Throughout this article, we’re going to provide you a greater understanding of pump and dump stocks and how these schemes impact stock movement.

In perusing the history of pump and dump schemes, you’ll observe several profitable trade opportunities, however, we believe the risk present in pump and dumps is too great. There are too many other trading opportunities with similar reward profiles while offering much lower risk.

With that out of the way, there are traders who make a living trading these stocks, and they shouldn’t be disregarded. So while it’s not our preferred strategy, this article will provide an overview of the pump and dump market and some tips on how to trade the stocks.

Pump and Dump Schemes: An Overview

A pump and dump is a scheme whereby a group of company insiders attempts to temporarily spike the price of their stock up through artificial means. The insiders usually have a large position in the stock prior to the pump, and sell them to their victims as the price rises. The mass-selling of their shares is what pushes the price down from the artificially inflated level, creating a dump. Hence the name “pump and dump.”

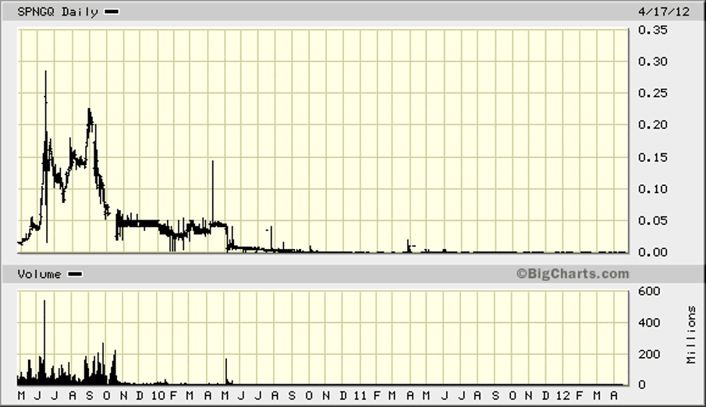

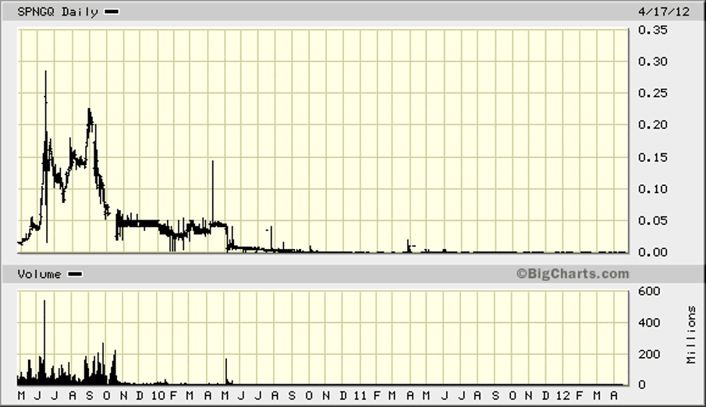

Below is an example of a famous pump and dump, SpongeTech, who were able to scam several professional sports teams out of millions of dollars in advertising bills. These sorts of scams, albeit on a smaller scale, are going on every day in the stock market.

SPNGQ Daily

Most of the time, a pump and dump works like this: the executives of a struggling micro or nano-cap company will load up on shares, then hire a stock promoter to bring investor attention to their stock, typically compensating the promoters in shares of stock. The promoter’s stock-based compensation ensures the alignment of incentives between the promoters and executives.

The promoters will usually employ plenty of hyperbole in their marketing, fooling their novice retail investor targets into buying the stock. As the retail buying gains steam, the pumpers sell their shares to the oblivious retail buyers. As the retail momentum dies down, the selling pressure created by the insider selling pushes down the stock price, creating the “dump,” leaving their victims with huge losses.

A Primer on Stock Promoters

At the micro and nano-cap level, most companies don’t have the capital to have an in-house investor relations department, so they outsource it to a specialized investor relations firm. The normal functions of an investor relations company are benign; answering investor questions, packaging financial data in an easy-to-digest format, and handling public relations.

