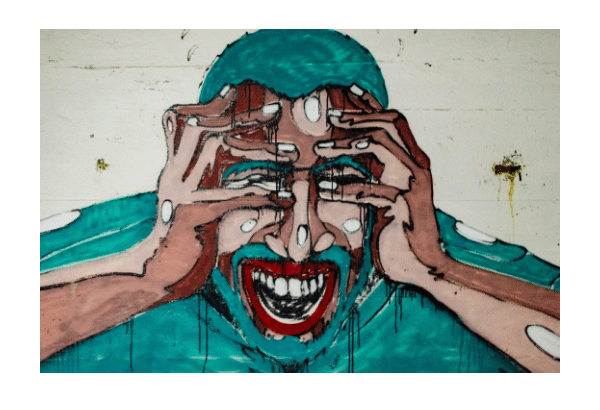

Are you currently trading and dealing with fear and anxiety? Don’t feel bad, you aren’t the only one.

Trading has a way of wearing you down if you don’t get a handle on the mental side of the game.

As you read this post, it is going to feel like I’m bouncing around from topic to topic. This is ok. Stay with it as we explore the fear emotion and how you can recognize it and ultimately how to overcome fear in stock trading.

Emotions in Trading

Emotions have no place in a day trader, swing trader, or even long-term trader’s outlook.

When we try and protect ourselves from fear, we end up resorting back to our habitual instincts to enter into a place of comfort, whether or not that place is a reality. We stop taking responsibility for our own fears and start blaming others for our problems.

In the end, we try and find an easy way out by searching for magic indicators, or Holy Grail solutions.

When I think back on my day trading career, I remember the times where I continuously changed my trading techniques to achieve the result that I was looking for. No matter what technical indicator or stock trading system I used, I would yield the same result, losses. It didn’t matter what I did, I had to fix the real problem which was in my psyche.

I was trapped by the life principles that governed my life since I was a child in that I needed to be a perfectionist and was a sore loser.

I was the guy always looking to ace every exam in school. My stock trading reflected this as well; I refused to take a loss quickly due to my overriding obsession with being right on every single trade.

I didn’t believe in myself; everyone else said the stock market was random, or gambling as many would put it. I would act as if this did not affect me but it did subconsciously and I carried that line of thought into my stock trading.

I was heavily trained in mathematics throughout my academic years and considered myself to be very analytical. Stock trading is an extremely fast game and requires lightning-fast decision-making skills; you don’t have very much time for analysis. Having these traits is not good or bad but it is not conducive to consistent trading profits.

The Stress Effect

Stress When Trading

Stock trading brings its fair share of stress, as you all know. The question revolves around how you handle the stress.

Some get physically sick, some start to panic, and some even go into depression due to the violent swings that the stock market can produce. Depending on the situation and the person, the stress reaction may be minor or very severe. Your bodies response to stress is physically and emotionally exhausting.

As you continue to experience stressful situations, the more accustomed you become to the idea of the negative feelings that are associated with stress. These negative feelings turn conviction into doubt and nervousness. Practice yoga, meditate, play sports, exercise, spend time with your loved ones, work on your spiritual growth. You need to de-stress your mind and clear your mind. Obsessing over your trades will do nothing but burn you out and leave you on edge all the time. There is more to life than trading stocks. Don’t let trading get you too emotionally high or low. The key to lowering stress levels is to be grounded and also to be confident that you can make the right decision when the time comes. That comes with experience so be patient.

Anger Management

Anger is another emotional response that has no place in a stock trader’s heart. Figure out what is troubling you inside and learn how to deal with it immediately before it manifests inside as pent-up anger which will show its ugly head sooner rather than later.

Anger makes you vengeful and provokes bad decision making in the hopes of “getting back” at the market or forcing trades due to the frustration of losing. I can’t tell you how many times this had happened to me when I was a junior trader and I never saw anything but losses stemming from it. Verbalizing and expressing your anger in the appropriate ways will allow you to drop the proverbial “baggage”. You will sense a feeling of freedom internally from not having to cover up your past emotional experiences which have kept depression, panic, and anxiety alive.

Remember, the more you can disassociate yourself from your emotions, the better at stock trading you will become.

Conquering Emotional Swings

You will face strong resistance internally from yourself when you take your first step to create a larger vision for your stock trading. This means you will need to let go of your bad habits and take a leap of faith and do what is required to reach your goals. I have seen many traders who psyche themselves up and temporarily follow their stock trading vision. The problem arises when trader’s experience the emotions of losing; many tend to lower their expectations and go back into their shell, going back to what they are used to. They start reverting to old habits and going back to square one again.

