What is proof of work in crypto?

The Proof of Work consensus mechanism is the most widely used consensus algorithm in cryptocurrency today. This process is known as proof of work (PoW). Its key feature is that it allows a crypto network to function without the need for a central authority. Instead, crypto miners compete to validate transactions and add new blocks to the blockchain.

In PoW, the first miner to successfully validate a block is rewarded with crypto tokens. This encourages miners to stay honest and helps to secure the network. However, Proof of Work does have some drawbacks.

For example, it requires a lot of energy to run crypto mining equipment, which can be bad for the environment. It also means that crypto networks are more vulnerable to "51% attacks," where a group of miners controls more than half of the network's mining power.

Despite these drawbacks, Proof of Work remains the most popular consensus mechanism in crypto due to its security and decentralization.

What is an example of Proof of Work?

When it comes to crypto, proof of work is a verification system that ensures crypto transactions are valid and genuine. Here's an example of how it works:

Each crypto transaction is unique and includes a digital signature that can be verified using a mathematical algorithm. Once the transaction is verified, it is added to the blockchain, which is a digital ledger of all crypto transactions.

The proof of work system ensures that all transactions are valid and that the ledger cannot be tampered with. As a result, crypto investors can have confidence that their investments are safe and secure.

Bitcoin Proof of Work

Bitcoin's "proof of work" system is one of the key features that makes it a unique and interesting cryptocurrency. Essentially, the proof of work system ensures that each transaction is verified and approved by the network before it can be added to the blockchain.

This adds an extra layer of security and allows Bitcoin to remain decentralized. Because there is no central authority verifying each transaction, it also means that there is no single point of failure. The proof of work system is just one of the things that makes Bitcoin a unique and intriguing cryptocurrency.

Proof of work vs Proof of stake: what is the difference?

When it comes to crypto, there are two main competing algorithms for reaching consensus: proof of work (PoW) and proof of stake (PoS). Both have their own strengths and weaknesses, so it's important to understand the difference between them.

With PoW, miners compete against each other to solve complex mathematical puzzles. The first miner to solve the puzzle gets to add the next block to the blockchain and earn a reward. This system is very secure, but it can be quite energy-intensive.

PoS, on the other hand, does not require mining. Instead, stakeholders simply vote on which blocks should be added to the blockchain. The more crypto you have staked, the more voting power you have. While this system is more energy-efficient, it can be more vulnerable to corruption.

What is proof of stake and how does it work?

In a proof of stake system, blockchain consensus is achieved through "stakers," who stake their crypto tokens in order to validate blocks of transactions. If they successfully validate a block, they receive a reward.

The staking process helps to secure the blockchain and eliminates the need for energy-intensive proof of work mining. Proof of stake is a newer consensus algorithm that is gaining popularity due to its energy efficiency.

However, it is not without its drawbacks. One concern is that proof of stake systems can be centralized, as the stakers with the most tokens will have the greatest chance of validating blocks and earning rewards.

Another concern is that proof of stake systems can be vulnerable to 51% attacks, in which a group of malicious actors colludes to control the majority of tokens and therefore can manipulate the blockchain for their own benefit.

Despite these concerns, proof of stake systems shows promise as a more efficient and environmentally-friendly alternative to proof of work consensus.

Is proof of stake better?

There's a lot of debate in the blockchain community about which consensus mechanism is the best. Proof of work has been used by Bitcoin and other cryptocurrencies for years, but it's becoming increasingly energy-intensive. Some people believe that proof of stake is a more efficient way to reach consensus, and it doesn't require nearly as much energy. However, proof of stake still has its critics, who point out that it can be vulnerable to certain types of attacks.

Ultimately, there's no unique voice about which mechanism is the best, and different projects would use different mechanisms depending on their needs.

There are a few key advantages to proof of stake systems over proof of work.

- They tend to be more energy-efficient since there is no need for expensive mining hardware.

- PoS systems are more secure since it is harder for attackers to amass enough stakes to mount a successful attack.

- They are more responsive since blocks can be generated much faster.

As a result, proof of stake systems has emerged as a popular choice for blockchain implementations.

Proof of stake disadvantages

While there are a number of advantages to using a proof of stake blockchain, there are also some disadvantages. One key disadvantage is that proof of stake blockchain networks tend to be less decentralized than proof of work blockchain networks.

This is because the validation of transactions is often done by a small group of individuals, rather than by the entire network. As a result, decisions about the direction of the network are often made by this small group, rather than by the community as a whole.

