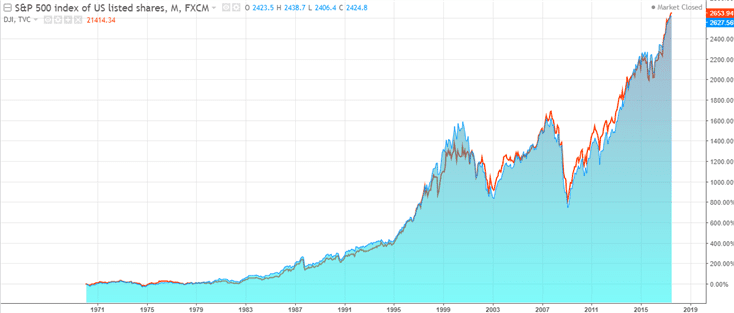

Cocoa is the fermented and dried fatty seed from the cacao tree. It is one of the main ingredients from which chocolate is made but other versions of cocoa include cocoa powder made from grinding the seeds and removing the cocoa butter from the bitter cocoa solids. In the commodity futures market, cocoa is said to be the smaller soft commodity.

Cocoa is also referred to as the fruit of gods when it was first discovered in South America. At one point in time, cocoa was used as currency and drink. Cocoa has been consumed for over thousands of years and currently it is estimated that over 3 million metric tons of cocoa is produced every year, with the chocolate industry being the biggest beneficiary of the product and is also used in non-food product based industries such as soap and make-up.

Cocoa is primarily produced in the warm rainforest climate near the equator. The major producers of Cocoa include West Africa (Ivory Coast, Ghana, Nigeria, and Cameroon) which accounts for nearly two-thirds of the world’s cocoa production. Other nations that produce cocoa include Indonesia, Brazil, Malaysia, Ecuador and the Dominican Republic.

Cocoa trees take about 3 – 5 years to mature and live up to 50 years. It takes on average 6-months for cocoa beans to ripen.

Cocoa futures are traded across different futures trading exchanges but the Cocoa ICE futures are the most popular, offering futures trading in cocoa for over 50 years. The cocoa futures contracts that are listed are for more than 18 contract months with physical delivery of the underlying with five delivery ports in the U.S.

The cocoa futures are no doubt one of the most volatile of the commodity futures. This is largely attributed to the complex seasonal cycles as well as production of cocoa being concentrated to just eight countries which meet the global demand. Supply shortages or surplus are not uncommon to the cocoa futures markets, thus attributing to the volatility.

The cocoa futures volatility therefore makes for attractive futures contracts to trade bringing both the hedgers as well as speculators. In order to trade cocoa futures successfully, traders need to pay attention to the cocoa futures seasonal cycle as well as the supply and demand dynamics.

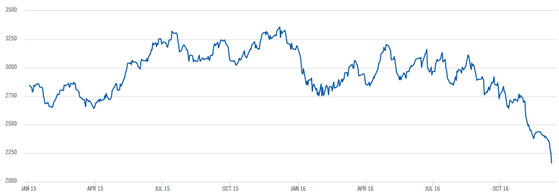

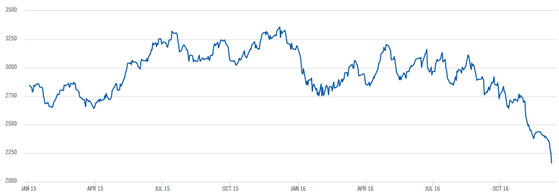

The chart below shows the 2-year Cocoa futures price chart, which depicts the volatility of this soft commodity over the 2-year period.

Cocoa Futures Price Chart

Cocoa Futures Contract Specifications

The cocoa futures contracts are standardized contracts which are traded at one of the many listed exchanges where the buyer agrees to take delivery from the seller for the specific quantity of 10 tonnes for a predetermined price on a future delivery date. Cocoa futures contracts can also be cash-settled if closed out before the expiration date of the contract month.

Of the many futures exchanges, cocoa futures are primarily traded on the NYSE Euronext and the New York Mercantile Exchange (NYMEX) part of the CME group. The NYMEX Cocoa futures contracts are standardized in units of 10 tonnes per contract with the price quoted in dollars per metric ton. On the ICE futures exchange, cocoa futures contracts are standardized at 10 metric tons. Below is a summary of the cocoa futures contract specifications.

| Exchange |

ICE Futures |

| Ticker |

CC |

| Contract Size |

10 metric tons |

| Price |

Dollars per metric ton |

| Tick size |

$1/metric ton |

| Tick Value |

$10 |

| Contract Months |

Mar (H), May (K), Jul (N), Sep (U), Dec (Z) |

Other variations of the Cocoa futures contract include the London cocoa futures where the commodity is priced in British pounds with a contract size of 10 tonnes and the Euro cocoa futures which are priced in euros. Among the three, the standard cocoa futures prices in U.S. dollars are the most popular. However, there are also various arbitrage opportunities between the three different cocoa futures prices, which can be exploited, but only for a short period of time.

