Real Estate Construction

Real estate market investing has always been a central theme for investors, although the equity markets are often more widely covered. Real estate investing and REIT ETF investing are two ways in which investors can make capital gains by investing in property or land. Some of the world’s billionaires have at some point invested in real estate and in the current context, what better example than the U.S. President Donald Trump who built his career in the real estate business, developing properties.

Unlike stocks or bonds, investing in real estate takes a slightly different mindset and at least in one of these two forms of investing, the goal is always long term, unlike stocks where investors can plan and pick stocks to realize yearly returns or even plan for smaller time frames.

The real estate markets are hoping for a dramatic few years ahead pinning hopes that the real estate magnate turned president will be favorable to the industry. There is also increased optimism that millennials (the ones born between 1980’s and 1990’s) are more likely to purchase a new home over the next few years, according to the U.S. based National Association of Realtors (NAR), one of the leading authorities on the real estate market in the country. According to a report, the NAR noted that around 17% of first time buyers under the age of 35 were able to pay a down payment for the home.

Among one of the detriments to buying home, student loans were being seen as one of the biggest hindrance to first time buyers. But investors are hopeful that Trump will stay true to his promises on tax reforms and de-regulation which could be a boon to the industry. The prospects of profitability in real estate has also seen a surge in optimism over the past few years indicating that the time is ripe to invest in real estate. There are a myriad of investment demographics in the real estate market which is comprised of foreign investors, institutional investors as well as private equity funds and insurance companies using leveraged debt highlighting the fact that the increased interest in the secondary markets was indicative that the recovery in the U.S. real estate market post-2008 financial crisis has been expanding steadily and moving beyond the traditional investment hubs.

The U.S. economy is also contributing to this growing trend in the real estate as household incomes are seen rising with the economy nearing its full-employment potential.

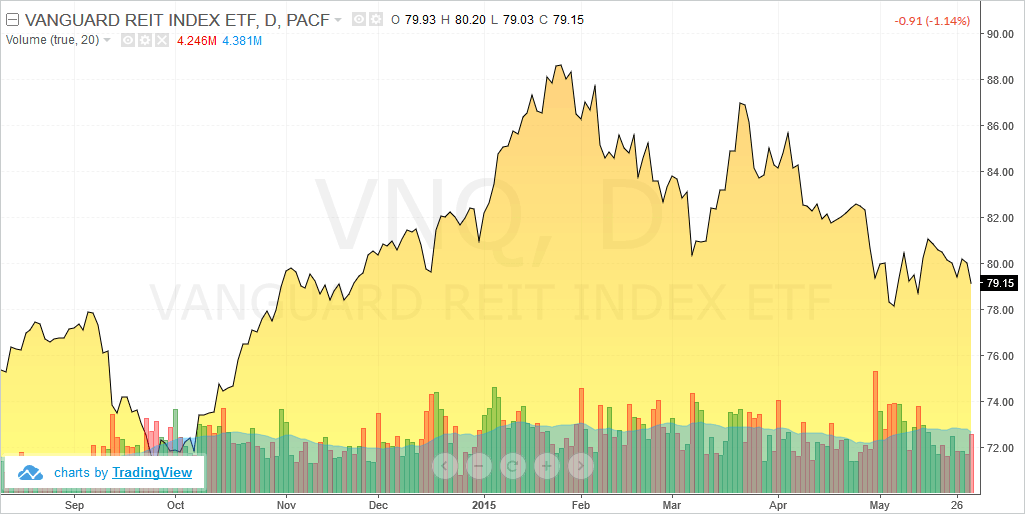

Example of a REIT ETF – Vanguard REIT Index Fund (VNQ)

As an investor interested in the real estate market the question that comes to mind is whether to directly invest in real estate such as purchasing land or property or to invest a Real Estate Investment Trust or REIT. In this article we’ll explore the pros and cons of both so that the reader will be able to make a more informed decision.

What is a REIT and how do they work?

Real estate investment trust or REIT for short is the name given to a company that is in the business of financing or owning real estate for the purpose of producing income. The REIT’s are structured similar to a mutual fund and they offer investors a choice of regular income streams, including diversification within the real estate sector and of course long term capital appreciation.

REITs pay the investors income as dividends which are taxable. REIT’s gained prominence after the U.S. Congress approved a bill in 1960 which allowed individuals to benefit from investing in income-producing real estate. When we talk about income-producting real estate, it is purchasing real estate for the purpose of earning income or a profit, as opposed to purchasing real estate for dwelling purposes. REIT investing makes it easy for anyone to indirectly own and be a part of financing properties in the same way as a company would do via issue stock, raising equity to fund its projects.

