A trailing stop is an order type that preserves profits on open trades. You can set trailing stops manually or automatically through your trading platform.

Manually Setting Trailing Stops

To manually set a trailing stop, you first need to define how much you want to trail your order. For example, you can trail an order by one dollar or a specific percentage.

The challenge with setting manual trailing stops as you might guess – they are manual. You could get greedy and not want to update the stop as your profit climbs or you may react slowly to a selloff and not update your trailing stop quickly enough.

Automatic Trailing Stop Placement (Recommended)

A better way to set trailing stops is thru automation within your trading platform.

You enter the amount you want to trail the position and the order updates dynamically. The order is dynamic because it adjusts based on price movement.

Trailing Stop Examples

You can use a trailing stop for both short and long positions.

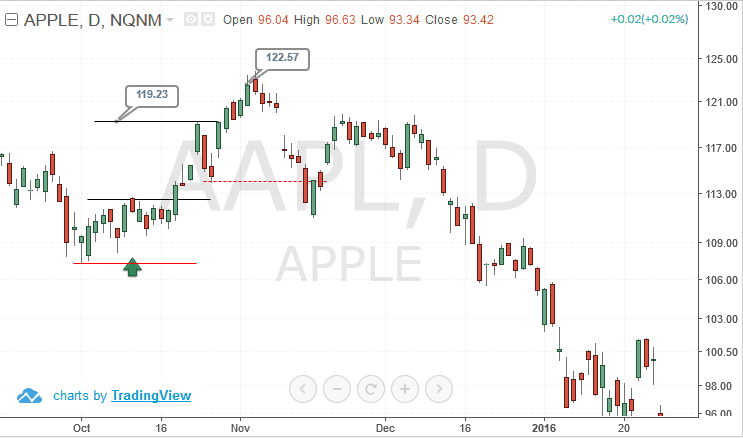

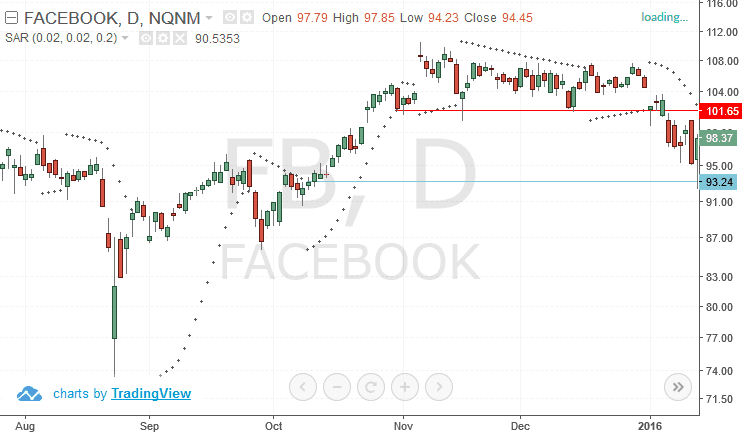

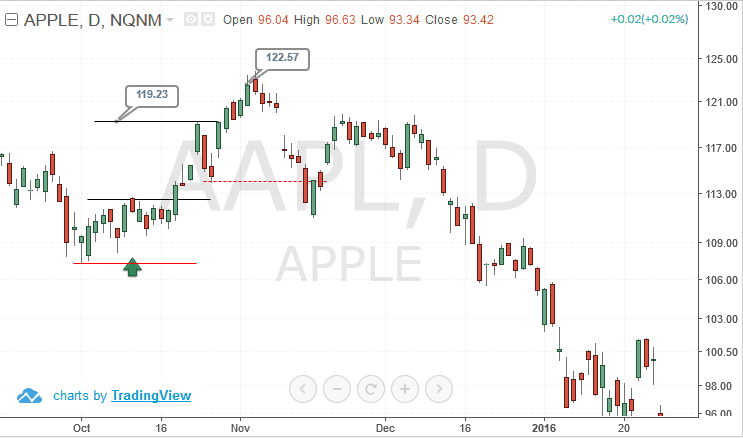

Apple Long Trailing Stop Example

Let’s now review a trailing stop order with Apple.

Example of how a trailing stop works

Standard Stop Loss Order

In this example, let’s say you would have purchased Apple at $112.50 in late October with a stop loss of $107.30.

With a standard stop loss order, you can see that after running over $121 you would have ultimately given back all your gains and stopped out for a $5 dollar loss in December.

Trailing Stop Loss

Now let’s use the same trade and instead of a stop loss order, you place a trailing stop of $3 dollars. The trailing stop keeps you in the trade all the way over $121 and stops you out later around $117 when Apple gaps down in early November. This represents a profit of approximately $5 dollars.

The same exact entry, yet in one trade you lose $5 dollars per share and in another, you walk away with a loss of $9 dollars. That’s a whopping $14 dollar gap.

