Robo-advisory investment services might seem like a leaf out of a financial science fiction movie, if ever there was one made. Simply put, a robo-advisor service is an automated algorithm based service that offers portfolio management with little to no human intervention. The purpose of robo-advisory service is to optimize a client or an investor’s portfolio and doesn’t require day to day intervention in the markets.

Robo-advisory services are part of the Fintech revolution that has disrupted the financial industry. Fintech, is nothing but using technology in the financial industry leading to some very innovative products. Examples of Fintech include online P2P lending platforms, Robo-advisory services, back end automation, wealth management and so on.

Robo-advisors are relatively new and have gained wider acceptance in the U.S. since 2008. It is estimated that there are over 100 robo-advisory services at the moment. The advent of robo-advisory firms are merely an extension of the use of technology in trading. For example, algorithm based trading has already been widely used among hedge funds and robo-advisory services are simply an extension of this same concept but applied to portfolio management or investing.

One of the main benefits of using a robo advisory service is that it removes the need for human interference. Thus, the investor can directly communicate with the robo advisory service which then allocates and/or manages the portfolio based on the client or the investor’s requirements. All of this is done either directly via a browser based interface or a smartphone application.

Robo advisors can come in different shapes and forms. The simplest of all is logic or a rule based robo-advisor that can pick stocks and the duration for holding the stock based on simple inputs. Other advanced forms of robo-advisors can make use of more advanced technology such as monitoring the market sentiment based on social media or tracking breaking news from a company or an industry and investing accordingly.

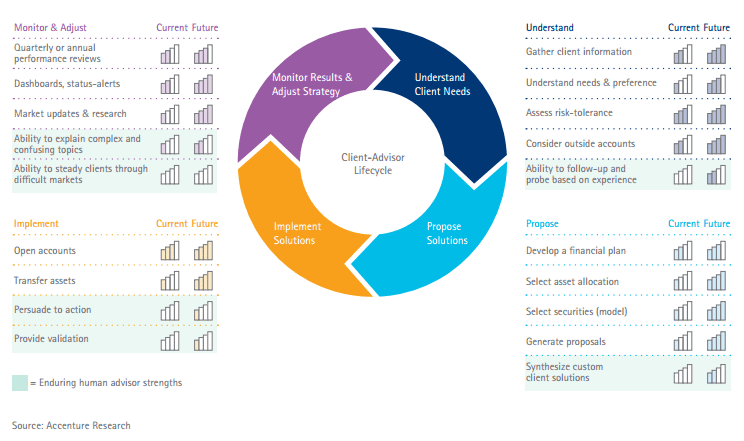

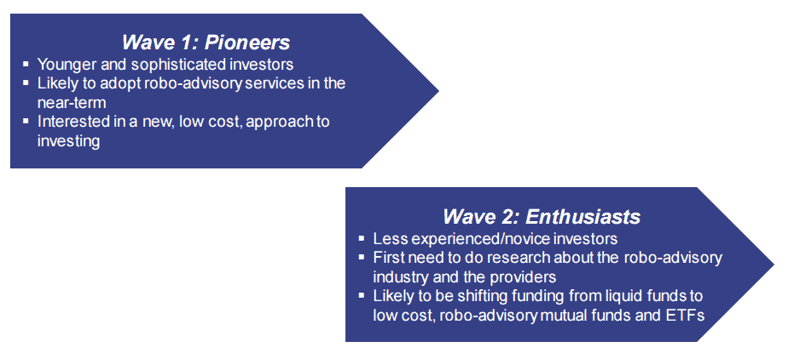

Robo advisors – Current capabilities and future growth (Source – Accenture Research)

For an investment firm, employing a robo advisor can help in the way they are implemented. A robo advisor can do some of the most simple but repetitive tasks or at times even cater to customer support. For most in the investment services, robo advisors are ideal to cut costs, use it as a means to promote investment advices or even financial literacy.

