Dividend investing gives you the best of both worlds in stock investing: dividends and potential capital appreciation through stock appreciation. According to Standard & Poor’s, since 1926, dividends contribution accounted for roughly 33%, while capital gains accounted for 67% of the total returns of U.S equities. For many investors, investing in stocks with a history of stable dividend payouts is a strategy that works well most of the time, even during market downturns.

But is it prudent to invest in riskier equities asset classes for the sake of dividends during times when interest rates are rising? If so, how can you successfully invest in dividend stocks to get returns higher than those offered by less risky, fixed-income asset classes?

In this article, we will try to answer those questions and highlight a few strategies that you can adopt to get the most out of dividend investing in a rising interest rate environment.

What is Dividend Investing?

Dividend investing is a strategy of investing in dividend-paying stocks to earn a return on investment. The dividend payout can be in the form of cash, additional shares, or even product (though rarely). However, not all companies pay out dividends as some reinvest the income they generate back into the company as a funding source.

Companies that routinely pay dividends generally have solid earnings and stable earnings growth with sufficient free cash flows. But this doesn’t necessarily mean that the companies who don’t pay dividends are mediocre or lack financial strength to do so. In fact, big corporations like Berkshire Hathaway, Amazon, Alphabet, and Tesla are some of the prominent names that have never paid dividends in their history, yet they are successful companies with great fundamentals. Their shareholders benefit from capital appreciation as these companies reinvest their earnings in the company instead of paying out to their shareholders.

Dividend Stocks

Here is the list of companies that have a long history of consistently paying out dividends to their shareholders for over 100 years.

- The Coca-Cola Company (KO)

- Procter & Gamble Co. (PG)

- ExxonMobil Corporation (XOM)

- Chevron Corporation (CVX)

- 3M Company (MMM)

- IBM Corporation (IBM)

- Pfizer Inc. (PFE)

Interest Rates & Dividend Payouts

To craft an effective dividend investing strategy, we need to determine the impact of the change in interest rate on a company’s dividend payout capability. In a rising interest rate environment, companies that rely on debt for their operations or have higher exposure to debt in their financing have to bear the brunt of high interest rates in the form of higher financing costs. High interest rates make it costly for companies to raise new capital.

The same is true for individual consumers. The lending rates become high, which reduces overall consumer spending.

Despite the potential drawbacks of rising interest rates for companies, there is another dimension to it. When the interest rates are high, stocks compete with bonds, T-bills, and other fixed-income securities on the rate of return they offer. Companies with a history of paying out dividends are pressed to at least maintain their dividend payouts despite the strains on their finances inflicted by the rising interest rates. Investors and the market might construe it as a weakness if a company with a consistent dividend payout history suddenly skips a dividend payout.

Dividend Investing Strategies in High Interest Environment

Here are some of the dividend investing strategies that you can use to earn a decent return on your investment, even in a high interest rate environment and without undertaking too much risk as is usually associated with equities compared to bonds.

1. Choose Stocks with Sustainable Dividends

Your stock selection matters a lot when investing in a stock for its dividends. This is particularly true for companies that have recently started paying out dividends because skipping dividends can negatively impact their stock price. While there could be plenty of reasons for a company to stop or momentarily skip paying dividends, this could signal to investors in the market about potential problems with the company’s cash flows, resulting in a stock price slide. So, the best way to reduce the chance of losing out money on investing in the wrong stocks is to consider investing in stocks with a track record of paying out dividends consistently.

Companies that pay out less than half of their earnings as dividends are more likely to sustain their dividend payout even in the event of a business downturn. Alternatively, investing in the so-called “Dividend Aristocrats” stocks (those that we mentioned earlier) can be a safe bet as these companies have been paying out dividends without fail for decades.

2. Reinvest the Earned Dividends

To earn a higher return in a high interest rate scenario, you should reinvest the dividends you earn into buying the same stock. Even Warren Buffet, one of the most successful investors of all time, emphasized this:

“When you first make money in the stock market, you may be tempted to spend it. Don’t. Instead, reinvest the profits.”

Some companies offer Dividend Reinvestment Plans (DRIPs) allowing its shareholders to reinvest their dividends in the company by buying new shares. After subscribing to the plan, the system automatically reinvests your dividends and allocates new shares. With this arrangement, you can compound your earnings over time by reinvesting as you accumulate more shares. So, if you are a long-term investor, dividend reinvestment plans could be a suitable option for you.

The shares that you get from this dividend reinvestment scheme come from the company’s own reserves rather than from the open market. This means that you don’t have to pay commissions on the additional shares and at a comparatively lower price than the market price. Similarly, when you decide to sell the shares, you have to redeem them directly to the company instead of selling it in the open market.

