Ascend your trading journey by exploring the tools and strategies employed by top-tier professional traders. With insights on risk management, technical analysis, and disciplined trading practices, unlock a pathway towards enhanced trading expertise and financial growth.

Very few amateur traders succeed at becoming professional traders. While there may not be any reliable statistics on the failure rate of budding traders, there’s an adage in the industry that 90% of traders fail.

That being said, some stick it out, trudging through the mire of losses and bad decisions, to finally reach a point of consistency and stability in generating income through trading. It often takes many years.

Along the way, these professional traders acquire tools and strategies that become a part of their routine, leading them to market success. Without them, they’d be flying blindly. In this blog, we’ll explore the strategies and tools used by professional traders, covering trading skills, discipline, software, and more.

The World of Professional Traders

Professional traders are genuinely an exclusive club in the world of finance and investing. The curve to success in this field is littered with a multitude of failures. Even the most successful traders are not without the temptation to blow up. The number who can claim to make a living solely on the gains of their trading is small. But they do exist.

Social media has a way of aggrandizing the life of a professional trader. Many see an extravagant lifestyle of private jets, Italian cars, and expensive watches and think that it’s easily attainable. Yet, the journey from novice trader to professional often looks more like many years of this:

- Read a few books or join a trading room.

- Throw your hard-earned money into a trading account.

- Follow a guru or a friend’s stock tip.

- Lose all your money.

- Refund your account and study more.

- Make more stupid mistakes and lose all your money again.

- Refund your account and study more.

- Make modest money, lose a lot of money, but save your account.

- Over time, learn the strategies you need to trade well.

- Manage risk well.

- Grow your account.

- Compound your gains.

- Make a living.

If there is one thread running through this list, it’s the importance of continuous learning and adaptation, as well as the ability to overcome losses and mistakes. Many of the greatest professional traders blew up at one point or another. And the path to success is not pretty.

Developing Trading Skills

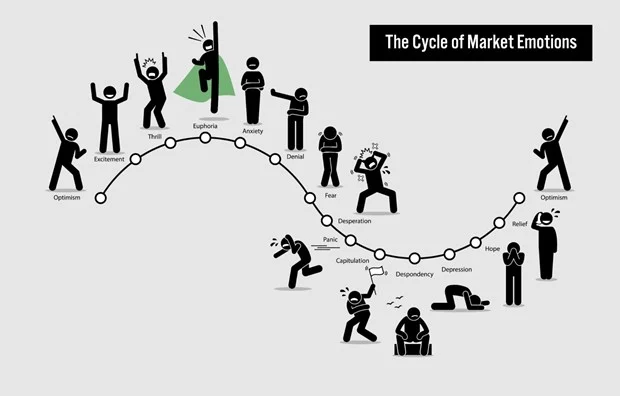

While many professional traders fail on their path to success, it is the development of their skills that eventually leads them to consistent profitability. Those skills include emotional intelligence and fortitude. In other words, psychological maturity.

Pro Tip: Be sure to check out our Guide to Trading Psychology for tips and tricks!

The Role of Psychology in Trading

While technical analysis and strategy are important, these will eventually take care of themselves as you mature in your understanding of markets. One need only apply himself to keen observation and study of the great market theorists to choose from a host of profitable strategies.

Trading psychology, on the other hand, can be a doozy to master. It often involves the humbling experience of repeated impulsive mistakes. For that reason, let’s take a look at some of the psychology principles you’ll need to master to become a professional trader.

- Embracing discipline: Understand that if your self-discipline is lacking, you’ll be prone to impulsive behavior, revenge trading, and many other blunders that will inhibit your trading success. You’ll likely come to the market without a plan, prone to gamble versus making rule-based decisions.

- Handling emotions: Dealing with drawdowns, managing winning trades, and the myriad other issues you’ll face all play into the emotions of fear, greed, and ego. To become a professional trader, you’ll have to learn that these are all natural emotions. Yet, without control of them, you’ll get tossed around in the markets like a tumbleweed.

- Building patience: The mother of all values. Lack of patience and recklessness is a killer for trading accounts, and it works in two directions. You must possess patience to wait for the right opportunities, and you must wait for the opportunities to fully develop once you’ve taken them.

