In this post, we are going to discuss how to start investing in water. To be even more specific, how to invest in water stocks, motifs, and ETFs, and the best water ETFs, motifs, and stocks to invest in.

Why Is Water Valuable?

How can water be considered precious like gold or hog futures if I can walk down the hall and turn on my faucet?

Water is perhaps one of the few natural resources that are necessary to sustain life on the planet. Please tell me what other commodity is this critical to the human species?

In arid regions of the earth, water has been the cause for wars and civil unrest.

There have already been conflicts between Turkey and Syria over the Euphrates River. The World Bank estimates that water is now a multitrillion-dollar industry and this number is only set to increase due to shortages as a result of climate change.

Global Statistics on Water

Over 71% of the earth’s surface is water.

Oceans hold about 96.5% of all the earth’s water and all of it is saline or salty, making it unusable for drinking or farming purposes.

Estimates show that over nine and a half out of ten liters of water is salty. The remaining half a liter of fresh water is used in farming, industry and household consumption. Only 4% of all water is fresh water, with 70% of fresh water frozen as ice, leaving the world with just 1% of the water as fresh water.

Water Consumption

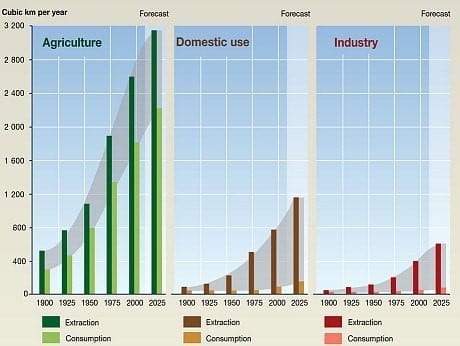

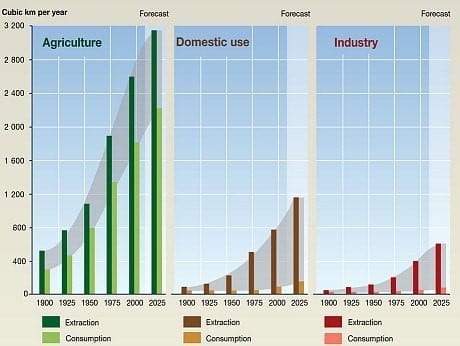

Water global consumption (Agriculture, Domestic and Industry) – Source – United Nations Environment Program

In addition to consumption, see these key statistics on water.

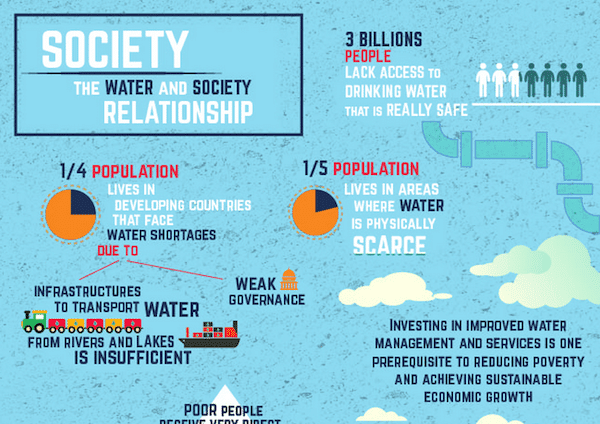

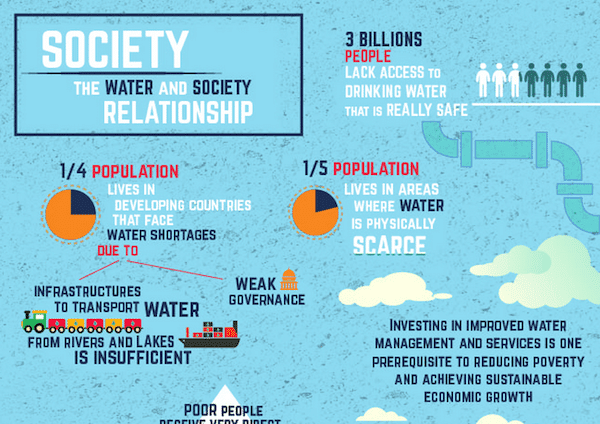

Infographics on the sustainability of water and the relationship to society (click for larger image). Source – UN

The most alarming thing from this infographic is 80% of the world’s population lives in areas where water is physically scarce. We as a species have so much more to do in terms of caring for one another.