3. Analyze Stock’s Key Dividend Metrics

When choosing stocks for dividend investing, many investors often get tempted by the stock’s high dividend yield. To ensure that you don’t fall into this trap, you need to know how dividend yield is calculated. It is simply the annual dividends paid per share divided by the stock’s current price.

For example, if a company paid out $10 dividends in a year and the stock’s price is $100, the dividend yield would be $10/$100 = 0.1 x 100 = 10%. The ratio shows that the stock has yielded a 10% return by paying out $10 dividend, compared to its current share price.

Now, if the stock price falls to $90, the dividend yield would rise to ($10/$90) = 11.1% despite the fact that there was no change in the dividend payout. So, relying solely on dividend yield for stock selection can mislead you into investing in the wrong stock. Instead, you should analyze different metrics of a stock, such as dividend payout ratio, earnings growth, rate, and dividend growth rate.

For example, the dividend payout ratio tells you the percentage of a company’s total earnings that are paid out as dividends, while the dividend growth rate tells you about the growth in the company’s dividend payout compared to a certain period.

4. Invest Longer Term for Capital Appreciation

Central banks jack up interest rates in response to high inflation, so we can assume that during a high interest rate environment, inflation would be high. In such a case, the real or inflation-adjusted return on your investment would be much lower. This means alongside dividends, you should also aim for generating additional return through capital appreciation, which is possible if you invest in stocks longer term.

