What Are Meme Stocks?

Where were you in January of 2021 when the meme stock phenomenon first started with AMC and GameStop stocks? While these are the two most well-known of the meme stocks, there is actually a substantial list of companies that qualify.

So what exactly is a meme stock? By definition, a meme stock is a company that has developed a cult-like following, usually on a social media platform like Twitter or Reddit.

Meme stocks often invoke a sense of nostalgia because they were once popular brands but have since fallen out of favor. Examples of this are Nokia, BlackBerry, and of course, GameStop and AMC. Because of this, meme stocks are generally older businesses that are not necessarily seen as good investments.

Another characteristic of meme stocks is that they tend to have a large short float percentage against the company. One of the ultimate goals of investing in a meme stock is to trigger a short squeeze. The results from this for meme stock traders are two-fold: first, it causes the stock price to rise rapidly, and second, it causes distress and the potential liquidation of hedge funds.

What Does a Meme Stock Mean?

How did meme stocks get their name? If you spend any time on social media these days, the name is obvious. The term meme refers to a clever, humorous image that can be copied and slightly altered to fit any situation. The idea is to represent a concept or idea via a single image with limited wording. These memes are then picked up by social media users and taken viral.

This is exactly what happens with a meme stock, so you can see how the two ideas became associated with one another.

A meme stock has many of the same characteristics as a meme image. The underlying tone behind investing in meme stocks is always kind of a joke. These traders are almost ironically buying shares of a company that isn’t a great investment and often does not have a good history of business operations.

The goal of creating a clever meme is to get likes, retweets, or engagement from people. The same can be said for meme stocks as retail traders try to get others to coordinate a short squeeze.

What Are the Top 5 Meme Stocks?

GameStop (NYSE:GME)

The original meme stock, GameStop is still one of the most popular ticker symbols on social media. During the initial meme stock short squeeze frenzy in January of 2021, GameStop’s stock hit an all-time high of over $500 in pre-market trading. While it has lost most of its value since that squeeze, GameStop traders are still patiently awaiting the MOASS or Mother of All Short Squeezes.