Having said that, at the microcap level, many IR firms serve as glorified stock promotion firms. Rather than being an outsourced IR team, they’re called on by companies who want to temporarily boost their stock price. Most of the time, the publicly traded firm compensates the promoter in shares, in addition to cash, to align the incentives of both parties. This ends in a scenario where both the promoter and the company’s executives have a bunch of shares to dump as they’re pumping up the price.

Anatomy of the Pump and Dump

The initial seeds of a pump and dump are typically planted months in advance of the promotion. The executives of the company will usually load up on shares, often forgoing their salary in favor of stock-based compensation.

Once the right people are in place, the promotion itself is planned. The promoters need an angle to sell.

Unless they’re a top promoter (like AwesomePennyStocks several years back), they can’t just say “I love this stock” and expect people to buy. Sometimes these angles can write themselves if the company is in a hot new industry, but most of the time, a catalyst needs to be devised.

Here’s an example of the type of stock that promoters love marketing. In a case like this, the company might not even need to have a “new announcement” coming, the novelty and scarcity sell the stock on its own. When this promotion came out, drones were brand new to most people and seemed like an industry that could offer exponential growth.

Pump and Dump Stock

In most cases, though, the company itself is boring, like a gold or energy exploration company. An interesting catalyst is necessary in order to create some allure around the stock. This could be a new exploration project with the massive potential or the possibility of a partnership with a much larger industry peer. One of the biggest stock promoter tropes is to tease partnerships with Apple or Walmart, but in reality, the partnerships rarely materialize.

Reverse Mergers: A Bright Red Flag

In some cases, the subject company is created purely with the intention to pull off a pump and dump scheme. In this instance, all parties (promoter, company owners, legal team) are commonly in cahoots with one another.

This process is called a reverse merger and is one of the most glaring red flags when analyzing a micro or nano-cap firm. In a reverse merger, a company is basically allowed to “go public” without any of the necessary due diligence or securities law compliance required by financial authorities and exchanges. A publicly traded (usually on the OTC market) “shell” company is purchased and merged with the holding company owned by the pumpers.

In the months leading up to the pump, the insiders of a reverse merger will create artificial trading activity by making trades amongst each other to give the illusion that the company has some prospects and history.

The difference between a reverse merger promo and that of an existing company is that the reverse merger promotions are almost always pure scams: companies with no real operations or revenue, created solely for the purpose of a pump and dump scheme.

A listed company is required to file an 8-K filing with the SEC when they perform a reverse merger. When you’re looking up the SEC filings of a promoted stock, be sure to comb through their 8-Ks to see if it’s a reverse merger. If it is, be extra careful when trading the stock.

Most of the time, these pure scams are found on the OTC market, rather than the listed exchanges.

Trading Pump and Dumps

I hope by now I’ve provided a big picture understanding of how pump and dumps work, the motivations behind the insiders, and some insight into what creates these enormous price moves. But this theoretical knowledge is unhelpful without the accompanying practical understanding of how to apply the knowledge.

The two most important technical aspects of trading pump and dumps are volume and momentum. As soon as one of the two dries up, the dump is around the corner.

Red Light Signals

When trading pump and dumps from the long side, we want to be as discriminating as possible. We have to look for as many red flags to prevent us from trading as possible. Failing to do so will lead to you eventually holding the bag when the dump occurs.

Here are the two main signals to NOT get long on a promoted stock.