When Will Water Futures Start Trading?

Estimates show that by the next quarter century, clean and drinkable water could become scarce on account of climate change and population growth.

Some industry experts such as Richard Sandor expect full-scale trading of water (commodity futures) within the next five to ten years. Sandor worked as an economist with the CME Group and was behind the creation of interest rate futures, so it’s safe to say he knows what he is talking about.

3 Ways You Can Invest in Water

#! Purchase Water Related Stocks

Retail investors can start investing in water by purchasing stocks of companies in the water industry. These companies include:

- Public utilities

- Bottling

- Water research and development

- Water desalination & reclamation

#2 – Invest in a Water Motif

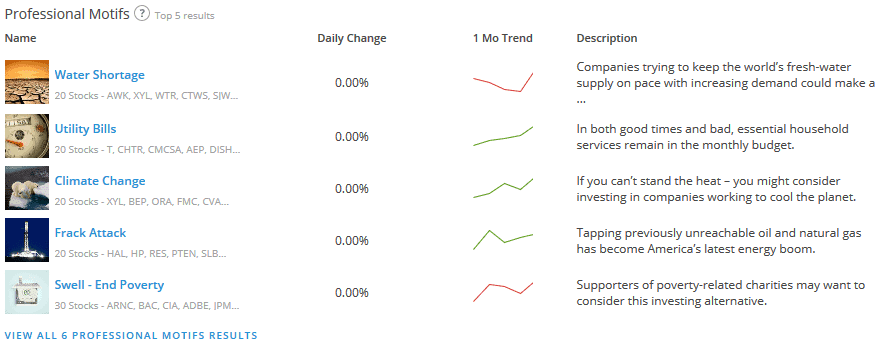

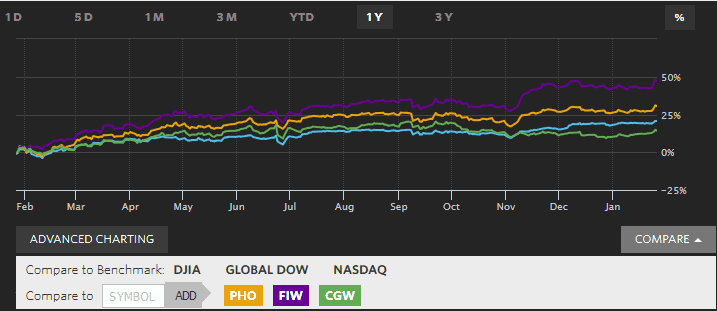

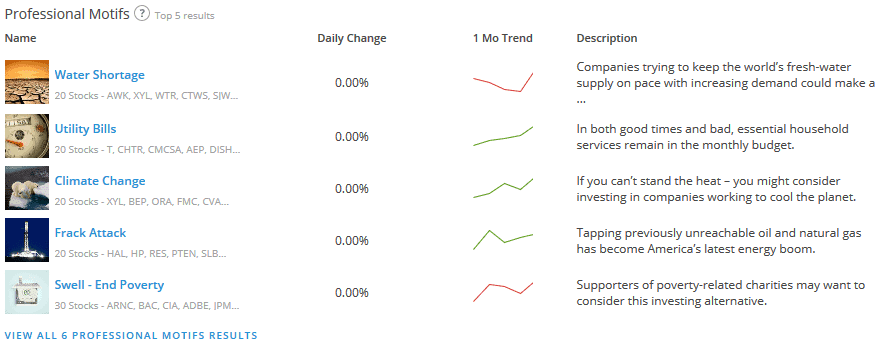

The chart below shows some of the top water-based motifs.

As you can see, even with water as the central theme, there are different angles you can take to invest in water.

For example, you can focus on companies that supply water during shortages. Then there are utility based motifs with exposure to essentially any bill you have in your house related to water.

