Commodity ETFs or exchange-traded funds are a great way to either diversify one’s portfolio or to trade different assets. As a day trader, it is quite likely that equities are the first choice. But did you know that commodity-based products can offer you exposure to a different type of assets?

No matter how you look at it, commodity ETFs offers day traders some unique characteristics. For example, did you know that commodities, in general, follow a different set of fundamentals?

What this means for you as a day trader is that commodity ETFs are ideal to trade in different market conditions.

Although supply and demand dictate the underlying price volatility, commodity ETFs behave differently from other assets.

But there’s more!

Exchange traded funds are also innovative products. It is because of this innovation that makes them so attractive to traders all over. Prior to the advent of ETFs, the average day trader or the investor could only look to the futures markets.

With exchange-traded funds, it is possible to find different types of funds that can acutely cater to one’s investing or trading needs.

Exchange traded funds have grown in popularity in the recent years. Due to an increase in competition, most of the big ETFs now come with low management fee. This makes it easy for just about anyone to trade.

The first exchange-traded fund was created in 1993 by State Street Global Advisor and began trading as Standard and Poors Depository Receipts. This is now widely known as SPDRs or spider ETFs.

Exchange traded funds began to innovative and growth exploded since early 2000. In a 2017 ETF report published by Ernst and Young, the global ETF assets totaled $4.4 trillion by the end of September 2017 with a cumulative average growth rate of 21%.

To put this in perspective, global ETF trading volume was around $417 billion in 2005. In the next three years, EY estimates that volume in ETFs could increase by as much as $7.7 trillion.

But before we get into the details, it is important to understand what commodity ETFs are and what makes them so unique.

Overview of commodity ETFs

A commodity exchange-traded fund that invests in the physical commodities. For example agriculture goods, natural resources, precious metals and so on. Besides investing in the physical commodity, you also have ETFs that track the companies.

Such ETFs invest in the activity of companies directly involved in some way with the commodity. Typical examples include mining companies, oil refineries, drilling companies, transportation and logistics companies and so on.

If you notice by now, you would see that commodity ETFs allows you different levels of exposure.

No more having to trade just commodity derivatives!

Commodity ETFs can open you to a world of possibilities with the ability to track and trade unique ETFs.

But what does this mean for you as a trader?

The flexibility that comes with the commodity exchange-traded funds means that you can trade both the bull and bear markets.

Commodity ETFs are broadly classified into the following types:

Broad ETFs: These are the most diverse set of exchange-traded funds. Broad ETFs either track a wide range of ETFs such as multiple commodities and funds that track a select set of industries.

What’s unique about broad ETFs is that due to the diversification, they tend to offer better protection against market shocks.

Commodity specific ETFs: These are ETFs focusing on a specific commodity. For example, you could have Oil ETF that focuses on different variations of crude oil. Examples include Brent Crude oil, or the West Texas Instrument (WTI).

Industry specific ETFs: AAs the name suggests, these ETFs track specific industries. In many cases, industry-specific ETFs track companies that are closely involved with the commodity. Examples include ETFs that are involved in drilling and refining of crude oil. Or it can also be mining companies in the natural resources or precious metals sector.

How to rank ETF

The first step to successfully trading commodity exchange-traded funds is to filter them. The criteria can be based on a trader’s choice or risk aversion. The important point to remember is that your success does not just rely on the ETFs that you pick.

This research paper from Mohammad Sharifzadeh gives a performance overview comparison between exchange-traded funds and index funds.

According to the research paper, different kinds of ETFs tend to perform differently compared to their closely related index fund. Therefore, it is essential that when ranking the ETFs you need to pay close attention to your investing or trading goals.

The first thing to understand is the difference in the ETFs. In many cases, you will come across exchange-traded funds that are either active or passive funds. An actively managed ETF has a fund manager who takes trading decisions.

Such ETFs have higher costs.

On the contrary, a passive ETF is one which simply tracks the entire index or a sector. This can mean tracking just one commodity or a commodity index. The returns from a passive ETF often mirror the returns of the fund or index that it is tracking.

