Power hour conjures a myriad of assumptions in stock trading. Could it be akin to happy hour, where everyone takes a shot if their trades go well? Perhaps traders must drop and do pushups every 5 minutes if their stocks are declining? No, no. Power hour isn't a fraternity hazing ritual, it is simply a time of day when stocks become more volatile than others.

In this post, we'll touch on what power hour means for day trading, when power hour occurs, and how to trade during these times.

When does Power Hour occur in the stock market?

Power hour is that time of the trading day when stocks become volatile, often signaling more volume and potential reversals in the market. While some would argue that power hour occurs at the end of the day, between 3:00 pm and 4:00 pm New York time, there is another power hour at the beginning of the day.

9:30 am until 10:30 am marks the beginning of the trading day for the US stock market in Eastern Standard Time. This is also a power hour in the stock market because the most trading volume occurs during this time. Like power hour at the end of the day, the majority of trading occurs around the edges of each daily stock market session.

9:30am - 10:30am Morning Power Hour

Many traders break up their trading day into three segments: the morning, lunch, and afternoon sessions. Aside from the lunch session in mid-day, the morning and afternoon sessions bring the most volatility and price movements. Mid-day sessions are usually choppy and trendless.

For this reason, the morning power hour sessions is highly sought after for day traders. Not only does it allow some European traders to catch a good trade before their day ends, but it also represents the heaviest volume of the day. This allows traders to get into and out of trades with plenty of liquidity.

Likewise, the morning power hour session often presents the biggest price moves of the day. This is when traders like to enter trades because a new trend is forming or continuing from the day before. Not only that, but the speed in which the movements occur can bring fast profits in a very short amount of time.

That being said, the morning power hour session is often associated with retail buying. Many amateur traders may be placing trades based on rumors or news from popular tv stations like CNBC. It is also a good time for short or long traps to occur.

Take a look at this example of AAPL during power hour and compare it with the mid-day action that occurs around 12pm.

Notice in the image above that AAPL's volume was much higher in the first hour of the morning. Also, the price swings during this time created the best volatility compared with the middle of the day.

3pm - 4pm Afternoon Power Hour

The afternoon trading session usually sees a return to higher volume, much like the open. It is also a time when stocks can make sudden reversals and big moves. For this reason, the afternoon power hour is another popular time for day traders to enter the market.

In our example above, we saw AAPL during the morning power hour. Now, take a look at how AAPL performs during the last hour of the day. Not only do we see an increasing volume signature, but volatility returns with a really fast reversal off the lows.

As you can see, the last part of the day provided a lot of volatility and volume increase. For traders who are not accustomed to trading volatility, power hour can be a good time to take profits and step aside during these volatile times.

What does power hour mean in the stock market?

The power hour time frame in the stock market simply signifies a typical period of heightened volatility and volume during trading. Many day traders and institutions use the power hour as liquidity events to place larger buy and sell orders.

For example, an institution might be rebalancing a portfolio and wants to wait until the market opens or the market closes in order to place its large buy or sell orders. The increased volume during the power hour allows the market participant to place these orders without moving the market too much during the mid-day lull.