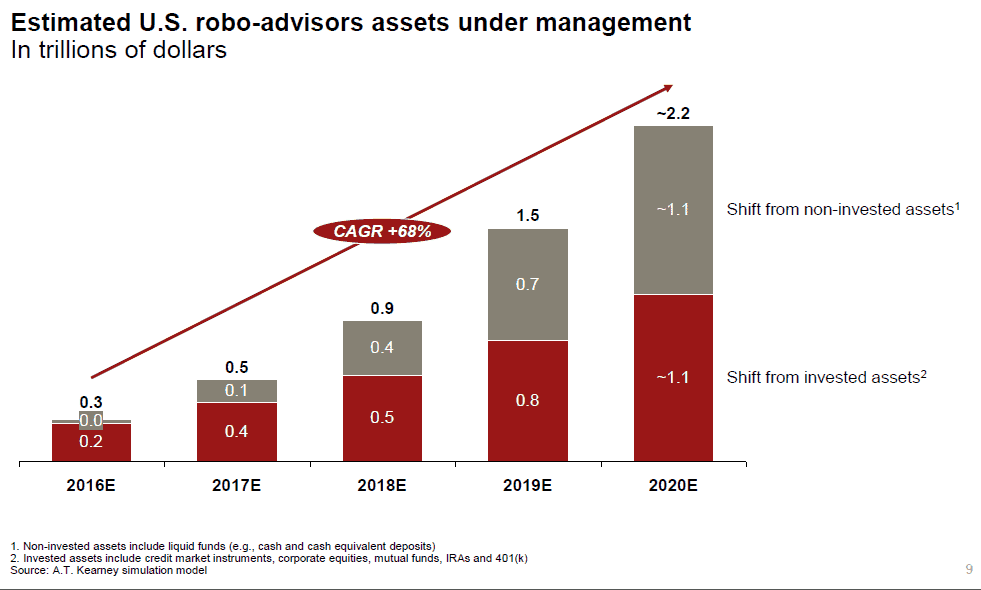

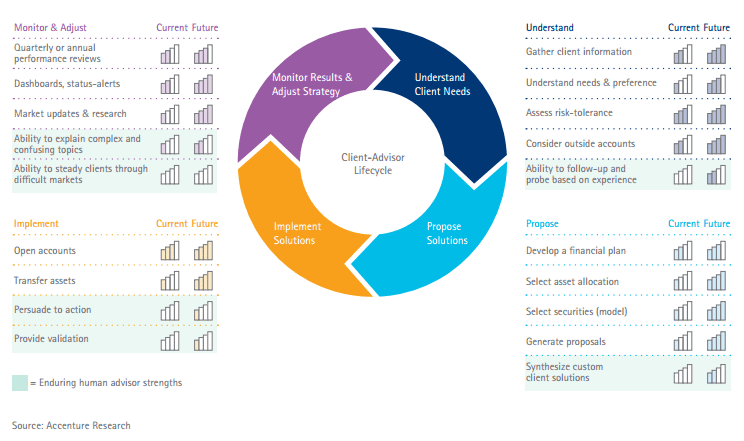

For an investor, a robo-advisory service brings them transparency and lower costs than what it would take when utilizing the services of a full service wealth management company. According to a report by A.T. Kearney and this report from Bloomberg, it is estimated that by 2020, U.S. robo-advisors could manage assets in trillions of dollars.

Robo-advisors, estimated AUM by 2020 (Source – A.T. Kearney, Bloomberg)

Brief history and evolution of robo-advisors

It is widely believed that the first robo-advisors were in existence since early 2008 although they were mostly limited to wealth managers. The first generation of robo-advisors was also limited in what they could do and were mostly relegated to automate some tasks such as portfolio rebalancing. Automated portfolio software was said to have evolved even before robo-advisors around mid-2000 and was initially targeted towards clients who had at least half a million in assets.

Things have changed since 2000 and now a quick look around robo-advisors can reveal some interesting services. For example, you can look at a robo-advisory service that specializes in increasing your after-tax returns. There are also robo-advisory services to help one to plan their retirement as well, which is as simple as linking to your brokerage account, selecting the retirement age and setting a few other parameters.

Robo-advisory services can help investors to develop a financial plan by assimilation multiple goals. When started at an early age, especially among millennials, robo-advisory services can help from college savings to retirement needs, including building wealth for home purchases, real estate planning and health care planning.

