipline and not about how much money you can make.

Trade on a Simulator

You may need to place more trades to get out of your reckless behavior. However, the last place you should trade is in the live market.

To this point, you can work through your recklessness in a market replay tool like Tradingsim.

If you can’t respect the limits in the simulator, you are not going to hit your goals in a live account.

Analyze Your Trades

The one positive out of hitting your limit is you have trade data to review. Meaning you can look at what you got right and what didn’t go so well.

See if your issue is losers that you let get away from you or a string of bad decisions.

One thing I have learned throughout my trading career is the power of finding out how you can improve by reviewing the data.

Profit Potential

For example, how far do your stocks run? This will help you understand the maximum profit potential you can make on a trade.

Time In Trade

A big improvement for me was analyzing how long it takes for my winners to work out. Once I had that number if I was in a trade and I was exceeding this average time I knew I was in hope mode and not trade mode. You will be surprised how many of your losers come down to sitting in trades too long that are just not going to work out.

Volatility

I had to find out the hard way that I’m not built for trading penny stocks. I just couldn’t handle the volatility, and things would get away from me too fast even if I were using a small amount of money.

Journal

Journaling will uncover all the things you are hiding, even from yourself. It will force you not only to review your trades, but also figure out what is going on in your head which is sabotaging your trading performance.

Use this time off to update and review your trade journal. Then spend hours in your market replay tool to see if your emotions match what was happening on the chart.

What the Pros Suggest

Mike Bellafiore, trading mentor, co-founder of SMB Capital and author of the best sellers, One Good Trade and The PlayBook recommends that traders should limit their losses to half of a good day.

So, if you normally make 1,000 per day, you should look to risk no more than 500. This ensures you never let things get too far out of control.

How Can Tradingsim Help

You can use Tradingsim to set your daily and weekly loss limits to see if you can exercise discipline.

Remember, loss limits are not a bad phrase. You need to learn to do less in terms of size and trading activity until you can reach the point where you can make profits consistently.

Day Trading Basics

Day Trading Basics