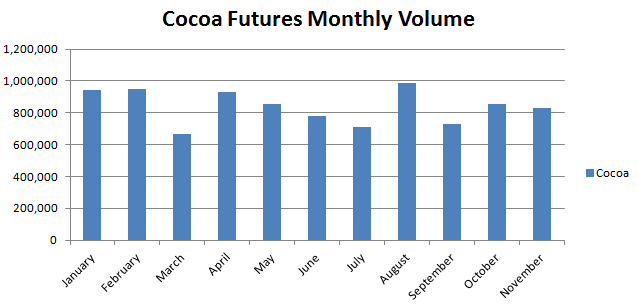

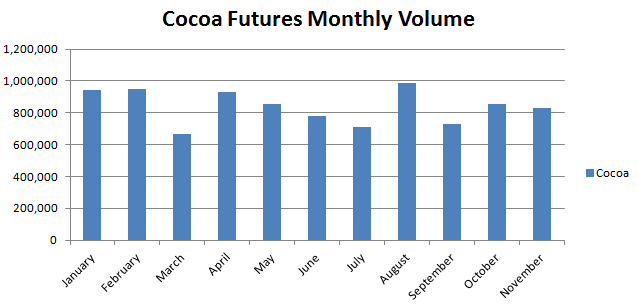

Cocoa Futures Monthly Volume (Source – ICE Futures)

Seasonality in Commodity Futures

Seasonality is a factor that is common to most agricultural products. It is based on the fact that certain crops have specific seeding and harvesting period, which often results in the supply side factors which influence the pricing in those respective crops. Among the many factors affecting seasonality, weather is one of the biggest factors that influence the crop seeding and harvesting periods.

The annual cycles in supply and demand tend to give rise to the seasonal price patterns also known as seasonality. In a market that is strongly influenced by seasonality, the price movements tend to become a self-fulfilling prophecy as the market participants tend to fall into the trading pattern without fail. However, there are times when seasonal pattern disruptions do occur such as harsh weather patterns which can put this cycle out of rhythm for a certain period of time.

While Cocoa has seasonal tendencies, it is largely volatile and therefore although the crop tends to have seasonal patterns, it should not be viewed in isolation when trading cocoa futures.

Cocoa has two main crop seasons of which the main crop from Ivory Coast and Ghana account for over 75% of the world’s production. This crop season runs from January through March. The remainder is made up from crop seasons in Brazil and Indonesia. It is widely accepted fact that Cocoa prices tend to bottom in June as a new crop harvest starts and peaks in March when supplies decline as consumers have already stockpiled on the products ahead of the Easter period. The main factors affecting cocoa crops are frost and due to the fact that Cocoa is grown in Ivory Coast and Ghana, the regional political instability also adds into the price volatility.

For crops from Brazil, the seasonal low occurs in January for the Bahia main crop. Demand for cocoa tends to rise into late fall and early winter and start to decline into January. Between Africa and South America, cocoa futures prices are more influenced by the supply/demand dynamics and the political stability from Africa. Transportation and logistics also plays a crucial role as cocoa futures are shipped from Africa to Europe and then to the US.

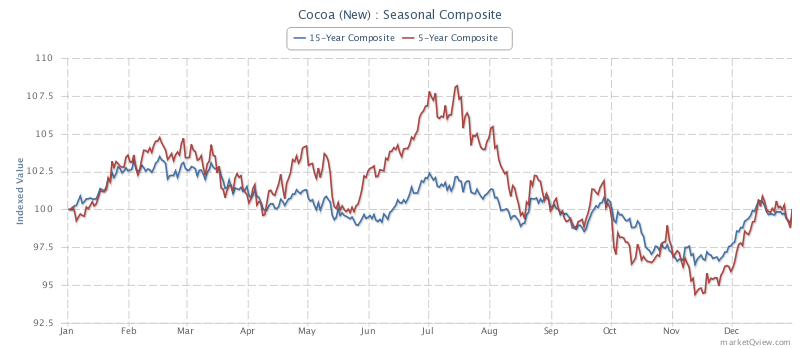

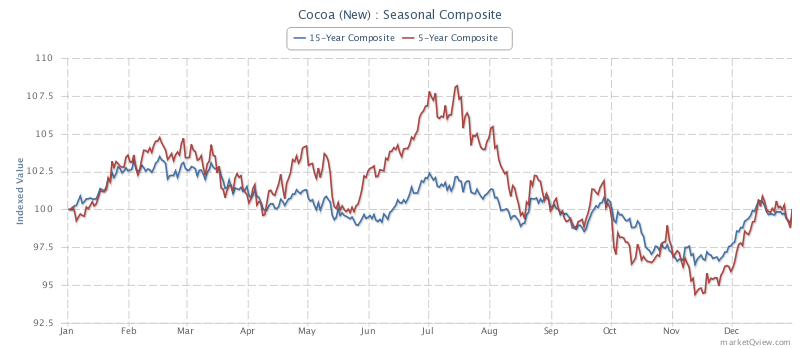

Cocoa Futures 5 and 10-year composite seasonal chart (Source – MarketQview.com)

The above chart shows a 5 and 10 year seasonal cycle for the Cocoa futures which can be used as a general guideline into understanding at which stage of the cycle the cocoa futures are currently at. However, it is important to remember that seasonality in Cocoa futures is not very strong, so traders should always be prepared for some anomalies.