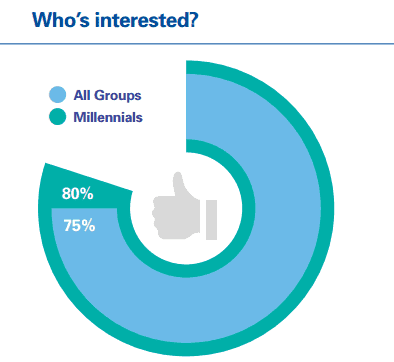

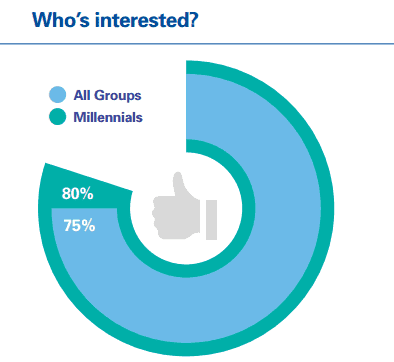

A research carried out by KPMG showed that among existing banking clients, interest in using robo-advisory services was very high and across generations, income groups and gender, more than 75% of the respondents indicated their willingness to make use of a robo-advisor services. Most the early adopters however was the millennials age 18 – 34 who said that they were more likely to use the services.

Who is more interested in robo-advisory services (Source – KPMG, Robo-advising, catching up and getting ahead)

Robo-advisors are already used to propose solutions to incorporate outside assets and managing individual securities including building and managing bond portfolios, low tax basis holdings and managing illiquid positions as well. Another important role of robo-advisors will be in helping clients understand their portfolios by providing information thus making investing a learning process as well as the market information is presented seamlessly, making more sense to the investor and thus leading to better investment decisions.

One of the biggest aspects that could draw investors and is already an appealing point of interest for using the robo-advisory service is the privacy factor, compared to traditional forms of investing. Investors have already expressed their willingness to use the privacy features offered by the digital solutions and thus make their own investment decisions as compared to dealing with a human counterpart. The next generation of Robo-advisory services is expected to build upon this to the point that emerging technologies will make use of cognitive computing which could power major advances in an evolution towards using automated advisor assistance with complex services.

What are the top robo advisors?

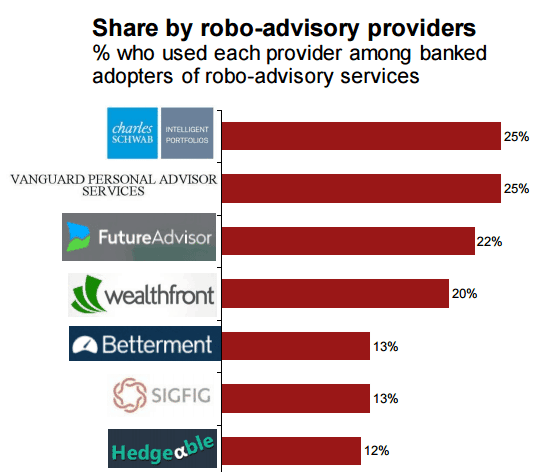

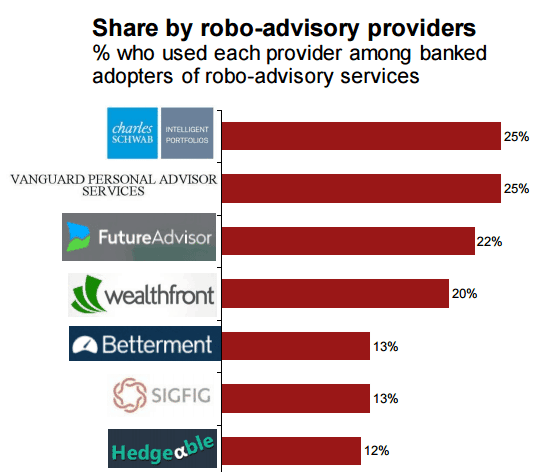

Although robo-advisory services are still small, Intelligent Portfolio from Charles Schwab and Vanguard’s Personal Advisor Services are said to be two of the top leading robo-advisory services today. However, the competition is catching up with Wealthfront and Betterment, SigFig, Personal Capital are among the other robo-advisory services that are fast catching up. As an example, Betterment and Wealthfront, two of the simpler robo-advisory services apparently have over $7 billion and $4 billion in assets under management currently.

A research by KPMG also puts Schwab Intelligent Portfolios and Vanguard Personal Advisor services as the top online robo-advisory services.

Top robo-advisory providers (Source – ATKearney)

Among the various services offered by a robo-advisor, account aggregation ranked at the very top. Account aggregation is the ability to see the aggregated view of the customer’s different bank accounts, brokerage accounts and so on, with the option to view accounts at other custodians. Ranked second was the ability to auto-invest.