Momentum Divergences: Stay Away

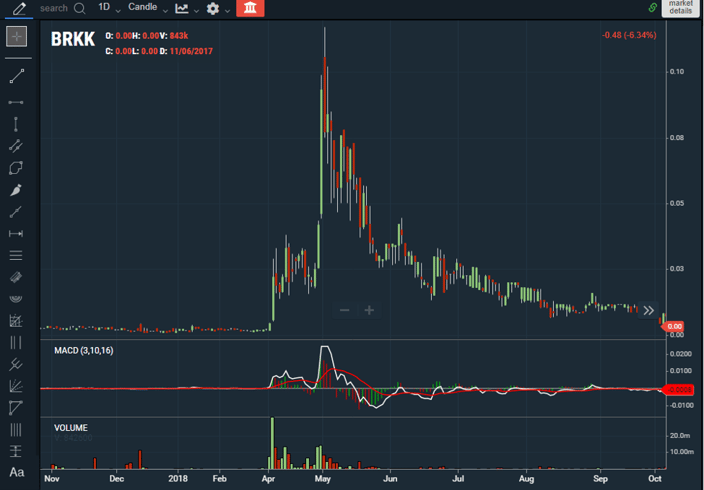

If a pump and dump makes a momentum divergence, AKA, the price makes a new high but momentum doesn’t, that’s a huge red flag and you should avoid trading the stock from the long side. Momentum is essentially a measure of how aggressive market participants are, price’s rate of change. If the level of aggression is waning, the dumpers will sense this and begin to unload the rest of their shares as fast as possible, sensing the bottom dropping out.

The maxim that “momentum precedes price” is one of the cornerstones of Market Wizard Linda Raschke’s trading philosophy. This means that we’ll generally see bulls aggressively hitting the offer before we see the new high that results from their aggression. The same principle follows inversely: weakening momentum normally precedes weakening price movement.

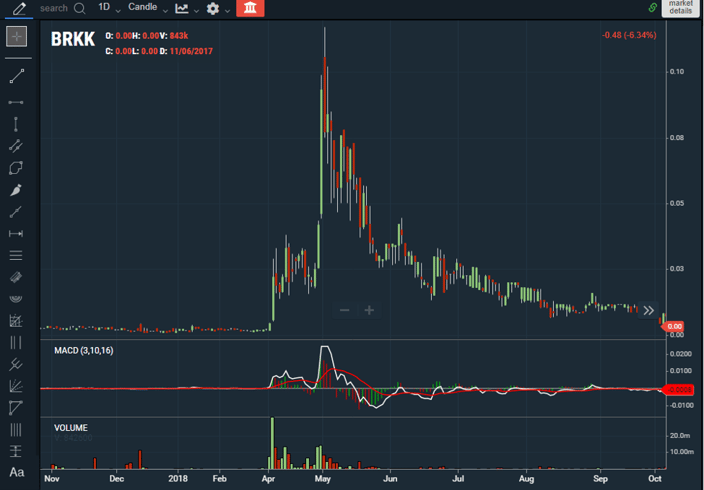

The simplest way to gauge momentum is through a momentum oscillator. There are tons out there: MACD, rate of change, RSI, etc. I prefer to use a modified MACD, the famous 3/10 oscillator popularized by Linda Raschke. That’s a 3-period slow line, 10-period fast line and a 16-signal period. Most of these oscillators are pretty similar, this is just the one I prefer.

When not trading pump and dumps, a momentum divergence most often indicates that the price is going to enter a phase of consolidation soon, rather than a complete trend reversal. However, in the manipulated world of pump and dumps, we can take a momentum divergence to mean a glaring red flag, that the dump will begin any time now.

Here’s a glaring example of a momentum divergence on a pump and dump:

Pump and Dump – Example 2

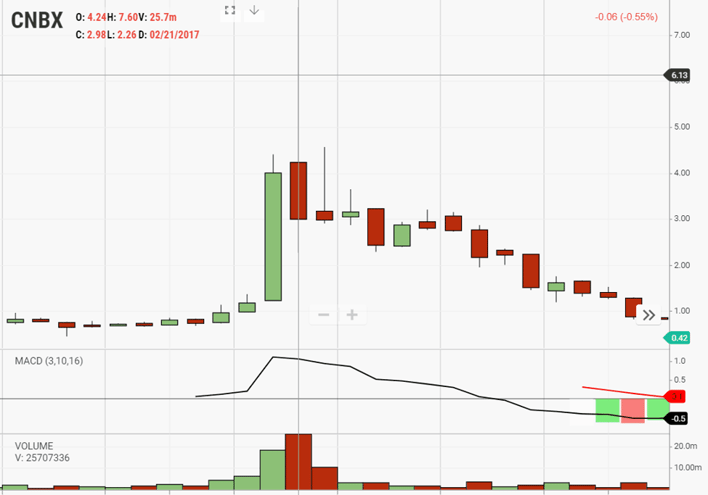

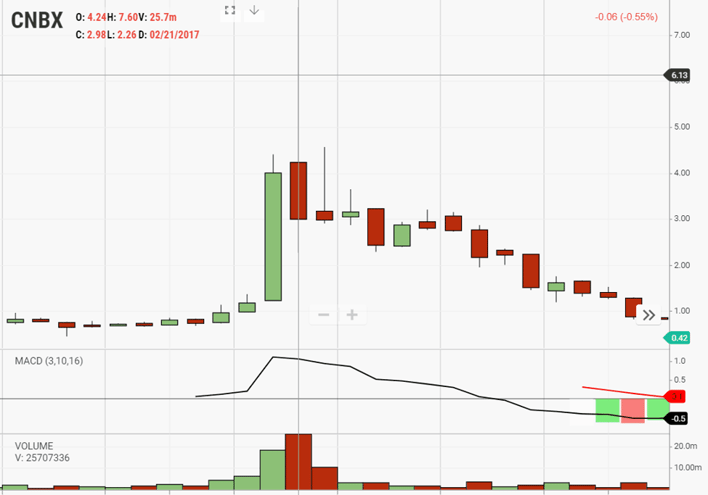

Volume Divergences

As I said earlier, momentum and volume play hand in hand in a pump and dump. The absence of one tends to precede the decline of the other. In this case, when we say we look for a volume divergence, that means that the price action and volume are saying two different things.

The key red flag to look for here is the volume on a pullback exceeding that of the recent upswing. In the CNBX chart below, we can see that the pullback volume was much heavier than the upswing volume, which preceded the dump.

CNBX Pump and Dump

Green Light Signals

The first step to analyzing a promoted stock is to screen it for the above red flags. Only then can you begin to look for the green light to enter a trade. The order of operations here is crucial because our greedy lizard brain will find a reason to trade and then trick our brain into ignoring red flags. If we look for red flags first and eliminate stocks that fail our tests, we can avoid some sticky situations.

That said, if your stock passes the test, here are some things to keep a note of when entering a promoted stock.

Get In Early (In The Day)