Criteria to consider when ranking ETFs

As a day trader, there are a few things that are critical. These aspects are:

Liquidity: This will determine the ease with which you can day trade without incurring extra costs such as slippage or spread. Liquidity is important especially if you want to day trade few times a week.

A good way to measure liquidity is the asset under management metric. The AUM measures the total market value of the dollars invested in the ETF.

Costs: It is widely known that exchange-traded funds also have additional fees. The expense ratio shows you the fee charged for every $1000 that you invest.

So how does this translate to costs for you as a day trader? Take a look at the example below.

If you were to day trade a position of $1000 in an ETF with an expense ratio of 0.5% (quote per annum) this means that you pay $5.00 per annum. For the day, the expense ratio would come to 0.0014%.

So, for a $1000 position that you hold on an intraday basis, you would pay $0.014.

Volume: The volume of the exchange-traded fund that you trade is also important. An ETF with a good volume enables you to trade in an out with ease. This is true when you want to trade with larger units or volumes.

You can measure ETF volume by the metric of Average Daily Volume or ADV.

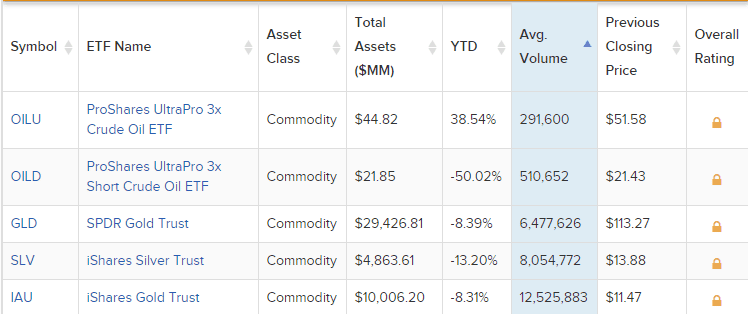

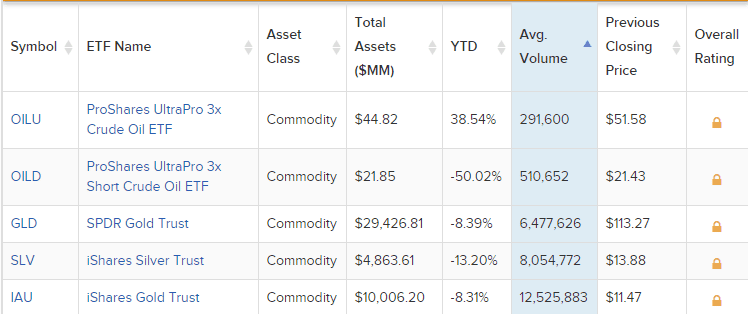

Top five ETFs based on the criteria

From the above-listed criteria, we can now select the top five ETFs. In the list below the criteria selected was as follows:

- Asset Class = Commodities

- Commodity Exposure = Futures backed and physically backed

- Included both active and passive funds

- All leverage

- Commission Fee = No

- Expense ratio up to 0.50%

- Average Daily Volume of 100,000 and more

From the above criteria, we get the below ETFs.

Top Commodity ETFs. Source: ETFdb.com

The above table is sorted based on the average volume. If you sort the above table based on the total AUM, you can see that the SPDR Gold Trust (GLD) is the largest. Further criteria you can use include the total returns.

But of course, this is dependent on the underlying asset’s performance. You can see negative returns for some of the ETFs. This is because these ETFs are passive and they track the performance of the underlying asset. This happens to be precious metals such as gold and silver for example.

Similarly, if you look at the Oil ETF, the leveraged Proshares ETF shows the inverse ETF with negative returns, while the Proshares UltroPro ETF tracking Crude oil has 38.54% return on a year to date basis.

What’s important to note from the above is that the criteria selected can vary. For a day trader it is important to pay attention to metrics mentioned above.

Five things to remember when trading commodity ETFs

Trading commodity ETFs based on technical indicators is not very different from trading stocks. Therefore, any existing strategy can work well on commodity ETFs as well.

