Both futures and options are derivative instruments, meaning that the prices in futures and options instruments are derived from the underlying asset that they track. Derivative instruments are primarily used for hedging risk. For example, the most ideal use of trading futures and options is an investor who has exposure in the underlying markets. They can mitigate the risks by trading the relevant derivative markets for the underlying asset.

Stretching this further, say for example an investor has a long position in Apple Inc (AAPL). However a string of bad news has sent the price down by over 15%. The investor is worried that the shares could fall even further. So, they offset their equity risk by purchasing PUT options on AAPL, or in other words speculating on further decline in Apple’s share price. If price reverses and resume a new bull trend, the investor would have lost the amount they invested in purchasing the PUT option, but if they were right and Apple’s share price indeed fell further, the investor would have made a profit on this options trade.

Based on the amount of options contracts purchased and at the price at which the trader was managing their equity positions, the additional derivatives trade would have helped in minimizing the risks.

Derivatives – Futures and Options

Futures and options are two of the most popular derivative financial instruments that are available for trading and these markets boast of a significant amount of speculators as well. This means that traders who do not have any exposure to the underlying market can also trade the futures or options markets. Depending on the volatility from the underlying asset that is being tracked, futures trading offer higher chances for traders and especially speculators to make significant gains from trading the futures or options equivalent.

When it comes to futures versus options, the debate as to which of these two markets are better continues endlessly. For one, futures and options are both widely popular and if one of them wasn’t, the market statistics would show clearly. However, the fact that both futures and options stand neck to neck is evidence of the fact that both these two derivative markets are popular indeed. At the end, it comes down to factors such as the ease of understanding of the markets.

Trading Futures Contracts

Futures contracts have been primarily used by commodity traders such as soybeans, wheat, coffee, crude oil and so on. The futures contracts are more liquid than their option contract counterparts. The biggest advantage when trading futures is that you don’t have to take into account the time decay which is a factor that needs to be accounted for when trading options.

Futures contracts trade more rapidly than options contracts. Furthermore, options contracts move in correlation to the futures prices which could be 50 percent of the options at the money with 10 percent options deep out of the money.

For day traders, futures trading are more ideal as there is no or little slippage and the vast liquidity of the options makes it easy to day trade, which can be difficult when you are trading options. With futures trading there are also many different types of trading strategies that can be employed, when compared to the options contracts trading strategies. For example, with futures contracts you can trade the spreads, trade the contango or backwardation in the contracts and so on besides applying your own fundamental analysis to some contracts.

Trading Options Contracts

Commodity traders who have experience in futures trading often start trading options simultaneously as well. The biggest attraction for commodity futures traders which draws them to trading options is that the investment made in the options contract is limited in risk, meaning that you cannot lose more than what you invested when purchasing the options contract. Furthermore, if the contract is deemed profitable during expiry, you can buy or sell the underlying asset for a profit or you can sell your option contract to another investor for a profit.

Thus, compared to futures trading, options trading can be conservative especially if only small sum of money was allocated per contract. The risks can be further lowered when the investment in options trading is combined with some specific options trading strategies that can help in limiting the risks every further. Examples include bull call spreads and bear put spreads among other methods can increase the odds of success with options contracts especially on a longer term trade or during the first leg of the spread which is already in the money.

However, all said and done, futures trading has some significant advantages over options. Although futures trading is not suitable for everyone, and the fact that because futures contracts are leveraged they can be risky, futures trading is one of the most widely popular markets in the retail trading community.

Below, are five reasons why trading futures is better than options:

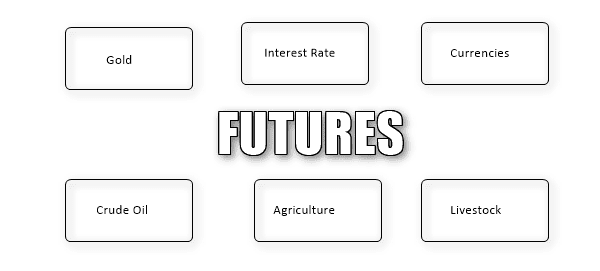

1. Futures trading is ideal for trading specific markets

Futures are best suited for trading specific assets

Every market has its own pros and cons and the futures market is no different. Although there are wide range of assets that you can trade in futures, from stock index futures to single stock futures to commodities, futures trading is best suited for trading commodities, currencies and stock indexes. Because futures contracts are standardized features, each contract comes with a built in leverage making it very useful for investors who have a certain amount of risk appetite. While the leverage factor might be a put off for some traders or investors, futures contracts can have the ability to make big profits within a short span of time. For example, if you took gold futures, the minimum tick size in a gold futures contract is 0.10, with each tick valued at $10. This means that for $1 move in gold prices, a standard gold futures contract is valued at $100.