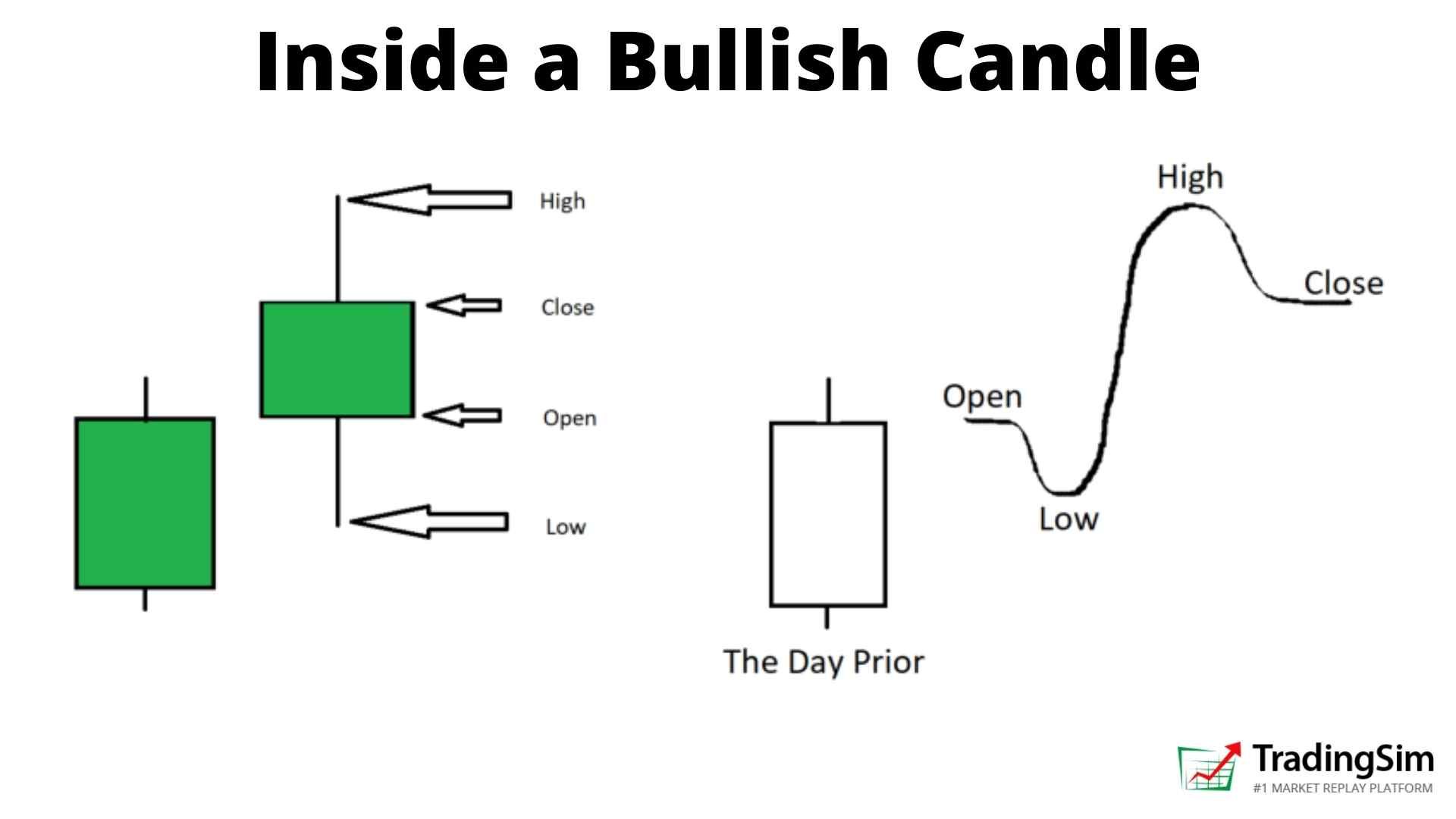

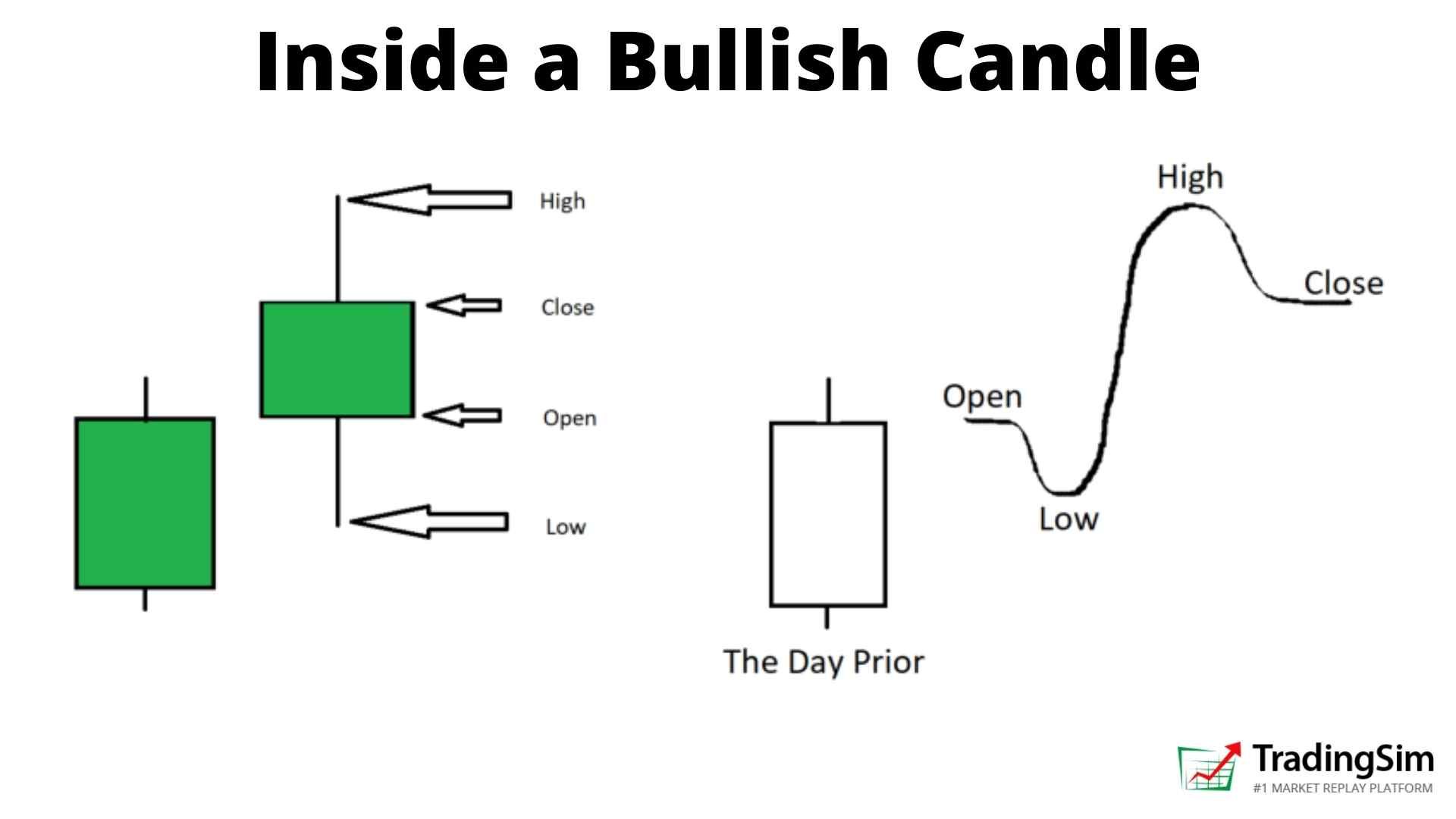

The end-of-day power hour is also a good indicator of how the daily candle will close on a stock chart. For this reason, you may find stock operators looking to buy or sell depending on the last hour of the day and how the stock's daily candle is forming. Their interpretation of the candle's potential close might influence the decision to buy or sell during power hour, before the market closes at 4pm.

What causes power hour stocks?

Power hour can be affected by many different things. Depending on the type of stock, the upcoming news, and any other market anomalies like "witching" events, you'll want to be aware of what can trigger a power hour event before you trade ignorantly.

1. News Catalysts

Many times a company will wait until the end of the day in order to release news. They can also release this before the market open. Depending on the news, it could bode well or badly for the stock in play. For example, a biotech stock could receive news from FDA clearance or rejection on a promising drug in the pipeline.

Many times, news events are foreseen by price action, but unexpected news can come at any time. Be sure to know what products and services or potential announcements could be made in a stock you are trading long before you place your trades.

2. Stock Offerings and Dilution Events

Stocks that are trying to raise money for their underlying company will often times dilute their shares by offering these shares into the market. You usually see this for newer companies and penny stocks.

One of the most violent ways to do this is by pumping a stock up on a press release and then filing an offering late in the day. We've seen this happen after hours, which can be devastating to share holders, but it can also create havoc during power hour as well.

