1. Are you ready for the Volatility?

I affectionately refer to stocks under 5 dollars as lottery tickets. This is more of a blanket statement and may not apply to every stock under 5 dollars, but the majority of the times this is the case. You maybe thinking, well the risk involved in stocks is the same whether it’s a $50 stock or a $5 dollar stock. Again, partially true. A stock like Sprint has billions of dollars in market capitalization and was trading below $5 dollars in 2012.

Let me further explain my definition of “too risky”. To me risk has very little to do with the price of the stock and speaks more to the volatility of the security. The volatility of a stock speaks to how wildly the stock will swing from one price extreme to another. When most people trade stocks under $5 dollars they fail to include this in the equation.

Why is volatility important to you? Let’s say you invested $10,000 into a stock trading at $4.80 and over the next 3 months the stock drops to a low of $2.40. You would have just loss 50% of your money. Now in the stocks under 5 dollars world, this could be completely acceptable, because maybe the stock ran up from .25 cents to over 5 dollars and is now having a simple 50% retracement from the highs.

Should you sell at this point? Probably not, but you would need to have the capital and the belief system to know you are right in order to sit through such a deep correction. Without these two, the market will likely press you until you submit.

Not to be all doom and gloom, so what about the times when the market gives you exactly what you want and the stock shoots up 400%. Will you be able to reap the benefits of this entire move? Will you know when to pull the trigger to exit such a profitable trade. In all of these charts that show a stock sky rocketing to the moon, there are very few traders who actually make money on the move.

Let me make this real for you based on one of my actual trades from 2013. I purchased RVLT at $2.66 on 9/3/2013. My target was $4.50 to $5.00. This represented a possible 70% return on the low end. As you can imagine when I was looking at the chart, all I could see was the potential dollars to the upside.

Well of course the market could not make this so easy. After entering the position on 9/3/2013, I was quickly stopped out at $2.27, as my max pain point loss of 10% was exceeded. Now I went at the position with a smaller amount of money, so the 15% loss wasn’t huge in dollar figures which is another reason why I let it run against me so much. No sooner did I exit the position, did it rally over $3 dollars, only to pullback again to a low of $2.22 towards the latter part of September. After this minor pullback RVLT had a number of rallies and slight pullbacks all the way to my target region of $4.71.

As you look at the chart, you can see the moves were sharp and unless you are prepared for the level of volatility, achieving the large gains on penny stocks is very difficult. The bottom line is you have to truly accept the risk involved with trading penny stocks and be prepared to sit through the sharp corrections until your ultimate price targets are hit. Short of taking this approach, you are likely to face a number of headaches trading most volatile stocks under 5 dollars.

2. Not Enough Liquidity

As of the writing of this article good stocks under 5 dollars like Zynga or Sirius XM Radio have enormous volume. This means you can enter and exit the position with ease. This however is not the normal. Since most mutual funds prohibit investing funds in penny stocks, the liquidity runs thin. So while you maybe able to pick up a few thousand shares, you will experience a tough time exiting your position.

Just imagine you are attempting to sell 10,000 shares at 3 dollars, but the next best bid is at $2.85. This represents 5% in trading profits you are set to lose only because there aren’t enough traders actively trading the security. Try explaining that one to yourself.

The market is tough enough trying to beat out every other trader on the planet. The last thing you need is not being able to exit the position because of wide spreads or not enough buyers on the other end at your target price. This situation is about as close as you will get to the limit up and limit downs of the commodities markets back in the 70s.

For example, let’s look at the stock PLUG. On November 25th PLUG was all quiet. The stock was trading between .63 cents and .64 cents. When you look a little closer the stock was only trading between 100 and 10 thousand shares every 5 minutes. So, imagine that for a second, 10,000 shares only represents $6,300 dollars. If you had to exit the trade and you were carrying $50,000 dollars worth of stock, how could you do so easily?

Now flash forward to early December, as PLUG began to have a sharp rally, the volume every 5 minutes began to exceed even 1 million shares. This more than likely would have made exiting your position your easiest task for the day and it would have come at a significant gain since PLUG was sitting at over $2 bucks. The only problem with this scenario is you would have pretty much been hostage in the stock for over a week. You would have had to either slowly work your way out of the position over time, which since PLUG was trending higher would have been okay. Now, flip this scenario and imagine that PLUG was tanking. Imagine how difficult it would have been to liquidate $100,000 in such a stock. Think how the market makers would have bled you dry all the way down as the stock tanked.

Moral of the story, the best stocks under 5 dollars will have enough volume that you can exit the trade without losing your shirt.