Some trader’s try psyching themselves up by screaming, shouting, speaking positive thoughts, working more, etc. Sure you need to be positive, but by solely taking these steps, you are subconsciously reinforcing the idea that you are deficient in some aspect of trading that is preventing you from reaching that true level of mastery. They mask the underlying issues that you need to face up front and center.

Refining Your System

Any time you make changes, you will face internal resistance from within, fear, fatigue, insecurity, and even opposition from family members or loved ones. You will most likely even receive negative energy from those around you who are threatened by what you are doing. Change does not happen overnight and you have to stick with your convictions in the face of self-doubt; be patient and allow yourself time to achieve the goals that you set out to reach. Don’t allow yourself to become a victim of these negative thoughts. They will only serve to distract you from concentrating on what needs to be done. Again, we want to attack the root of the problem which is how you interpret these feelings. You will not necessarily be able to rid yourself of them; however, you can stop focusing on them. Focus on the future and on what you want out of it. It is key that you change your thought process when it comes to negativity.

To manage your risk and emotions, you have to accept the negative feelings that you internally attempt to suppress. Rather than ignoring them, face them and associate no significance or meaning to these feelings.

Eventually, we will become what we resist similar to the way we say that we will never become like our parents. Most of us do. Therefore, by showing no importance or resistance to your negative feelings; you allow yourself to focus on your positive goals.

Identify How Your Past is Impacting Your Future

You can ask yourself a few questions to understand how much your past affects your thinking. Figure out what the opinions of others mean to you:

- Do you heavily rely on others?

- Are you hesitant to speak up in front of others due to fear of sounding “stupid”?

- Do you look to others for approval before you commit to action?

- Are constantly speaking about past accomplishments?

- Do you need input from others in your decision-making process?

For those of you who answer “yes” to many of these questions, you are fearful to act or commit to a plan of action without external approval. Consider how this affects your stock trading activities; you will quickly realize how fear prevents you from becoming the trader that you know you are or can be. Be honest with yourself and you will then move forward.

My Personal Journey of Conquering My Fears

Journey

When I thought of fear in the market, I thought this meant me running away from volatile stocks. I had this belief that I needed to be like every other trader out there and only trade penny stocks that move wildly first thing in the morning.

Well going back to who I am as a person, I an anything but wild. I lead a conservative life and am a private person. So, why was I focused on stocks that trade unlike I live?

I spent four long years trading these highly volatile stocks with some success but never the explosiveness I knew was within me.

I just kept banging my head against the wall in the spirit of not being afraid.

In Reality, My Fear Was Recognizing My Strengths

It took many years of trading both the US markets and Nikkei before it finally hit me. The penny stocks are not for me.

I remember when I first started trading low volatility stocks it felt like I was giving up on years of research. Years of hard work just thrown out the window.

I had to let go of everything I heard on the web and read in trading courses. At first, it felt like giving up but within the first week, I saw immediate results.

It’s like all of my techniques and strategies were on steroids. Was it that my systems somehow magically started working overnight? Or could it be the market was more conducive to my trading style?

Neither, it was that I finally put my baggage behind me and accepted I am not some wild cowboy. Letting go of this need to trade like others truly released me from my own mental jail cell and endless analysis.

Now, this doesn’t mean I don’t at times refine my techniques, but I now know who I am. Having this level of clarity ensures I stick to what works for me.

How to Confront Your Own Fears

Below is a method you can use to identify, confront and resolve the fear you are facing as a trader. You can also use this technique to combat other emotions such as greed.

- Write down what you are afraid of. Don’t worry about making it perfect or using perfect grammar. Just get it all on paper. This should be completely free form with no concerns about judging yourself or how you will sound.

- Define the source of your problem. Now your first inclination will be to think from the prism of the market. This exercise will require you to think in more broader terms. For example, I had to confront the fact I live a pretty tame, private life before realizing low float stocks do not match my personality. So, what is the root cause of your problem? Have you always had money troubles? Are you bored in your personal life and just looking for an escape?

- Next, think about ways you can solve for these emotions you are facing. Again, your first inclination will be to refine your current strategy, but a lasting solution may require you to unravel your perceptions of the market and how you should be trading. For me, it was abandoning trading low float stocks. What is it for you?

- The next part of the process will require you to test and learn your new approach. For me, while I targeted lower volatility stocks, I needed to find the right mix. Meaning too low and the returns were not worth the time. For you, you will need to test this unchartered territory to refine your hypothesis. This process is not a race but more about breaking bad habits and accepting your new norm.

In Summary

To get to the next level in your trading journey, it may require you to take major steps. These steps could require you to let go of old beliefs or a trading guru who’s methods do not match your trading style.

But believe that with enough effort and willingness to change, you can learn how to overcome fear in stock trading. This will allow you to move forward and into the bigger and better version of yourself.