In this post, I will discuss the six key differences between futures and forex markets. Even if you do not trade these securities, it’s important to have some base understanding of these highly liquid markets.

Before we go into the differences we will provide quick overviews on the forex and futures markets.

Overview of Forex Market

Size of Forex Market

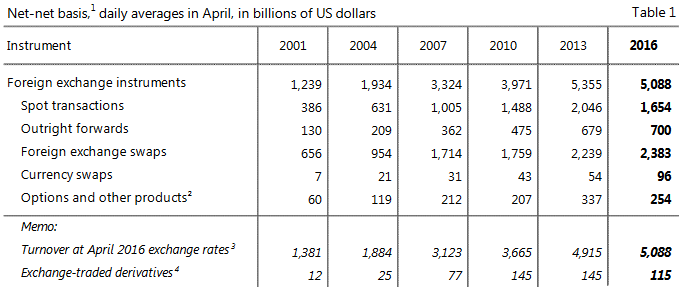

The foreign exchange or forex is the largest market in the world with an average daily turnover of $5.1 trillion (as of April 2016 – Triennial Central Bank Survey by BIS). [1] The forex spot markets trade over the counter and there is no central exchange.

The forex market is simply a juggernaut. Retail traders and institutions love its liquidity, low capital requirements and the ability to leverage up.

Forex Daily Turnover

Currency Pairs

Foreign exchange trading is the trading of currencies in the spot markets. Unlike stocks forex is traded as a currency pair such as EUR and USD. The first currency is known as the base currency and the second currency is known as the quote currency. [2] Therefore, in forex, a rate of EURUSD = 1.1095 means that 1 euro is equal to 1.1095 U.S. dollars.

Leverage

The high use of leverage has become one of the main points for the retail category of traders. With high leverage comes the risk of losing significant capital. It is for this reason in 2010 the Commodities and Futures Trading Commission (CFTC) introduced new rules for U.S. based forex brokerages limiting leverage to 1:50, from 1:200 in a bid to keep private traders losses more manageable. [3]

However, look outside the U.S and chances are that forex brokerages based in other jurisdictions continue to offer even higher leverage ratios.

This, of course, does not bode well for investors.

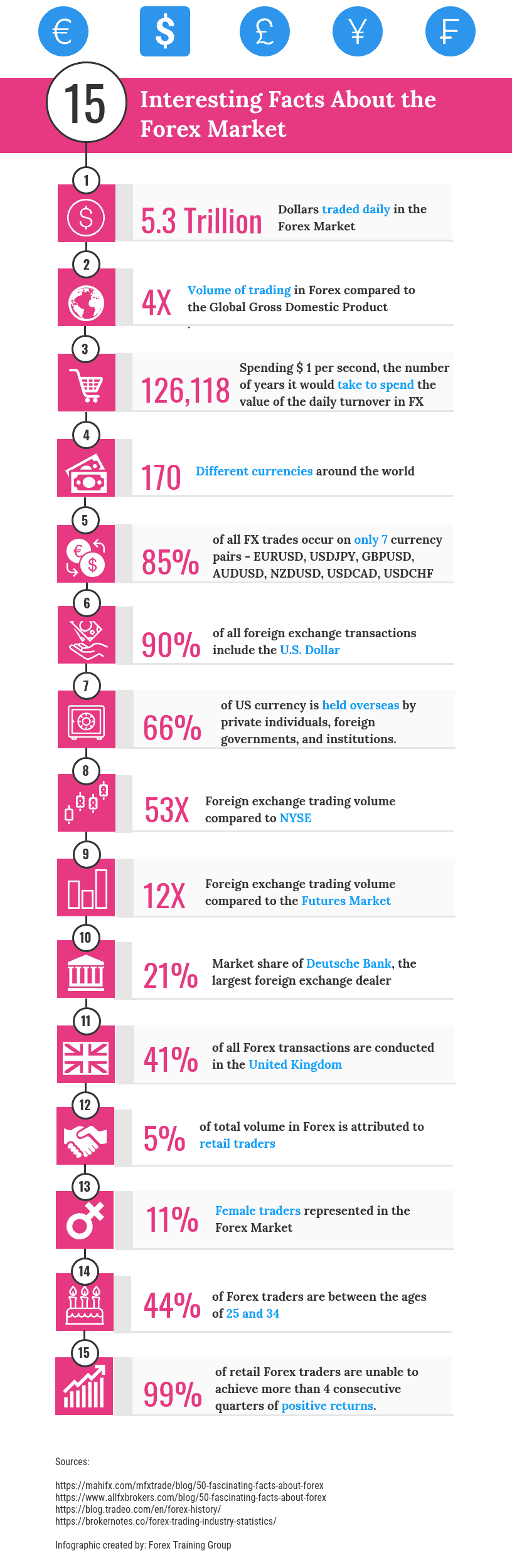

What is the Forex Market? [Infographic]

I am a visual learner, so if you are anything like me, the below infographic will breakdown the forex market on a third-grade level.