3. Technical Analysis Gets Tricky

Technical analysis is not perfect, nothing really is in the market; however, technical analysis does provide you with an edge on how to interpret the market. Technical analysis works best when the laws of supply and demand are upheld. This means that if there are more buyers present, then the stock is likely to head higher. Also, key support and resistance levels are being watched by many traders and a stock will generally break in one way or another upon testing these key levels.

Now that we have an understanding of how this generally works, let’s take a look at the world of stocks under 5 dollars. Because the liquidity is thin and the number of market participants is light, relying on technicals becomes more and more challenging. For example, I have seen stocks explode only too quickly reverse and go well below the breakout level. Then there are times when stocks will just float higher and higher with no volume.

So, if you use technicals you will mostly want to focus on the price action of the security and realize that your other indicators may prove less reliable. I love to use the slow stochastics as my favorite oscillator and there have been times when the oscillator will stay below 20 for weeks at a time if I am swing trading. It took me a few bumps in the road to realize that you need a large number of market participants to react to the readings from indicators, or else it’s just nonsense on a chart.

4. Too Many Bottom Feeders

Stocks under 5 dollars attract people looking to make a fast buck. This within itself brings a very erratic nature to the way these securities trade. Most institutions are unable to purchase cheap stocks, so the number of market generals capable of moving the stock in one direction or another are large in number because it takes less money to do so. This makes analyzing the price movements somewhat trickier, because there are so many potential clues in terms of the true direction for the next move. Looking at volume which is normally a great indicator of supply and demand loses it’s value as you go down in the food chain in terms of quality of the security you are trading.

A great analogy for swimming with the bottom feeders is the pits of ancient Rome. The most prized gladiators would fight in the coliseums which could literally rival the modern day NFL stadiums. Large wagers were placed on who would win the contests by what were considered respectable business leaders of their day. The pits on the other hand were off the grid. This is where the low end fighters were placed and the overall betting pool much smaller. This sort of environment has a greater propensity for fixed contests and the presence of shady characters.

This is no different than for cheap stocks. You will find all sorts of information on the web from the top penny stock guru to the constant spam emails claiming to know the next stock set to rise 500%. Remember, if you do not select the top stocks under 5 dollars, you should expect the worse, just like in the pits of Rome.

5. Too Much Greed

Greed will have the opposite of the desired affect on your trading account. The more you search for profits, the more you will see them flying out of the window. There are very few places where you will find greed alive and will other than stocks under 5 dollars. On a pure fact basis, a stock under 5 dollars is trading so because it is perceived to have less value than a number of other securities. The stock is often facing serious financial issues or concerns of it’s longevity. Yet, so many people looking to make a fast buck gravitate to these securities.

If you take a look at the top results in Google for stocks under 5 dollars you will see see titles like, “best stocks”, “explosive”, “set to soar” and “trading at a discount”. Are you kidding me? There are literally hundreds of stocks trading under $5 dollars across the Nasdaq and NYSE. How many of these do you think soar 300%-500% per year? How could anyone possible know definitively what a stock will do over the next 12-months, let alone the next 2-weeks.

I’m not saying your edge can’t provide you with some forecasting capability, but let’s get real. The odds of you picking the small percentage of stocks that will have that sort of run and you actually get all of the run which would require nerves of steel is just statistically a long shot. It’s the same way gamblers go to the track and place large sums of money on the horse with 500 to 1 odds. On paper you may say to yourself, if I place $2,000 on this horse I will be a millionaire. Well yea, but it will probably take you 500 bets of $2,000 dollars to make the money.

So why do we all chase the cheap stocks (myself included years ago). I think something in our brain focuses on the y-axis of charts and the appearance of endless room to the upside. It just gives you a rush to think your entire financial life could change in a mater of months. Who really wants to take hte time to learn the craft of trading and make consistent profits over years. That’s work and with the very short time expectations of the millennial generation, they want things fast and they want them now.

6. The Experts don’t have a Clue

In the previous paragraph I cited some of the article titles for the top search results on Google and how overwhelmingly positive they are in terms of listing the top stocks. Now, let’s take this a step further. Each site is recommending a list of stocks that are set to “explode”. If you take a look at the top 30 results over 18 of them are claiming to have the top 5 or 10 stocks to choose from. If you do the math on this that means there are approximately 90 – 180 stocks to choose from. How can there be so many different options, if the experts are so sure on the next rising phoenix? It’s because they don’t have a clue.