From a fundamental perspective, investors must pay attention to the information. Supply and demand, and to certain extent, the global economy can influence the commodity markets.

As a result, investors need to pay attention to reports that are specific to the commodity markets.

Here are five things to bear in mind when trading commodity ETFs.

#1. Commodity reports

Commodity reports are released on a quarterly basis. Some of the well-known reports that tend to move the commodity markets include:

The USDA’s National Grain report, the weekly crude oil inventory report, oil forecasts from the U.S. Energy Information Administration to name a few. Broadly put, the commodity reports for the respective commodities influence the price.

The commodity report gives a complete overview of the commodity markets. This is a market moving report and can also result in changing trends in the commodities.

#2. Geopolitics

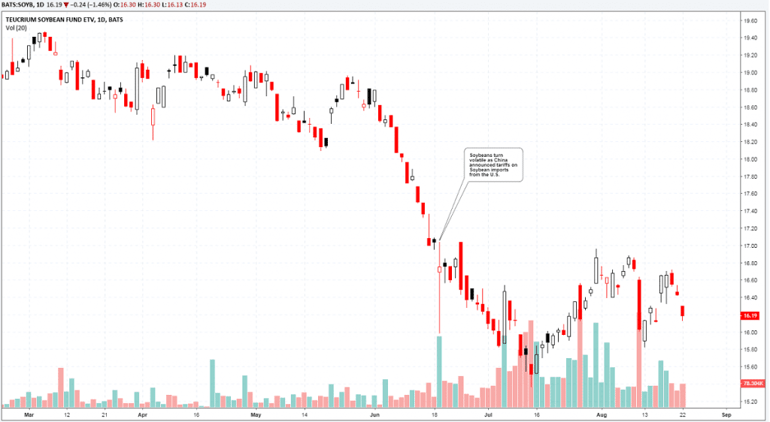

The world is closely connected and therefore geo-politics play an important role in the commodity markets these days. Geopolitics gained prominence, especially under the Trump administration. With the U.S. currently engaged in a heated trade war against China, commodities were widely affected.

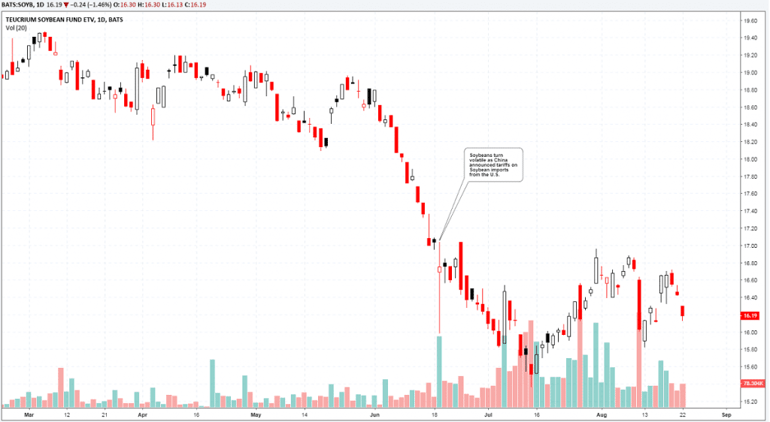

The chart below shows how the Teucrium Soybean ETF fund (SOYB). This ETF, for example, turned very volatile on June 18th. The reason behind the volatility was that China announced retaliatory tariffs on U.S. soybean imports.

SOYB impacted by China’s tariffs on U.S. soybeans

#3. Weather

When it comes to some commodity markets such as grains and livestock weather plays a huge role. This is because the planting and harvesting cycles are seasonal. The right weather conditions can certainly establish the future supply chain trends.

When you are trading similar commodity ETF’s, it is important even for day traders to get a rough idea on the weather reports. Initiating a position without knowing the fundamentals can prove to be disastrous.

Coffee and cocoa ETFs, for example, are susceptible to the weather reports. Because countries such as Brazil are one of the largest producers, the weather reports from Latin America have the ability to change the market perception.

The risks also increase further when you trade leveraged commodity ETFs.