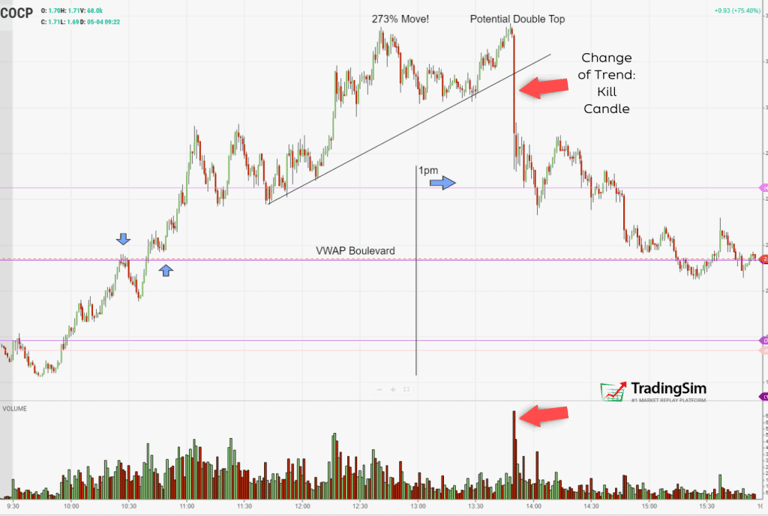

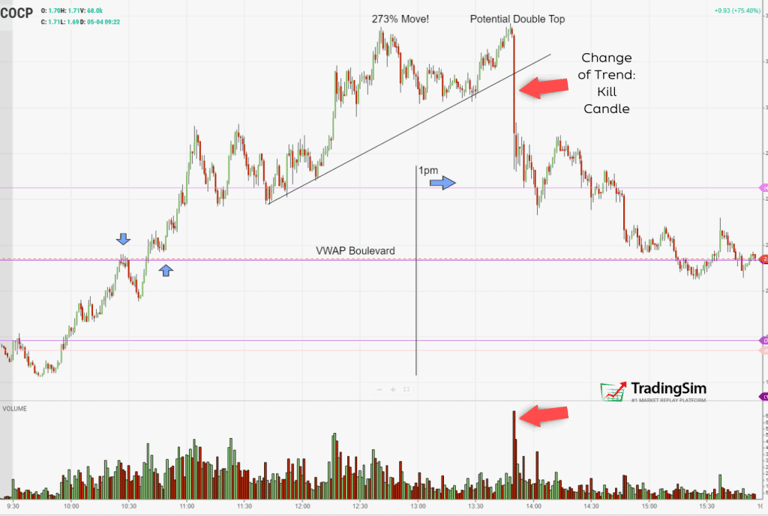

In our tutorial on the 3pm Bloodbath setup, we discuss an example of a stock that was up over 200% on the day with massive volume. It then got hit around power hour with the news of a stock offering, which killed the momentum and sent the stock spiraling into a downward halt.

3. Federal Reserve and Economic News

Depending on the time of day when the Federal Reserve Chair speaks, or job and employment numbers are released, this can create a lot of volatility in the market. More often than not, these numbers are released closer to the open or close of the trading day.

The Federal Open Market Committee meetings will usually decide whether they will increase or decrease interest rates and then send the fed chair to make the announcements toward the end of the day. While there is no real way to predict what the market will do in response to a fed rate hike or decline, these power hour events are always marked by heightened price activity and volume.

Here is a recent look at AAPL after a fed chair announcement right before power hour:

4. Triple Witching Hour

Triple witching occurs when stock options, futures, and index contracts expire at the same time. This occurs on only four Fridays out of the entire year. What this means for power hour is that on these specific Fridays volatility is increased as institutions are rebalancing their portfolios by the options or futures expiration at the end of the day.

How to trade during power hour?

Trading during power hour can be tricky for novice traders. Many times it is best to let the volatility settle, find a good risk/reward setup, and then place your trades. Not all power hours will be the same and they can be choppy sometimes.

We have written about a strategy called the 1-minute Opening Range Breakout, which can also be applied to other time frames. This is a very popular method for choosing a direction very early in the trading day. To that end, it could be applied to the morning power hour.

For the afternoon session, we suggest having a read on our 1-3pm Bloodbath article if you are looking for a solid trend-reversal and shorting opportunity in for the afternoon power hour. Here are the criteria for that setup:

If you decide not to trade the power hour, we don't blame you. Volatility isn't for everyone. Many traders like to let the dust settle and then find a stock that is breaking out in to a new trend. For that, we recommend the volatility contraction pattern.

Conclusion

As with any strategy or trading period, day traders need to review their setups and understand the risks involved. Power hour is just one of many concepts in the market that you should be aware of. The more experience you have, the more you'll learn to either take advantage of this period of heightened market volatility, or avoid it altogether.

Regardless of which path you take, if you're looking to increase your learning curve exponentially, we recommend you try our replay simulator. Not only will it allow you to replay and study the price movement of stocks during power hour, but it will give you the chance to do that for up to three years of historical data.

Study, test, and build your data set before you put your hard-earned money to risk!

Technical Analysis

Technical Analysis