You have to learn to start thinking for yourself and making your own investment decisions. Let’s say you purchase a stock, but you don’t fully understand why the expert made their selection. Will you be able to hold onto this position when times get rough and their is a pullback? How will you know the position has gone sour and you need to exit the trade. From the articles I see posted on the web, after the so-called expert posts their hot stocks of the year, month or week, they do not come back later to update you on their progress. These experts have now moved on to the next hot recommendation to keep would-be buyers intrigued. While they have moved on you, you are living with the harsh reality that you have placed your hard earned money in the market.

When I first started trading, I want to say it was around 2000 or 2001 there was a pretty well known company named Lucent Technologies. Let’s just say it was pretty early in my trading career and I was susceptible to advice and guidance from others. Anyhow, Lucent has been one of the darlings of the late 90s, so when I saw the recommendation to buy the stock on a break of $5 dollars, this mad perfect sense to me. When I looked at the stock chart, all I could see was how high it had fallen and that even if the stock made a quick run to $20 dollars, I would be up huge. Flash forward a few months and I was down well over 50%. Let me tell you this did not feel good at all. All i could remember was feeling burned by the expert that made the recommendation. Again, early in my trading career and I know it was just too painful for me to accept responsibility for my trading decisions.

If you get nothing else out of this article, please use my mistake as a lesson of why you should avoid falling for advice from experts.

7. What is your End Game?

So let’s say on average one out of every 200 stocks under 5 dollars has a 300% or more run per year. You also somehow manage to sit through every crazy pullback which may require you to watch your account lose the majority of its gains a number of times before finally showing you this huge profit. What do you do next?

Do you thank the trading Gods and say you will never touch these cheap penny stocks again? Do you just trade the next one you think is perfect? How can you possibly stop yourself from going back to the same well that just made a boat load of money.

You see where I’m going with this right? You will place your money back on the table again for another wager. Since you do not associate any pain or hard work with your gains, you will approach the next situation not with sound trading principles or an edge, but with the belief that you will again find the needle in the haystack. This is where the house rules will prevail and over time the market will take back every bit of profit you have made, as well as any other cash you might have on-hand.

8. Ask Yourself Why You are Really Looking for Cheap Stocks?

What is your true motivation for wanting to get involved with cheap stocks? What do these stocks offer you that a reasonably priced stock of $20 can’t? Have you ever heard of a little company called Tesla Motors Inc (TSLA)? TSLA was trading below $35 dollars a share in March of 2013. Did you know that TSLA went on an amazing run in April of 2013 that took the stock north of $190 by October? That’s a little over a 500% run in 6 months.

Now the odds of you finding a stock that will do this again is statistically a tall order; however, you can achieve significant gains without having to swim in the pits.

So really ask yourself, why are you looking for cheap stocks? If you dig deeply enough your reasons are likely one of the following:

- Looking to make a lot of money fast because you either don’t like your current financial situation or the job you are working

- Feel that stocks under 5 dollars are on discount

- Think that stocks priced over 5 dollars a share can’t move as quickly or as far as cheap stocks

- Do not want to put in the work to learn your edge of how you will make money in the market and would rather pick a cheap stock and let it ride

- Were hoping to do a quick search in Google and see what stocks the “experts” have stated will be explosive this year.

Do you see how unhealthy any of the 5 reasons are to your trading psyche and bank account?

9. Shorting Stocks Under 5 Dollars

This one is very tricky. If you have been reading this article, you are likely saying to yourself, this guy is clearly saying stay away from these stocks for very good reason. Therefore, I should just use that bit of knowledge and take a nice short position. Most brokerage firms will not allow you to short stocks under $5 dollars, because they fully understand the risk involved. However, there are a few brokerage firms that will allow you to do so.

The reason I feel you should not short stocks under $5 dollars is very simple. In the event that you are wrong and you somehow select that high flyer accidentally, you could be wiped out. What I mean by this is since these stocks often move sharply in one direction, you could face a number of gap up days that could completely erase your account balance and have you owing money to your brokerage firm.

While the odds of this happening are slim, this is something you can not afford to happen even once. So, let’s take a look at another real-world example of when a penny stock can start taking off.

The below chart is from the stock PLUG. PLUG hit a yearly low of .12 cents in February 2013 and then had a number of rallies and pullbacks until it finally started to quiet down at the .70 cent range. Now at the time PLUG could have given you the impression that it was topping out for the third time around the .70 cent region and was set for a pullback. Assuming you could actually find a brokerage firm or prop firm that would allow you to short PLUG, you literally could have been wiped out in a matter of 2 days as the stock ran from .80 cents over a $1.60.