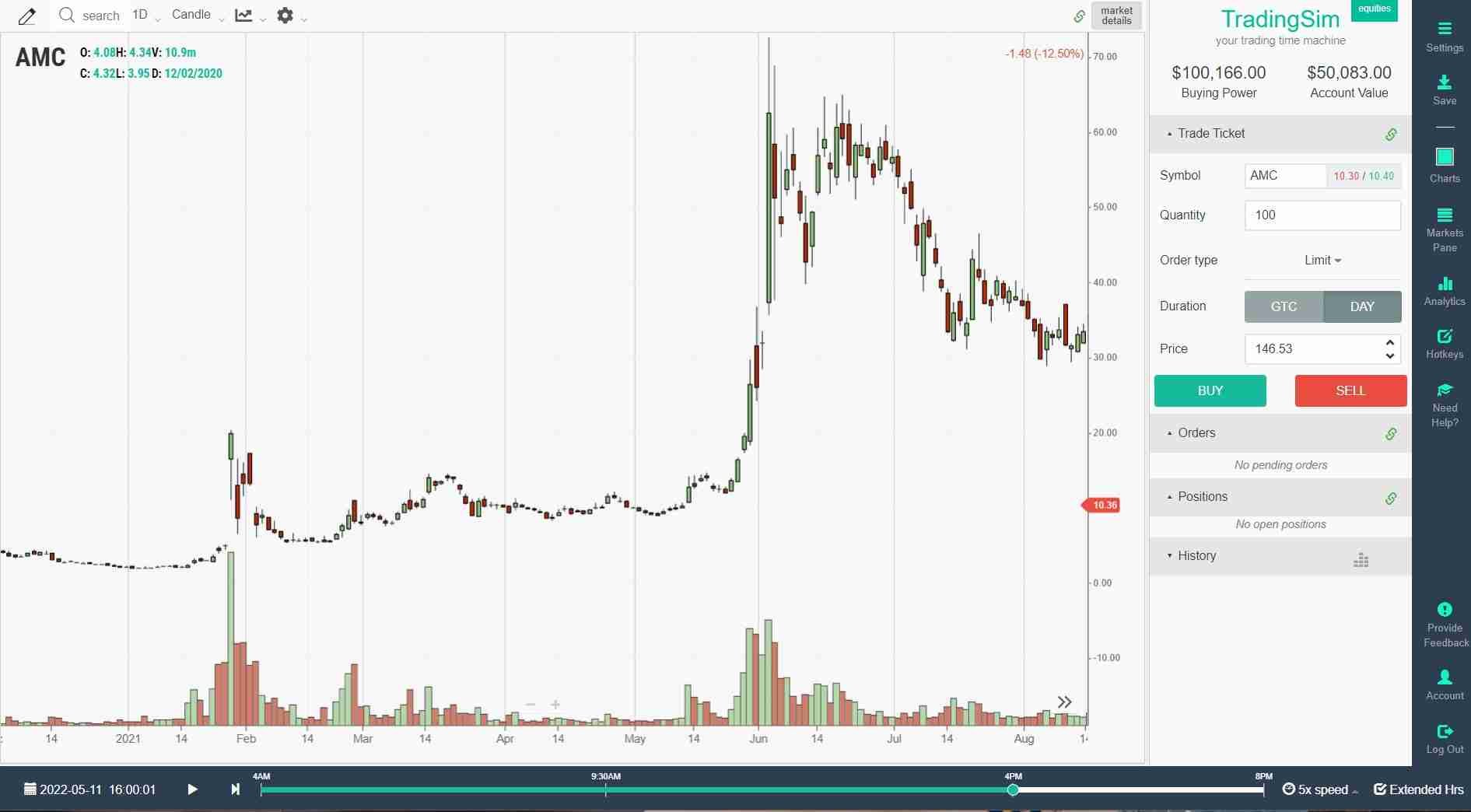

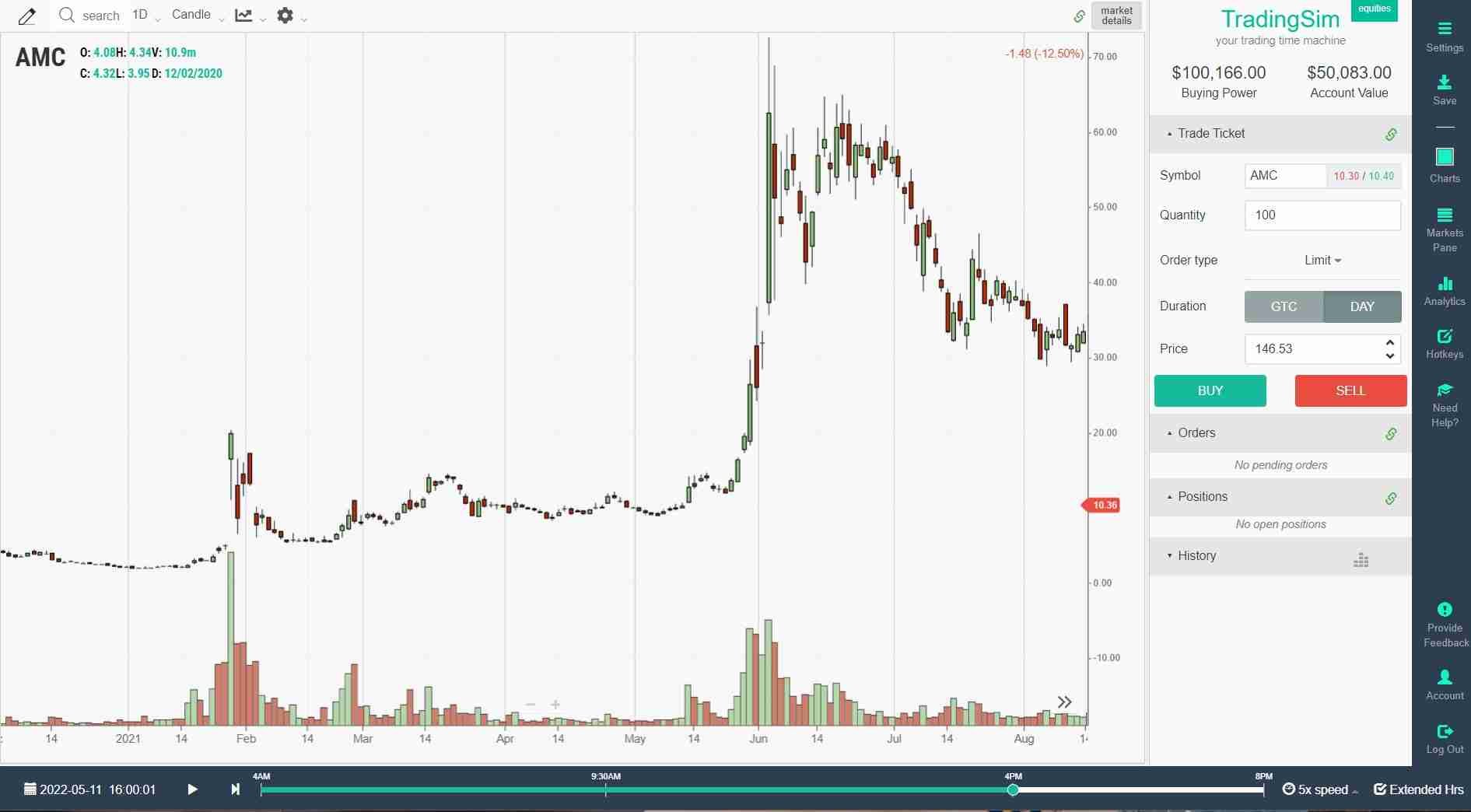

AMC (NYSE:AMC)

AMC is generally seen as GameStop’s running mate, but the movie theater company has its own strong legion of supporters called the AMC Ape Army. AMC had its own short squeeze in May of 2021, where the stock hit an all-time high price of over $72 per share. Since then, AMC has lost all of its gains from the short squeeze, but the Ape Army is certainly still holding the stock with diamond hands.