- Developing analytical skills: This goes beyond technical analysis. Rather, as a trader you must be able to analyze your psyche, your position in the market, the perceived threats to your account, and trust your analysis. It’s like checking the gauges of an airplane while flying at night – constantly checking, charting, and reevaluating until the destination is reached.

Professional Trading Strategies

There are an infinite number of trading strategies. With the evergrowing field of quant trading and AI, trades can last as long as a few milliseconds or for many years. There are no right strategies or wrong strategies, except the ones that turn into losses. But even those, when managed properly can be considered a win.

The goal for professional traders is to educate themselves on several strategies and market conditions and then apply themselves to mastering at least one or two of them. Over time, the experience traders glean from the markets will help guide their decisions on when to execute these strategies, or when to sit on the sidelines. Let’s take a look at the more popular styles of trading for professionals.

If you’re looking for an in-depth guide to trading strategies, be sure to head over and check out our Ultimate Day Trading Strategies Guide!

Popular Strategies Used by Trading Professionals

- Scalping: Scalp Trading is a lot like it sounds. Your goal is to shave just enough off the top to make a profit. Scalp trading is a higher-frequency trading style that has the following benefits:

- Less exposure to long-term risk

- Less susceptibility to greed as targets are typically reached quickly

- More trading opportunities

An example of a successful scalp trader is Eduardo Briceńo.

- Day Trading: Day Trading is a popular strategy for many trading professionals. From prop firm traders to individual traders, day trading promises a 9-5 in the markets chasing profits. But it isn’t as easy as it sounds. Day trading is as risky as any other type of trading. Here are a handful of the types of trading strategies that day traders employ:

An example of a successful day trader is Nate Michaud.

- Swing Trading: Swing trading is one of the more popular trading strategies for professionals because it doesn’t require the constant monitoring of positions that day trading and scalping requires. Swing trading allows you to hold a position for a few days to a few weeks, perhaps even a few months as it develops.

One of the more successful swing traders in modern history is Gil Morales.

- Position trading: Position trading is for longer-term portfolio managers. Perhaps the most successful position trader in history is Warren Buffet. The goal of position traders is to take the 10,000-foot approach to trading: buy when a company pulls back, and hold on for the long haul.

Professional Trading Tools

Professional traders are typically moving large sums of money around in the markets – maybe not all at once, but with bigger accounts than the typically 9 to 5er would be. In order to do this with efficiency and accuracy, they rely on more precise brokerage tools, scanners, and risk management tools.

That doesn’t mean that all professional traders use proprietary software or trading platforms. In fact, Gil Morales has often said that he trades through ThinkorSwim, a trading platform readily available to the public. But for the more proficient day traders searching for short locates and needing precise order fills, ThinkorSwim may seem like a Honda compared to a fine-tuned racing machine.

On that token, let’s look at some of the more prevalent trading tools used by professional traders and why they are important.