Example of some water motifs with different themes (Source – Motif investing)

#3 – Water ETFS

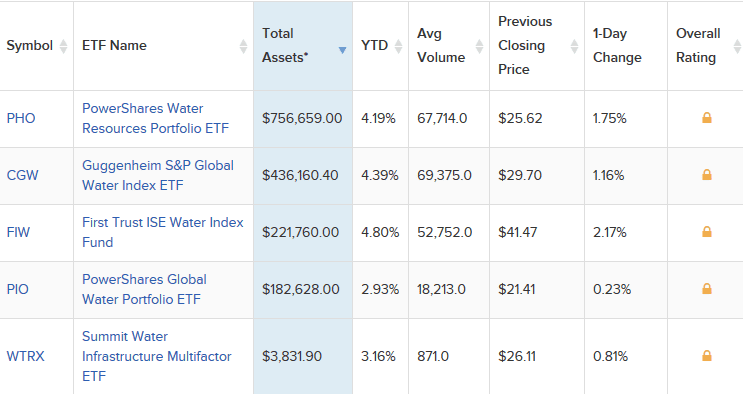

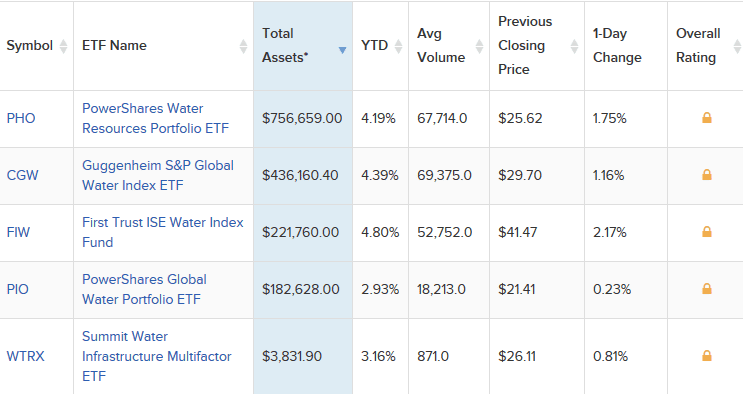

There are five ETFs under the water equities category. Most of the water-based ETFs were founded in the early 2000s, so they are relatively new compared to other sectors.

In addition, each water ETF has its own make up of stocks and focus.

For example, First Trust ISE Water ETF (FIW) and PowerShares Water Resources Portfolio (PHO) ETFs track companies whose revenues are based on water conservation and purification.

While Guggenheim S&P Global Water Fund (CGW) and PowerShares Global Water Portfolio (PIO) focus on companies dealing with water utilities, infrastructure, equipment and materials.

Prior to investing in one of these water ETFs, make sure the stocks they track and focus align with your investing strategy.

Water equity ETF’s – Top 5 (Source – etfdb)

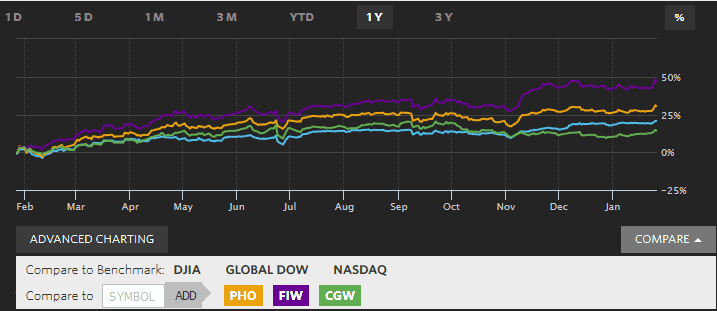

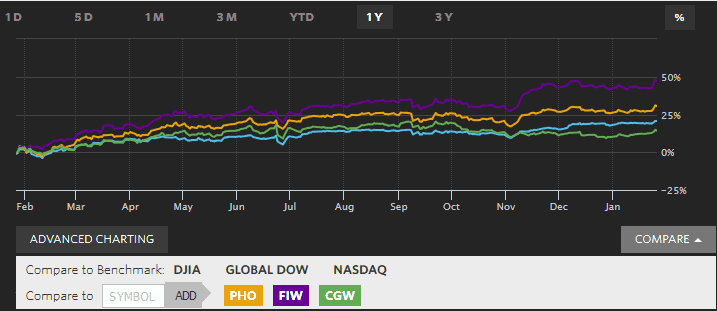

Comparing the top three ETFs (PHO, CGW, FIW) to the S&P500 one can find that all the three ETF’s have performed above average compared to the S&P500 index.

Top 3 Water ETF’s performance to S&P500 (1 year return). Source – WSJ

So, which one works best for you, stocks, motifs or ETFs?

How Can Tradingsim Help?

You can practice trading water-related stocks in Tradingsim to see if it’s a better fit for you to actively trade stocks or if you should invest in one of the water ETFs.

You can also review the trade history and performance of the 5 water ETFs detailed in this article.

Basics of Stock Trading

Basics of Stock Trading