Tesla (NASDAQ:TSLA)

Not all meme stocks are of failing businesses. Tesla is also one of the most popular stocks on Reddit and Twitter, as it checks off all the boxes for meme investors. Much of its notoriety as a meme stock comes from its charismatic CEO, Elon Musk, who is a hero in the meme stock sector. Musk has cheered on retail traders during the short squeeze bubble and has even shown his support for meme fads like the cryptocurrency DogeCoin.

Palantir (NYSE:PLTR)

It’s unclear as to why the mysterious data analytics company became popular with meme stock investors. Perhaps it was the intrigue or the reputation of being an evil company. Perhaps it was the cheap stock price at which the company listed when it moved to the public markets. Either way, Palantir has become a rallying stock for meme investors, even when most of them don’t even know what the company does!

BlackBerry (NYSE:BB)

Ah BlackBerry. The once king of the mobile phone business was left for dead when Apple launched its iPhone. The company shifted to a cyber security and software company due to its hundreds of patents, but it hasn’t ever managed to regain the success it once had. BlackBerry has the nostalgia for meme stock traders, and while it has seen some mini squeezes, it has never managed to reach the same levels of AMC or GameStop.

What is the Best Meme Stock?

It depends what your definition of ‘best’ is. What is the best meme stock to own? That would probably be Tesla since it is likely the most successful of all of the meme stocks. What is the best meme stock for meme investors? It’s hard to argue against the originals in GameStop and AMC. It seems like most of the retail army is holding either of these stocks, so they probably have the best chance to see another squeeze in the future.

However, many of them have likely lost their shirts trying to hold on for dear life.

Is the Meme Stock Craze Over?

Given the market correction in 2022, it seems like a short squeeze is the last thing on investors' minds. On one hand, most meme stocks are down big, and have lost most of the gains they made during the short squeeze events in 2021.

On the other hand, the meme trader army is still strong and determined to see the squeezes through to the end. As long as there are Apes with diamond hands, it’s hard to ever say that the meme stock craze will be over.

The meme stock craze might never reach the levels it did in 2021, especially after those stocks have lost nearly all of their gains since. So for now, maybe we can say that the initial meme stock craze is over or not as strong as it once was. T

his doesn’t mean we can’t see another meme stock frenzy in the future, but it does mean the meme stock industry will probably be pretty quiet for the time being.

Will There Be Another Meme Stock?

The possibility is always there! Meme stock investors are always on the lookout for new potential meme stocks to squeeze. No doubt as long as Reddit groups like r/WallStreetBets exist, there will always be the opportunity for the birth of new meme stocks!

Until then, the old faithful meme stocks like AMC and GameStop will likely continue to remain popular with meme traders.

Which Meme Stock is Next?

As of now, it’s impossible to say. Since the bear market of 2022, many retail traders might lose interest in investing, or even have their accounts liquidated. Some other meme stocks have been popular with traders like Bed Bath and Beyond, Digital World Acquisition Corp which is the SPAC stock for former President Trump’s Truth Social platform, and Hycroft Mining, the mining company that AMC invested in.

But if we’re talking about which meme stock is next to potentially squeeze, it’s difficult to predict. The best way to find out which meme stock will pop next is to get on social media and see what the buzz is about. This is where you can often see which stock everyone is talking about and has the potential to be a meme stock in the future.

However, we don't recommend this as a buying strategy. As most meme stock investors have likely lost money over time, we recommend a sound approach to trading. One of the best ways to do this is to practice in our simulated environment using paper money. Don't risk your hard-earned cash until you know the basics of a sound strategy.

Where Meme Stock Investors Are Now?

So far in 2022 it’s been fairly quiet on the meme stock front. This is likely due to the fact that the market is in a correction and short squeezes are more difficult to coordinate. Aside from one mini squeeze for AMC stock that saw it gain 45% in a single session, most other meme stocks have been dropping lower and lower. Even AMC has lost all of the gains it made during that one squeeze.

Meme stock investors are still around though. Take a quick trip to r/WallStreetBets on Reddit or through FinTwit and you’ll see that there is plenty of support for meme stock names. Whether or not they can help these meme stocks rally is another story.

Perhaps we need to wait until the market starts to go up again before we see any other meme stock squeezes. Until then, meme stock traders will be holding, or should we say HODLing on to these meme stocks with their diamond hands!

Day Trading

Day Trading