Gold, as an investment vehicle serves its purpose, not just as a hedge against inflation for investors but it has also become an integral part of a diversified portfolio among investors. Gold, also known as the precious metal or yellow metal is not just sought after during times of economic crisis or geo-political uncertainty (demand does peak during such times when risk appetite wanes) but has become an actively invested commodity in the investing community regardless of the market conditions.

For gold investors today, there is no shortage of choice when it comes to investing or speculating on gold. From investing in gold bars to coins which come at additional cost of storage, insurance etc to purchasing mining stocks that deal with mining and exploration of the precious metal, and gold ETF’s to speculating on gold prices via trading spot gold or gold futures, there are many ways investors can take exposure in gold.

Of the many types of investments available for gold, Gold ETF’s and gold futures probably two of the most popular trading instruments when it comes to an investment product that is directly related to gold. Although both these investment vehicles tend to track the same asset, which is gold, there are subtle differences between gold futures and gold ETF’s which makes it two completely different investment vehicles for trading. Thus, while there is some level of correlation between the two, the level of correlation is not always strongest.

While gold ETF’s are primarily used by investors who tend to follow a buy and hold strategy, for gold futures market which is mostly made up of speculators, the interest in trading gold futures comes purely from making money in the day to day volatility in gold prices or on a short term basis.

Gold ETF’s and ETN’s

In the ETF world, there are many different gold backed ETF products. Among them, SPDR Gold shares ETF (GLD) is one of the biggest with an estimated $30.5 billion in assets under management. In terms of trading volumes, SPDR Gold ETF attracts close to $1.03 billion in average daily trading volume. The SPDR ETF was launched in 2004 and was designed specifically to offer an inexpensive way to investing and owning physical gold.

Since its introduction, ETFs have become a widely accepted alternative way of investing or trading in gold. It is not surprising to see why many investors have a preference for a certain gold-specific ETF used as a convenient asset to invest in gold without having to be exposed to the risks of owning, purchasing and storing the physical bullion. Despite the convenience offered by Gold ETFs, what many investors fail to realize is that the fact that the cost of trading Gold ETFs which track gold prices may exceed over time, and more often than not, investors prefer trading gold future contracts as a better alternative to gold ETF’s under the right circumstances.

Some investors prefer Gold ETF’s for the fact that they merely replicate the performance of gold and due to the fact that gold ETF’s are traded on the stock exchange, they are convenient in terms of liquidity.

Besides the SPDR gold ETF (GLD), other popular gold backed ETF’s include VanEck Vectors Gold Miners ETF (GDX), and iShares Gold Trust (IAU).

There are specialized products called Exchange Traded Notes or ETN’s which look similar to ETF’s but are structured differently. These products are very different from ETF’s as they do not own any physical gold but come with leverage. For example, Velocity Shares 3x Long Gold ETN with the ticker UGLD offers three times the price movement of the gold futures contract. The expense ratio is also higher at 1.35%, compared to GLD’s 0.4%. Other examples include the Gold double Short ETN (DZZ) which trades inversely to gold prices with a two times leverage built in.

Comparison of Gold ETF and Gold Futures Contracts

Still, despite the technical differences, gold futures and gold backed ETF’s due to the fact that they track the same underlying asset which is gold tend to have a certain level of correlation.

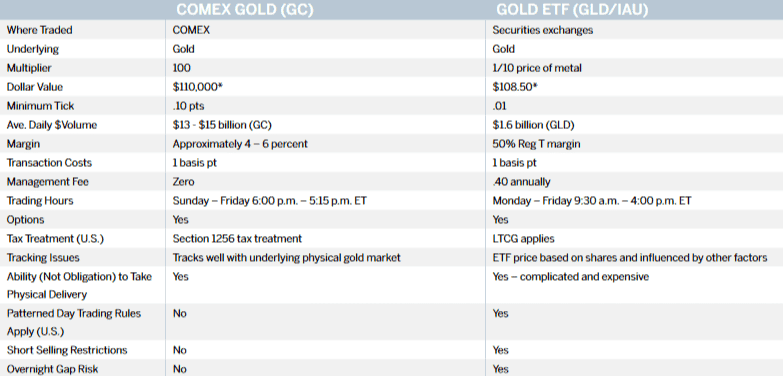

In order to understand the correlation between Gold ETF and Gold futures, it is ideal to first compare the contract specifications for both of these instruments. Both gold futures and gold ETF’s differ on many technical aspects. For example gold ETF’s don’t offer any leverage. This means that securities brokers will at best offer 50% collateral to trade Gold ETF’s but this also comes with higher risks. Unlike gold futures, where leverage is built into the futures contract, the leverage for gold ETF’s can vary from one broker to another. Besides leverage, there is also the aspect on tax where futures and ETF’s are taxed differently.