Blockchain technology is often touted for its security features, but recent events have shown that it is not immune to attack. In particular, the proof of stake consensus algorithm is vulnerable to a so-called "long-range attack." This type of attack involves creating a blockchain fork that starts from a point in the past and then waiting for enough blocks to be mined before revealing the fork. Since the blockchain fork is longer than the original blockchain, it will be accepted as the valid blockchain, allowing the attacker to double-spend their coins.

While this type of attack is not yet practical on a large scale, it is a serious threat to blockchain systems that use proof of stake. For now, the best defense against a long-range attack is to keep your blockchain software up to date and be aware of any forks that are created. In the future, however, more sophisticated defenses may be needed to protect against this type of attack.

Will proof of stake kill mining?

The short answer is “probably,” but we have to weigh the differences in terms of advantages and disadvantages.

There are several ways to validate transactions, but two main ways emerged against the others: proof of work and proof of stake. As we have learned, with proof of work, miners compete to solve complex problems in order to add new blocks to the blockchain and earn rewards. With proof of stake, validators stake their own cryptocurrency to secure the blockchain and earn rewards for their participation.

Proof of work requires significant computational power and can be quite energy-intensive. Proof of stake, on the other hand, is much more efficient and environmentally friendly. Because users are staking their own currency, there is no need for expensive mining equipment. In addition, proof of stake is much faster than proof of work, so transactions can be confirmed more quickly.

While both methods have their advantages, proof of stake is generally considered to be superior to proof of work. Proof of stake is more environmentally friendly, more efficient, and faster than proof of work. As a result, many blockchain projects are moving away from proof of work and toward proof of stake.

Considering PoS's growing popularity, mining will likely diminish over time, especially from proof of stake. It does not, however, exclude future forms of mining with a similar logic but with less expensive energy and capital costs.

What does delegated proof of stake mean?

The delegated proof of stake algorithm is a new consensus method that was developed in 2014. This type of blockchain operates on several platforms including those by Bitshares, Steem, and Lisk.

In a blockchain, transactions are verified by all nodes in the network. This means that anyone can verify the transaction, and no single entity has control. However, blockchain networks can be very slow, because all nodes need to verify each transaction.

Delegated proof of stake is a way to speed up blockchain verification by allowing certain nodes to verify transactions. These nodes, called validators, are elected by the community. Validators are typically very experienced in blockchain technology and have a good reputation.

When a validator verifies a transaction, it is added to the blockchain. Delegated proof of stake can help to improve the speed of blockchain verification without sacrificing decentralization.

When will EtherEum merge to become proof of stake?

At the beginning (2013) the Ethereum project was born with the idea of a blockchain-based proof of work consensus mechanism. In 2015, a new vision started spreading among the Ethereum lovers: the possibility to have an energy-efficient proof-of-stake network.

The idea was to adopt the beacon chain; a side chain that would have allowed users to use it as an independent network based on Proof of Stake.

The Beacon Chain would run in parallel with the Ethereum main net where the consensus is still PoW. The beacon chain has been live since November 2020 and is “ready for action and secured by millions of ETH deposited across over 240K validators” (source: ethmerge.com).

But, that’s not enough. Today when you hear about “the merge,” it is the process through which Ethereum is trying to innovate itself with an elegant transition to Proof of Stake at 100%.

The enormous work of migration would allow Ethereum to move the story of transactions and all the blocks created from the PoW to the PoS and finally run as a unique chain.

In other words, Ethereum 2.0, or the new Ethereum, is nothing new, just an upgrade from an old structure.

As of May 2022, the process of merging is still in progress and announced to take place in June. But, it is more likely that it will happen before the end of the year.

Can bitcoin go to proof-of-stake?

Bitcoin's blockchain is a distributed ledger that records all of the Bitcoin transactions that have ever taken place. In order to maintain the blockchain, Bitcoin uses a consensus algorithm called "Proof of Work" (PoW).

Under PoW, Bitcoin miners compete to add new blocks to the blockchain by solving complex math problems. The first miner to solve the problem gets to add the block and is rewarded with newly minted bitcoins.

However, PoW is a very energy-intensive process, and as Bitcoin has grown in popularity, the amount of electricity needed to power the Bitcoin network has become, arguably, unsustainable. For this reason, there are rumors of switching BTC to a different consensus algorithm called "Proof of Stake" (PoS).