Clients who wanted to use robo-advisory service or are currently using the service expressed the desire to set up auto investing options so a certain percentage of their income was automatically allocated towards investing. Last but not the least, robo-advisor services were also required to come with the function to consult a financial advisor, meaning that despite the relative ease, investors still preferred to get in touch with a financial advisor at some point in time.

How can robo advisors help in retirement planning?

According to a research report about robo-advisory services from Accenture, they expect that robo-advice will more likely complement, than replace or disrupt financial advisors and thus retirement planning. For the very simple requirements from clients, the robo-advisory model is often considered to be fulfilling and therefore, in the near future, the robo-advisors might be seen growing in demand for easy investing models such as saving for retirement, planning for a home and so on. However, more complex investing models might however continue to be seen as the domain of financial advisor experts who are unlikely to be replaced any time soon.

Another research by ATKearney in 2015 showed that nearly 20% of people polled already knew about the robo-advisory services and note that we are currently in the adoption curve. As of 2015, it is estimated that only 3% of banked customers adopted the use of robo-advisory service. While this is still the nascent stages, one can expect to see the role of robo-advisory services rising over the coming years as technology continues to play a big role in changing how we do things, investment and retirement planning included.

One of the biggest advantages of using robo-advisory firms comes from the fact that besides new or inexperienced investors, even existing clients have been looking at transitioning from an expensive managed account programs to using robo-advisory services for the benefits of low cost, automation and of course privacy. So while new and upcoming savers are most likely to adapt to using robo-advisory services, a good portion of existing investors are also quite likely to switch over to using robo-advisory services at least for some basic tasks.

There are some factors that investors need to bear in mind when considering a robo-advisory service. These include:

Minimum balance

Not all robo-advisory services are the same and there are different account types, which determine what kind of service you receive as well as the minimum balance that needs to be maintained.

Account services

There are robo-advisory services to help with one’s retirement and then there are robo-advisory services that can help one build wealth over time towards retirement or towards a specific purpose. There are also specific robo-advisory services that cater towards optimizing one’s after tax returns as mentioned earlier in this article. Thus, investors need to keep this in mind as well.

Investment services

The type of investment services offered by the robo-advisor is also something that needs to be considered. This includes the management fees which can vary depending on the type of service or the investment option that is selected. Most of the robo-advisors are specifically catered towards investing in exchange traded funds and choosing ETF’s with lower expense ratios.

Despite all the enthusiasm, robo-advice services are not expected to suit the taste of every investor, despite the likelihood of being embraced by wealth manager firms and individual investors. The share of assets under management is expected to still remain small. However, robo-advisor services will no doubt have an outsized impact on the wealth management business by and large and could be seen as a catalyst for making wealth management more competitive.

There are some limitations to robo-advisors however as only a few are able to manage existing investments, while in most cases, robo-advisors are used to building new portfolios from cash. The SEC has also alerted that while robo-advisors offer some clear benefits, investors should be alert to the risks and limitations before using a robo-advisory service.

These limitations will more likely mean that robo-advisory services at least from a purely retirement planning perspective will take some time to catch on as they are more suited towards building new investment plans from scratch compared to managing existing investment models.

While it is understandable to expect existing investors to switch to robo-advisory services, future generations are more likely to easily adapt to robo-advisory services than the current generation or two. Furthermore, the services offered by robo-advisors are still limited at this point in time and until technology continues to evolve, the uptake for robo-advisors might be slow, compared to the adoption to other similar Fintech enabled investing or financial services.