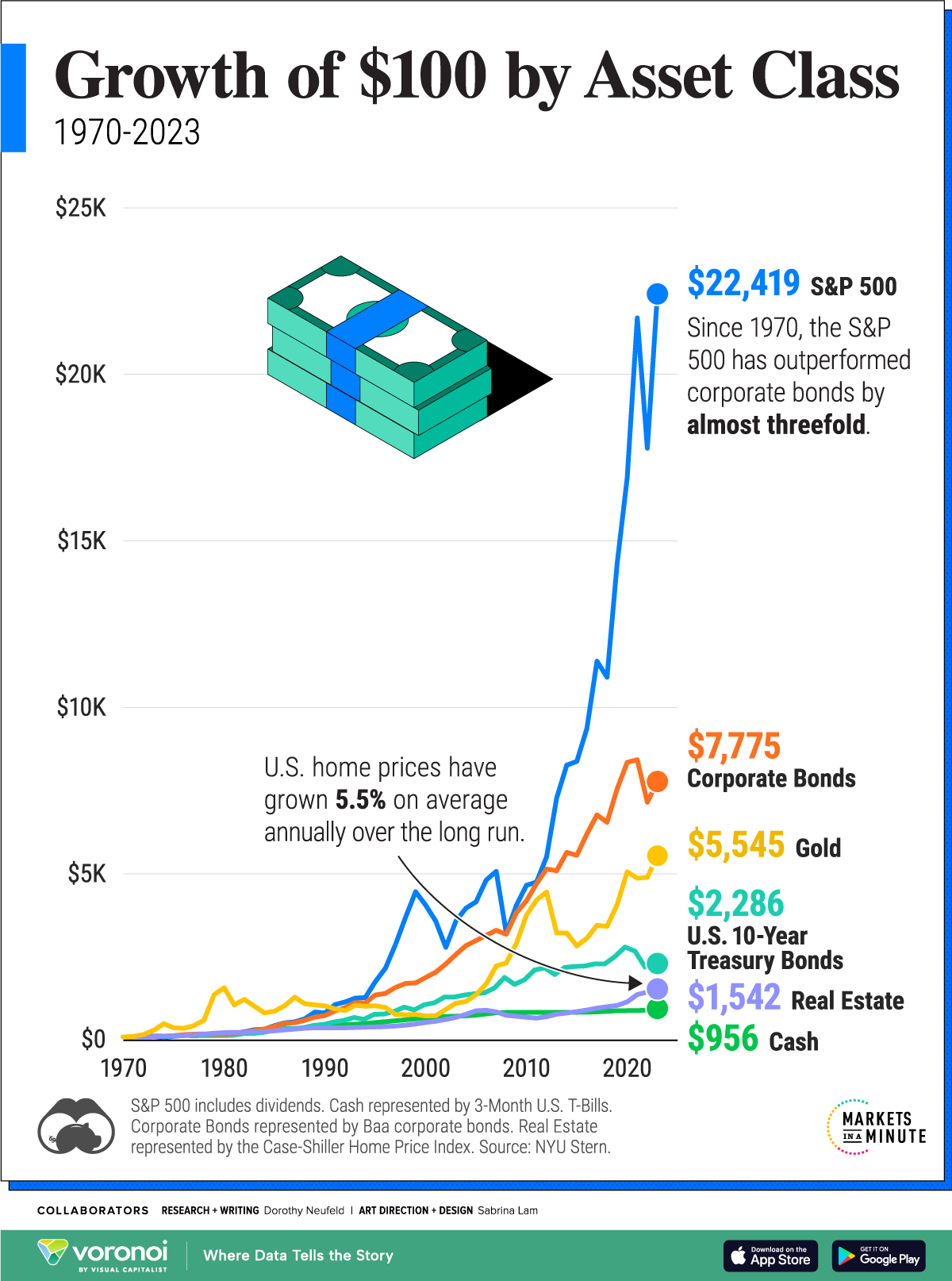

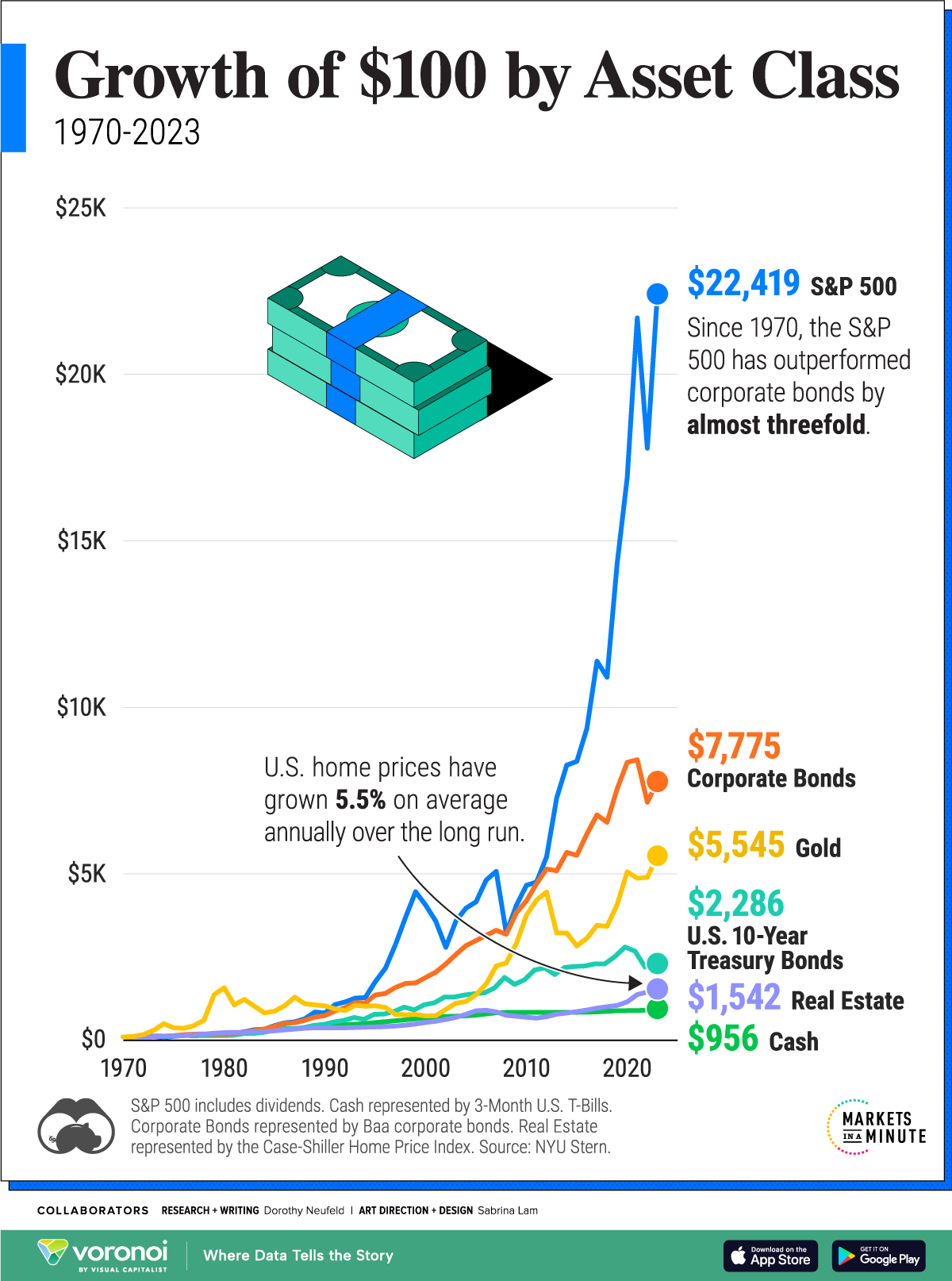

With long-term investing, not only will you allow the stock to move higher with time, but the dividend reinvestment will compound the return on your cumulative investment, which should grow over time. Historically stocks have outperformed any other asset classes, despite occasional market crashes, which shows the importance of long-term investment. Further, investors who hold stocks for periods exceeding one year are taxed at a lower rate on their capital gains than those who sell their holdings within one year from the date of purchase. The resultant tax savings can further add to the total cumulative returns and make a significant difference over longer periods.