While the volatility for gold varies, a $3 – $5 move in gold is nothing surprising and part of the everyday volatility in gold. This roughly translates to around $300 – $500 moves when trading a standard gold futures contract.

When it comes to options for the commodities, traders should bear in mind that the options are known as options on futures, meaning they are derivatives of the derivative contracts, thus making the options on futures contracts more volatile than one can expect, given that leverage is also factored in. To speculate on the price movements on an underlying commodity, futures traders are able to better position themselves in managing risks and profits than compared to options traders.

2. Fixed upfront trading costs in Futures

When it comes to trading costs, the fees associated with futures trading is a lot easier to understand and calculate as most of the trading fees remain constant. For one, the trading costs incurred when trading futures are the commissions on the trade, the exchange fees, brokerage fees. Besides the above, there are other costs such as maintenance margin and the initial margin or performance bond requirements and some data charges as well.

The initial margin requirements, although not exactly termed as a trading or transaction fee is just a cost that is something which needs to be accounted for. In most cases, the initial margin requirements do not change for most of the futures contracts and definitely not on a day to day basis, thus a trader is able to know beforehand the costs that are required when they want to trade a particular futures contract or an asset.

While it is straightforward with futures trading, the costs are slightly different when trading options.

In options trading the options are either trading at a premium or a discount offered by the seller of the option. These can significantly vary depending on the volatility of the underlying asset and are never fixed. Higher premiums are usually tied into more volatile markets and even assets that are priced less expensive can see the premiums rise when the markets head into a period of uncertainty.

For example, in the run to the Brexit event in June 2016 or the U.S. presidential elections in November 2016, the premiums on options across many assets shot up due to heightened uncertainty in the markets. In contrast, the margin requirements did not change much for most of the futures contracts.

3. No time decay factor in futures

Time decay is a factor that is critical to options trading and is specific to this particular market alone. It is a ratio of the change in the option’s price to the decrease in time to expiry. In options trading, the value of the contracts decreases over time as it approaches the expiry date. The time decay in options exists because an options contract becomes worthless when it nears the expiry date and is not in the money. As the expiration date of a contract nears, the result of the contract (will it end in the money or out of the money) becomes clearer.

With the futures markets, traders do not have to content with factors such as time decay.

4. Liquidity and spreads

When it comes to liquidity and spreads, the futures contracts have a major advantage. Due to the popularity and depending on the futures contract in question, liquidity and thus by extension the spreads tends to vary from one futures contract to another. Liquidity is essential to any market as it ensures that there is enough volume to absorb any unnatural moves in the market which can be manipulated by big orders. High trading volumes also help in keeping the spreads tight thus making it easy for traders to enter and exit the markets with their day trading.

Depending on the type of futures contract you trade, for the most part, many futures assets are highly liquid and come with fairly acceptable spreads. This is one of the reasons why day traders prefer to trade the futures markets compared to options. The options markets on the other hand, might not have sufficient liquidity all the time. This is true when you look at options that are far away from the strike price or options that have a longer term expiry.

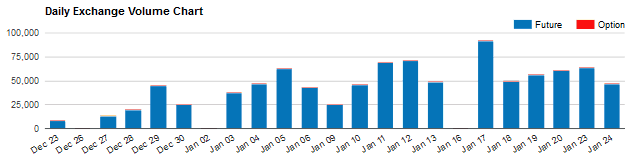

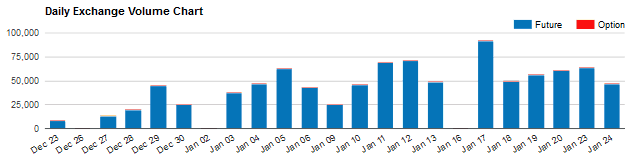

Futures and Options Volume Comparison

The above chart shows a sample volume comparison between the futures and options contracts. The above chart is the daily volume data for the Nikkei/yen futures contract. While some might consider the Nikkei 225 futures contract to be exotic thus justifying the low volume in the options, you can notice similar volume discrepancies across other assets as well.

Options contracts follow liquid markets and not the other way around. Therefore, you can often find high volumes on options contracts for an asset (futures contract or a stock) if it is very liquid. As an example, the E-mini S&P500 futures contract has high volume both in the futures and the options market.

5. Futures pricing is easy to understand

The pricing structure in the futures markets are quite easy to understand which is in fact one of the reasons behind its popularity compared to trading options. Under the cost of carry model in futures trading, the price of the futures contracts track the underlying asset prices. Therefore futures prices tend to track the underlying asset’s stock price with the cost of carry priced in. When there is a misalignment between the spot and futures markets, the market participants automatically balance the temporary imbalances in prices.

activision blizzard

activision blizzard