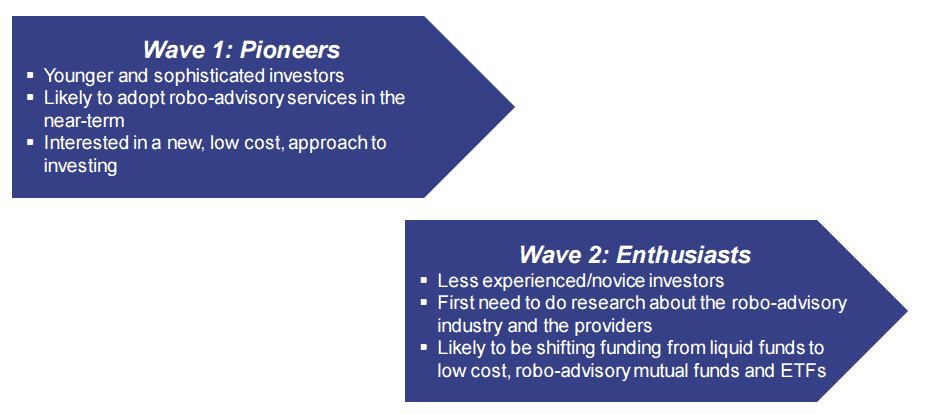

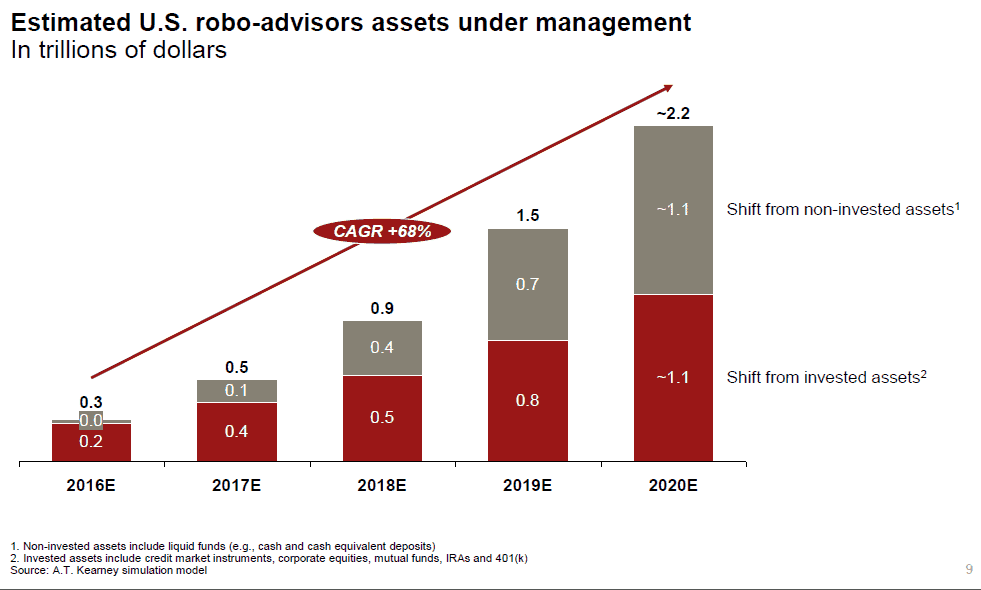

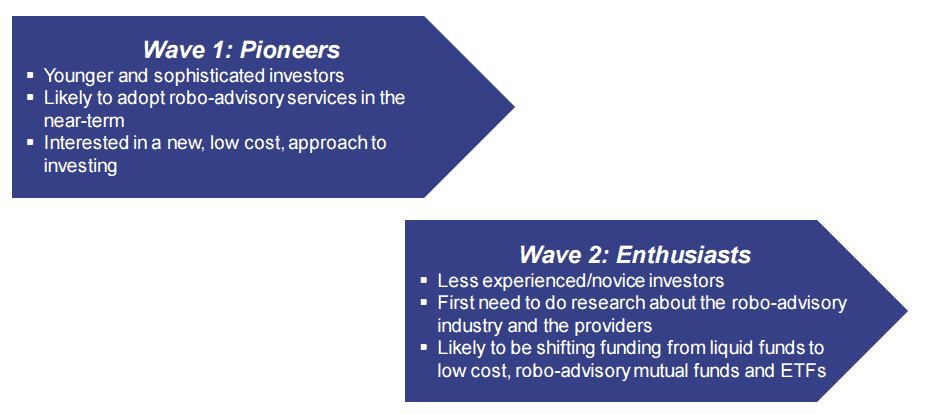

Adopters of robo-advisor services (Source – ATKearney)

The chart above, courtesy of ATKearney shows that pioneers and enthusiasts are more likely to make up for demand for robo-advisory services. The initial adopters are likely to come from sophisticated investors from the younger generation compared to the late adopters, being the less experienced or novice investors.

Therefore, in conclusion while Robo-advisor services might be the next big thing when it comes to financial planning and investing, the industry is still too early and could take a couple of years, if not more to be used as a service for retirement planning. Fintech has already disrupted the way business is done in the financial world with various automated trading and investment services already making inroads. Thus, robo-advisory services for retirement planning are unlikely to be left behind. We can also expect to see further changes and developments coming in the form of technology that will allow for easier integration or a switch from existing retirement planning models into a full use of a robo-advisor app or a service.

Day Trading Basics

Day Trading Basics