So you have learned about the futures markets and the many benefits it has to offer and you are of course curious to getting started. However, there is one nagging question that keeps coming up. How much money or trading capital do you need to trade futures and to make a consistent income from your futures trading journey.

You might have watched some Youtube videos where you see how some traders show you how easy it is to make money and it only keeps urging you to start trading futures.

Warren Buffett

But with all the glitz and the dollar signs, it is essential to keep you feet firmly grounded. Futures trading, just like any other financial markets where you speculate can be risky. It is not suitable for everyone and definitely not suitable if you do not have the right approach and mindset for trading.

Therefore, always apply caution when you want to speculate, especially in the futures market as all it takes is one bad trade to wipe out your hard earned gains as well as your entire trading capital.

You might have heard this before, but it is important to understand that you should not trade if you cannot afford to lose your trading capital. There are many stories about how some traders have lost not just their shirts but their homes as well. If you think that “it might not happen to me” then read this well documented article about how a trader ended up owing $100,000 to his broker after being on the wrong side of a stock trade.

Ok! So the guy was trading a penny stock, but it still highlights the fact that you just cannot take things easy with the financial markets, be stocks, penny stocks, futures or forex.

With that said and assuming that you understand the risks, let’s dive into the prospects of how much money you can make trading futures.

To get started with trading futures, you need to open a trading account with a licensed futures broker. There are many, and the terms and policies differ from one futures broker to another. You might find a discount futures broker offering you futures trading for as little as $100 and you can have some futures brokers requiring a minimum deposit of $5000 or more. But is this money enough to trade futures? Not really!

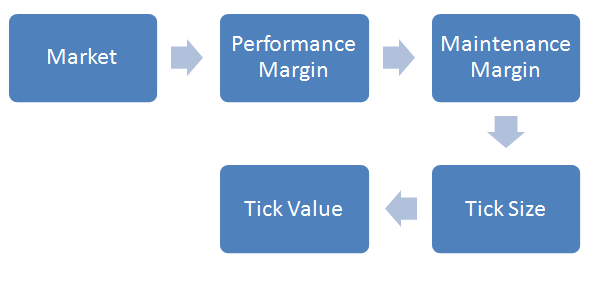

Understanding Margins, Tick Size and Tick value

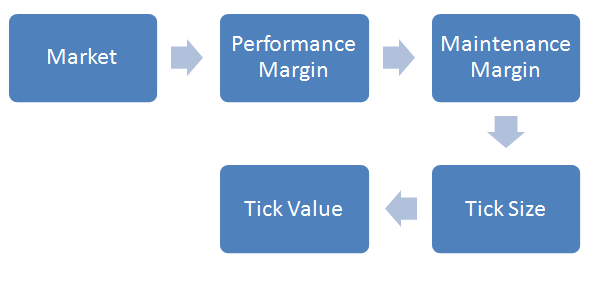

Before you think about how much money you need to trade futures, you need to have a good understanding of three things:

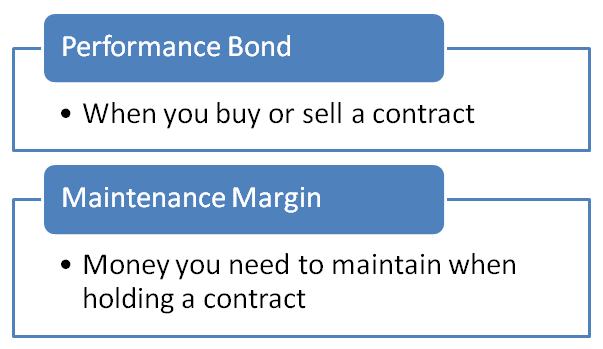

- Performance Bond

- Maintenance Margin

- Tick Size

- Tick Value

What is performance bond?

In the futures market, a performance bond is collateral or a deposit that you need to make with your broker when you buy or sell a contract. Performance bond is also known as an initial margin and it is paid up front. The amount you pay as initial margin is determined as a percentage of the trade price. Most of the retail futures brokerages require an initial margin of $400 for trading one contract of the e-mini S&P500 futures.

What is maintenance margin?

Maintenance margin is the amount that you must have in your trading account at all times to maintain your positions. Depending on your futures brokerage, the maintenance margin can vary. As an example, most futures brokerages require a maintenance margin of $4,750 for trading the e-mini S&P500 futures. The moment your trading capital falls below this level you will get a margin call from the broker and you need to top up your account to meet the maintenance margin requirements. Failure to do so will result in your trade being liquidated.

Performance Bond and Maintenance Margin

What is tick size?

Tick size or a tick is the minimum price movement in the market. The tick size of one asset can be completely different from the tick size for another asset. When determining the amount of money you need to trade futures, the tick size should also be a factor that should be understood correctly.