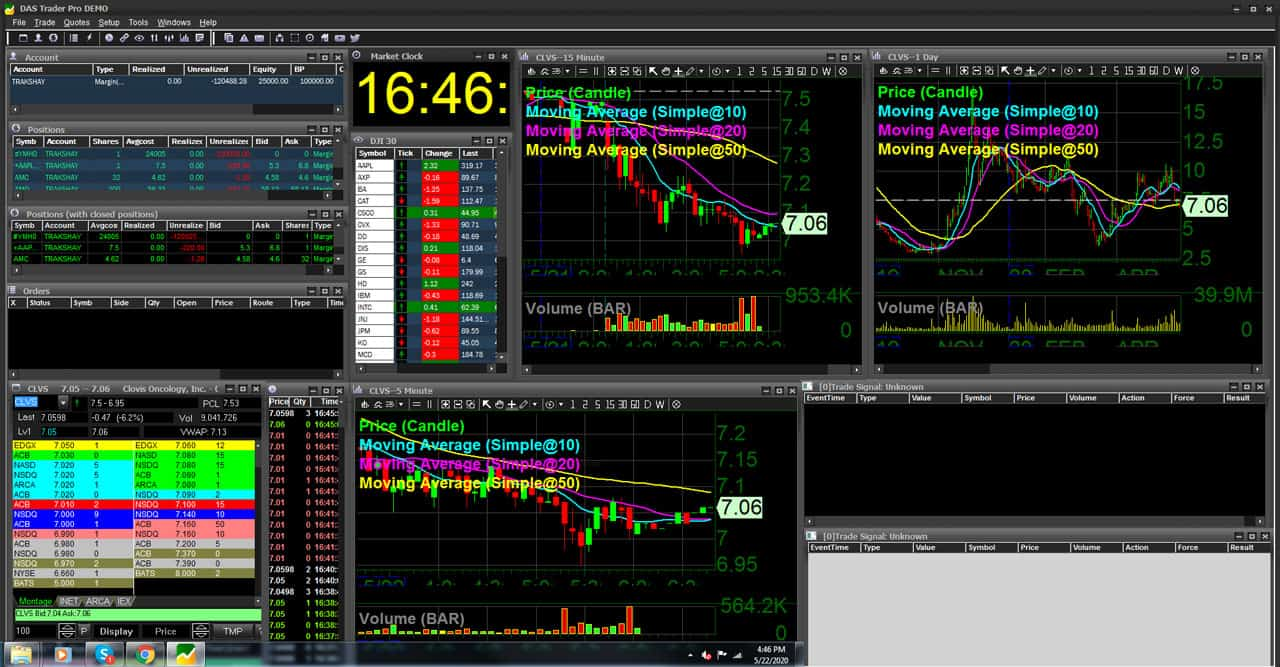

1. Trading Platforms

Every trader has to have one. Unless you’re still relying on calling in your orders to your broker the old-school way, you’re going to need access to a platform. Most brokerages have them now, and they are becoming more and more high-tech as AI and quant computing evolve.

There are several in-house trading platforms for different brokers that provide a range of tools from charting to automated trading. Here’s a short list of the more common ones:

- ThinkorSwim

- Fidelity Investments

- Interactive Brokers

- Merrill Edge

- E*Trade

- TradeStation

- WeBull

- RobinHood

- Meta Trader

While most of these would get the job done for a position trader or a swing trader, day traders and high-volume, high-frequency traders usually opt for a more advanced platform connected to a boutique broker. These brokers provide special routing, hard-to-borrow short locates, and lightning-fast execution. In addition, they usually cut deals for high-volume traders.

Here is another list of the more popular day trading platforms available:

2. Boutique Brokerage Firms

The trading platforms that professional traders use wouldn’t be worth the money if they weren’t tied to a firm that couldn’t handle the needed fuel to power the platform. In other words, you need a broker who has access to multiple routes, multiple clearing firms, and short locates, all connected at super-low latencies.

Here are a handful of some of the popular boutique firms that pro traders trust:

3. Trading Risk Assessment and Management Tools

Most trading platforms have risk management tools built into them. For example, in DAS Trader Pro, you can code your own risk management rules. These rules can be set at the time you place a trade so that if a position goes against your prediction, the system will automatically stop you out of the trade.

In similar fashion, many of the brokerages mentioned above feature a “max-loss” that keeps you from blowing up your account by liquidating your trades and preventing you from making any further trades on the day. This comes in handy when emotions are running hot.

4. Scanners

Almost all pro traders have some sort of scanner. Some even code their own. Take Nate Michaud from InvestorsUnderground.com as an example. Nate has employed a coder named Max in his chat room for many years now. Max has built a lot of great tools for that community, including a market scanner, an AI social sentiment scanner, and other proprietary tools.

Whether you can code your own or use third-party software, your scans will be heavily dependent upon your strategies. For example, if you follow the Episodic Pivot strategy of Kristjan Kullamagi, you’ll want a scanner that looks for these events in the market.

Gil Morales swears by the High Growth Stock Investor software, but also uses a number of other tools like StockCharts.com. Other popular scanners include TradeIdeas.com, TC2000, and TradingView software, just to name a few.

Regardless of the scanner you choose, it should be an efficient tool for the type of trading you want to do. In other words, if hyper-scalping is your thing, you may not like the broader market scanning of certain tools like StockCharts.com. You might need a more intuitive, real-time scanner like TradeIdeas.

Generally speaking, the tools of the trade will become an extension of your strategies. Most pro traders settle into the type of software and tools they love and stick with them. Not everything that glitters is gold, and often less is more when it comes to the tools you need.

Trading Discipline and Mastery

Discipline is arguably the #1 tool any person needs to become a successful trader. If you were only given a set of rules and one strategy and told to follow them, chance are, you’ll veer from the rules and place trades outside your strategy. It’s the old cookie jar adage. When you’re told not to do something, you usually do it anyway.