10. Really High Maintenance Requirements

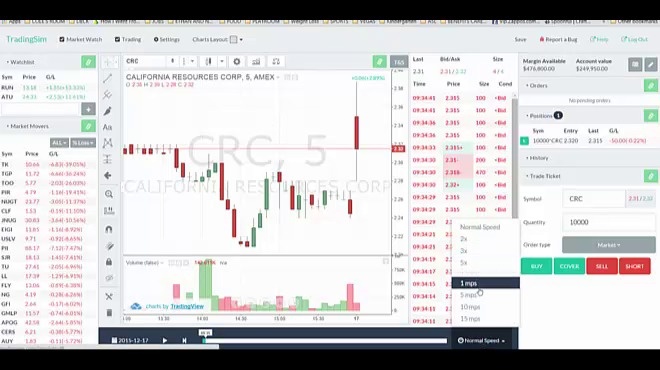

Beyond the real possibility you will be unable to short stocks under 5 dollars, there are really high margin maintenance requirements for holding high-risk stocks. For those of you unfamiliar with maintenance requirements, your brokerage firm assesses the volatility and perceived risk of a security and places a requirement of the amount of cash you are required to maintain in your account at all times. If you dip below this cash requirement, your brokerage firm is within their right to liquidate your position at market.

These margin requirements can range from 50% all the way up to 100%. This means that if you use margin your borrowing power is reduced significantly. Which begs the question, if you feel there is more money in trading the cheap stocks, yet you can’t use all of your available trading funds, what is the point? You would be better off trading a 8 dollar stock where you can use all of your margin.

Remember how we led into this article discussing volatility. If you push your margin too far, you may prevent yourself from being able to sit through the shakeout moves due to the maintenance requirements. It’s hard enough trading, no sense in allowing your brokerage firm to force you out of an otherwise winning position.

11. Money Management

Risk is forever present in the stock market. If you are uncomfortable with the risk you might as well not show up. Beyond simply accepting the inherit risk of trading you also need to think through your money management principles and how this applies to your trading methodology. This becomes even more critical when trading stocks under 5 dollars. Going back to the earlier section in this article on volatility, the amount a stock goes against you has a direct correlation to the amount of money.

So, how much do you plan on risking per trade? One strategy used by many traders is to trade smaller with penny stocks, because the increased volatility will result in larger percentage gains. I myself have fallen victim to this sort of logic, because once you start trading smaller you begin to loosen your rules for exiting the position. The end result is the small trades now have the potential to become big losers.

12. Start Thinking in terms of Opportunities Not Dollars

Let me break this one down, because you should always be thinking of how to extract money from the market. What I mean is that you should approach the market with the perspective of you will make money based on a defined edge. That edge may show up in stocks under 5 dollars, but I think if you step back and look at your overall goal of making money you will see an endless amount of opportunity in stocks priced above this level. You of course need to define some criteria which can reduce the number of possible opportunities, but price is probably one of the less valued filters. Unless of course you are looking to limit your risk, since cheaper stocks by the sheer nature are riskier. If you don’t’ believe that is a fact, as stated earlier in this article, checkout how many brokerage firms do not allow you to short stocks under 5 dollars.

Also, why is $5 dollar the magic number? Some will say that it’s because this is the level where stocks can be delisted or mutual funds can no longer invest in the stock. so you can really get things on the cheap. But who is to say the traders that believe stocks under one dollar have the most potential or maybe stocks below ten dollars. At the end of the day if a stock is set to move higher it will. It has very little to do with whether it is below a certain value. You should enter into each trading opportunity with a clear state of mind and focus on your trading rules and not worry about the actual stock price.

In Summary

We can’t rule out the possibility that you may have an edge exclusively trading stocks under 5 dollars. I’ll be the first to agree with the fact there are many ways to make a dollar in the market and there are no absolutes. I will say though that trading these volatile cheap stocks requires a lot of experience. Things that work when trading larger stocks like Google or Facebook simply will not work.

Just remember you don’t have to trade cheap stocks to make money. You can make money trading higher priced stocks and it does not mean you will have less of a shot making a fortune in the market.

If after reading this article you are still committed to trading stocks under 5 dollars, first take our trial offer of Tradingsim.com. You can login and trade as many penny stocks as you like to see if you are able to turn a profit. You can use our market movers scanner to query a list of stocks under 5 dollars. You have to prove to yourself that you know how to make money with these high flyers. The swings will be so violent that you will need both a strong state of mind and intestinal fortitude to match.

Day Trading Basics

Day Trading Basics