An important factor that contributes to this anomaly is the fact that unlike other crops which are largely industrialized, cocoa production is largely scattered with most of the beans coming from small family run farms especially in Africa. It is estimated that there are over five to six million cocoa farmers worldwide with the largest concentration in Ivory Coast and Ghana. The cocoa futures prices are therefore highly dependent on weather, as well supply logistics, monitored by governments and international organizations.

Cocoa goes through three main cycles. The growing period is the most crucial as the cocoa tree is said to be very delicate and a sensitive crop which can succumb to wind, sun and pests. Cocoa trees typically start yielding pods by the fifth year and the pods grow for about 10 years thereafter.

The harvesting period comes next but this can also be influenced by the weather patterns. Typically there are two main harvesting seasons but the weather tends to shift the harvesting seasons. The pods are removed from the trees, from which the beans are extracted. It is estimated that each pod can yield 20 – 50 beans. On average, it takes 400 beans to make one pound of chocolate.

Once the beans are harvested, they need to be fermented and dried. This period takes about three to seven days and it is during this period that the beans produce the chocolate flavor.

The marketing phase is where the beans are packed and sent to the exporters. From here on the buyer can then process the beans for further use.

Cocoa Futures Trends and News

Supply and demand form the basis for cocoa futures prices and therefore traders need to pay close attention to the timely statistics that are released. Besides weather, the political stability in Ivory Coast and Ghana also play a role in setting the expectations for cocoa supply and it’s pricing.

There are many independent resources that traders can refer to, to track the fundamentals in the cocoa futures prices. The most prominent source for cocoa trading is of course the International Cocoa Organization where the daily cocoa prices are published which can be used for historical references. Besides the ICCO, there are other independent organizations such as the Netherlands Cocoa Association which gives production data for the world market and finally, the UN Food and Agriculture Organization. The ICCO’s data is the most active publishing monthly and quarterly data for cocoa production.

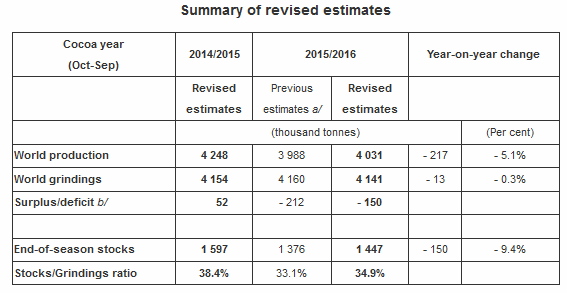

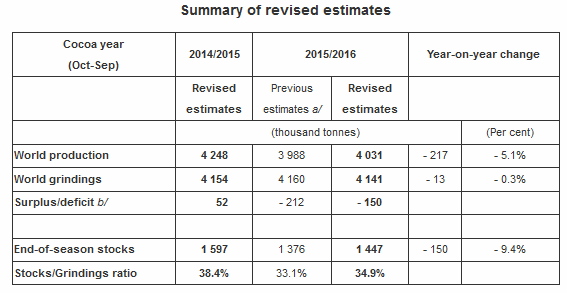

ICCO Cocoa Production Estimates (Source – ICCO.org)

The above table shows a brief overview of the production data from the ICCO which can be an important factor when trading cocoa futures. For example, the above table shows the latest estimates of November 2016 for the world production of cocoa, which is currently down 5.1% from a year ago while the end of season stocks are down 9.4%. However reading this report in isolation does not give the full picture.

Risks of trading cocoa futures

While cocoa futures might make for a viable alternative to trade a soft commodity which is largely dominated by only a few countries, it does highlight the fact that cocoa futures can be highly volatile. At $10 per tick, profits or losses can quickly accumulate. The 10-day Average True Range (ATR) for Cocoa futures are about 60 points, which roughly translates to $600. Therefore incorrect positioning in the markets especially when not paying attention to the fundamentals can quickly see the positions turn to losses.

Due to the fact that there are various news sources that one needs to keep track to follow the fundamentals that shape the cocoa futures prices, the volatility can often come unannounced. To be successful in trading cocoa futures, traders should therefore take their time to completely understand the cocoa futures markets before trading. While cocoa futures are risky due to their volatile nature, with good practice and an eye on the fundamentals, the profit potential can be significant.

Commodity Futures

Commodity Futures