Thus, the path to trading mastery often lies within your ability to stay disciplined and avoid costly mistakes. Without a defined strategy and the discipline to follow it, you’ll lose in the end. At the end of the day, successful trading isn’t about making money, it’s about the process. Follow the process and the money will come.

Successful Professional Traders

One of the more successful traders of the current generation is Kristjan Kullamagi. He’s only been trading for a little over a decade but has amassed a fortune in trading gains. According to him, he’s somewhere around 100 million dollars in profits by 2023.

You can read his story on his site, but one thing peculiar about “Qullamaggie” is that he gives out his strategies for free, often live-streaming on Twitch. You can read about his story here.

In short, Qullamaggie got started years ago in Nate Michaud’s Investors Underground chat room as a penny stock short trader. He blew up 3 or 4 times and was working as an overnight security guard in a museum. Over the years, he studied and evolved his strategy to become more of a swing trader, following advice from Pradeep Bonde, Dan Zanger, William O’Neil, Gil Morales, Mark Minervini, and other famous traders.

Techniques for Maintaining Discipline in Trading

We’re huge fans of the work that Dr. Brett Steenbarger does for professional traders. He works with prop firms on trading psychology and has written many books as self-help guides to navigating the emotional side of trading. We’d be remiss to not point to his work for how to maintain discipline. After all, there is no quick fix. Instead, we’ll leave you with this quote from Steenbab:

“I have been impressed in recent years at how many traders generate good ideas and enter positions at good levels. They simply cannot weather the price path once the positions are on. Very often, when we review where they stopped out of positions, we find that the trades ultimately worked out and hit planned targets. The problem was not discipline in finding and entering trades. The problem was the self-discipline required to navigate the trade.

Self-discipline is more about envisioning multiple what-if scenarios and knowing how to respond to each. The disciplined trader takes the break-out trade. The elite trader tracks order flow and the flow of buying and selling from the point of breakout and flips the position if those breakout flows are not sustained.

A great deal of trader education emphasizes discipline. Success in financial markets, however, requires self-discipline. The training of traders should look more like the training of elite performers who operate in fluid situations and less like the training of grunts in basic training.”

Trading Technical Analysis

Technical analysis in professional trading is no different than any amateur trader would employ. We all see the same charts, the same ticks, the same volume, the same indicators. Sure there might be slightly more advanced tools to visualize order flow behind the scenes, but even Wyckoff would tell you it's all in the tape.

The key to understanding technical analysis tools and indicators for professional traders lies in the ability to trust them and your ability to use them. More often than not, less is more. At the end of the day, every analysis tool relies on three basic things: volume, price, and emotion. Find a tool that shows you those three and you’ll be well on your way to understanding where to buy and where to sell.

Professional Trading Courses

Education in trading is often overlooked as an essential to becoming profitable. It is a profession unlike any other in that the barrier to entry is so low. We send doctors to school for decades before they come out ready to perform surgery. Yet, anyone can throw some money into a free brokerage account and gamble it away without any recourse.

To be successful, traders need more than just a crash course. It takes time and practice to learn how to navigate the markets. Our ethos here at TradingSim is founded on that. We believe that the best traders learn through trading without the risk of loss – paper trading. Replaying markets to find strategies, test analysis, and observe trends before you put your hard-earned money to work.

That being said, there are a handful of great resources for trading education available on the web. From free courses on YouTube to paid courses online, you should give them a try and glean what you can. Here are a few to get you started:

- Free Day Trading Course on YouTube

- Paid Wyckoff Course from Wyckoff Analytics

- Mentorship and Analysis from Gil Morales

- Free Live-Stream from Qullamaggie

Pro Tip: Learn everything you can for free online, then try the monthly trials for any paid subscription services so you can see whether or not the service fits your goals before you commit to a long-term payment.

Conclusion

We hope you’ve found this exploration into the world of professional traders beneficial. It can be an exciting and challenging endeavor to become a professional trader, and the rewards are many. However, getting there will require an intimate knowledge of the strategies and tools that pro traders use consistently. Educating yourself along the way will help you pave your own path to success.

Stay disciplined, cut those losses quickly, and best of luck!

Investing

Investing