Source of Infographic: http://forextraininggroup.com/15-interesting-facts-forex-market-infographic/

Overview of Futures Markets

Futures markets are exchanges where traders buy and sell forward contracts for a security. These securities can be in the form of commodities such as sugar and oil. These securities can also come in the form of index futures which reflect the major global indexes such as the S&P 500.

The futures markets trade on a number of exchanges such as the Chicago Mercantile Exchange (CME) and the London International Financial Futures and Options Exchange.

I’m not going to provide as detailed an overview of the futures market because it is more known and visible than Forex.

So, I’m going to leave it here with the futures overview and dive into the six key differences.

6 key differences between Forex and Futures markets

#1 – Spot forex markets are traded over-the-counter, while futures are centralized

OTC – Forex

As mentioned earlier in the article, forex is traded over-the-counter. This results in less trade transparency.

Trading over the counter also introduces counter-party risk.

Futures Exchanges

Futures are centralized and traded on an exchange. The futures exchange rulebook requires all participants to put up a performance bond followed by maintaining a maintenance margin at all times. This greatly reduces the risk of a counterparty default when you trading futures.

#2 – Spot forex markets can have spread mark-up and commissions while futures only have commissions

Forex Spread Mark-up

In the OTC spot forex markets, traders will have to pay either a commission or a spread mark up. A spread mark-up is a markup on the bid and ask prices added by the broker.

Furthermore, some retail brokers also add an additional commission as well, on top of the spread mark up thus further increasing the cost of transactions.

Futures Commissions

When you trade the futures markets, the pricing is straight-forward. You only pay a commission on the trade. The commissions you pay can vary based on the futures brokerage house. But no matter what commissions you pay, the fees are significantly lower than trading the spot forex markets.

#3 – Futures are priced in US dollars

When you trade futures, the different contracts are all quoted in US dollars.

The chart below shows three charts. To the left is the Japanese Yen futures and to the right is the USDJPY spot forex chart.

Yen Futures – USDJPY and 1-USDJPY

Therefore, as long as you trade a futures contract that is quoted in USD, you can find a similar spot forex instrument as well. The table below gives a brief summary.

| Futures Instrument | Spot Forex instrument (equivalent) |

| Euro futures | EURUSD |

| British pound futures | GBPUSD |

| New Zealand dollar futures | NZDUSD |

| Australian dollar futures | AUDUSD |

| Swiss franc futures | 1/USDCHF |

| Japanese yen futures | 1/USDJPY |

| Canadian dollar futures | 1/USDCAD |

| Mexican peso futures | 1/USDMXN |

| South African rand futures | 1/USDZAR |

#4 – Futures tick values are different than spot forex

When you trade forex futures, the tick value for the contracts can vary. For example, a mini euro or a British pound contract has a tick value of $6.25 (or $12.50 if you trade a regular big contract) with the minimum tick size is 0.0001. This is standardized, but when you trade the spot forex markets, the tick value changes.

For example, if you trade a standard contract in the spot forex markets which is 1 lot or 100,000 units, the minimum tick size is $10.

#5 – Futures have an expiration

All futures contracts, including currencies, have a contract expiration date. [4]This means if the futures trader wishes to retain their position, the futures trader will have to rollover their contract to the next month.

In the spot forex markets, there are no expirations and traders can buy and hold their positions indefinitely.

#6 – You can view institutional positioning

A unique aspect of the currency futures market is the ability to view some information that is otherwise not available in the forex spot markets. For example, the weekly institutional position reporting, known as the Commitment of Traders report [5], offers insights into whether the speculators and hedgers are net long or net short.

Commitment of Traders Report for British Pound Futures

How Can Tradingsim Help?

We do not have forex data, but we do have currency futures within Tradingsim. If you are thinking about trading these contracts you can practice 24/7 in order to develop your own custom strategy.

External References

- Triennial Central Bank Survey of foreign exchange and OTC derivatives markets in 2016. Bank for International Settlements

- How to Identify Base and Counter Currencies. Dummies.com

- New CFTC Forex Trading Rules Call For 50:1 Leverage. Forbes.com

- Understanding Futures Expiration and Contract Roll. ETrade.com

- Commitments of Traders. U.S. Commodity Futures Trading Commission.