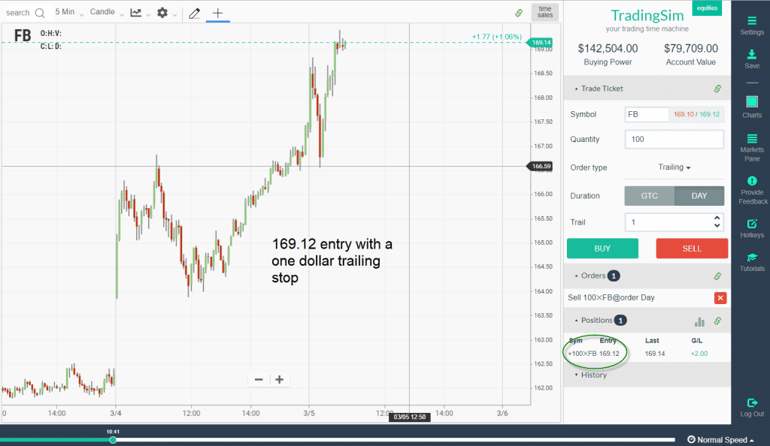

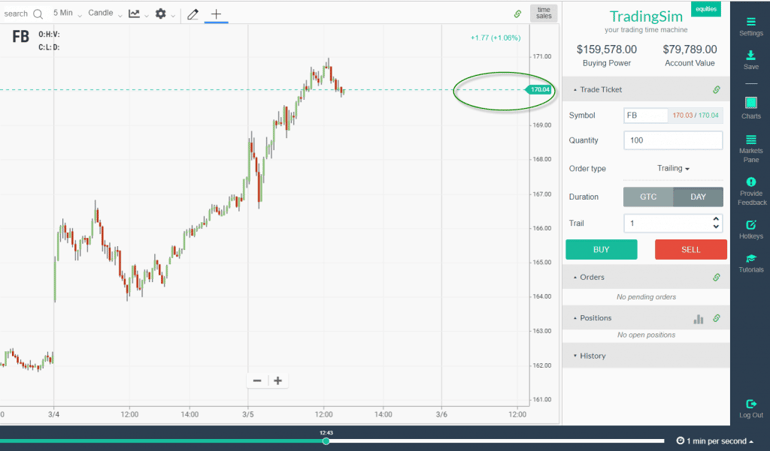

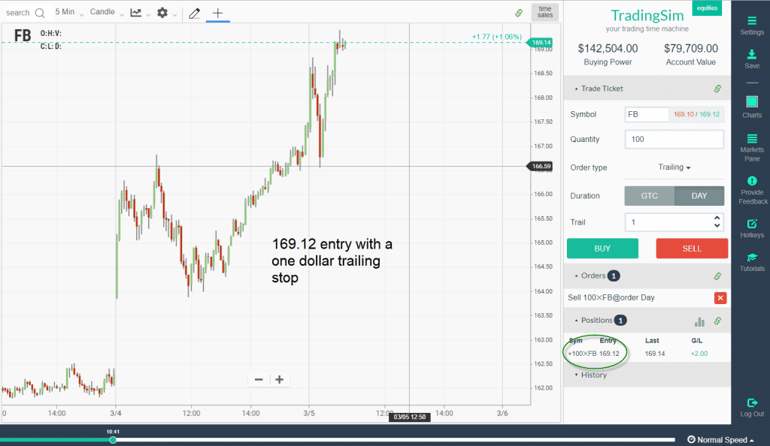

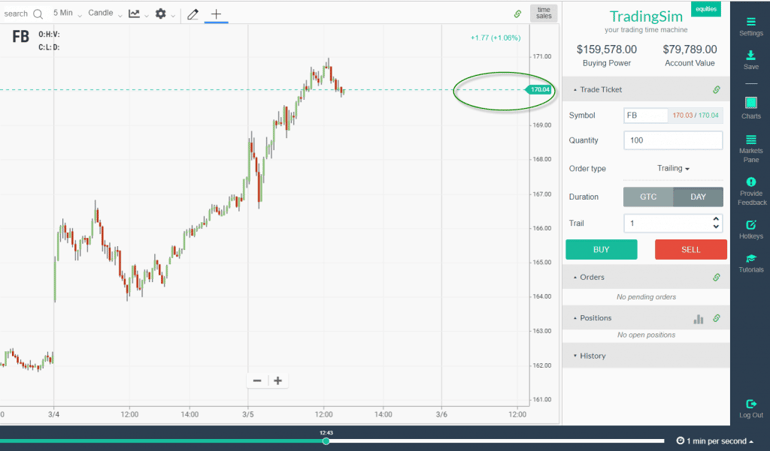

Facebook Long Trailing Stop Example

FB Trailing Stop

In this example with Facebook, we open the position after an early morning breakout at $169.12

We then enter a one dollar trailing stop, so when profits move in our favor we can protect our cash.