For financing the projects, REIT investors benefit by owning shares in other corporations and earn income through the revenues and profits generated via the real estate investment. All of this is made possible without the investor ever actually having to buy property.

REITs are flexible investment tools and allows individual investors to quickly build a portfolio of investments in large scale properties. REITs as mentioned earlier are structured similar to a mutual fund but they trade either as a stock or as an exchange traded fund. Most REITs are publicly listed on a stock exchange and if an investor wants, they can also opt for a non-publicly listed, private REIT investments.

REITs are categorized into two main types:

- Equity REITs: These REITs generate income from collecting rents on the properties and sales or properties and can be commercial or even residential properties

- Mortgage REITs: The mortgage REITs use a different approach, in that they invest in mortgages or mortgage backed securities that are tried to commercial or residential properties

Investors can usually pick REIT ETFs that can track either the equity REIT stocks or the Mortgage REIT stocks. There are also options for picking a hybrid of the above two as well.

One of the biggest advantages of REITs is that the IRS mandates that REITs pay out at least 90% of the income as dividends to the share holders. Therefore, REITs provide higher and perdictable yields compared to the fixed income securities while also giving the benefit of being less volatile than the traditional stock.

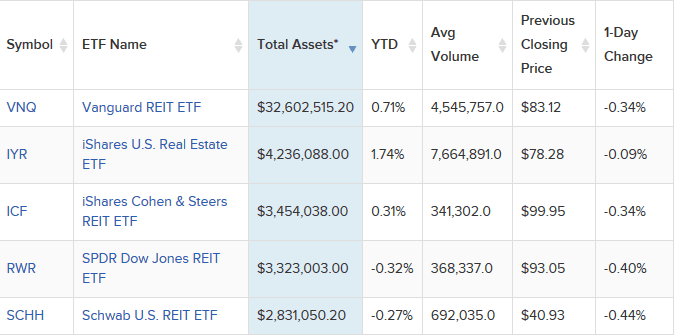

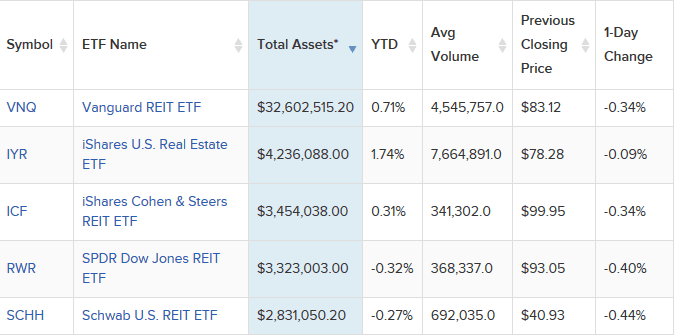

REIT ETFs or real estate ETFs track stocks in the real estate market. There are a wide number of REIT ETFs that one can invest in, and on average the expense ratio is from 0.07% to 0.95%. The top 5 REIT ETFs are shown below.

Top Five REIT ETFs (Total Assets). Source – ETFDB.com

Investing real estate – Direct ownership

Investing in real estate is a direct ownership of the property in question. In order to invest successfully in real estate via direct ownership, investors need to have significant amount of capital, either to purchase the property outright or to use the capital as a down payment. A lot of time and research also needs to be done in the market in order to make a good investment decision.

One of the most common mistakes investors make while directly investing in real estate is that they think the rent will pay off the mortgage and any additional maintenance costs and also leave some small profit in hand. However, there are a lot of variables that can eventually influence the estimated returns.

Most beginners to real estate investing start by purchasing a small apartment that has a good location so that it attracts tenants and ensures a steady flow of income. Depending on the returns such an investment generates, real estate investors can then slowly look towards diversifying such as purchasing commercial property or even land which can then be leased out.

Direct real estate investors need to be careful as changing legislations can mean that there are always inherent risks on buying property for investment, which is one of the easiest ways that the government can clamp down.

Investors are often at an advantage when they begin direct real estate investing at a younger age as it allows them enough time to see their investments churn a healthy profit and also open them up to new investing opportunities within direct real estate investing.