PoS does not require any mining equipment or expensive electricity; instead, it relies on users staking their bitcoins in order to validate new blocks. If successful, the switch to PoS would greatly reduce the environmental impact of the Bitcoin network.

Despite the energy reduction from a switch to PoS would grant, the doubt for many is the reduced decentralization that would come with it. PoW, indeed, is recognized as the most reliable method of reaching consensus on a blockchain.

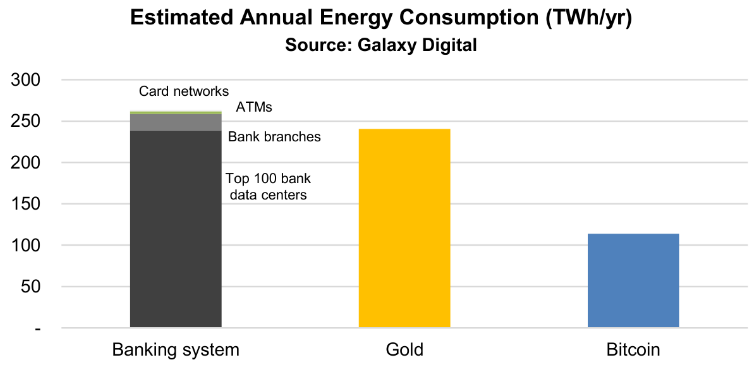

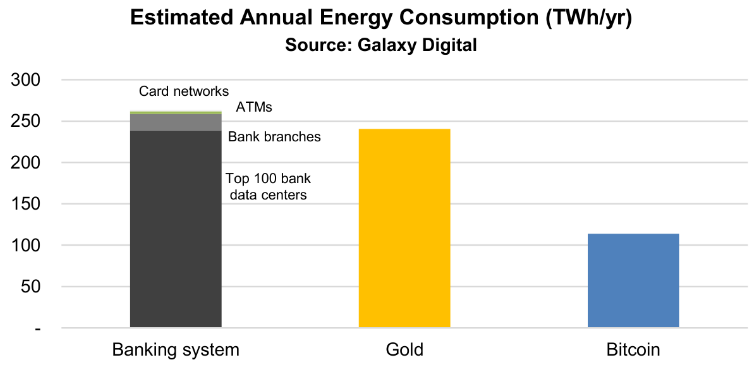

Regardless of the critics of energy consumption, in a study from Galaxy digital it has been noted that the banking system and gold mining energy consumption is almost two times those of bitcoin.

Which cryptocurrencies have proof of stake?

Some major cryptocurrencies that use PoS include Cardano, EOS, and Tezos. Thanks to its energy efficiency, PoS is seen as a more sustainable alternative to PoW. As a result, an increasing number of projects are moving away from PoW and towards PoS.

What are the best proof of stake coins?

Below are some of the best proof of stake coins based on the market cap of the most relevant cryptocurrency in the market. Keep in mind that all of these coins have their own unique benefits and peculiarities. This is not a recommendation to buy/sell or invest in any coins or cryptocurrencies.

Cardano

The Cardano ADA token is a digital asset that allows holders to participate in the Cardano network. ADA holders can use their tokens to send and receive payments, or to store value.

Solana

The Solana SOL token is a digital asset that allows users to access the Solana blockchain platform. The token can be used to purchase goods and services, or traded on cryptocurrency exchanges. Solana represents a decentralized blockchain built to enable scalable, user-friendly apps for the future.

Polkadot

The Polkadot DOT was created as a way to make cryptocurrency more accessible and inclusive for everyone. DOT's vision is to allow cross-chain interoperability.

TRX Token

The TRX Token is a powerful tool that can be used to transform the way businesses operate. The token provides a new way of handling data and assets that can dramatically improve efficiency and transparency. With the TRX Token, businesses can streamline their operations, reduce costs, and improve their bottom line.

Avalanche

The Avalanche AVAX tokens provide access to the network and allow users to transact on the network. The Avalanche network is a decentralized platform that enables instant, secure, and scalable transactions while supporting the scaling of web3 decentralized apps.

Proof of Work and Proof of Stake Summary

Hopefully this information has helped you understand the difference between proof of work and proof of stake and the upcoming merge with Etherium. As you can see, there are pros and cons to both systems of consensus.

While PoW is arguably a more decentralized mechanism for consensus, PoS is gaining in popularity due to its ability to circumvent the mining aspect of crypto and blockchain.

Will this be good for the blockchain? Time will tell.

Crypto

Crypto