Investment Options When Interest Rates are High

It can be challenging to find appropriate stocks during times when interest rates are elevated. Here are some options that you can consider:

Dividend Stocks

Many stocks regularly pay out dividends. The best option in this category would be to invest in “Dividend Aristocrats” with decades of stable dividend payouts. If you want to build an aggressive portfolio of dividend stocks, you can also consider adding stocks that have recently started paying out dividends with growth every period. Such companies have high growth potential and can give you additional return but with additional risk.

Value Stocks

While value stocks may or may not give you dividends, you can combine them with other dividend yielding stocks in your portfolio to increase your overall return. Value stocks are considered undervalued, which means they trade for less on stock exchanges than their intrinsic value or their true worth. However, finding such stocks could be challenging and require thorough analysis of the company’s fundamentals.

You can analyze some key metrics, such as price to earnings (P/E) ratio, price to book (P/B) ratio, dividend yield, earnings growth, industry standing, etc. to get some insights into the real value of the stock. For example, P/E ratio suggests the multiples at which the stock is trading relative to its earnings per share. So, a high P/E ratio of a stock in comparison to its peers would suggest that the market is valuing the stock higher than its peers indicating that it is overvalued.

Mutual Funds

Stock mutual funds are a great option for those who don’t want to conduct analysis and find suitable stocks for investing. There are plenty of stock mutual funds available that let you invest in a range of stocks. For example, if you want to invest in stocks that pay out consistent dividends, you can simply buy a mutual fund, which will give you exposure to the dividend paying companies constituting the fund.

By buying units of Fidelity’s Vest S&P 500 Dividend Aristocrats Target Income Fund Investor Class (KNG), you effectively buy 101 stocks in different proportions, with exposure to dividend stocks like 3M, Dover Corp., Exxon Mobil Corp., Nextra Energy Inc., Target Corp. etc. It is a cost-effective method to invest in hundreds of stocks, without buying individual stocks. However, mutual funds charge investment management and redemption fees, so you should consider these as well.

Financial Stocks

Financial stocks are shares of financial institutions that earn a significant portion of their revenue from interest. So, when the interest rates are higher, it makes sense to invest in the stocks of financial companies as their earnings can get a boost from high lending rates.

For individual investors, investing in different financial stocks could prove costly and require significant investment as well. A cost-effective alternative is to choose a financial sector mutual fund that lets you invest in a collection of stocks in the financial sector. The fund is managed by a qualified portfolio manager who manages the investment portfolio in the fund and makes decisions about inclusion or exclusion and weights of stocks in the composition of the fund. An example of a financial stocks mutual fund is The Financial Select Sector SPDR Fund

Summary on Dividend Investing with Rising Interest Rates

Dividend investing is a time-tested investing strategy that can give you considerable returns. During a high interest rate environment, inflation also tends to be on the higher side, which can reduce your real return on investment. Further, fixed income investments become attractive as they can provide investors with higher returns with little risk in comparison with riskier assets like stocks. Consequently, it becomes increasingly important to modify your dividend investing strategies to improve your overall return.

Be careful choosing random stocks that can’t sustain their dividends in the future. If a company can’t sustain its dividends, it could lead to a negative impact on its stock price and might lead to capital depreciation. Choose stocks with sustainable dividends, and then reinvest the dividends into buying new shares to earn compound returns and grow your holdings.

To pick stocks, you should analyze different dividend-related metrics, such as dividend payout ratio, earnings growth rate, dividends growth rate, earnings per share, etc, which will give you a better idea about the dividend sustainability and expected dividend growth rate. Further, having a long-term investment horizon is key during times of rising interest rate as this compound effect will kick in and you’ll be able to benefit from lower capital gains taxation due to your high holding period.

Dividend Aristocrats stocks could be a safer option for most investors as they provide stable dividends despite market downturns. Value stocks could also prove an excellent choice to earn higher interest in a high interest environment, albeit with higher risk. But if you don’t want to do stock picking by yourself, then a better alternative is to invest in mutual funds, which is a cost-effective method to invest in a collection of stocks by buying units of mutual funds.

If you'd like to analyze the recent performance of dividend stocks and mutual funds, give Tradingsim a try. We've got the safest and most realistic market replay in the world. Start your research on dividends with our 7-day free trial.

Investing

Investing