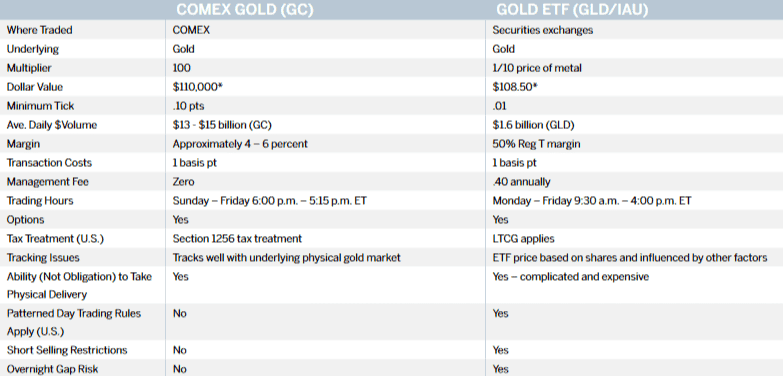

The chart below gives a comparison between the Gold futures and Gold ETF’s (GLD).

Comparison of Gold futures (GC) and Gold ETF (IAU)

Note that regardless of the exchange traded fund, be it IAU or GLD, gold ETF’s have a multiplier of 1/10th the price of the metal.

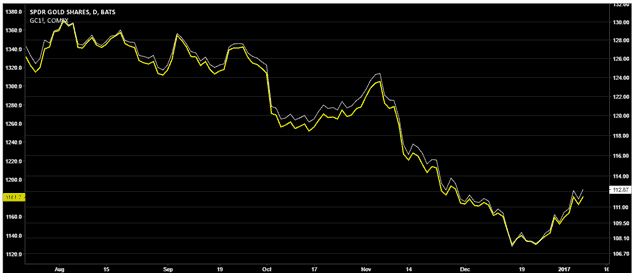

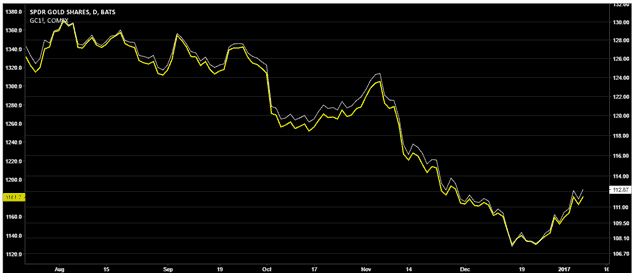

The next chart below illustrates this point. We have a comparison of gold futures (GC) and the SPDR Gold ETF, GLD you can see that 1000 shares of GLD is equivalent to one Gold futures contract.

Price chart comparison, GC and GLD

The following points are important to remember, when comparing Gold futures and Gold ETF’s.

- 1 GC futures contract = 100 ounces of Gold

- 1 GLD share = 1/10th of an ounce of Gold

- 10 GLD shares = 1 ounce of gold

- 1000 GLD shares = 100 ounces of Gold = 1 GC futures contract

Besides the above factors, trading hours for gold futures and gold ETF’s also differ. While gold futures are available for trading over 23 hours a day, gold ETF’s are traded only 7-hours a day. Gold futures and ETF’s also differ when it comes to other aspects such as the trading hours, taking delivery of the physical commodity and so on.

Understanding the correlation between gold ETF and gold futures

Gold futures and gold ETF’s might look the same on a broader perspective but there are many differences, which add up when looking at the correlation between the two products.

Gold backed exchange traded funds are structured as a trust. Under this structure, the ETF holds certain amount of physical gold for every share represented on the ETF that is issued. Therefore, when buying a Gold ETF share, it simply means that the investor owns a portion of the gold that is held in the trust.

The price of each share in the gold ETF (GLD as an example) is worth 0.09528 gold ounces, also known as the Net Asset Value. So when the price of actual gold fluctuates, the price of GLD moves as well. Based on investor demand the price of GLD can be above or below the NAV. On top of this, the gold ETF’s also charge a fee for investors. For GLD, the ETF charges a fee of 0.4% per year which tends to erode the value of the investment over time. Still, it is a lot less cheap than compared to storing physical gold. From a technical stand point, Gold ETF’s and gold prices have a correlation over of 0.80 (a correlation of 1 means a perfect price movement in both the assets), which is quite strong. The correlation might weaken a bit when comparing gold ETF’s to gold futures, but still the level of correlation is considerably stronger.

The chart below shows GLD gold ETF and COMEX Gold futures based on the monthly chart. Here, it is quite clear on the strong correlation between both these products.

GC and GLD Monthly Chart

Gold futures on the other hand track the price of the underlying asset, which is spot gold. The futures contracts can be purchased and traded and in some instances, they can be held unto maturity to take physical delivery of the previous metal. However, for retail futures traders, it is quite unlikely that the contracts will be kept open until maturity. Regardless the key difference between gold ETF and gold futures is that while one tracks the price of gold directly, the other (ETF) represents a certain amount of gold per share.