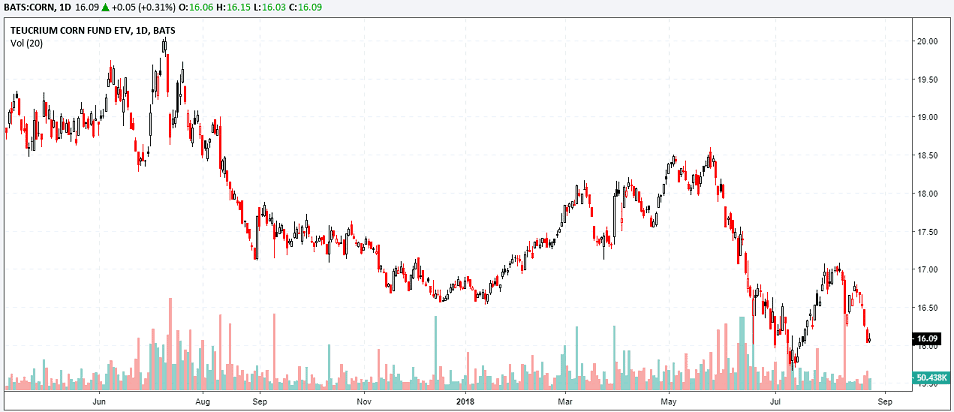

#4. Commodity Trends

Although not entirely fundamental, commodity trends are an important aspect that one cannot ignore. Trends are very prominent and well established in the commodity markets.

As a result, passive commodity ETFs follows the same pattern. In such instances, it is important for the day trader to first understand the long-term trends. This will enable you to position yourself in the right direction.

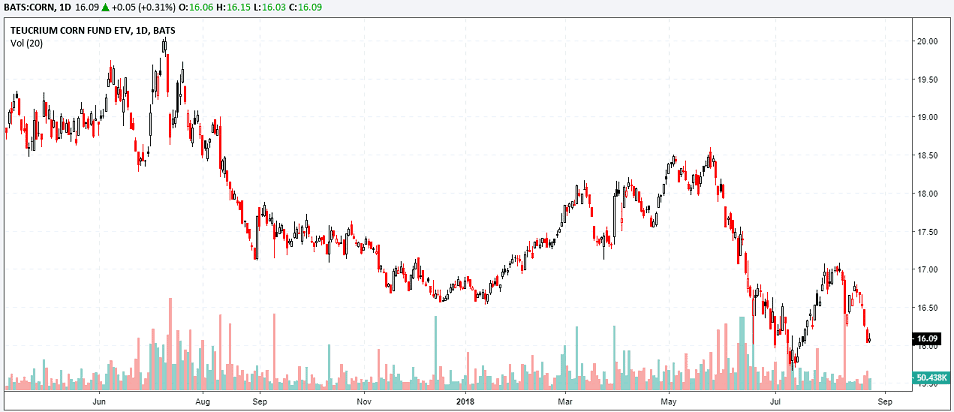

The chart below shows the Teucrium Corn Fund (CORN). You can see how the trends in the Corn ETF are strongly established.

What’s common to the commodity markets is that the trends tend to last over months to years.

Trends in the CORN ETF Market

When you understand the prevailing trend in the commodity you are looking at, trading these ETFs can give you an edge.

#5. Economic trends

Economic trends drive and control the demand side of the commodity markets. Ideally, a stronger economy usually triggers higher demand for the commodity. For example, during years of strong growth, China was one of the top consumers for Iron ore.

As the Chinese economic growth started to stabilize demand for Iron ore consumption also fell. Similar examples can be seen with other commodities such as crude oil and natural gas. Such commodities strongly rely on demand which can often set the momentum in the price of the commodity.

Why trade commodity EFs?

In conclusion, commodity ETFs comes with many advantages. For one, traders can easily diversify from the traditional portfolio of stocks and fixed income. Depending on the commodity ETF, you can make money when the market is moving in either direction.

With a vast number of commodity ETFs now available, traders can pick and choose; from leveraged ETFs to inverse ETFs which allow you to make money in both rising and falling markets.

best natural gas etfs

best natural gas etfs