For example, the tick size for Oil contracts and gold futures contracts are different, 0.10 tick for gold and 0.001 tick for oil futures.

What is tick value?

For every futures market that you trade, the tick value changes. The most popular futures contract, which is the e-mini S&P500 futures contract, has a tick value of $12.50. This means that a 0.25 tick move is equal to $12.50. Therefore, if the S&P500 futures moved from 2010 to 2011, that is four ticks or valued at $50.

But when you trade gold futures contracts for example, the tick size is valued at $10. Therefore a 0.50 point move in gold, for example from $1200.00 to $1200.50, it is equivalent to $50, or a full one point move from $1200 to $1201 is equal to $100.

The dollar value and the markets you trade

The markets you trade will eventually determine whether you are adequately or under-capitalized. Still, many traders would agree that the minimum starting capital needed to trade futures is about $10,000 which is at the bottom end of the scale. With $10,000 in capital to trade futures let’s look at a few numbers.

The chart below gives an average overview of your trading capital, the initial and maintenance margin required and the final balance. Based on this we can then see how many ticks in loss you can face before the margin call is triggered.

| Starting Capital |

Futures |

Margin |

Maintenance Margin |

Balance |

Ticks |

In Points |

| $10,000 |

ES ($12.50) |

$400 |

$4750 |

$4850 |

388 ticks |

97 |

| GC ($10.0) |

$1000 |

$6000 |

$3000 |

300 ticks |

30 |

| CL ($10.0) |

$1000 |

$2900 |

$6100 |

610 ticks |

6.10 |

Bear in mind that the above chart shows the values for just 1 contract. You can see that by increasing or decreasing your starting capital, you can leave less or more breathing space for your trades. So what does the above table tell you?

When you trade with a small trading capital, you cannot afford to make too many mistakes as a string of losing trades can quickly eat away at your trading capital, leaving you with having to fund your trading account.

Beware of the markets you trade as the tick size and value differ from one asset class to another.

For beginners getting started with futures trading, focusing on just the equity indices is a better option. It comes with benefits such as low margin requirements and gives your trading capital of $10,000 enough breathing room to day trade while also giving you enough buffers to cover any reasonable losses on your trades.

Factors to consider when trading futures contracts

Trading futures with a small account

Many futures brokerages offer to open a trading account for as little as $5000. But you can quickly see why many traders will simply end up losing this money as they trade on higher leverage.

A few too many mistakes and it’s an empty wallet you are staring at. The most important aspect to bear in mind is that the larger your trading capital is, the bigger your buffer is, to face losses and still be able to trade another day.

Trading with an undercapitalized account can be the biggest mistake you would make even before you start trading futures.

But is money the only criteria to success in trading futures? No! Besides money you also need to have other characteristics that will eventually determine the success or failure in trading futures.

4 Things that will keep you on the side of success

If you were expecting to see a golden number then, sorry you are mistaken. There are futures traders who have started with a capital of just $10,000 to make fortunes, and some professional fund managers (Commodities Trading Advisors or CTA’s) who trade with a capital of nothing less than $500,000. As you might have realized by now, it’s not the money but your approach to trading that will determine your success in futures trading.

Having a trading plan

Many traders fail because they do not have a trading plan, or a plan of attack to either make money or to minimize their losses. Traders tend to go about buying or selling just because they see the markets rising or falling strongly. Follow this method of trading with your emotions and you will certainly start to see your trading capital shrink sooner than you expected.

Understand the markets

There are many commodities and underlying assets that you can trade in futures. Don’t try to be a jack of all traders and switch from one underlying asset to another. Instead, focus one particular futures asset that you like and get to know that market better. For example, you could either focus all your attention on trading only the e-mini S&P500 futures or you could keep track of the e-mini Dow and Nasdaq futures markets as well. As long as you stay focused on a particular set of markets, the easier it is to get familiar and to manage your trades as well. Your job in understanding the markets doesn’t end there. Are you able to quickly tell how much margin is required to trade one e-mini futures contract? Or what the spread is? How about the initial margin requirement to trade gold futures?

Follow a system

It takes a lot of time to find your edge in the markets. The edge can be a money management strategy or a trading system that you are drawn to. Whatever your mojo is, stick with it. Having a trading system will help you to know when to time your trades, when to book profits and where to exit if you see that the trade is not going as planned.

Be patient

The markets follow their own logic and there is no point in rushing; rushing to either enter a trade or to exit a trade. Timing is an essential factor in the markets and it is your patience that will determine how well you are able to enter the markets and also manage your trades. Many day traders in the futures markets tend to spend hours watching the charts. At times price can move swiftly but at times price can just range, edging sideways which can often frustrate a trader. Having patience is an essential element to your success in trading.

Awesome Day Trading Strategies

Awesome Day Trading Strategies