Comparing REITs and Real Estate Investing

| Investing in REITS |

Investing in Real Estate |

| Investing in REIT is not capital intensive. One can investing in a REIT for as little as $500 and expect returns, as compared to the costs required to buying property, even if it means having to put up a down payment. |

Investing in real estate can be capital intensive and can take a lot of time to search for the right property and to get it evaluated. The investor must also have clear goals as to what they want to do with the property they buy and set their expectations on the returns accordingly. |

| Investing in REITs is like investing in stocks. You can buy and sell the shares with relative ease. Liquidity is one of the key factors that works in favor of owning REIT unlike the bigger challenge that comes from buying or investing in a physical asset such as property. |

There are some tax benefits to owning real estate such as writing off depreciation or mortgage tax deductions. With direct real estate investing, an investor can pick a lot of tax benefits that works in the favor of direct real estate investing. |

| There are no overheads when you own some REIT unlike investing in property where you need to invest in additional overheads such as maintenance, insurance, keeping up with the mortgage payments and so on. |

Because real estate investment is capital intensive, the returns you get are also proportionate to the amount invested under normal circumstances. But there are also significant risks that comes with a capital intensive investment as a sudden downturn in the market can leave you exposed to an investment that could take years to recover while you end up paying the mortgages, regardless of which way the economy is moving |

| REITs allows you to invest for a very little amount compared to owning real estate. It is also flexible as you can slowly expand your REIT investment across different segments such as residential or commercial properties to experience different rate of returns. This diversification is much harder when you are actually involved in purchasing real estate which is a lot less flexible. |

Investing in real estate directly means that there are no fund managers who take decisions on your behalf. You have full control of your real estate investment and it is you who decides on the rent, and what properties to buy or sell. |

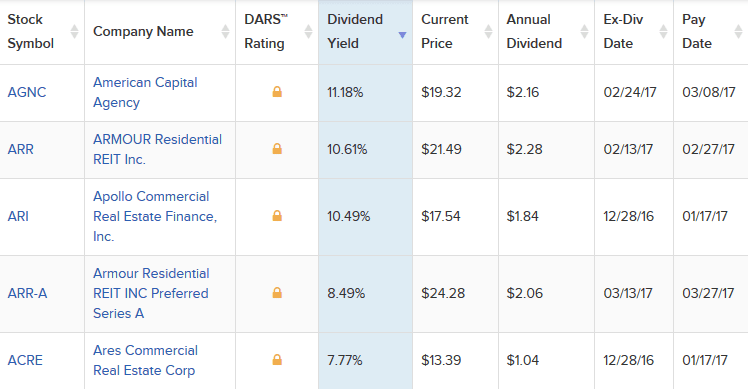

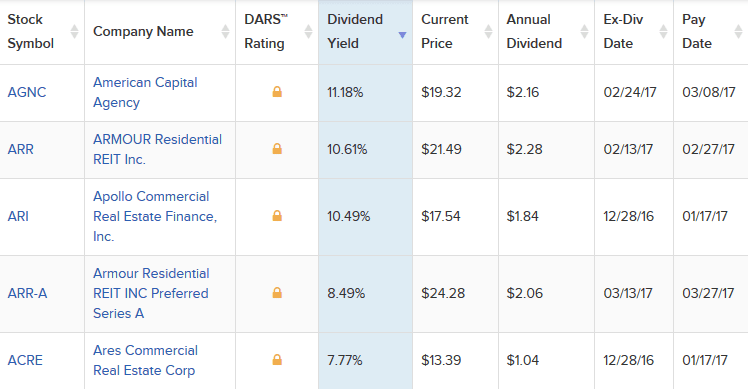

Top 5 REIT stocks with highest dividend yields. Source – Dividend.com

REITs have become a popular way for investors to dip their hands into this lucrative sector of investing. REITs have grown over time to become closely tied into nearly all aspects of the economy and covers nearly every possible corner of real estate, ranging from hospitals, shopping malls, residential apartments, homes and offices.

REIT owned properties have been growing exponentially and according to one study, the REIT market is said to support nearly 1.8 million estimate jobs in the U.S. REITs have also grown to be so popular that similar models of investment have been formed in more than 35 countries outside the U.S. which have adopted legislations on REIT investment.

Investing in real estate can often vary from one investor to another and the ultimate decision as to purchase real estate or to purchase REIT stocks or to invest in an REIT ETF is a matter of personal choice, flexibility and availability of funds.

However, it is not hard to miss the fact that when it comes investing for the only purpose to see capital appreciation, investing in a REIT ETF or REIT stocks is a lot more easier to handle besides the additional fact that it is also easy to sell the shares in the event of a deep downturn in the markets. REITs are often preferred due to the the fact that most of the REIT stocks pay dividends and thus owning a few REIT stocks or investing in some REIT ETFs can be seen a good way to diversify one’s portfolio towards building a stable income investing portfolio of stocks or ETFs as well.

Having said that, owning real estate can also be a significant way to increase one’s wealth as it can provide a stable second income. And doing this quite early on in life will see the investor enjoy the returns rather than invest in real estate at a later point in time. Of course, this is subject to a lot of variables such as the type of real estate, the location and the general state of the economy.

Thus, in conclusion, both REITs and real estate are good investment tools for the long term and the question as to which of these two is better eventually comes down to one’s investing goals.

Basics of Stock Trading

Basics of Stock Trading