Looking at Figure 3 again, you can see how the price of gold futures and gold ETF differ slightly. When accounting for the 1/10th multiplier, there is still a $40 – $50 difference in pricing between the ETF and the futures contracts, but beyond this difference, both gold futures and ETF’s tend to move similarly.

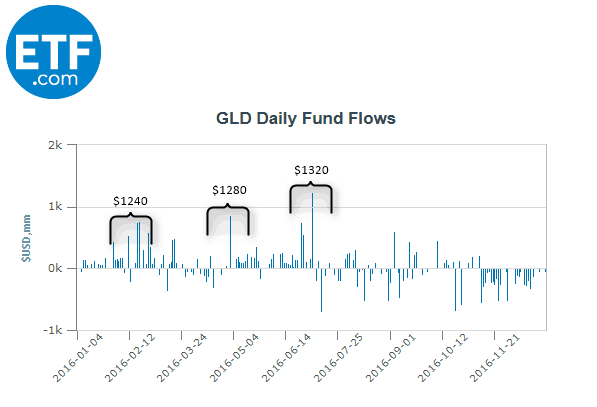

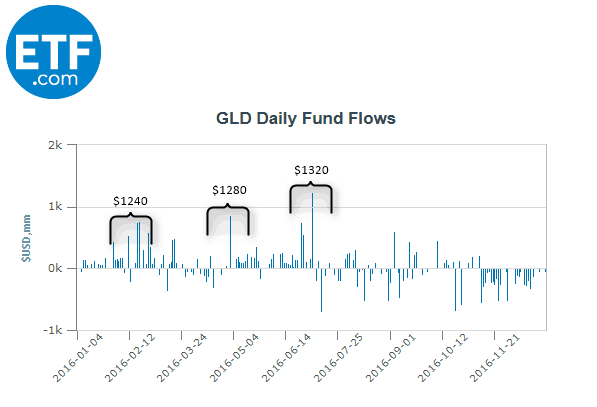

While the correlation between gold futures and gold ETF’s are almost similar, a larger distinction can be seen when comparing the price of gold and its correlation to gold futures and gold ETF’s. A research paper released by analysts at Nomura, suggested that gold prices and gold ETF correlation was smaller compared to the correlation between gold prices and gold futures which are stronger and more volatile. However, the research paper noted that in the long term, gold ETF’s tend to give a better view of the long term trends in gold prices. More importantly, the peaks and troughs in gold prices often coincide with fund inflows into gold ETF’s. In other words, when there is a rush in gold ETF’s gold prices tend to show a bottom and vice versa.

The chart below shows the 2016 GLD ETF fund flows. Notice how gold prices have posted a peak every time the ETF fund inflows surged ahead. Although the correlation is not entirely positive, the ETF fund flows shows a significant level of coinciding with the peaks and troughs in gold prices.

GLD ETF Fund flows (Source – ETF)

On a broad scale, the ETF fund flows tend to closely follow the larger trends in gold prices. On the other hand, gold futures closely track the day to day movements in the spot gold market, making it more vulnerable to the intraday volatility in spot gold markets. Thus, gold futures are more closely correlated to gold prices than compared to gold etf’s which show stronger correlation in the long term, which is more suited for investors who prefer a buy and hold approach.

Between the two products, traders and investors will find that trading gold futures is a better option. Not only can futures day traders, trade on margin, the ease of going long and short is quite simple when trading gold futures. The margin requirements are also less especially when day trading gold futures, which is one of the reasons why gold futures make for an attractive proposition for traders than gold ETF’s.

For the average retail futures day trader, trading gold futures is more affordable in terms of the deposit and day trading margin requirements, compared to trading gold ETF’s where the margins are less and can change depending on the securities broker that you trade with. Of course, there are risks with gold futures, on account of trading on leverage which is built into the contracts, but the risks can be minimized based on following good risk management principles. That is not to say that gold ETF’s are less risky than gold futures contracts.

For traders looking to trade based on correlation, it is safe to stick with gold futures and spot gold price correlation due to the fact that the futures prices track the underlying spot market prices at the end of the day. Besides spot gold, traders should of course keep track on other factors such as the state of the U.S. economy, the strength or weakness of the U.S. dollar and monetary policy decisions from the Federal Reserve that can influence the short term interest rates.

Due to the fact that investing or dealing with the physical gold or bullion can be cumbersome and requires lot more capital, most traders and investors opt for the more accessible option such as trading gold futures or gold ETF’s. However, when it comes to correlation, gold ETF’s tend to lag for the simple reason of the way Gold ETF’s are structured. On the contrary, gold futures contracts which are based on the direct underlying price of the spot gold tend to be more closely correlated with actual gold prices.

While gold ETF’s and gold futures contracts are correlated due to the fact that both the investment products track the same underlying asset, given the structure and the way they are traded make it two completely different trading products that is often used for different purposes.

Commodity Futures

Commodity Futures