The trailing stop let us ride the profits in Facebook until things started to turn a little after lunch and our one dollar stop closed our position a little over $170.

The beautiful thing about the trade is that we do not have to do anything. You literally enter the position and let the stock do the hard lifting.

When Should You Use a Trailing Stop?

You Need to Practice Locking in Profits

After trading for a while, you will notice there are times that you will go from having a profit on a trade to a losing position. This is one of the most frustrating experiences for new traders.

This is where trailing stops can help. A trailing stop will allow you to book some of the profits instead of going on the entire rollercoaster ride with your position.

Your Emotions Run Wild When In a Position

If you have trouble letting your profits run, then trailing stops can be a tool you use to get thru this phase of your trading career.

You can have an ultimate target you are shooting for where you would consider the optimal selling point. However, until this level is reached, the trailing stop can protect any gains you have made thus far on the trade.

Where Trailing Stops Can Fail

You Don’t Assess Volatility Properly

Trailing stops are super effective when set properly. However, if your trailing stop is too tight, then it will trip before you are able to reap the rewards of being right on the trade.

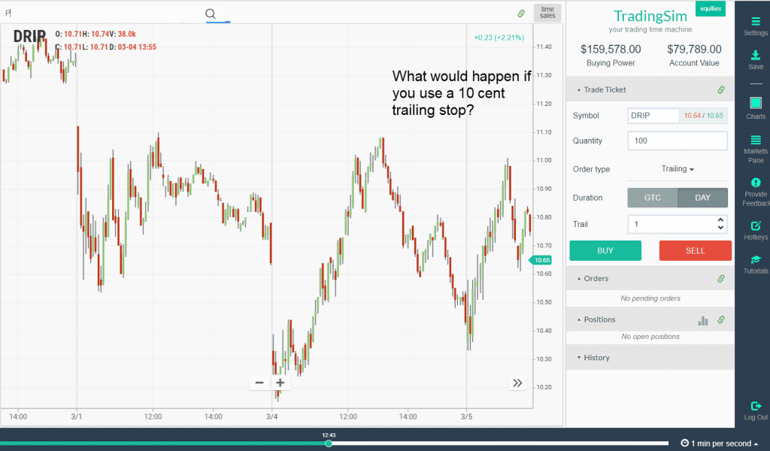

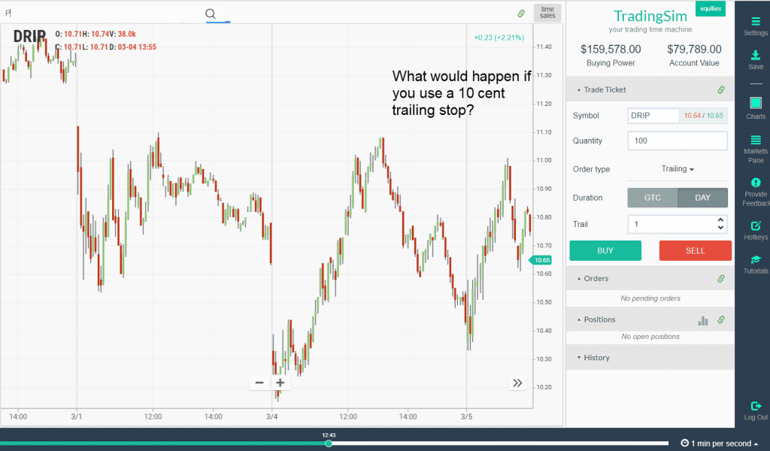

For example, take a look at the below chart of DRIP (S&P 500 Oil Services Bear 3x Shares).

Drip 10 Cent Trailing Stop

DRIP is a 3x ETF which mirrors the oil market. Now, you would think a 10 cent trailing stop is more than enough since it’s almost 1% of the share value.

Wrong.

As you can see in the above chart, DRIP has moves from low 11s down to 10.50s and back up to the 11s again.

If you set a stop for 10 cents, what do you think is going to happen? That’s right, you are going to get stopped out.

Setting Trailing Stops that are Too Large

The other issue you can run into is if you set trailing stops that are too large.

What do you think happens in this scenario – you guessed right, you will give back the majority of your gains. The whole point of the trailing stop is to maximize the amount of profit you can make on the trade.

Too Big of a Stop

In this example, GSKY, which is always a big mover had two nice runs from the low 12s to 13.

Now, you need to give it room to move, but should you give 75 cents? That equates to over 5% on an intraday trade in the above example.

How Can Tradingsim Help?

If you are contemplating trading with trailing stops you can test out the order type in Tradingsim. You can backtest specific securities to see which trailing stop will work best.

To learn more about trailing stop orders check out this YouTube video from the Online Trading Academy.

Basics of Stock Trading

Basics of Stock Trading