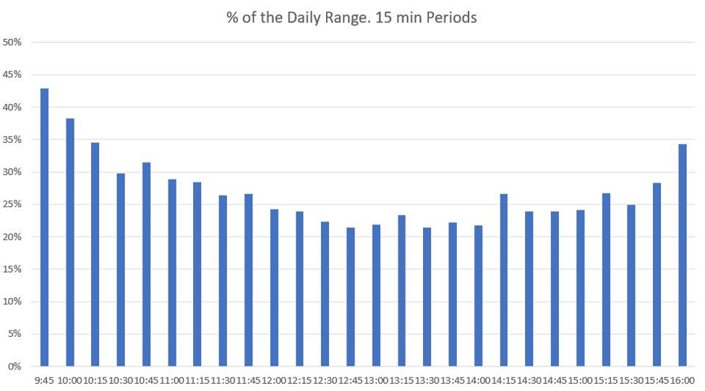

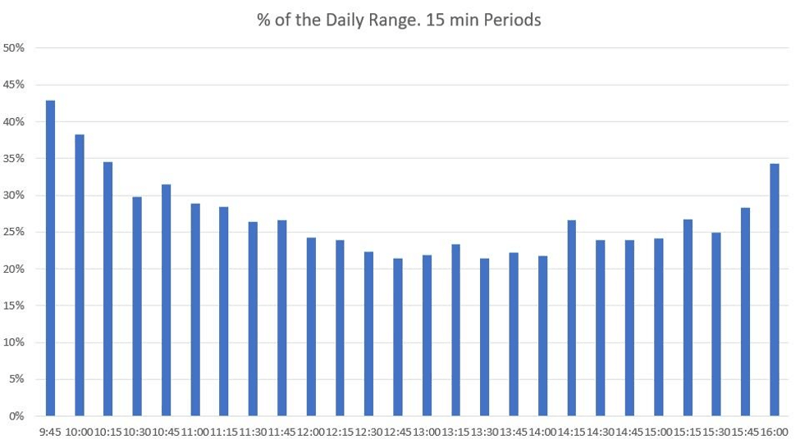

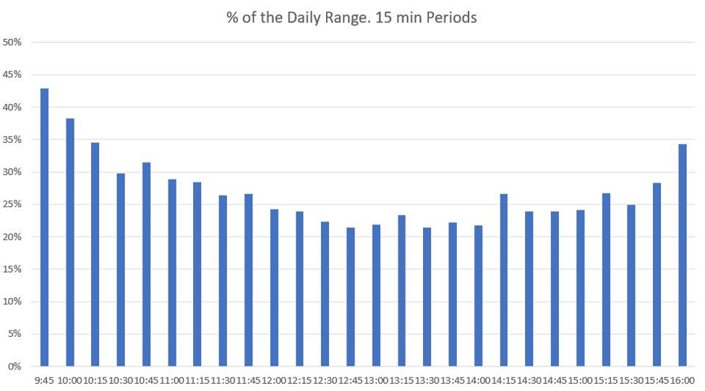

Take this graph from Fernando Oliveria, author of Traders of the New Era. In his study, he looked at 15-minute data from the S&P 500, a slow-moving large-cap index.

15-minute Trade Data

As you can see, most of the action in a trading day, even for a large-cap index, takes place in the first and last half-hour of the regular trading session. Now, imagine the volatility of the data for pump and dump penny stocks?

Of course, the ideal situation is to get into the stock as early in the promotion (without any red flags present), but if you’re late, the best move in terms of expected value is likely to wait for the following day’s market open to trade the stock. The best promotions last several days before dumping, with the meat of the moves being made in the morning at the open.

Hitting The Ask

You want to enter when buyers are still slapping the offer. There are plenty of indicators out there to analyze this, but to me, it’s easy to watch the time & sales. When a transaction takes place on the ask, the print will be green. You want to be consistently seeing more green prints on T&S for size.

Once you begin seeing large blocks of shares taking place on the bid, that may be the insiders sizing up their liquidation as they see that the end of the pump is near.

Additionally, when looking at over-the-counter and thinly traded promoted stocks, I look for a fat bid. I want to see several buyers lining up to buy the stock, while offers staying remain small because buyers keep taking them out.

New Momentum High

This is more dependent on when you get into the stock. If you get in super early, like within minutes of getting an email alert from a hot promoter, of course, there will be a new momentum high because the stock probably gapped up from trading sideways for several months.

However, if the pump is already underway when you’re ready to enter, you want to enter on a new momentum high. Remember, momentum precedes price.

Final Thoughts

Most pump and dump traders focus on the short side. They wait for weakness on the backside and short as the bottom falls out. Shorting these stocks hold some key advantages: they almost always return to their pre-promotion price, they’re usually shoddy companies if not outright scams, and the float usually becomes dominated by short-term traders who are inevitably going to leave the ticker behind as the momentum leaves the stock.

Keeping all of that in mind, shorting parabolic penny stocks is probably the most common way traders blow up their accounts, especially holding overnight. Because of this, there is a significant allure to taking advantage of pump and dumps on the long side. This is how famous trader Tim Grittani made his first millions.

While I think I laid out the groundwork for learning about pump and dumps, there is so much more to learn. Execution and exit plans matter the most in these stocks, more than knowing the background of the company or reading the filings. No amount of reading will make up for the experience of just trading these tricky stocks day in and day out for a while. You can opt to “learn” with your own capital, or you can just trade the hot tickers of the day with our simulator.

Like any trading strategy, trading pump and dumps requires ample screen-time and a sample size of trades to evaluate your results in a statistically significant way. Due to the immense risk of trading these types of stocks, using your own hard-earned capital to practice trading them is virtually guaranteed to be an expensive venture.

Instead, just use TradingSim as your stock market time machine to practice trading these high-flying stocks.

Day Trading Rules

Day Trading Rules